Complaint Review: Geico - Nationwide

- Geico Nationwide USA

- Phone: (509) 328-1422

- Web:

- Category: Car Insurance

Geico Pretends to be cheap, but rip you off for CREDIT REPORT! Spokane Nationwide

*Author of original report: Typical

*UPDATE EX-employee responds: Credit Score and Insurance

*General Comment: Geico

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

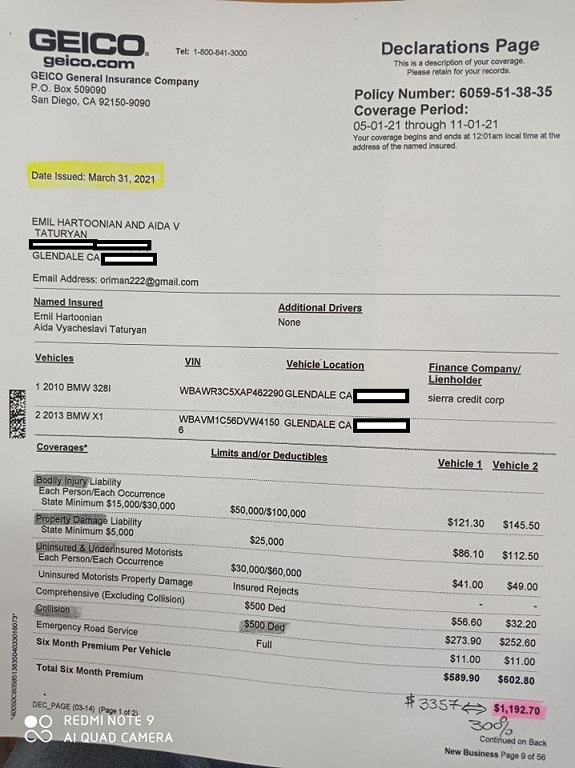

I asked for a simple insurance quote on my car which is an 05. I got a HUGE quote, not because I am a terrible driver (no tickets, no accidents), not because I haven't been driving long...40 years driving a commercial vehicle, but because of some OLD credit dings. Geico didn't inform me that they would be dinging my credit for an insurance quote either. The more inquiries, the lower your score gets. I was not informed that simply by shopping for car insurance, my credit score would be lessened... This should have been told to me up front.

Here are the reasons my quote was so high.

-Insufficient length of credit history (-) [only since 1988]

-Recent delinquency (-) [2008 foreclosure, this is 2015]

-Delinquency (-) [from any time in my life apparently]

-Delinquency date too recent (or date unknown) (-) [2008 on a house payment only is too recent? Since when do reporting companines report delinquencies without a date?]

So because I lost my house, but stayed current on my other bills, Geico sees fit to not only damage my credit for their auto insurance quote, but also give me 4 different (-) in order to get more money.

Here are some of the insulting things they said on the next page;

"Research shows that consumers with longer credit histories have lower insurance loss risk than those with shorter credit histories." So years of driving accident and ticket free are nothing compared to the year old credit card you never used...

"Analysis of consumer credit histories shows that consumers with previous late payments are much more likely to have greater insurance loss risk in the future." The fact that I have NOT had any tickets or accidents doesn't matter because "analysis shows" that after all these years I might suddenly become a risk because my house was repossessed 7 years ago. Really. I have had insurance for 40 years as well...without any breaks in coverage.

"Research reveals that consumers with previous late payments are much more likely to have higher insurance loss risk in the future." Even if you have never been a "loss risk" in your life. The RESEARCH REVEALS that I'm a risk! Not actual facts, un-cited abstract RESEARCH reveals it. What research? Into what? It sure wasn't "research" into my driving record and (non-existant) LOSS file.

Again they explain the last "delinquency" ding as "ANALYSIS" makes the consumer more likely to be a loss risk. Not your driving record or the number of miles driven accident and ticket free...ANALYSIS of late payments is the deciding factor of risk. Seems more like they want to make sure they get the money than it does about "loss risk".

My credit score was over 700 btw. Not bad for being the kind of deadbeat "risk" that GEICO makes me out to be. 4 separate (-) for the same event. Thanks GEICO.

GEICO needs to be more upfront about what they are doing. Using a credit report instead of a driving record for a car insurance quote is playing dirty. Claiming that a missed house payment means that you shouldn't have reasonable car insurance is bad policy. The fact that they check your credit apparently WITH your (unknown) authorization makes your credit score go down should also be explained to auto insurance shoppers.

This report was posted on Ripoff Report on 03/23/2015 05:22 PM and is a permanent record located here: https://www.ripoffreport.com/reports/geico/nationwide/geico-pretends-to-be-cheap-but-rip-you-off-for-credit-report-spokane-nationwide-1217666. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Author of original report

Typical

AUTHOR: - ()

SUBMITTED: Thursday, August 25, 2016

The response shows exactly why GEICO is so bad. Look at how nastily the employee writes. Did this person even READ what I wrote? "So many dings"? What "dings"? Of course I can buy a car! New OR used. As I stated, all my other bills were always current, I went through a foreclosure back when everybody was. This attitude of pretending like a credit report with ONE bad thing on it from years ago is what makes you a good or bad driver is EXACTLY why I will never deal with the arrogant ripoffs at GEICO. Oh and by the way. I haven't had any tickets or accidents since I wrote the original report and I drive 80,000 plus miles per year. GEICO lost out on a lot of FREE money.

#2 UPDATE EX-employee responds

Credit Score and Insurance

AUTHOR: Ex Employee - (USA)

SUBMITTED: Wednesday, August 24, 2016

In today's world, virtually anything that involves a large purchase, home, car, insurance, involves a credit history. Why? Beacause it is a RISK. All risks must be exmined. And all risks are different. WIth so many 'Dings' on your credit history, you probably wouldn't be able to finance a car-the bank would have turned you down.

To be surprised that Geico checked your credit history simply means that you didn't ask what factors they look at when considering you for a policy. You could have and they would have had to tell you. They did nothing wrong. You just didn't do all your homework.

#1 General Comment

Geico

AUTHOR: george - (USA)

SUBMITTED: Sunday, April 12, 2015

Do not blame Geico YOU The consumer Do Not Want to read anything in the contract, we use AFTER MARKET PARTS, or any car that is how we stay cheap. You got a BMW, Mercedes, Audi, SORRY you getting after market parts ask any ADJUSTER AND THEY MUST TELL YOU. READ BEFORE YOU SIGN IDI.. S WE DO NOT TELL ANYTHING TO ANY INSURED specially about credit reports or after market parts because the only thing YOU want to know is how cheap you getting the policy. You get what you pay for

Advertisers above have met our

strict standards for business conduct.