Complaint Review: Afni - Bloomington Illinois

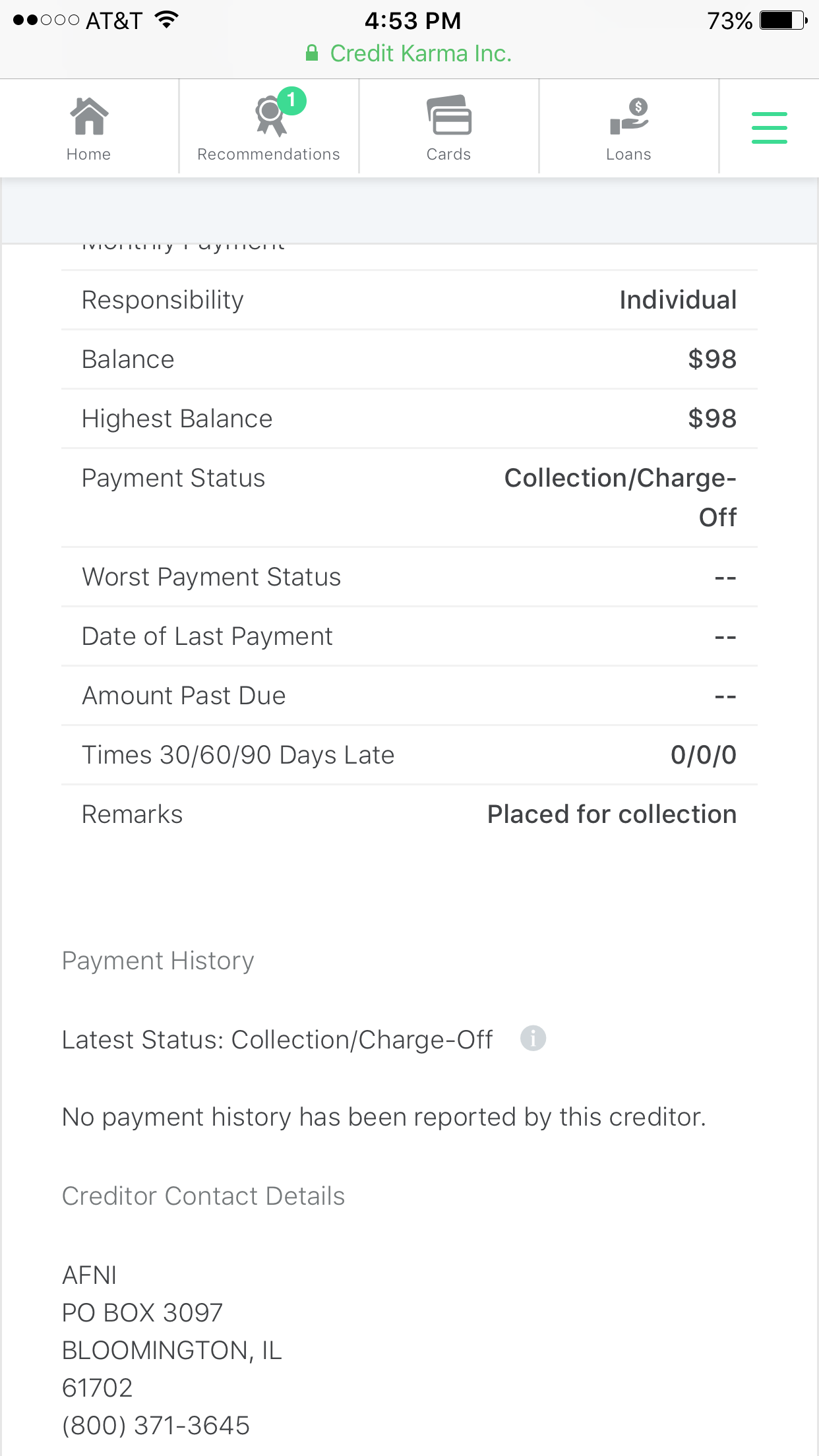

- Afni PO Box 3427 Bloomington, Illinois U.S.A.

- Phone: 888-8796810

- Web:

- Category: Collection Agency's

Afni, Major ripoff, Scumbags, FDCPA violators Bloomington Illinois

*Consumer Suggestion: Actually jennifer has a right to sue, And..

