Complaint Review: CBCS - Columbus Ohio

- CBCS P.O. Box 163250 Columbus, Ohio U.S.A.

- Phone: 888-413-0093

- Web:

- Category: Collection Agencies

CBCS Scamming MCI Claim wrong address and says its from 10yrs ago Columbus Ohio

*Consumer Comment: passed SOL and NO business has the right to yell at you

*Consumer Suggestion: PDJ Strikes Again!

*Consumer Comment: False

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I received a letter today from CBCS about a fake MCI claim over 10 years ago. The address they said I was living at was in Montana but 10yrs ago I was living in Texas. On top of that the guy was very rude, interrupting and yelling at me on the phone. After the attacking from him he said he is terminating this call and it will continue on with collections. I called back, got a different guy and he says it must had been a mistaken account and he would cancel the collection. So which one is it? The first guy I talked to said to send a dispute letter with 2 forms of I.D. and a social security number...yeah right, can we say identity theft???

Anyway this company is nothing but a scamming organization looking for money, identity theft and who knows what else. On top of all that, trying to collect on a fraudulent account from over 10 years ago?

Eric

Billings, Montana

U.S.A.

This report was posted on Ripoff Report on 05/24/2008 02:18 PM and is a permanent record located here: https://www.ripoffreport.com/reports/cbcs/columbus-ohio-43216-3250/cbcs-scamming-mci-claim-wrong-address-and-says-its-from-10yrs-ago-columbus-ohio-334663. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

passed SOL and NO business has the right to yell at you

AUTHOR: Sunny - (U.S.A.)

SUBMITTED: Wednesday, June 11, 2008

The poster who stated that CBCS was on the up and up is either a moron or works for them. He was absolutely wrong on almost everything he said. 1) they need to prove that this is your debt and it is valid. 2) what CBCS and the poster also fails to mention is that if you send them any sort of agreement or money just to get rid of them it affects your credit report and score. basically it will show up and be on the report for the next seven years and will be shown as a negative even if you pay it off. Due to the fact it is past the SOL it is in your best interest not to pay it EVEN IF it was your debt.

The fact that you are claiming it is not and they are requesting proof is a red flag. Send them a certified letter stating you want them to have NO CONTACT WITH YOU until the prove that is is your debt, its valid, and is not past the SOL. Do not send them any forms of IDs. Be aware however you may have to do this process time and time again because it only applies to that one credit agency, once they sell the info to a different collection agency it starts all over again. They have the right to contact you one more time after they sign the letter but that is all.

Also make sure to check your credit report to make sure they have not reported it as a bad debit, if they have dispute the charge and tell the Credit reporting agency that they have illegally changed the charge off date on the orginal loan and would like it notated, and removed from the report , make sure to check all three credit reporting agency. Then make an official compliant on them to the AG office in your state and the state where the collections are located and the BBB, if they did change the date and post it on the report.

Sadly many of these collection agency feed off of the fact that most people would rather pay off a $300 debit even if its not theirs, thinking it would save them the hassle and keep their credit scores high when the trurth is it doesnt. Last but not least any one calling from a business that yells, screams and threatens you is not someone you do with business with, Collection agency or not. also if some threatens you with a law suit from a collection agnecy they need to follow up on it or they are in violation of the fair credit reporting laws.for more information check out you states website or Guard My credit.com .

Most states offer a yearly check of your credit report for free. I checked mine for the first time almost three years ago and was shocked to see some of the things on it due to collection agencies just like CBCS. Wrong Names, Ages, Addresses. I had 7 negative chrarges and disputed them all, all were taken off and official compliants filed on each every collection agency most changed the SOL on loans goin all the way back to 1990 when I was a juvenile. find out what your rights are and protect yourself.

#2 Consumer Suggestion

PDJ Strikes Again!

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, June 11, 2008

""I'm sure there is an account you need to be more cooperative and CBCS is a collection agencies...""

CRAPOLA. The consumer needs to send a certified return receipt requested letter to CBCS to DISPUTE this alleged debt in its entirety. The consumer is not required to comply with any "fraud proceedures" or other such nonsense to CBCS. The burden of proof is on CBCS. Further, the statute of limitations appears to have expired, this is another reason the OP should refuse to pay this alleged debt.

The OP should visit the FTC website www.ftc.gov and download the Fair Debt Collection Practices Act and the Fair Credit Reporting Act. The FDCPA tells the consumer how to DISPUTE and DEMAND VALIDATION of any alleged debt from a debt collector, as well as what actions the debt collector MUST COMPLY WITH when a consumer DISPUTES or DEMANDS VALIDATION.

PDJ conveniently forgets to mention this pesky little federal law.

