Complaint Review: World Financial Group - Anaheim California

- World Financial Group State College, Orangewood Anaheim, California U.S.A.

- Phone:

- Web:

- Category: Multi Level Marketing

World Financial Group rip-off! Anaheim Califorina

*UPDATE Employee: Victims? Just because someone washed out makes them victims?

*UPDATE EX-employee responds: WFG ruined my brother's life

*UPDATE Employee: World Financial Group is a straight forward Dynamic Company!

*Consumer Comment: WFG- No Central Recruiting Office

*Consumer Comment: Just came from the recruitment process

*UPDATE Employee: WFG isn't for everyone... just as investment banking, automotive sales, accounting, and law often are not as well.

*Consumer Comment: insurance agents

*UPDATE Employee: WFG-AEGON-WRL??

*UPDATE EX-employee responds: Agree With Paul Arabi of Louisiana (VUL's are the Swiss Army knife of insurance policies, but it is engineered to cut your wallet up)

*UPDATE EX-employee responds: WMA/WFG misleading clients and cashing in on it.

*UPDATE EX-employee responds: WMA/WFG misleading clients and cashing in on it.

*UPDATE EX-employee responds: Recruit, recruit, recruit and sell VUL's ..They found my resume on Monsters.com

*UPDATE Employee: World Financial Group is not illegal

*UPDATE EX-employee responds: World Financial may not be a scam, but ... IT IS ILLEGAL

*UPDATE EX-employee responds: World Financial may not be a scam, but ... IT IS ILLEGAL

*UPDATE EX-employee responds: World Financial may not be a scam, but ... IT IS ILLEGAL

*UPDATE Employee: WFG - Not for Everyone

*UPDATE Employee: World Financial Group is not a scam

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

My friend is so excited to be employed by this so called World Financial Group, he is telling me that after they send him out to get his life insurance license he will be making 6000 a week. So this seminar was approaching (6-30-04) and he got myself and 2 other people to come, and it was held in a hotel I think it was Hilton Hotel.

All the people he introduced to me seamed like thieves, They also seamed like they could not get the point across for their company and another thing is that they kept on referring to all of these other company net profits and gross profits. they have two assets and have none of there own products.

It was not a very clear seminar at all. I mean everybody was talking about there life story. This was so freaking dragged out by this guy talking about his Military time in the Navy.

Anyway the main objective with this company was to own your own Branch and to do that you need Brokers license and Life Insurance License ex. but it was still fishy. I think I had a better understanding going in there than from when I came out. They didn't know how to put on a seminar for their life so I left like 3 min before the seminar was over and they flipped out.

They were saying bad stuff to me. I went outside of the hotel and I explained to him what I got out of the seminar and started using financial terminology. He was so stupid and started telling me how I am not going to be successful. I looked at him and just laughed in his face.

It seems like all of the World Financial Groups stability is bad and if you are looking for a career in world financial group don't conceder it. It is a scam.

Mike

califorina, California

U.S.A.

This report was posted on Ripoff Report on 07/01/2004 04:34 PM and is a permanent record located here: https://www.ripoffreport.com/reports/world-financial-group/anaheim-california-92870/world-financial-group-rip-off-anaheim-califorina-97296. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#18 UPDATE Employee

Victims? Just because someone washed out makes them victims?

AUTHOR: David - (U.S.A.)

SUBMITTED: Sunday, February 15, 2009

I'd like to introduce myself. I and my wife are agents with WFG and are very happy there.

To "Victim's Family" rebutle. Your brother was no victim, and if he only make 6k a year, no one made much money at all off his "victimization" anyway. If he went 2 years and made that kind of money, he did something wrong. If you work the system right, you can make that kind of money within the first 6 months of starting, and moving it up very quickly. Just because your brother failed, doesn't make it a scam.

To the original poster, I'm sorry for your experience, with 10s of thousands of agents out there for our company, it is obvious to say that you may run into some idiots/uninformed agents as well. That's like going to Mcdonald's and assuming everyone who works there knows everything about the entire company.

You people need to do some real reasearch on this company before jumping to conclutions instead of googleing and reading up on these "report" websites where anyone with an e-mail address can spew lies.

#17 UPDATE EX-employee responds

WFG ruined my brother's life

AUTHOR: Victim's Family - (U.S.A.)

SUBMITTED: Tuesday, September 16, 2008

My brother got involved with WFG about 3 years ago. He was SO excited and invited me to his meeting right away. The meeting did not go well, the guy who was suppose to be his mentor did not know his material well. He told me a sob story about how he "helped" his family and his dad cried out of joy. Out of respect for my brother, I did not stop him from giving this job a try. When it came time for me to buy a house, I went to him to find me a good loan. He referred me to his home loan "expert". This girl did not know ANYTHING! She was so slow that after 2 weeks, she has yet to pull my credit. I eventually went with some other company. She then told me brother how disappointed she and how I was probably cheated by going to someone else for the loan. How unprofessional is that?