*Consumer Suggestion: K, You Need To Shut Up While You Are Behind

*Consumer Comment: Their SOL excuse

*Consumer Suggestion: SOL

*Author of original report: Case Closed

*Consumer Suggestion: AFNI CONTACT INFO AND GO TO BUDHIBBS.COM FOR UPDATED AFNI INFO

*Consumer Comment: AFNI - You can complain online. Save your stamps

I, too recieved a letter from these slimeballs in yesterday's (22 Jan)trying to say that they have been attempting to contact. Complete bull#%*^. Already filed complaints for FDCPA and FCRA violations with the FTC, BBB of Illinois and the Attorney General's office of IL complaint is going out today in the mail.

J.F.

Noneyabusiness, Iowa

U.S.A.

This report was posted on Ripoff Report on 01/23/2007 09:15 AM and is a permanent record located here: https://www.ripoffreport.com/reports/afni/bloomington-illinois-61702-3427/afni-major-ripoff-scumbags-fdcpa-violators-bloomington-illinois-232166. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Consumer Suggestion

Actually jennifer has a right to sue, And..

AUTHOR: Steve [Not A Lawyer] - (U.S.A.)

SUBMITTED: Thursday, February 15, 2007

Jennifer,

You CAN sue for the frivolous collection attempt. This is easy to get paid on.

And regardless of what K says, you CAN persue CRIMINAL fraud charges against them for attempting to collect a debt that they knew was legally UNCOLLECTABLE.

File a complaint with the FBI Financial Crimes Division and also make an appointment with your local prosecutor.

We need legislation that would require any collector/junk debt buyer to FULLY validate a "debt" before making first contact with the consumer/debtor.

#6 Consumer Suggestion

K, You Need To Shut Up While You Are Behind

AUTHOR: S.n. - (U.S.A.)

SUBMITTED: Tuesday, February 13, 2007

I read through some of the previous posts and I am not reading that ANYONE is complaining about a past the statute of limitations debt. AFNI appears to be attempting to bully everyone into paying old debts that are not theirs and, as far as I'm concerned, that's fraud. Food for thought everyone who has been threatened by AFNI for debts that are NOT theirs.

#5 Consumer Comment

Their SOL excuse

AUTHOR: John - (U.S.A.)

SUBMITTED: Monday, February 12, 2007

is lame at best. Of course they will not admit to phishing for info because they DO NOT have any validation material on her.

#4 Consumer Suggestion

SOL

AUTHOR: K - (U.S.A.)

SUBMITTED: Monday, February 12, 2007

Just because the debt's SOL expired doesn't mean they can not send you a letter asking for payment or contact via phone in regards to the debt. There was no violation of FDCPA from what you wrote.

#3 Author of original report

Case Closed

AUTHOR: Jennifer - (U.S.A.)

SUBMITTED: Monday, February 12, 2007

I am pleased to report that complaints to both the IL BBB and Attorney General's office worked. AFNI told the BBB in a letter that they are closing attempts to collect because it is in fact out of statute.

They must have figured out that they are not dealing with a complete dummy who will not just roll over and pay up and who knows her rights to complete validation. They knew they had no proof that this money was owed. It was a 100 bucks that they were asking for, but it is the principle that counts. I would be shocked if in the letter that they will send to me stating that the case is closed a check for $1000 for knowingly violating the FDCPA.

Will update again when the letter arrives in the mail. Whoohoo! Keep up the pressure folks and they will figure out that most of their portfolio is complete bull. HAHA!

#2 Consumer Suggestion

AFNI CONTACT INFO AND GO TO BUDHIBBS.COM FOR UPDATED AFNI INFO

AUTHOR: P - (U.S.A.)

SUBMITTED: Thursday, January 25, 2007

Corporate Headquarters

404 Brock Drive

Bloomington, IL 61702-3097

800.767-2364

Afni, Inc.

404 Brock Drive

Bloomington, IL 61702 USA

Contact: Jim Hess, Director, Business Development

Phone: 800-767-2364, ext. 3321

Fax: 309-820-2632

Email: jimhess@afninet.com Afni, Inc. IL 309-663-4510 Jim Hess

Website: afninet.com

President and COO:

RONALD L GREENE

404 BROCK DRIVE

BLOOMINGTON 61701

Secretary: GREGORY J DONOVAN same address

Bruce F. Griffin

Chairman and Chief Executive Officer

Ronald L. Greene

President and Chief Operating Officer

Greg Donovan, CPA

Vice President of Employee Services

Stenia Dziadiw

Vice President of Sales & Business Development

Michael D. Garner

Vice President of Call Center Services

John Mobley, Jr.

