Complaint Review: Springleaf Financial Services - Evansville Indiana

- Springleaf Financial Services 601 NW Second St Evansville, Indiana United States of America

- Phone: (800) 435-6285.

- Web: http://www.springleaffinancial.com

- Category: Financial Services

Springleaf Financial Services American General Finance personal loan credit FCRA violation rights credit report reporting Evansville, Indiana

*Consumer Comment: Excellent. credit

*Consumer Comment: Never use them

*Consumer Comment: Spring Leaf in Fox Lake ILL. JERKS!

*Consumer Comment: You negotiated a settlement

*General Comment: 21.9% loan rate is cheap for our State

*Consumer Comment: BEWARE IF THESE LOAN SHARKS!

*Consumer Comment: I SALUTE THE LAST COMMENTER!

*Consumer Comment: You are a person of principle. They are not.

*Consumer Comment: More information

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I fell into hard times in 2007 and defaulted on a personal loan with American General Finance (who has since rebranded to Springleaf Financial Services, Inc.). When my finances improved, I reached out to their hired collection agency, negotiated a settlement, and paid the agreed amount. Springleaf was obligated to update my credit report to reflect the paid nature of the account, and the new $0 balance due, among other things. When they failed to update the three major credit bureaus in a timely manner, I filed a dispute with them. When contacted by the credit bureaus, Springleaf illegally certified that the information I was disputing was "accurate" when it did not yet reflect the paid nature of the account. This is a violation of the Fair Credit Reporting Act. To certify information as accurate, when it in fact is NOT is a clear violation of the law.

I then contacted the hired collection agency who informed me that it was out of their hands, and that only Springleaf could update that information (as Springleaf was the one reporting it to begin with). I once again filed a dispute with the credit bureaus, which Springleaf once again ignored, and illegally certified the information as accurate. It wasn't until some time later that they finally updated all of my credit reports. However, they still did not completely and accurately update the accounts, which still report some inaccurate information to this day.

When I contacted Springleaf about their violations of my rights, and the inaccurate reporting, their Senior Attorney Mr. S. Michael Gray, sent back an extremely rude letter outlining how I was a deadbeat client, and that my letter meant nothing to them. He closed out with a statement that they would refuse to respond to any additional correspondence from me.

Companies such as these have an obligation under the LAW to take information disputes seriously, and to only report accurate and complete information. By quickly rebuffing the credit bureau disputes, they broke the law again.

Despite my attempts to have Springleaf resolve the matter, they have chosen to ignore me. Thus, I am filing legal action against them and making sure the public is aware of their abusive tactics. I can tell you with some degree of certainty that they are abusing my rights because I turned out to be a bad client for them. I took my licks, and eventually paid the debt, more than could probably be said for a great number of their defaulted accounts, yet they still wish to treat me like trash.

This report was posted on Ripoff Report on 08/31/2011 09:56 PM and is a permanent record located here: https://www.ripoffreport.com/reports/springleaf-financial-services/evansville-indiana-47701/springleaf-financial-services-american-general-finance-personal-loan-credit-fcra-violation-771700. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#9 Consumer Comment

Excellent. credit

AUTHOR: Suno358 - (USA)

SUBMITTED: Thursday, February 04, 2016

I can't comprehend why someone who has excellent credit would go to Springleaf.Why didn't you go to your bank or a credit union.

#8 Consumer Comment

Never use them

AUTHOR: Suno358 - (USA)

SUBMITTED: Thursday, February 04, 2016

I needed $1000.00,they qualified me for $3000.00.Took the loan like an idiot.I'm on Social security and work part time caring for elderly.Long story short,my patient went in hospital,I couldn't make the payments,I tried to calla nd negotiate with them,wanted to pay a lesser amount for 2 months,they sent an employee to my house,not once but 2-3 times.One of the days I was trying to leave and she blocked my path until I threatened to call police.Don't deal with this company.

#7 Consumer Comment

Spring Leaf in Fox Lake ILL. JERKS!

AUTHOR: None of your business - ()

SUBMITTED: Wednesday, November 05, 2014

Spoke to a guy named MATT at Springleaf! What a f-ing jagbag this guy is. He is not nice nor easy to speak to. He was VERY rude on the phone and was yelling at me rather than speaking to me as a human being. This person should be fired for how he handled the situation and the threats he made during the call. This was totally not acceptable! What the hell happened to customer service? Also, I am a client, you do not speak to clients in such manners! I will NEVER use them again once my loan is paid in FULL! I will also make sure others do not use them to borrow money from.....mark my words..............I WILL PUT YOU OUT OF BUSINESS!