He worked at WFG full time for a few more years. He was super dedicated. Always on the phone and going to every meeting. His office is full of "awards" for pretty much any insignificant recognition you could think of. And when I visited his colleagues' office, they are also full of awards. I'm pretty sure the company gives away awards like candy....probably one for perfect attenance and best hair too!

After working so hard for nearly 3 years, he has yet to make any real money. Only about 6k a year. He was in debt. Credit card company was always calling the house. Initially the company told him it'll take about 2 years before his "investments" will pay off. Well 2 years have passed, and now they're saying 5 years. But he believed it! By the time the family tried to talk some sense into him, he was already completely brain washed and lost so many friends.

He is now unemployed and has destroyed his relationship with his family and friends. He is constantly angry because he feels his family has let him down and won't let him follow his dreams! In reality, we were just trying to safe him from getting more into debt and wasting more of his life on this scam of a job.

I have lost my brother and I blame WFG for taking advantage of people. Sure, there are the few success stories (those very few on the top of the pyramid). But how many people do they have to victimize to get to the top? My brother was a victim. And unfortunately, the rest of the family was victimize by this too.

#16 UPDATE Employee

World Financial Group is a straight forward Dynamic Company!

AUTHOR: Steve - (Canada)

SUBMITTED: Sunday, September 07, 2008

I would like to say that understanding the concept of what World Financial Group actually does is not addressed, or if addressed not understood by the person who is actually typing their comments. First of all if the person understood what WFG does, how the independent agents get compensated, what the criteria's are to actually become an agent, and last but not least that it is a highly regulated business, then that person should not even be criticizing.

I have been representing WFG for almost 2 months now, so far it is straight forward. From day one I knew what I had to do to start earning money. Let's understand one of his objections and i quote "you need Brokers license and Life Insurance License ex. but it was still fishy." hmmm, Interesting! Fishy to me would be to step into the office of a Financial company where it had a sign on the door stating the following "We are here to help you put your financial life back together. We do not need to be licensed because we know all the laws, rules and regulations of all states and provinces throughout north america, I promise! As well we expect payment upfront before we talk to you!" Now that is where everybody should get their financial planning done in MY OPINION, don't you agree? Don't you think that you would go to a company or agency that you know is licensed? Has a reputation of helping people get back on track with their finances? Show people legal ways of retiring successfully? Aside from that giving your opinion today has become so easy that anyone with a computer keyboard can just write anything they want and post it on the internet to try and get attention. Strange that the company's that we (WFG) represent are some of the largest financial institutions and insurance companies in North America, hmmm?! And everyone knows that big companies like to be represented by companies that are SCAMS, don't they? As well the person said that the main objective was to own your own branch. If anyone reading this understands what it means "To own your own business!" would you kindly explain to the person, giving his educated and professional opinion, the meaning of that phrase, please. Some people don't mind working for a company that pays them when they decide, be it once a month, twice a month, weekly and earning only what that company perceives that you are worth. Other people who are enthusiastic and strive for financial independence would love to own their own branch, franchise, agency, or their own business, do you agree?

I would like to say that everyone has the right to their opinion as do the people of certain hipe magazines. Everyone, be a person that researches for his/herself about a company by physically going out to see it and understand it before criticizing it. When the company you represents ends up in Forbes magazine, or when one of the agents receives the prestiges Entrepeneur of the year award in Canada, oh did the critic forget to mention this about WFG, I would think twice about giving it the SCAM award on the Rip-off web site.

I am proud to be part of this Dynamic Company called the World Financial Group!

Don't forget, You Can Do Anything You Want to As Long As You Believe Strongly Enough that You Can!

Steve

Alberta, Canada

#15 Consumer Comment

WFG- No Central Recruiting Office

AUTHOR: Debbie - (U.S.A.)

SUBMITTED: Thursday, September 04, 2008

My experience with WFG (aka Aegon) has been similar to the others. I am a computer programmer who's been unemployed for longer than I want. So I posted a resume on Monster.com that I tried to emphasize the Customer Service aspect of my programming, in hopes of getting a receptionist job or something. The resume shows a lot of gaps because I was trying to highlight my history with regards to CSR and I did no CSR at all with some employers.

The Los Angeles area has many WFG offices. It appears like their recruiting process is independently done in each office. I've gotten calls from Brea, Pasadena, West Los Angeles, Ontario, Anaheim.. I'm probably missing a few from the list.

About a month ago I finally said "yes" to going in for an interview in the Brea office. It was on Saturday morning. I thought it was exceedingly odd for a respectable business to be conducting interviews on a weekend. I debated up to the last minute if I was going. I don't consider myself a salesperson. But, I was feeling desperate and my inner greed monster took over.