""each person has background check/credit check no one is out to steal your identity theft..all collections require that""

Absolute garbage. If anything is false here, it's your bogus postings as a consumer. Perhaps you should post as an employee. All collection agencies DO NOT require a credit check-it would be nice if they did, but they don't.

""...and you can check with BBB CBCS is probably listed in good standing""

LOL! Yeah right. I checked. CBCS is NOT a member of the BBB and the BBB website indicates:

Contract Issues BBB Definition:

Contract Issues - Claim of alleged failure to honor contract or agreement, work performed without authorization, or invalid contract.

Resolved BBB Definition:

Resolved - The company resolved the complaint issues.

1 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

Administratively Closed BBB Definition:

Administratively Closed - The BBB determined that the complaint could not be satisfactorily settled using standard methods of voluntary dispute resolution

1 - BBB determined the company made a reasonable offer to resolve the issues, but the consumer did not accept the offer.

Billing or Collection Issues BBB Definition:

Billing or Collection Issues - Claim alleging billing errors, unauthorized charges, or questionable collection practices.

Resolved BBB Definition:

Resolved - The company resolved the complaint issues.

139 - Company resolved BBB Definition:

resolved - The company resolved the complaint issues.

the complaint issues. The consumer acknowledged acceptance to the BBB.

4 - Company offered a partial (less than 100%) settlement which the consumer accepted.

362 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

9 - Company offered a partial (less than 100%) settlement which the consumer failed to acknowledge acceptance to the BBB.

Administratively Closed BBB Definition:

Administratively Closed - The BBB determined that the complaint could not be satisfactorily settled using standard methods of voluntary dispute resolution

23 - BBB determined the company made a reasonable offer to resolve the issues, but the consumer did not accept the offer.

30 - BBB determined that despite the company's reasonable effort to address complaint issues, the consumer remained dissatisfied.

2 - BBB determined that while the company addressed the complaint issues, the complainant was dissatisfied and the matter was outs

ide the BBB Rules of Arbitration BBB Definition:

Arbitration - http://www.dr.bbb.org/ComSenseAlt/bindArb.asp

.

9 - BBB determined the company provided proper verification that indicated there was no obligation to resolve the issues of the complaint.

1 - The parties could not provide sufficient information to support their positions nor were they agreeable to make reasonable efforts toward resolving the issues of the dispute.

Sales Practice Issues BBB Definition:

Sales Practice Issues - Claims of alleged sales presentations made in person or by telephone that contain misrepresentations of the product or service, high pressure sales practices, failure to disclose key conditions of the offer, and verbal representations not consistent with written contractual terms or agreements.

Resolved BBB Definition:

Resolved - The company resolved the complaint issues.

3 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

Administratively Closed BBB Definition:

Administratively Closed - The BBB determined that the complaint could not be satisfactorily settled using standard methods of voluntary dispute resolution

1 - BBB determined that despite the company's reasonable effort to address complaint issues, the consumer remained dissatisfied.

1 - BBB determined the company made a reasonable offer to resolve the issues, but the consumer did not accept the offer.

Service Issues BBB Definition:

Service Issues - Claims of alleged delay in completing service, failure to provide promised service, inferior quality of provided service, or damaged merchandise as a result of delivery service.

Resolved BBB Definition:

Resolved - The company resolved the complaint issues.

1 - Company resolved BBB Definition:

resolved - The company resolved the complaint issues.

the complaint issues. The consumer acknowledged acceptance to the BBB.

3 - Company offered a partial (less than 100%) settlement which the consumer failed to acknowledge acceptance to the BBB.

2 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

Administratively Closed BBB Definition:

Administratively Closed - The BBB determined that the complaint could not be satisfactorily settled using standard methods of voluntary dispute resolution

2 - BBB determined the company made a reasonable offer to resolve the issues, but the consumer did not accept the offer.

Customer Service Issues BBB Definition:

Service Issues - Claims of alleged delay in completing service, failure to provide promised service, inferior quality of provided service, or damaged merchandise as a result of delivery service.

BBB Definition:

Customer Service Issues - Claims alleging unsatisfactory customer service, including personnel's failure to provide assistance in a timely manner, failure to address or respond to customer dissatisfaction, unavailability for customer support, and/or inappropriate behavior or attitude exhibited by company staff.

Resolved BBB Definition:

Resolved - The company resolved the complaint issues.

17 - Company resolved BBB Definition:

resolved - The company resolved the complaint issues.

the complaint issues. The consumer acknowledged acceptance to the BBB.

1 - Company offered a partial (less than 100%) settlement which the consumer accepted.

45 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

2 - Company offered a partial (less than 100%) settlement which the consumer failed to acknowledge acceptance to the BBB.