#6 Consumer Comment

You negotiated a settlement

AUTHOR: lwloco - ()

SUBMITTED: Friday, June 20, 2014

I went through similar when i paid off debts i negotiated down. It might say paid in full but with exception because it is not the full debt. I don't think legally much you can do since it was a settlement and not full amount due, there will be a asterik by it.

#5 General Comment

21.9% loan rate is cheap for our State

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, May 21, 2012

I had to write regarding last response of 21.8% post and run for the hills "scam artists". People need to realize there are two basic types of money available out there to ALL consumers. Regular retail bank lending and secondary market lending. Secondary market picks up "if" primary/retail banking market does not loan (for whatever reasons). In case of Springleaf, they always have been a secondary lender for the most part as they purchase monies first from prime retail lending institution, then re-lend those again at a markup for their profit. It is normal and very legal (All States set this loan level for such lenders).

As for saying 21.8% interest rate is criminal, come here to NC where the State sets that amount limit to 30.00%; meaning Springleaf and all other secondary lenders can charge up to this amount (depends on your credit).

All is dependent on your State's laws of lending and your credit report and stats, etc. Here, Springleaf will do an "unsecured loan" up to about $7,500.00 if you qualify with top credit and such. I had one of these in past for my business. They lend above that level but it has to be "collateralized", and they can do so against a paid off vehicle, a home, or similar major asset which you own or have substantial equity available in. I even borrowed against an "owned" work vehicle as well. Best rates here for Springleaf are about 16% (collateralized) and 18% (unsecured) but I do know, they have a lot of nearly 30% borrowers too who simply have low credit scores and bad payment histories and have unsecured loans using no collateral either.

When I have used them, I knew my credit was excellent and my cashflow was very solid in my business, so that I could make additional principle payments and pay the loff off fast, so interest was never a problem. However, those who simply pay minimum, will end up paying a ton of interest and that is the way it is. Problem wiht "banks", is their requirements are highly limited as far as loans for new or used vehicles, what they will or will not lend against, etc. It sadly eliminates MANY people today. ie: here our local banks will not give a loan for a used vehicle over say 2 years old or more than about 50,000 miles. Likewise, they will not lend at all against an owned vehicle unles sit is a few years old and in top condition, etc.... SO most people are forced to go to secondary lenders today and it has nothing to do with you being a great credit risk or hard working person. The system is highly flawed.

Reason I have to go to Springleaf at times, is retail banks still do not lend like they should be doing, and those of us US Small Business owners like myself, constantly are told by retail banks that we are "too risky" to lend to today. So I have had to use Springleaf several times over the years to cover "forward costs" and such in my business operations, and ALWAYS paid those loans off fast (long before maturity). Yeah I don't like the interest rates, and here in NC, they can charge up to 30%- so my 16% is considered very cheap by the secondary market standard. I wish the retail banks would lend to my business, but they act like they do not care to do so- they want front fees to start paperwork, but rarely ever complete loans irregardless of my reputation in my local area with my customers.

#4 Consumer Comment

BEWARE IF THESE LOAN SHARKS!

