Complaint Review: BB&T - greenville South Carolina

- BB&T greenville, South Carolina United States of America

- Phone:

- Web: BBT.com

- Category: Financial Services

BB&T B&T Online Mobile Banking holds funds for a week greenville, South Carolina

*REBUTTAL Owner of company: Remember the App

*Consumer Comment: Check The Agreement!

*Author of original report: Oh Really... ?!?

*Consumer Comment: And The Finger Points...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Funds deposited through the mobile phone app takes more than seven days to clear.

I recieved a check for $1600.00 and tried to use the new mobile deposit app to put the funds into my account.

First, the program does not let you deposit more than $1000.00 per day. So, after going back to the check issuer to get two $800.00 checks... I used the progaram to photograph the front and backs and the deposit was made... That was on Wednesday evening...

Thursday, I checked out my deposit history and sure enough I had two deposits for $800.00 each... Now, it was time to wait until after midnight to get credit, right...?!?

Friday arrives and there's no balance in the account... I called the bank, they said, sorry checks deposited via mobile banking takes 48 hours to process...

Saturday, and we need to go shopping... $85.00 for groceries and I get a low balance alert on my phone...

Call the bank again... New customer service person and this time... it was... "We're sorry, mobile banking transactions can take up to three days to clear..."

Three days? I ask... "Yes, three days... your deposit was deposited, effective on Thursday and your funds will be available on Tuesday..."

Yep! that's right three BUSINESS DAYS!!! not three days... like we live in... three business days... in todays age of business banking and electronic reporting... using a mobile phone app will tie your money up for nearly a week...

Oh, but it's convienient... and I didn'thave to drive to the bank to make my deposit... Oh, and the $5.00 I saved on gas... It cost me $105.00 in overdraft fees to cover the funds I spent of the balance that shows but is not in my account!

This report was posted on Ripoff Report on 08/25/2012 02:05 PM and is a permanent record located here: https://www.ripoffreport.com/reports/bbt/greenville-south-carolina-29602/bbt-bt-online-mobile-banking-holds-funds-for-a-week-greenville-south-carolina-932537. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 REBUTTAL Owner of company

Remember the App

AUTHOR: 3rd Party Observer - ()

SUBMITTED: Monday, May 26, 2014

I have been looking for reasons to, and not to deposit my checks via the mobile app. I think you guys have both become lost in fine-print semantics and run off the main point here - which is the credibility and effectivity of the BB&T Mobile App.

After watching the short promotional video for the mobile app on the bbt website, I am excited to finally not have to deal with the hassle of going to the bank to deposit checks. The only reason one would use this app, the focus of the entire video, seems to be convenience.

Perhaps Jimbo is correct about the policy and what it states, but the simple fact is, this app is just inconvenient, and therefore loses all credibility and effectivity. In today's fast-paced electronic world, the devices we have are supposed to give us an advantage over what we lacked before. If going to the bank and waiting in line was the problem, the mobile app should be the solution.

I am sad to say that, as it exists now, the BB&T Mobile App is far from a solution. It substitutes one disadvantage for an arguably worse one. I will gladly drive to the bank, and suffer a 15 minute line before I suffer days of insufficient funds. The Mobile App is pointless.

#3 Consumer Comment

Check The Agreement!

AUTHOR: Jim - (USA)

SUBMITTED: Sunday, August 26, 2012

I read the agreement and policies. Thank you for sending the link. The agreement is CONSISTENT with using the term "BUSINESS DAYS" when describing funds availability. That's not unusual, unethical or illegal. It has nothing to do with the Federal Reserve either. However, the person at the bank should have used that terminology as well. He or she should have said "business days" instead of "days". if in fact that's what he/she did say. In the abscence of what that person told you, what does prevail is the WRITTEN AGREEMENT which you are a party to. Also notice in the general funds availability disclosures the bank can take up to five BUSINESS DAYS to release all the funds. Also notice in the electronic capture agreement, the bank uses the word "generally" instead of "will". "Generally" gives them a window to "slip thru" because "generally" is not a definitive word. I am not the enemy here and I do not work for any bank or represent any. I do understand how you were expecting to use the money. had to use the money and its simply wasn't there as you expected. However, your full understanding of the policies are to blame. not the bank. What I would have done is deposit one of the checks and take the other to Walmart where they will cash it for a very reasonable fee. You could have bought your groceries and made a cash deposit with the rest.

When you become involved with any entity which provides you with paperwork such as banks, credit cards, loan companies etc, that paperwork needs to be read so that you can see what strategies you may need to implement to avoid extra fees and charges. Most people don't do that and when something happens the usual responses are: "they are illegal", "they are unfair", "they are scams". The real case is if we AGREE to do business with these entities, we MUST KNOW how to play the game so we avoid fees and charges. The only way to do that is to know what you are agreeing to by reading the paperwork. Your report was well written, so I can see you aren't a dummy. Just remember to be on top of the rules they play by so that you aren't left holding the bag.