Vice President, Information Technology Services and

Chief Information Officer

John O'Donnell

Vice President of Credit & Collections Services

Organization Number 0491821

Name AFNI, INC.

Profit or Non-Profit P - Profit

Company Type FCO - Foreign Corporation *****

Status A - Active

Standing G - Good

State IL

File Date 3/27/2000

Authority Date 3/27/2000

Last Annual Report 5/1/2006

Principal Office 404 BROCK DRIVE

BLOOMINGTON, IL 61701

Registered Agent C T CORPORATION SYSTEM

KENTUCKY HOME LIFE BLDG

LOUISVILLE, KY 40202

Current Officers

President Ronald L. Greene

Vice President Gregory J. Donovan

Secretary Gregory J. Donovan

Treasurer V. Curtis Oyer

Director Bruce F. Griffin

Director Ronald L. Greene

This organization has no assumed names

Previous Names

previous company names:

06/24/1986 - CREDIT CHECK INC.

06/29/2000 - ANDERSON FINANCIAL NETWORK, INC.

For collection-related inquiries, contact our Recovery Team at 1.800.371.3645, by mail at Afni, Inc. PO Box 3517, Bloomington, IL 61701 or email at: recoveryteam@afninet.com.

To handle your collections account on the internet, visit the collections website at AfniCollections.com

Important Note Regarding Collection-Related Inquiries:

If you choose to communicate via email, please remember that no matter how many measures Afni takes to ensure the confidentiality of your email, the Internet may be a non-secure medium for communication. If you choose to communicate your collection-related inquiry via email, Afni cannot be responsible for any possible disclosure of an account to a third party

COLLECTIONS PORTION OF THE COMPANY URL APPEARS TO BE AFNINET.COM

Anderson Financial Network, Inc.

404 Brock Drive

Bloomington, IL 61701

Administrative Contact:

Girard, Chris g@AFNINET.COM

Afni

404 Brock Dr

Bloomington, IL 61701

(309) 828-5226 fax: (309) 820-2610

Technical Contact:

Anderson Financial Network, Inc. oktober_isbell@HOTMAIL.COM

404 BROCK DR

BLOOMINGTON, IL 61701-2654

US

309.828.5226 fax: 123 123 1234

GENERAL INFORMATION FROM VARIOUS SITES ON DEALING WITH COLLECTION AGENCY'S

Tell them to validate by

. What the money you say I owe is for;

Explain and show me how you calculated what you say I owe;

Provide me with copies of any papers that show I agreed to pay what you say I owe;

Provide a verification or copy of any judgment if applicable;

Identify the original creditor;

Prove the Statute of Limitations has not expired on this account

Show me that you are licensed to collect in my state

Provide me with your license numbers and Registered Agent

1. NEVER talk to a collection agency on the phone. Period.

2. Keep good records. This can be the difference between a good and bad settlement. Don't expect them to remember you or what you agreed upon.

3. Send all correspondence via registered mail, receipt requested and put the registered mail number ON THE LETTER. DO NOT SIGN THE LETTER TYPE YOUR NAME

4. Keep a copy of every letter you send.

5. Penalties and extra interest are typically fictious amounts of money added on by the collection agency to pad their profits. Sometimes as much as to 50% of the debt or more claimed to be owed by a collection agency consisting of interest and fees. This is illegal, every state has usery laws (which dictate the maximum interests allowed to be charged. That is except North Dakota. There are no such laws which is why most credit card companies incorporate there.) Junk debt buyer pay anywhere from 1 cent to 7 cents on the dollar, there is no way there is this much interest.

6. Time is on your side. As time passes, the creditors will likely stop calling and the debt will be filed away for future attention or until the SOL runs out ..

#1 Consumer Comment

AFNI - You can complain online. Save your stamps

AUTHOR: Gloria - (U.S.A.)

SUBMITTED: Tuesday, January 23, 2007

I received a letter too as well as my husband... like we would have separate accts. and with Verizon. HA! We never had.

You can fill out a form online at the Illinois Attorney General's Office. I did it under /about/email_consumers

Advertisers above have met our

strict standards for business conduct.