I got there and they shuttled me into this social mixer. I'm handciapped and can't stand for long periods. I'm also over 50 years old. I asked for a chair and was told "it won't be long" before we get a chance to sit while the presentation is made. It seemed like forever to my sore legs.

We sat down and the speaker immediately picked on myself and one other participant who was over 50. He railed about how it was a young person's world and how hard it is to get new jobs when you are over 50. Then he promised that WFG wasn't like that and offered equal opportunity for those wise older folks. I felt comforted and pumped up like a school rally.

Next, we were given our initial interview with our advisors. She told me I would have to pay for my own licensing and I gulped. Where would I get that kind of cash? And why should I pay for it in the first place; employers normally pay for training, not re-imburse you much later.

Then she told me how easy it was to become an advisor. As an advisor, she would get a percentage off my sales. She told me it was everyone's goals to become advisors so they could make more money. I took Business 101 in college and could recognize a pyramid scheme when I saw it.

Ten minutes into this interview, I stood up and announced I was sorry but the opportunity was not for me. I apologized for wasting her time, shook hands and left. What I WANTED to do is tell her she wasted my time (and gasoline) as well.

Even after this Brea interview, I've gotten 2 more phone calls from an WFG advisor. I wish I could make my resume invisible to all WFG offices. The guy that called me from Ontario last night was particularly annoying in his persistence to reel me in. I finally hung up on him as he was trying to convince me that the social mixer is a way to celebrate weekly that they are making so much money. I wish these people would leave me the hell alone.

While this pyramid marketing does seem illegal to me, maybe it's not. I see it's been going on for several years without federal crackdown. I dunno. To me, I think they should be put out of business. Bottom line is, don't get suckered in to work for them.

#14 Consumer Comment

Just came from the recruitment process

AUTHOR: Elexa - (U.S.A.)

SUBMITTED: Tuesday, February 13, 2007

I met a young woman at a store in my neighborhood. She stopped me to compliment my outfit and then proceeded to ask me questions such as what I am doing for a living. she asked if I was interested in making more money, and being an 18 year old college student, working part-time at a resturaunt, of course I am interested in making more money! She seemed very nice so I continued to talk with her and gave her my name and phone number. She called and invited me to her company's "open-house". Mind you throughout this entire process she did not mention what this "wonderful" job was or was comprised of.

So I was sceptical, but I am the kind of person who has to test the waters and see for myself, rather than going on my purely gut feeling that this was "too good to be true." I mean she told me I could work part time and make a lot more money than I was making now. Very appealing and very unlikely , especially for someone fresh out of highschool and in college.

So I went to the "open-house", and it was exactly the dog and pony show the first person's report stated. When I was finally allowed to leave I had to speak with the person who invited me so that they could answer questions and get my information and get me started if I decide that this is the career for me. well I told my Recruiter that I wasn't really sure about the entire thing, she responded, very crassly, " What are you unsure of, helping people or making more money?" To which I replied,very insulted, and trying to contain my desire to tell her what a scam I thought the whole thing was and that she had completely wasted my evening with this nonsense, I stated politely," I just don't think I have the money to become liscenced in order to work for the company right now." To which she responded," well I'll keep your information and be sure to keep you in mind if the opportunity opens up again."

After that I got out of there as fast as I could feeling very angry . I asked questions, I asked what it is the company does, how you make money there, and how you gain clientel. The only responses I recieved were extremely ambiguous statements such as, "we help people handle their finances, or We are involved with a lot of big name companies". That told me nothing, and if someone can't give me a description of their job and what their company does, than it doesn't sound legitimate to me. I got nothing from that seminar or whatever they call it, except a cramp in my back and the loss of three and half hours I can never get back.

I will be very sure to warn any of my friends of this company and that they should be very leary. Maybe I look innocent and nieve enough to have believed their nonsense, but you can never judge a person by looks alone. I will be warning my friends and family about this scam, which is what it is despite, the loyal employees defending it. If the company is so great and on such a large scale, why is it necessary to recruit? Shouldn't people know about the company already and be supplying more than enough applications?

If it is such a big , grand company, shouldn't people go through human resources, and have their application carefully looked over? I looked this company up immediately, as soon as I came home, and I was led to this site very quickly. It most definitly assured me that I did the right thing by leaving that "seminar" As quickly as possible. Thank you.

#13 UPDATE Employee

WFG isn't for everyone... just as investment banking, automotive sales, accounting, and law often are not as well.

AUTHOR: Andrew - (U.S.A.)

SUBMITTED: Monday, August 21, 2006

In response to Ben's comment... just because you sign an application saying "your an independent contractor" doesn't mean if something bad happened and a client sued you and WFG/WGS, that the courts would say "oh ... well you were an independent contractor and you signed that in the application" - they have two tests to determine whether someone really is an EE or IC - method of payment and degree of control over daily activities. Of those are you that are employed, if you ever read NRS 608, 609, 613 and 616 you would be SHOCKED at how many of your ER's are in non-compliance with state employment laws, not to mention federal laws including FLSA and NLRA.