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Thursday, May 17, 2012

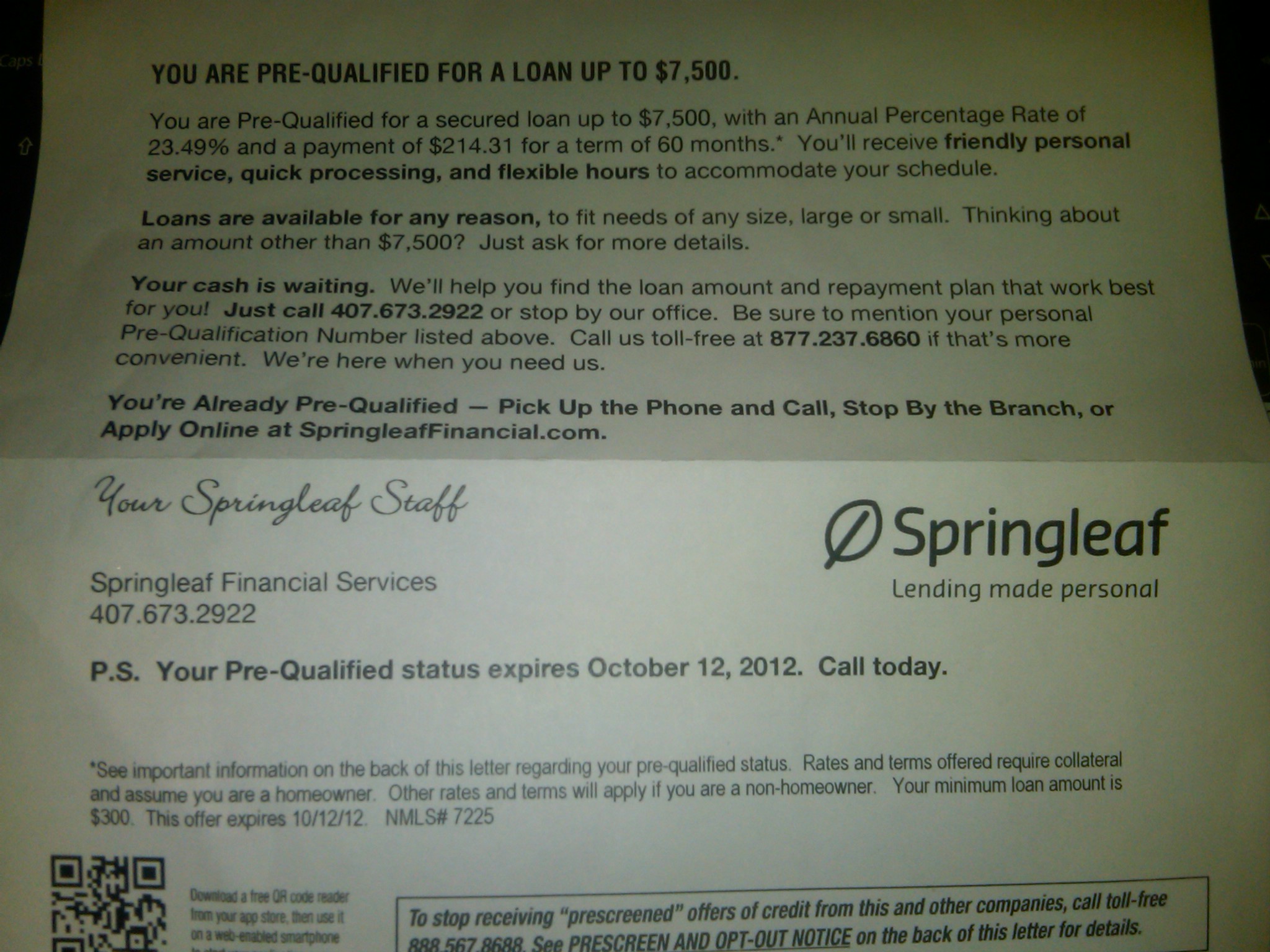

I just received a loan offer in the mail from these pirates at an interest rate of 21.98% APR. Do not borrow money from these loan sharks. That rate of interest used to be illegal in my state and many more for obvious reasons. You will NEVER pay it off and they may end up owning your house. Throw all of their advertisement in the trash!

#3 Consumer Comment

I SALUTE THE LAST COMMENTER!

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Tuesday, May 15, 2012

That was a very insightfull and comprehensive comment that exhibits the fallacy of the current financial institutions archaic policies, that have contributed to their downfall and made the economy the the national disaster that it is today.

#2 Consumer Comment

You are a person of principle. They are not.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, November 25, 2011

I read your post and wanted to say you did the correct and proper thing repaying your debts and additional charges that were assessed, but sadly, today, these companies simply do not care. They firstly are not prime lenders and are subprime type lenders and fall under different set of "loan ruels" as say a maninstream bank or credit union would. It is upsetting knowing their mother company (AIG) received over $180 Billion in free taxpayer funds a couple years ago, then American General Finance (AGF) rebranded itself to get out from under that shadow to now be named Springleaf Financial to give a more prettier name of their subprime lending arm (formerly AGF)

And if what you say is truth, they must report all changes to the credit reporting agencies; however, the way it is worded is they must "respond" in some manner within so many days- does not say they must correct language, etc.. So you are in this demise as they care about money first and not following through on incidentals. They can drag their butts for months which I have seen many times, including past matters we had ourselves; and had to keep pressing and forcing them to do the right thing and correct improper reporting they made to our reports. Why EVERYONE needs to get a copy of their credit report every year or twice even and make sure everything is cleaned up on it. You have to now make sure THEY are doign their jobs, instead of believing they operate efficiently and honorably for the consumer because none of them do today. The weight of negativity is always against today's consumer and I long said these credit agencies had worked in cohoots with the lending industry for many years... Not the benefit of the consumer.

Another problem today as I see it, is all 3 major credit reporting agencies now are listed on stock exchanegs and should not be (publicly traded companies), as this in itself, to me, violates an independent nature of these agencies and what they were created for to begin with. It only adds more skepticism against them and more support for the lenders and works against the very consumer they were first established to fairly report and rate for financing needs.

#1 Consumer Comment

More information

AUTHOR: Dave - (USA)

SUBMITTED: Friday, September 16, 2011

What is inaccurate in the reporting of your account? How much time passed before the account was updated on your credit files?

Advertisers above have met our

strict standards for business conduct.