Complaint Review: Capital One Auto Finance - Long Beach California

- Capital One Auto Finance P. O. Box 93016 Long Beach, California U.S.A.

- Phone:

- Web:

- Category: Loans

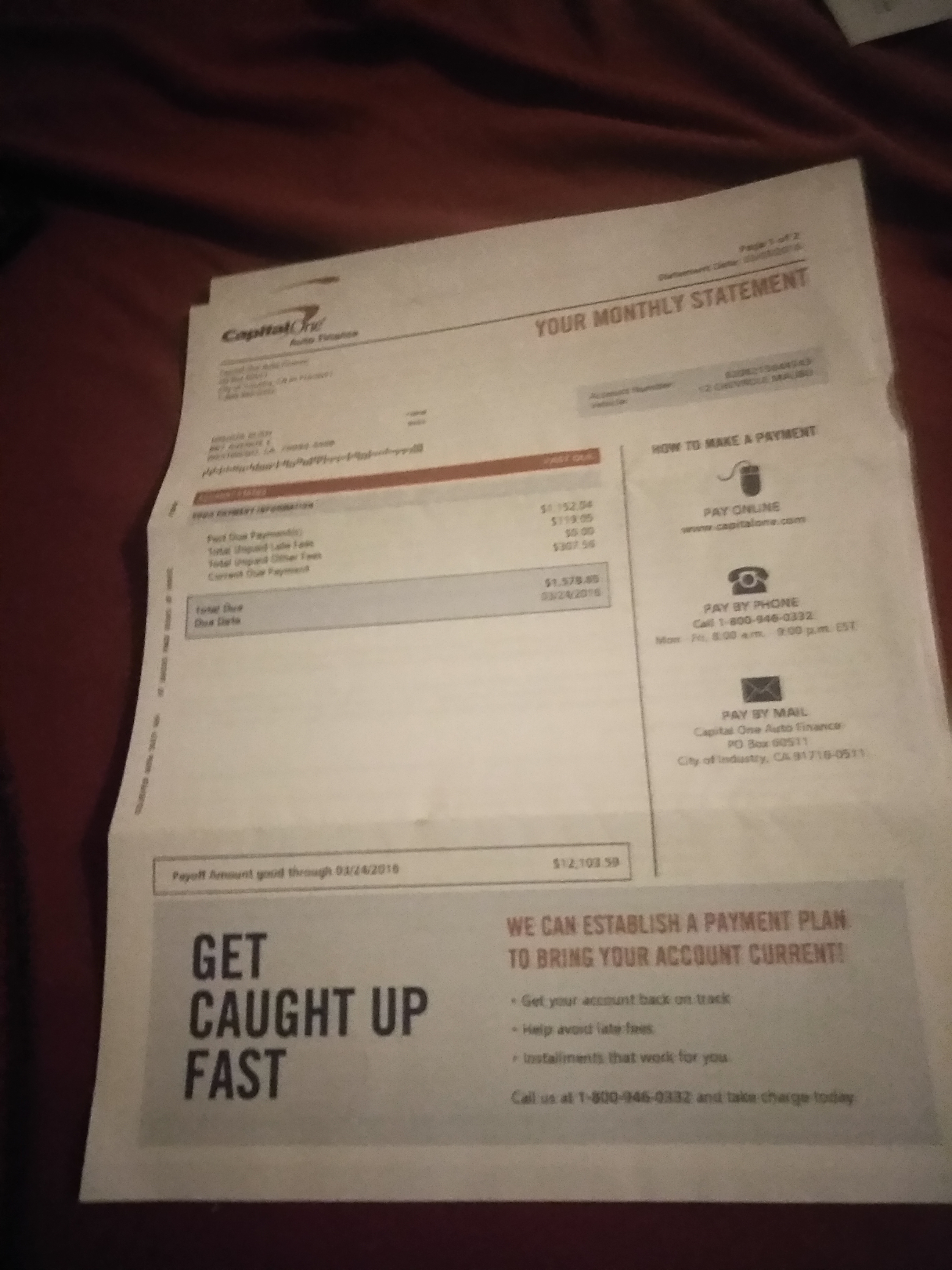

Capital One Auto Finance - Ascension Capital Major issues with bankruptcy filing - CAR NOT INCLUDED IN BANKRUPTCY - WON'T ACCEPT PAYMENT!!! Long Beach California

*Consumer Comment: Educate yourself..No Rip Off

*REBUTTAL Owner of company: Payments during your bankruptcy

My credit card rates were increased from 10% to 33% for no reason. I couldn't afford to pay them, they wouldn't work with me, etc. So I filed Chapter 7 - Capital One Car Loan WAS NOT included in the bankruptcy. I was never late making payments and intended to keep making payments.

For whatever reason, they have decided to turn this over to their bankruptcy group (Ascension) and nobody at either outfit will talk to me AND I am not allowed to make any payments. I am very afraid that they are going to come repo it - and of course hit me with all kinds of extra charges to get it back.

Patricia

Newville, Pennsylvania

U.S.A.

This report was posted on Ripoff Report on 05/19/2008 10:05 AM and is a permanent record located here: https://www.ripoffreport.com/reports/capital-one-auto-finance/long-beach-california-90809/capital-one-auto-finance-ascension-capital-major-issues-with-bankruptcy-filing-car-not-333431. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Educate yourself..No Rip Off

AUTHOR: Tcm - (U.S.A.)

SUBMITTED: Monday, April 11, 2011

I see this all the time. Legally if you file bankrupcty it includes all your debts. You can not say this or that is not included. That is considered preferential treatment and is illegal. If you filed chapter 7 are you reaffirming the vehicle?? They have to send it to their bankruptcy group. How may people who are not filing bankruptcy even know what a reaffirmation is. Until you declare and file the paperwork with the court they don't have to let you make payments. If you don't file the paperwork then yes they can take the car. And if they have to hire an attorney then yes attorneys cost money and they would charge you for those fees. If you or your attorney file the correct paperwork in a timely manner you can prob. keep your car but hold on to each and every payment you were supposed to pay they will want every payment once the paperwork is completed with the court.

Filing bankruptcy is a very involved legal matter. If you filed yourself seems that you did not educate yourself fully. If you have an attorney then they either took your money but didn't bother to let you know what was going on or they are idiots. Again this is not a rip off at least not from capital one.

#1 REBUTTAL Owner of company

Payments during your bankruptcy

AUTHOR: Mike - (U.S.A.)

SUBMITTED: Wednesday, October 13, 2010

All creditors are required by federal law to set aside your opened loans while you go through your bankruptcy. Like Capitol One Car they have their own company to manage your car loan until your bankruptcy is finalized then after it is finalized it will go back to the lender which in your case is Capitol One Car.

You mentioned you didnt put your car into your bankruptcy however your loan is on your TRW so anything you have opened and in good standing regardless on your TRW is going to be treated the same way. If you have a home loan it will to be set aside until your bankruptcy is final. You'll find that your house payment wont go through the normal channels anymore.

You need to call Ascension and request a "Affirmation" for your car loan oh and it also pays to be polite. You for the time being will be making your payments to Ascension and yes they do take your payments they are required to by law unless you are just so far behind you cant afford to make the payment they require.

Advertisers above have met our

strict standards for business conduct.