For anyone that questions what I said or doubts it... i strongly advise you to consult an attorney (a good one for that fact) - and they will tell you what I just did.

WFG tries to circumvent the 'mop' test by having you pay for everything, but the applicable court (district, supreme... if you appealed to that level) would recognize that and just look to the degree of control they exert over your daily activities. By the way, the real reason why they have "EE's" sign up as IC's is because they don't have to pay taxes (into workers comp, etc.) and they are hoping to avoid liability from what the agents are doing, god forbid they really screw something up.

If you do any research into the difference between an IC vs EE for an ER, you would figure all this out... a lot of strip clubs try to make the girls into 'independent contractors' by not paying them anything and having them pay just to come in for the night... again circumventing the method of payment test, but - they never pass the degree of control test.

On a different note, WFG isn't for everyone... just as investment banking, automotive sales, accounting, and law often are not as well.

#12 Consumer Comment

insurance agents

AUTHOR: Ben - (U.S.A.)

SUBMITTED: Monday, July 31, 2006

WFG is a marketing arm, a BIG one, I have just been to the Florida Convention, and also have seen other "make money" opportunities, some of the agents I spoke with are very ethical and some are not, WFG itself is very ethical, but like everything else or everyone; it is not perfect, it is up to your recruiter how they represent WFG, if your recruiter is not properly trained you will be improperly trained, the produts they offer are legal else OIC will not let the companies issue them. whether VUL or term or EVUL, WE; I signed up, I am not an employee I am an independent agent, therefore NOT an employee.

Because I saw the value of the products and the MDs side, WE just have to be open and above board with everyone we recruit, and not hide any information that can help our future recruits to make an inteligent decision. I am still commited to make this my business, more so after reading this blogs, because I dont have big $$$ to invest in any business, and because I know I can make a difference to my recruits and my clients life, one family at a time, brainwashed you say, yes you can say that but I take it in a positive way, because if helping people nowadays is a BAD thing, then I'd rather be a terrorist telling all the bad people that that they a have a way out the rat race. I know I need to invest $$$ but not as big as say $65,000 for a restaurant I was thinking of buying. This is a business therfore you have to be prepared to invest time and money in it, it is not free, nor is it for everyone, OHANA

#11 UPDATE Employee

WFG-AEGON-WRL??

AUTHOR: Donna - (U.S.A.)

SUBMITTED: Saturday, September 24, 2005

My question goes to fomer posters. If you felt the VUL was a "scam" and you are pointing fingers at WFG, I have to let you know that I think you are in the wrong. WFG does not INSIST on agents to get a VUL. They do suggest it, especially if this product you are going to be selling. For example, if you worked for Nextel Cellular phones- they want you to use their phones, that way you can really know the products that you are selling. They even GIVE you them while you are working there!! It is NORMAL for any company to encourage their employees, contractors, agents, ect to use their products!!!

Another thing I would like to mention like a previous poster- WFG is a BROKER- they represent LOTS and LOTS of the best companies out there with lots and lots of different products- NOT just the VUL. If you are questioning WFG, the ethics, the training, did you know there are TRAINING REPS that come for the LARGE companies we work with to come in and do trainings, you NEED to get certified with them. If WFG was misrepresenting Western Reserve Life, PacLIfe, TransAmerica products---- don't you think we wouldn't be reprenting them anymore. Especially with a HUGE company like AEGON backing them up.

You are right, WFG is not for everyone, not for everyone to invest with or work with. To each their own but lets keep in mind-- each successful company has a few bad apples that love to TRY to ruin the barral.

#10 UPDATE EX-employee responds

Agree With Paul Arabi of Louisiana (VUL's are the Swiss Army knife of insurance policies, but it is engineered to cut your wallet up)

AUTHOR: Joseph - (U.S.A.)

SUBMITTED: Monday, January 10, 2005

Paul,

Thanks for explain the VUL product in such plain terms. My own experience is that WMA/WFG do not (or intentionally) train their sales representatives that way. I never understood it completely when I was told to sell it. And I never understood it completely when I was pressured to buy it. After two years of "INVESTING" (the term that my upline would like me to use, I lost the entire $12,000 since there was no cash value in my "Investment".

#9 UPDATE EX-employee responds

WMA/WFG misleading clients and cashing in on it.

AUTHOR: Paul - (U.S.A.)

SUBMITTED: Thursday, November 11, 2004

John-Duarte,California wrote: [VULs are very powerful products. They are the swiss army knife of financial products and offer many benefits. You don't seem to understand what they are and how to use them. They are an insurance product first, and an investment product second, and a very good one at that.]

