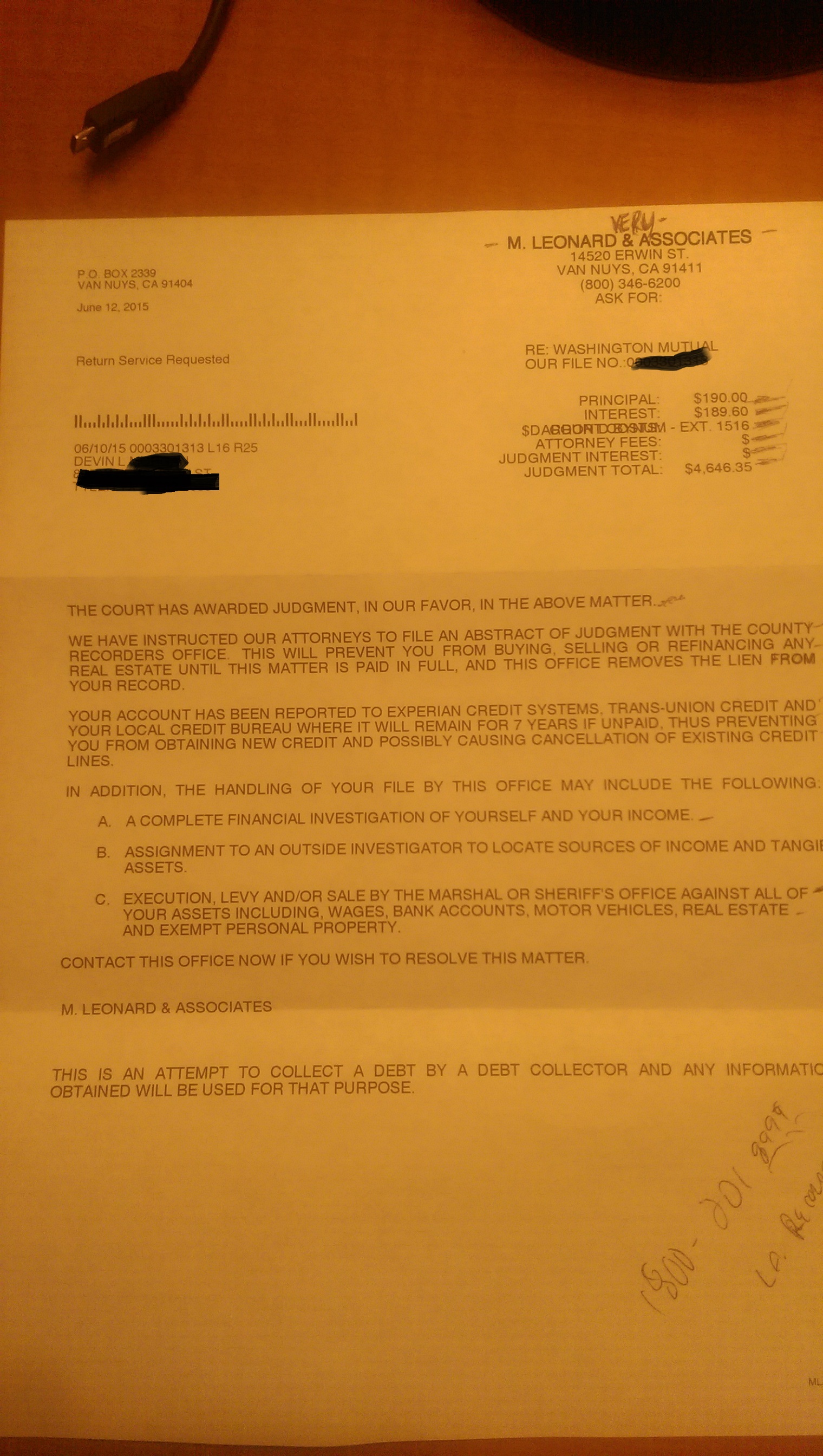

Complaint Review: Washington Mutual - Dallas Texas

- Washington Mutual PO Box 660487, Dallas TX 75266-0487 Dallas, Texas U.S.A.

- Phone: 866-892-9268

- Web:

- Category: Credit & Debt Services

Washington Mutual WaMu raises credit card rates 100% Dallas Texas

*Consumer Suggestion: Sherry, this is easy to deal with. There are 2 things you can do.

*Consumer Suggestion: Sherry, this is easy to deal with. There are 2 things you can do.

*Consumer Suggestion: Sherry, this is easy to deal with. There are 2 things you can do.

*Consumer Suggestion: Sherry, this is easy to deal with. There are 2 things you can do.

*Consumer Comment: Bad news, Sherry- CC Banks reserve the right to change your credit trems as thep please

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I just received my WaMu credit card bill- and my interest rate went from 8.99%- 17.99%! I have never made a late payment, and have not been over my limit (two things that might cause this) so I contacted them. They said they had sent out a letter stating the increase (which I did not get) and that it was due to my TransUnion report. I pulled up the report while talking to them, and my credit is better now than when I took out the account over 4 years ago.

I have been looking through the internet and it seems that WaMu has done this to all of it clients across the country. I say we ban together and make something happen. If this has happend to you please contact me at thescherrs@charter.net. I think a class action is in the works!

Sherry

St. Charles, Missouri

U.S.A.