Administratively Closed BBB Definition:

Administratively Closed - The BBB determined that the complaint could not be satisfactorily settled using standard methods of voluntary dispute resolution

9 - BBB determined the company made a reasonable offer to resolve the issues, but the consumer did not accept the offer.

1 - BBB determined the company provided proper verification that indicated there was no obligation to resolve the issues of the complaint.

2 - BBB determined that despite the company's reasonable effort to address complaint issues, the consumer remained dissatisfied.

Refund or Exchange Issues BBB Definition:

Refund or Exchange Issues - Claim of alleged failure to honor company policy or verbal commitment to provide refunds, exchanges, or credit for products or services.

Resolved BBB Definition:

Resolved - The company resolved the complaint issues.

1 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

Issue Not Defined

Resolved BBB Definition:

Resolved - The company resolved the complaint issues.

1 - Company addressed the complaint issues. The consumer failed to acknowledge acceptance to the BBB.

Cheers

#1 Consumer Comment

False

AUTHOR: Pdj - (U.S.A.)

SUBMITTED: Tuesday, June 10, 2008

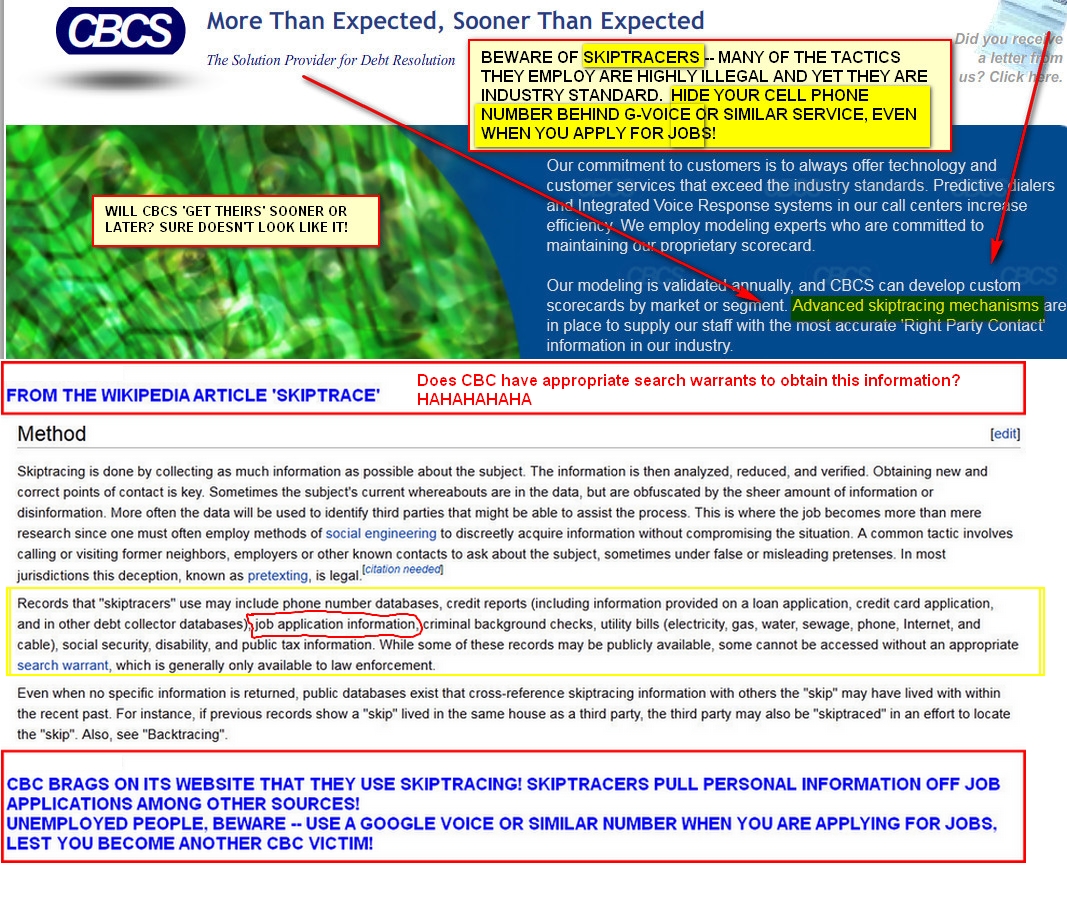

I'm sure there is an account you need to be more cooperative and CBCS is a collection agencies...each person has background check/credit check no one is out to steal your identity theft..all collections require that...and you can check with BBB CBCS is probably listed in good standing

Cheers

Advertisers above have met our

strict standards for business conduct.