I was a WMA/WFG recruit. I am single and wanted no load investments. I did not need insurance but I was pushed a VUL constantly by uplines. After researching I found out why.

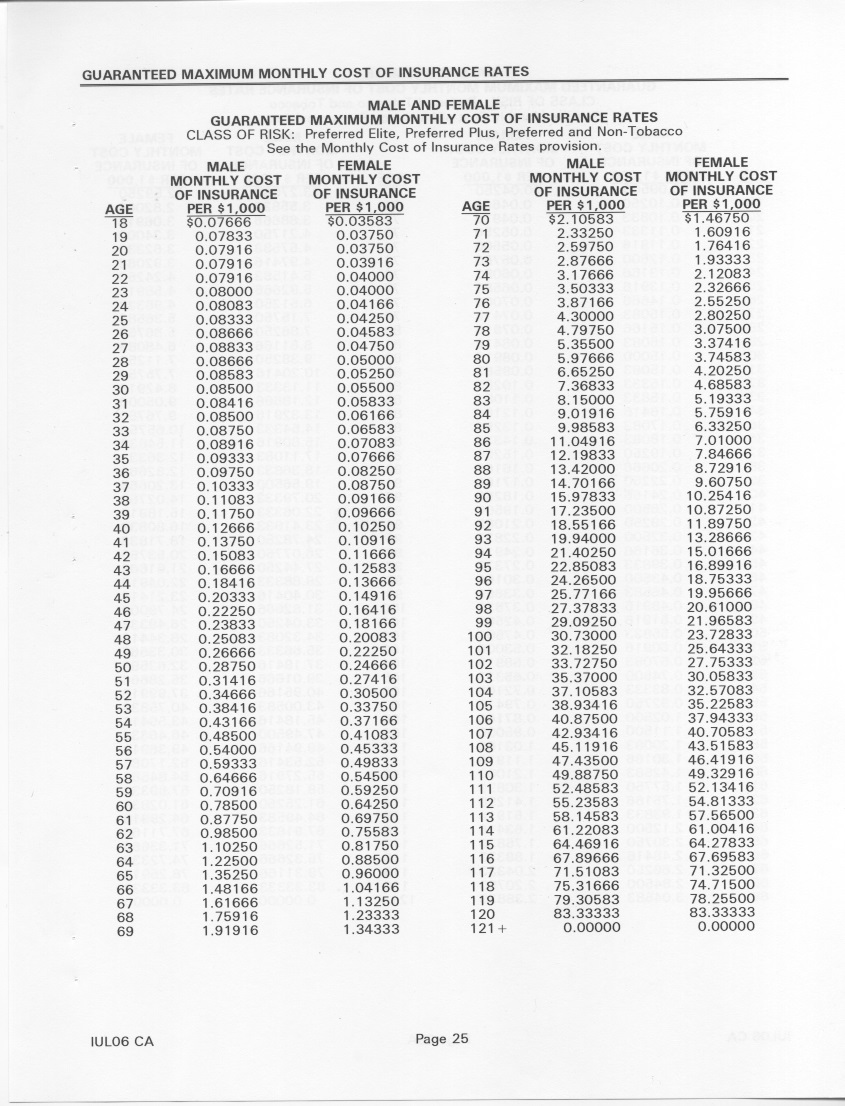

VUL's are powerful products for the issuing companies and the commissioned salesmen who push them. They offer the largest commissions because they are the most profitable policies that a company can sell. The "Big Lie" sales pitches are (tax free) and (investment). VUL's are insurance policies not investments. They are not tax free, read the prospectus. The taxes are paid by the issuing company and are reflected in a lower rate of return. Also, they charge mortality and expenses to your account. You pay a second insurance expense to protect the profits of the issuing company.

As for the cash value side of the policy if you borrow "your" money they charge you interest. There is a sales pitch to hide this fact: "We charge you but we refund it". How it works: $10,000 cash value, borrow $2,000 plus 5% fee and you have a loan reserve of $2,100 but your cash value will show $8,000. Close this account and do you get $8,000, no. Do you get $7,900, no. You would get $5,900 ($8,000 cash value less $2,100 loan reserve). This is known as the Cash Surrender Value. Cash value is actually just a credit limit.

VUL's are only prepaid insurance policies. Check it out: You have a $300,000 death benefit and a cash value of $58,000. If you die your beneficiary only gets $300,000 not $358,000. The cash value is actually the Insurance Companies money not yours. There is a VUL that would pay the $358,000 but it charges extra so it is just smoke and mirrors.

The "Swiss Army Knife of Financial Products" is guaranteed to cut you up financially if you purchase one.

#8 UPDATE EX-employee responds

WMA/WFG misleading clients and cashing in on it.

AUTHOR: Paul - (U.S.A.)