This report was posted on Ripoff Report on 09/20/2008 10:04 AM and is a permanent record located here: https://www.ripoffreport.com/reports/washington-mutual/dallas-texas-75266-0487/washington-mutual-wamu-raises-credit-card-rates-100-dallas-texas-374615. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Suggestion

Sherry, this is easy to deal with. There are 2 things you can do.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, September 21, 2008

Sherry,

If they cannot prove you got the alleged rate increase notice, they are out of luck.

All you need to do is maintain your position that you never got it, and then they are required to return your rate to the previous rate. Here's why. Federal Law requires a 30 day notification of a rate increase on a credit card and also gives you the option to opt out of the new rate, but then you cannot make new charges on the card. If you do, then you accept the new rate.

Basically, you can legally refuse the new rate, but your account is effectively closed at that point. However, you can pay off the entire account over a long period of time at the old terms.

OR, you can just walk away, and tell them to jump in a lake. This will hurt your credit, but is still an option, although not the best one you have.

Get a name of who you talk to, and a confirmation number.

My opinion is that they need to put these notices ON YOUR MONTHLY STATEMENT.

In clear view. Then there is no confusion, and the proof of delivery is automatic once you pay the bill from that statement.

Such an easy solution, but they like to skirt the law, and be deceptive.

They are in financial trouble and want to get every dollar they can, by any means possible.

Typical lowlife.

Then they wonder why people like me just walk away.

Think about it.

#4 Consumer Suggestion

Sherry, this is easy to deal with. There are 2 things you can do.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, September 21, 2008

Sherry,

If they cannot prove you got the alleged rate increase notice, they are out of luck.

All you need to do is maintain your position that you never got it, and then they are required to return your rate to the previous rate. Here's why. Federal Law requires a 30 day notification of a rate increase on a credit card and also gives you the option to opt out of the new rate, but then you cannot make new charges on the card. If you do, then you accept the new rate.

Basically, you can legally refuse the new rate, but your account is effectively closed at that point. However, you can pay off the entire account over a long period of time at the old terms.

OR, you can just walk away, and tell them to jump in a lake. This will hurt your credit, but is still an option, although not the best one you have.

Get a name of who you talk to, and a confirmation number.

My opinion is that they need to put these notices ON YOUR MONTHLY STATEMENT.

In clear view. Then there is no confusion, and the proof of delivery is automatic once you pay the bill from that statement.

Such an easy solution, but they like to skirt the law, and be deceptive.

They are in financial trouble and want to get every dollar they can, by any means possible.

Typical lowlife.

Then they wonder why people like me just walk away.

Think about it.

#3 Consumer Suggestion

Sherry, this is easy to deal with. There are 2 things you can do.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, September 21, 2008

Sherry,

If they cannot prove you got the alleged rate increase notice, they are out of luck.

All you need to do is maintain your position that you never got it, and then they are required to return your rate to the previous rate. Here's why. Federal Law requires a 30 day notification of a rate increase on a credit card and also gives you the option to opt out of the new rate, but then you cannot make new charges on the card. If you do, then you accept the new rate.

Basically, you can legally refuse the new rate, but your account is effectively closed at that point. However, you can pay off the entire account over a long period of time at the old terms.

OR, you can just walk away, and tell them to jump in a lake. This will hurt your credit, but is still an option, although not the best one you have.

Get a name of who you talk to, and a confirmation number.

My opinion is that they need to put these notices ON YOUR MONTHLY STATEMENT.

In clear view. Then there is no confusion, and the proof of delivery is automatic once you pay the bill from that statement.

Such an easy solution, but they like to skirt the law, and be deceptive.

They are in financial trouble and want to get every dollar they can, by any means possible.

Typical lowlife.

Then they wonder why people like me just walk away.

Think about it.

#2 Consumer Suggestion

Sherry, this is easy to deal with. There are 2 things you can do.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, September 21, 2008

Sherry,

If they cannot prove you got the alleged rate increase notice, they are out of luck.

All you need to do is maintain your position that you never got it, and then they are required to return your rate to the previous rate. Here's why. Federal Law requires a 30 day notification of a rate increase on a credit card and also gives you the option to opt out of the new rate, but then you cannot make new charges on the card. If you do, then you accept the new rate.

Basically, you can legally refuse the new rate, but your account is effectively closed at that point. However, you can pay off the entire account over a long period of time at the old terms.

OR, you can just walk away, and tell them to jump in a lake. This will hurt your credit, but is still an option, although not the best one you have.

Get a name of who you talk to, and a confirmation number.

My opinion is that they need to put these notices ON YOUR MONTHLY STATEMENT.

In clear view. Then there is no confusion, and the proof of delivery is automatic once you pay the bill from that statement.

Such an easy solution, but they like to skirt the law, and be deceptive.

They are in financial trouble and want to get every dollar they can, by any means possible.

Typical lowlife.

Then they wonder why people like me just walk away.

Think about it.

#1 Consumer Comment

Bad news, Sherry- CC Banks reserve the right to change your credit trems as thep please

AUTHOR: Friendly Help - (U.S.A.)

SUBMITTED: Saturday, September 20, 2008

Your WISEST action is to PAY OFF your credit card balances ASAP or you will discover one day that you are both old and poor.

Loans (except for fixed-rate house mortgages on houses bought at the right price) are a really bad idea.

Pay off WaMu now. WaMu needs money badly & you are a cash cow for them.

BoA raised their CC interest rates a while back by 100% to 200% and now they have used that money to buy Merrill Lynch.

So unless you want to help some millionaire CEO buy his new yacht, pay off the CC now.

Advertisers above have met our

strict standards for business conduct.