Complaint Review: NCO Financial Systems Inc. - Philadelphia Pennsylvania

- NCO Financial Systems Inc. PO Box 13570 Philadelphia, Pennsylvania United States of America

- Phone: 800) 550-9619

- Web: www.ncogroup.com

- Category:

NCO Financial Systems Inc. NCO Financial, NCO Group, NCO Finacial/55 NCO Posting credit items that are not mine to Credit Report Philadelphia, Pennsylvania

*Consumer Comment: lawyer!

*Consumer Comment: advise

*Consumer Comment: Yes they are fiends.........here's how I know

*Consumer Comment: Hope this helps

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

NCO has illegally obtained my information and has posted two medical collection bills onto my credit report, both are from hospitals in Texas (Methodist Hospital and Travis Emergency Physicians). I live in California and have not been to these hospitals. I keep disputing these items with the credit bureaus and as they remove one a new one will post to my credit report.

This has been ongoing for months and I am so tired of dealing with them, they are rude scam artists. I have no idea how they obtained my social security number, but its pretty obvious that they did it illegally since these are not my medical bills. In the process after NCO posted to my credit report West Asset Mgmt and FNCL also known as FCO has posted to my report for the same hospitals. I believe they are selling information illegally.

These companies are committing fraud and need to be stopped.

Its not fair that I have always had good credit and they can come in and destroy it for something that I have never heard of and bills that aren't mine.

This report was posted on Ripoff Report on 01/20/2010 02:53 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems-inc/philadelphia-pennsylvania-19101/nco-financial-systems-inc-nco-financial-nco-group-nco-finacial55-nco-posting-credit-557457. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

lawyer!

AUTHOR: Jeanski - (U.S.A.)

SUBMITTED: Thursday, January 28, 2010

You need a lawyer - and fast. These people were all over me for a debt that wasn't mine. I sent them all kinds of documentation that it wasn't my debt and that it was clear to me and the original creditor (Sprint) that NCO just made it up and put it on my credit report. The credit agency wasn't any help either. After putting up with them for two years I googled them and found a site similar to ROR where an attorney said we could contact him. Well, I did! And although it took him almost a year he finally got it fixed, got me a small settlement, and it came off my credit report - finally! And his fees were pain by NCO :-)

#3 Consumer Comment

advise

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, January 28, 2010

Send a letter via Certified Mail + Return Receipt to the debt collector stating:

Your firm has damaged my credit rating by the posting of frivolous, incorrect info on my credit file for a debt that does not belong to me.

Per the Fair Debt Collection Practices Act, I am requesting written validation of this alleged debt, to include a copy of the original signed contract with my signature. A typed account statement showing an account number with amount due is not validation.

Per the Fair Debt Collection Practices Act, the burden to validate the debt falls on the debt collector. It is not my responsibility to validate this alleged debt. Sending a request for more identification or a typed account statement is not validation. If you have enough information to post negative info on my credit files then you clearly have my identification validated.

Either validate this alleged debt or remove it from my credit files. If this notation is not removed, I will file complaints with the Attorney General of your state. If this does not remedy the problem, then I will take legal action for Fair Debt Collection Practices Act and Fair Credit Reporting Act Violations.

Receipt of this letter is being officially time-stamped by the USPS. Refusal to to validate will be officially documented.

#2 Consumer Comment

Yes they are fiends.........here's how I know

AUTHOR: Happy1withshatteredreamz - (U.S.A.)