SUBMITTED: Thursday, November 11, 2004

John-Duarte,California wrote: [VULs are very powerful products. They are the swiss army knife of financial products and offer many benefits. You don't seem to understand what they are and how to use them. They are an insurance product first, and an investment product second, and a very good one at that.]

I was a WMA/WFG recruit. I am single and wanted no load investments. I did not need insurance but I was pushed a VUL constantly by uplines. After researching I found out why.

VUL's are powerful products for the issuing companies and the commissioned salesmen who push them. They offer the largest commissions because they are the most profitable policies that a company can sell. The "Big Lie" sales pitches are (tax free) and (investment). VUL's are insurance policies not investments. They are not tax free, read the prospectus. The taxes are paid by the issuing company and are reflected in a lower rate of return. Also, they charge mortality and expenses to your account. You pay a second insurance expense to protect the profits of the issuing company.

As for the cash value side of the policy if you borrow "your" money they charge you interest. There is a sales pitch to hide this fact: "We charge you but we refund it". How it works: $10,000 cash value, borrow $2,000 plus 5% fee and you have a loan reserve of $2,100 but your cash value will show $8,000. Close this account and do you get $8,000, no. Do you get $7,900, no. You would get $5,900 ($8,000 cash value less $2,100 loan reserve). This is known as the Cash Surrender Value. Cash value is actually just a credit limit.

VUL's are only prepaid insurance policies. Check it out: You have a $300,000 death benefit and a cash value of $58,000. If you die your beneficiary only gets $300,000 not $358,000. The cash value is actually the Insurance Companies money not yours. There is a VUL that would pay the $358,000 but it charges extra so it is just smoke and mirrors.

The "Swiss Army Knife of Financial Products" is guaranteed to cut you up financially if you purchase one.

#7 UPDATE EX-employee responds

Recruit, recruit, recruit and sell VUL's ..They found my resume on Monsters.com

AUTHOR: Teresa - (U.S.A.)

SUBMITTED: Monday, November 08, 2004

They found my resume on Monsters.com and told me to come to an information seminar. It was a "rare" opportunity because a big wig from the company would be speaking.

I went to the seminar and there was a room full of people and the sales pitch began. I was intrigued because I was already licensed and I wanted to get into financial services because I had a background in finance.

I had an interview with the branch manager who told me I needed three things. (1) INTEGRITY (2) Work Smarter not harder (3) Work ethic

I possessed all three and so he said I would have to pay $100 for a background check because I would be an independent agent so I was responsible for the cost. Then next evening I went to my first evening of training. It was given by a young (25 year old) and the training was about marketing a leads. I have been in sales for 15 years I wanted the financial training they talked about at the seminar. We then got a piece of paper with the compensation plan. The only way to make more money was to bring 3 people in underneath me. MLM? Pyramid? I think so.

Then next day I met with this guy one on one because he was my manager. The first thing he had me do was write as many names as possible on a sheet of paper for people who would be possible leads. I started to probe him about questions relating to finacial services. I was talking about term life. He stated that it was best to sell VUL policies because it paid a higher commission. That was all it took for me I knew something was up.

I got home and did some research and realized it was a MLM and discovered the WMA-WFG fiasco as well. I emailed the branch manager and stated exactly why I didn't want to sell for the company. I also found out that background checks are to be paid for by the employer regardless if you are independent. I also told this to Todd. He said that he told me it was a non-refundable administration cost. For what? I didn't get anything. California law also has a three day right to rescind law. At that point he gave me the corporate office. They were no help either so now I am filing complaints with the better business bureau and small claims court. It isn't about the money but the principle and dishonesty and I want others to know. I am just glad I realized before I got sucked in. I spoke with several successful financial planners about VULs and they say it is better to invest in other vehicles and get term life to cover death. Which is really what life insurance is about.

Anyway that's my story. They didn't get the names I had written down so thank God none of my friends and family will be subjected to their sales agenda.

#6 UPDATE Employee

World Financial Group is not illegal

AUTHOR: John - (U.S.A.)

SUBMITTED: Friday, November 05, 2004

Kim, I've been with WFG for over 2 years now. In my last post I said it was just over one year, maybe I had too much to drink that day.

First of all, WFG is not WMA. WMA was acquired by Aegon, which changed the name to WFG. It wasn't a manuever to escape bad mojo, it's common practice when a company gets bought out by another and comes under new management.

You obviously had a bad experience at a WMA office, but you can't translate that to WMA as a whole, and then by extension to WFG. I had a bad experience with a loan officer at a Countrywide office, but I'm not posting here how Countrywide is a ripoff.

If you went to an office that really did insist everyone open a VUL, that is unethical and they should have been investigated by the SEC. VULs are not right for everyone, and in my 2 years here I've never seen anyone insist a new recruit open a VUL. I did, but it's because I had an insurable need and had no retirement savings yet.

