Complaint Review: CashCall - Anaheim California

- CashCall CashCall.com Anaheim, California U.S.A.

- Phone:

- Web:

- Category: Cash Services

CashCall CashCall reps: Rude, Harassing, obnoxious, unsympathetic Anaheim California

*Consumer Comment: FDCPA....

*UPDATE EX-employee responds: Your rights vs. Their rights

*Consumer Suggestion: Rocky, You have no idea what you're talking about.

*Consumer Suggestion: You acknowlege you owe them money but refuse to pay?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

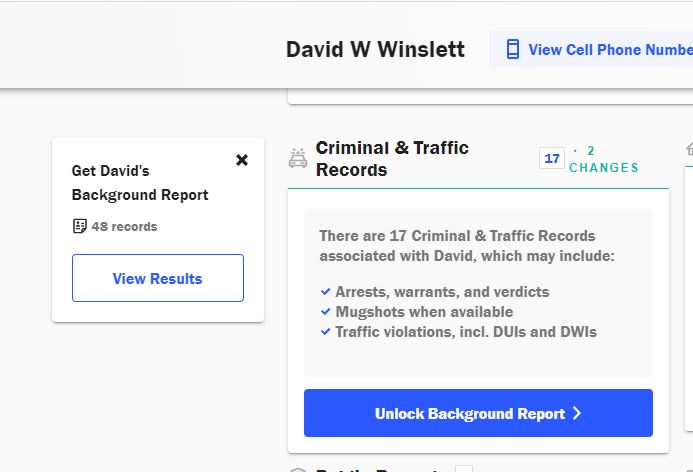

I got a loan of $10,000 about 3 years ago. I was always prompt in my payments until about 6 months ago. I was 2-3 days late. I am now 60 days past due. I don't dispute that I owe the money and want to pay it off.

They have been calling my cellphone, home phone and work phone. I did demand that they do not call the work phone and the home phone. They have quit calling my work but have continually called the home phone.

They have called my cellphone up to 20 times a day. All calls within about 15 mins of each other.

One time they took it upon themselves to deduct my bank account and extra payment when they were not given the permission to do this. I did ask them about sending personal checks or money orders and they told me that was not an option. I have learned recently that I don't have to do efts. When I demanded the money from the extra payment be debited back into my acct they said that was impossible.

They acknowledge the 2 payments made for that particular month but told me that they had the right to attain that payment. I did tell them that they only had permission to take one payment out nothing any more than that without my permission.

They were told again on 2/7/08 not to call the home phone, The Rep said he put a stop call on the home phone and then transfered the call to a very rude rep who refused to listen to me. So I ended the call and hung up. They called the home phone again on 2/8/08, after they were requested not to call this phone.

The conversation went just as it did yesterday. She would not let me talk. I would start to ask her what I could do and she would just interupt and not let me finish my sentence.

She suggested that I money gram the payment. I don't have access to a money gram store. She got belligerent. I tried to explain the area where I live and she pretty much called me liar.

By the time I payoff this loan I will have paid almost $30,000. I was not aware of the interest till after I received the money.

Merie

Independence, California

U.S.A.

This report was posted on Ripoff Report on 02/08/2008 03:01 PM and is a permanent record located here: https://www.ripoffreport.com/reports/cashcall/anaheim-california/cashcall-cashcall-reps-rude-harassing-obnoxious-unsympathetic-anaheim-california-307392. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

FDCPA....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Sunday, March 09, 2008

The Ex-Employee is mostly correct. However, if you start quoting the Fair Debt Collection Practices Act(FDCPA) to them they will just laugh. Because they are considered an Orignal Creditor, thus not subject to the FDCPA.

However, there is the CA equivalent of the FDCPA called the "California's Rosenthal Act". This extends the protections under the FDCPA to Original Creditors as well. Just remember that this does not make the debt go away, it just keeps them from contacting you about it.

#3 UPDATE EX-employee responds

Your rights vs. Their rights

AUTHOR: Tarken - (U.S.A.)

SUBMITTED: Sunday, March 09, 2008

Merie,

Here's the problem... in your contract it states that Cashcall can deduct payments from your bank account until the Cashcall account is caught up. If you are 2 months behind, they can deduct 2 payments, and believe me, they will try. If you are 3 months behind, they will try to deduct 3 payments, etc. It's in the contract that you e-signed. As well as their right to attempt to contact you on a daily basis, if this means they call your cell phone 20 times in a day... well, they call your cell phone 20 times in a day.

Now for the (moderately) good news. You DO have the right to have them stop from calling your cell phone simply by telling them this is costing you, Cashcall cannot get you to incur more debt by trying to pay this debt, meaning they can't call you collect, send you something C.O.D or call your cell phone if it costs you minutes.

You can also stop them from deducting payments from your bank account (EFT), AND you have the right to have them stop calling you at home, but both will take a little work on your part. You will need to send them a "Cease & Desist" letter.

Cashcall has the right to contact you at home until they receive a letter asking them to stop. By law, they then have to cease and desist all communication (phone calls, they can still write a letter unless you specifically ask them to stop that also.) In this letter, you can also request that they stop the EFT. Remember: they will NOT stop until they get this in writing.

One final note, after they receive the letter, they can contact you ONE MORE TIME to tell you they are not going to contact you, and to alert you that they WILL continue to collect on this loan by whatever means available to them. They cannot on that phone call try to collect from you, that is a violation of the FDCPA.

The best bet is to, of course, try to pay off this loan as quickly as possible. Those loans were meant to be a quick fix, not an extended financial arrangement. The interest you are being charged is ridiculous, but at this time legal. If you borrowed $10,000 and made every single payment on time, by the end of the 10 year loan you would pay Cashcall back in the vicinity of $40,000.

Good luck, I hope this helps.

#2 Consumer Suggestion

Rocky, You have no idea what you're talking about.

AUTHOR: Abstractgirl - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

You obviously don't know how it feels to deal with a predatory lender like Cashcall.

You have these people call you 20 times a day, double deducting your account, insulting your co workers and telling them all your personal information including threats. You have a representative threaten you over the phone and threaten to come to your work, and say racist things and let's see how you feel about JUST paying them back. If this company acted in a manner that was anywhere near human, they would get the consumers cooperation. Harrassing people is not going to get anything worked out in their favor. People tend to dislike when they are treated like a dog because they owe money. Most Americans owe money whether it is a mortgage or a car loan even credit cards and many with this housing market has filed for foreclosure. There are hundreds of people who are losing their homes, I doubt that these people are worried about paying Cashcall. I think they are worried about losing the roof over their head instead, so why don't you give people a break. After all, we all are debtors and if you are not in debt, you are one of the few Americans that don't have to deal with predatory lenders like Cashcall, but it doesn't mean you have to treat people who are going through this like we are a whole bunch of low lifes. I am a pillar of my community and support my family of 5. I pay all my debts and have paid off many loans even one with Cashcall, but I don't respond too easily to threats.

#1 Consumer Suggestion

You acknowlege you owe them money but refuse to pay?

AUTHOR: Rocky - (U.S.A.)

SUBMITTED: Friday, February 08, 2008

If you borrowed the money, it is your moral and legal obligation to re-pay it on time. CashCall did not quibble when lending you the money and you certainly were not so foolish as to not realize what their interest was at the time.

You are just plain lucky that they have not sicced the law on you and filed a large claim action in court.

Instead of writing to Ripoff Report, spend your time doing something worthwhile to get the money to repay your debt. Get a J-O-B or collect aluminium cans or something that will bring in money and REPAY your debt.

Advertisers above have met our

strict standards for business conduct.