SUBMITTED: Thursday, January 28, 2010

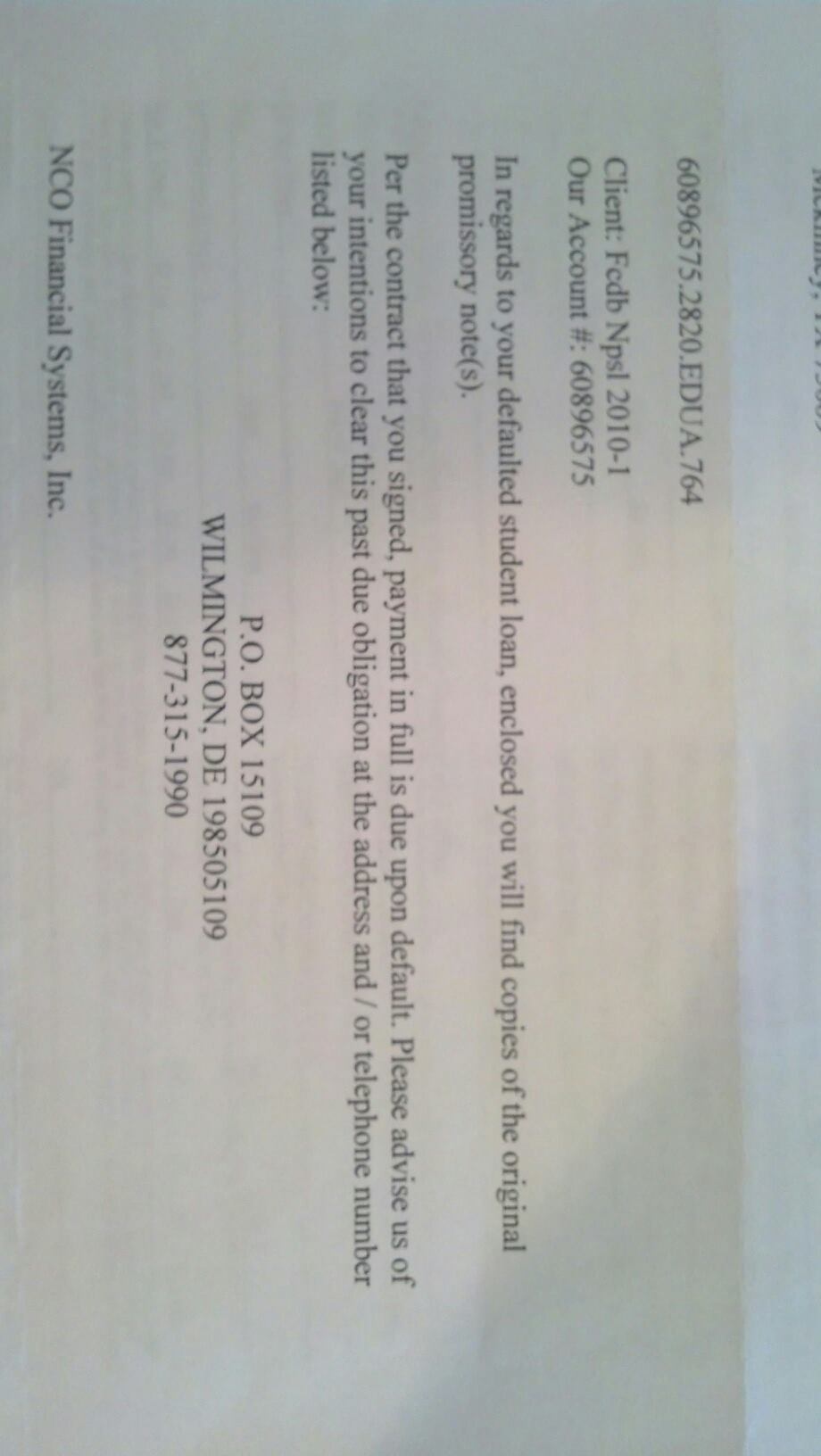

My best friend and I have both been dealing with these fiends. My student loan was sold to them. She had a credit card account or 2 sent to them. These people are basterds believe me: you can't talk to them. My best friend was ripped off by an ex boyfriend whom decided to commit grand theft auto on her credit card. He was sued and made responsible for paying the debt, which she is now paying because the creditor can't find him. This card was charged off and sent to NCO whom has:

1. Tripled her debt

2. Threatened to sell everything in her home.

3. Threatened to sue her for the money. (unless it's a lawyer on the phone they can not do that it's against the law)

4. Garnished her bank account for payments (she allowed this but not the way they did it.) in which they double charged her account twice and bounced her account. (she is on SSI) They attempted to collect the debt one month from her old account which was closed 4 years ago, then they went into her new account and took the 2 months of payments out. They did this again a second time which forced her to close her account.

5. When she closed her bank account and got a new one, they threatened to have her put in jail. She explained she would send them the money she owed, however she would not give them her new account info. She was then sued.

I have gotten them on some of my accounts before and they threatened to call the Department of Social Services on me to have my child taken away for the fact I can't pay my bills. I am hoping the latest account they have will get taken from them: it's a student loan.

#1 Consumer Comment

Hope this helps

AUTHOR: BlackMuse - (USA)

SUBMITTED: Monday, January 25, 2010

I am sorry this is happening to you. I would suggest the following:

1) contact a lawyer in your area that deals with consumer debt

2) Send them a debt verification letter ( you can google a templet) asking them to detail your information and the supposed debt

3) Call the hospitals billing departments and see where the error came from

Here is a good link:

http://www.allaboutcreditreports.com/CorrectYourCreditReports.cfm

Advertisers above have met our

strict standards for business conduct.