VULs are very powerful products. They are the swiss army knife of financial products and offer many benefits. You don't seem to understand what they are and how to use them. They are an insurance product first, and an investment product second, and a very good one at that.

I'm 32, so I have an aggressive investment posture. You tell me what other product will return me an average 12% (not guaranteed) on my investment that will grow tax-free, and distribute tax-free. It also insures my wife and I for $800,000 between us, we can borrow against it tax-free and penalty-free, and it's untouchable by any legal judgment. If you don't think that's a good product, you are simply ignorant and in no position to criticize that which you don't understand.

I also find it interesting you claim our desire is not to guide someone through their financial goals. That's what my desire is. I work with several other license agents and that's what their desire is. We also have a desire to recruit people to build a business with agents under us, but I know that no one I work with would do so by pulling a fast one on a client.

#5 UPDATE EX-employee responds

World Financial may not be a scam, but ... IT IS ILLEGAL

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, November 04, 2004

TO the employee who defended World Financial Group, I'm not sure how long you've been with the company, but you failed to mention the history of WFG.

Years ago, it was called WMA and WMA Securities. WMA does heavy recruiting to spread the word of the company and " sell the dream " as they elegantly put it. They also insist that each new member open a VUL contract. For those not in the field, it is an insurance policy. They marketed this product as their flagship product, as an investment vehicle ( big no-no! ) and every new member is expected to open one, regardless of age. The higher the death benefit on the policy, the higher the commission paid out.

Once the new recruit obtains his/her licenses, then they are able to work for WMA Securities.

I have attended their meetings, trainings and retreats..and have seen hundreds of "agents" who just graduated from high school representing the companies you mentioned.

This is a powerful company, but their original plan to take financial services to the public on a mass scale has backfired. There are certain satellite offices where they focus strongly on recruiting and getting each member to open a VUL that they forget all the technical training that is involved in preparing someone's financial future. I have seen that most of the agents don't even pick up the financial papers or know what an index fund is.

personally, I would not trust anyone from WFG, formally WMA Securities. Although they mean well and are driven to succeed, they're attention is definitely not to guide someone through their financial goals. That can only come with many years of experience, not from attending weekly meetings at the office on how to recruit and the Rule of 72, DCA and all the other stuff one can read in Chapter 1 of any business book.

Lastly, for now at least, you failed to mention how many times the SEC took a close look at WMA Securities, how the company was banned to hold these pow-wows, retreats, meetings solely for the purpose of pumping people up to go recruit, sell the dream and convince clients VUL is actually an investment product. If it is an iinvestment vehicle, why do the agents need an insurance license? That was the reason they had to change their name. Just like Primerica and Equinox is the same company, but had to change names to clear the bad reputation.

No doubt it makes people rich, unfortunately, many have broken laws to get there, many have "fake it 'til you make it" and some have been barred from obtaining any kind of license by the SEC, Dept. of Ins. permanently.

To be fair, I invite anyone curious to go check it out for themselves. If it doesn't feel right, stay away, don't give them your money and do not refer others to them. If you do see something you like, then maybe it'll work for you. Good luck everyone.

#4 UPDATE EX-employee responds

World Financial may not be a scam, but ... IT IS ILLEGAL

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, November 04, 2004

TO the employee who defended World Financial Group, I'm not sure how long you've been with the company, but you failed to mention the history of WFG.

Years ago, it was called WMA and WMA Securities. WMA does heavy recruiting to spread the word of the company and " sell the dream " as they elegantly put it. They also insist that each new member open a VUL contract. For those not in the field, it is an insurance policy. They marketed this product as their flagship product, as an investment vehicle ( big no-no! ) and every new member is expected to open one, regardless of age. The higher the death benefit on the policy, the higher the commission paid out.

Once the new recruit obtains his/her licenses, then they are able to work for WMA Securities.

I have attended their meetings, trainings and retreats..and have seen hundreds of "agents" who just graduated from high school representing the companies you mentioned.

This is a powerful company, but their original plan to take financial services to the public on a mass scale has backfired. There are certain satellite offices where they focus strongly on recruiting and getting each member to open a VUL that they forget all the technical training that is involved in preparing someone's financial future. I have seen that most of the agents don't even pick up the financial papers or know what an index fund is.

personally, I would not trust anyone from WFG, formally WMA Securities. Although they mean well and are driven to succeed, they're attention is definitely not to guide someone through their financial goals. That can only come with many years of experience, not from attending weekly meetings at the office on how to recruit and the Rule of 72, DCA and all the other stuff one can read in Chapter 1 of any business book.

Lastly, for now at least, you failed to mention how many times the SEC took a close look at WMA Securities, how the company was banned to hold these pow-wows, retreats, meetings solely for the purpose of pumping people up to go recruit, sell the dream and convince clients VUL is actually an investment product. If it is an iinvestment vehicle, why do the agents need an insurance license? That was the reason they had to change their name. Just like Primerica and Equinox is the same company, but had to change names to clear the bad reputation.