SHALOM

#2 Author of original report

Oh Really... ?!?

AUTHOR: Bob - (United States of America)

SUBMITTED: Sunday, August 26, 2012

Well, Jimbo... Let's see... You must be either a BBT employee, or just a loyalist Dolt...?

Please tell me, where, in this exact excerpt form the BB&T terms of agreement from the "Mobile Remote Deposit Capture User Agreement", (which is found at: http://www.bbt.com/bbtdotcom/online-services/mobile-banking/mobile-check-deposit/terms.page? ) I have varied from these rules... Or, better yet... explain to me, how BBT has lived up to its conformance to this agreement... (Remember, a "terms of agreement" effects both parties equally unless theres and exclusivity clause.)

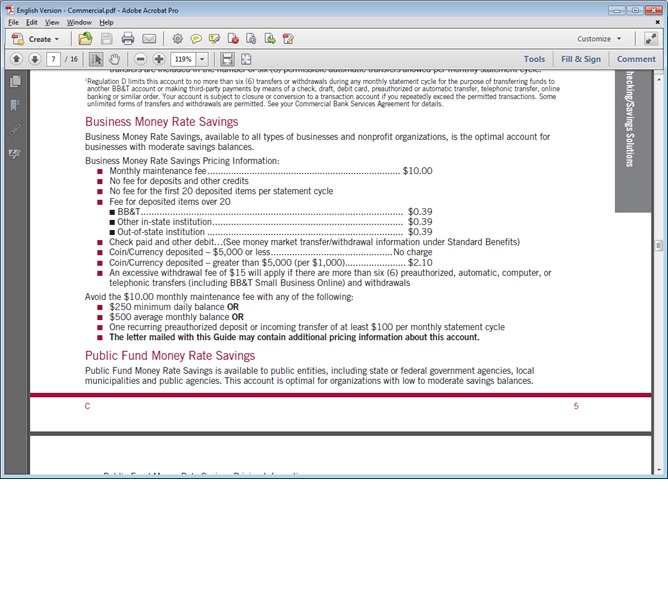

9. Availability of Funds. You agree that items transmitted using the Services are not subject to the funds availability requirements of Federal Reserve Board Regulation CC. In general, if an image of an item you transmit through the Service is received and accepted before 8:00 p.m. Eastern Time on a business day that we are open, we consider that day to be the day of your deposit. Otherwise, we will consider that the deposit was made on the next business day we are open. Funds deposited using the Services will generally be made available in three business days from the day of deposit. BB&T may make such funds available sooner based on such factors as credit worthiness, the length and extent of your relationship with us, transaction and experience information, and such other factors as BB&T, in its sole discretion, deems relevant.

So, let's see... Deposit on Wednesday (credit at midnight...) (A business day that the bank is open, right? For the sake of argunment...) Oh, and if you wish to try the argument that Friday Midnight equals Saturday, a non business day...?!? I'm not buying it.

Either way... your responce has only served to confirm what I have already determined... BBT's mobile banking system, (or any mobile banking system with similar rules) is not as portrayed or advertised... and that is...

In todays electronic information age, where the economy runs at light speed... For any monetary institution to stand behind the "old (and since revised) rules" of the Federal Reserve has the appearance of inflexibility for its customers.

BTW: if you are a bank employee, or you just wish to be "informed"... go to the Federal Reserve and see what changes are proposed at this WEB Site... http://www.federalreserve.gov/newsevents/press/bcreg/20110303a.htm

Then maybe you won't have to be so sarcastic in your next responce.

Dolt!

#1 Consumer Comment

And The Finger Points...

AUTHOR: Jim - (USA)

SUBMITTED: Saturday, August 25, 2012

When you installed this app, did you READ all the provisions. Did you read and understand the funds availability policy? You act surprised this has happened probably because you didn't read all those things. If you would have known about that policy, maybe you wouldn't have used it! Then this incredible gem: "It cost me $105.00 in overdraft fees to cover the funds I SPENT..."! Do you even understand what "funds availability" means? Do you actually think if you put a check into your account at 12:30, that the money is available at 12:31? If you don't want to end up like so many of the other whiners who complain about banks here, I urge you to learn about two things:

1. ALL banks have a funds availability policy. It may vary based on where the deposit was made and what form the deposit was. That policy is contained in the paperwork you received when you opened the account and/or application.

2. Start using a check register. The on line figures ARE NOT ACCURATE! The most accurate balance in the universe is when YOU mark down every transaction, do the math right then and there and don't add in deposits UNTIL they are posted and available. Then, using the MOST ACCURATE FIGURE IN THE UNIVERSE, you decide whether or not to ever pay an overdraft fee again.

In this instance, you gave yourself the $105 in overdraft fees because you spent money you didn't have. You did this...the bank didn't. And no, I don't work for them.

Advertisers above have met our

strict standards for business conduct.