No doubt it makes people rich, unfortunately, many have broken laws to get there, many have "fake it 'til you make it" and some have been barred from obtaining any kind of license by the SEC, Dept. of Ins. permanently.

To be fair, I invite anyone curious to go check it out for themselves. If it doesn't feel right, stay away, don't give them your money and do not refer others to them. If you do see something you like, then maybe it'll work for you. Good luck everyone.

#3 UPDATE EX-employee responds

World Financial may not be a scam, but ... IT IS ILLEGAL

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, November 04, 2004

TO the employee who defended World Financial Group, I'm not sure how long you've been with the company, but you failed to mention the history of WFG.

Years ago, it was called WMA and WMA Securities. WMA does heavy recruiting to spread the word of the company and " sell the dream " as they elegantly put it. They also insist that each new member open a VUL contract. For those not in the field, it is an insurance policy. They marketed this product as their flagship product, as an investment vehicle ( big no-no! ) and every new member is expected to open one, regardless of age. The higher the death benefit on the policy, the higher the commission paid out.

Once the new recruit obtains his/her licenses, then they are able to work for WMA Securities.

I have attended their meetings, trainings and retreats..and have seen hundreds of "agents" who just graduated from high school representing the companies you mentioned.

This is a powerful company, but their original plan to take financial services to the public on a mass scale has backfired. There are certain satellite offices where they focus strongly on recruiting and getting each member to open a VUL that they forget all the technical training that is involved in preparing someone's financial future. I have seen that most of the agents don't even pick up the financial papers or know what an index fund is.

personally, I would not trust anyone from WFG, formally WMA Securities. Although they mean well and are driven to succeed, they're attention is definitely not to guide someone through their financial goals. That can only come with many years of experience, not from attending weekly meetings at the office on how to recruit and the Rule of 72, DCA and all the other stuff one can read in Chapter 1 of any business book.

Lastly, for now at least, you failed to mention how many times the SEC took a close look at WMA Securities, how the company was banned to hold these pow-wows, retreats, meetings solely for the purpose of pumping people up to go recruit, sell the dream and convince clients VUL is actually an investment product. If it is an iinvestment vehicle, why do the agents need an insurance license? That was the reason they had to change their name. Just like Primerica and Equinox is the same company, but had to change names to clear the bad reputation.

No doubt it makes people rich, unfortunately, many have broken laws to get there, many have "fake it 'til you make it" and some have been barred from obtaining any kind of license by the SEC, Dept. of Ins. permanently.

To be fair, I invite anyone curious to go check it out for themselves. If it doesn't feel right, stay away, don't give them your money and do not refer others to them. If you do see something you like, then maybe it'll work for you. Good luck everyone.

#2 UPDATE Employee

WFG - Not for Everyone

AUTHOR: Carlos - (U.S.A.)

SUBMITTED: Wednesday, August 25, 2004

Sorry you had such an experience.

I have a legal, insurance and mortgage background for over 15 years. I am able to conduct an analysis sufficient to make an informed decision.

As such, WFG is great for those who desire the vision and for helping families attain their financial goals.

There are complaints about the people and the process, even about Citibank, Bank of America, Chase, the Postal system, Sprint, Verizon, AT&T, etc. Does that mean they are rip-offs? No. That simply confirms the fact that in just about every profession there are those who distort the system and those who are not satisfied with the process.

Make the best of opportunties that come your way. If you choose a job for your career, so be it.

I choose independence.

#1 UPDATE Employee

World Financial Group is not a scam

AUTHOR: John - (U.S.A.)

SUBMITTED: Friday, July 16, 2004

I have been a licensed agent with World Financial Group for over a year now. I'm sorry you had such a poor initial contact with us. WFG is a member of the Aegon group. Aegon is a Dutch-owned, multi-national ~250 billion dollar company.

They own TransAmerica, among many other holdings. WFG is a financial services marketing organization, their goal is to get financial education out to middle-America. We teach people about the Rule of 72, different savings vehicles and their tax-treatments, and the importance of estate planning.

We are also actively recruiting people to be agents so we can get into even more homes to help more people. WFG is a broker, so of course we don't have any of our own products. We represent Pacific Life, Lincoln Benefit, American Skandia, Zurich Life, Western Reserve Life, IDEX Mutual Funds, and many others. You think these companies would let a "scam" represent them?

WFG has thousands of agents, maybe you did meet some who were jerks. Maybe you're a jerk yourself. WFG is not suited for everyone, many people simply can't handle being in business for themselves, they need a boss telling them what to do. It doesn't sound like you're a fit, but that doesn't make it a scam.

Advertisers above have met our

strict standards for business conduct.