Complaint Review: Chrysler Capital - texas

- Chrysler Capital texas USA

- Phone:

- Web: P.O. Box 660335 Dallas TX 75266-033...

- Category: Car Financing

Chrysler Capital Wrongful Repossession Nationwide

*Consumer Comment: Why didn't you pay it?

*Author of original report: Wrongful Repossession

*Consumer Comment: Wrong

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

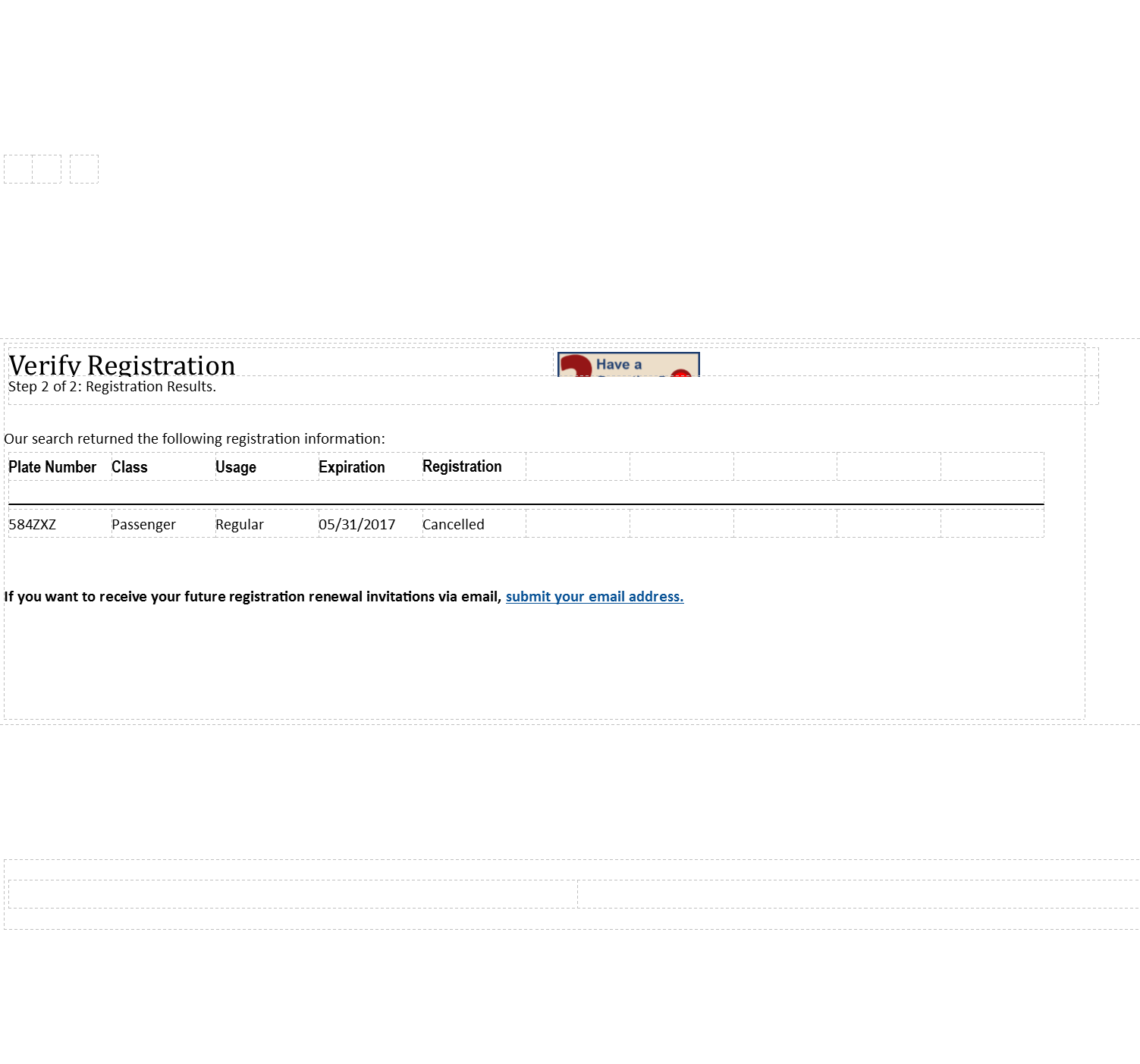

Repossession of my car. Not even 3 weeks late. I was in a hospital 8/18/2016 9/23/2016. Payment to be made on 8/22/2016 when I came home a letter dated 9/15/2016 stated my car was being auctioned unless I paid finance balance $22.000 my car fully covered in a accident no other people involved. Nothing severe. I called Allstate Insurance they knew about a accident. I filed a report with them and nothing no answers. Recently finding out Chrysler Capital told me they called my house spoke to a person who said he was a,boyfriend and he told them pick up my car. They made contact with a person in my home illegal. Last week speaking to Chrysler Capital again because of this hardship and still no car and trying to get one its,thrashed my credit. Im now being told $3,800 will clear my debt. What? I have been trying to get in another car from Chrysler salesman and managers keep saying they are trying and every where is a no. My car 2015 Jeep Patriot driving off the Las Vegas, NV Sahara Chrysler lot no down at all. Cant even get a second chance finance.

This report was posted on Ripoff Report on 04/08/2017 02:30 AM and is a permanent record located here: https://www.ripoffreport.com/reports/chrysler-capital/texas/chrysler-capital-wrongful-repossession-nationwide-1366579. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Why didn't you pay it?

AUTHOR: FloridaNative - (USA)

SUBMITTED: Sunday, May 21, 2017

Your rebuttal doesn't make sense. If you had the funds to pay off the vehicle, why didn't you make the payment? That doesn't make any sense at all.

In your original post you said you were in the hospital for 3 weeks and that hospitalization kept you from making the payment on time. For the lender to say you have to pay the balance off in full indicates you were not making your regular payments on time and missed a payment date more than one time. As a result you have a recent repossession on your credit. Why would the lender that was stiffed by you take a chance and loan you additional funds for another vehicle with a recent repo? Don't you expect to have to show you are now creditworthy?

By the way, it isn't the lender that trashed your credit - you did. You can't blame the lender for your non-payment. Once you learn that lesson, you will be on the road to credit recovery.

#2 Author of original report

Wrongful Repossession

AUTHOR: - ()

SUBMITTED: Saturday, April 08, 2017

I disagree with this when I got the car I signed a contract and yes it matters, I read my contract. I wasnt spoke to and there could have been other ways for me to pay. Now 3 weeks late seriously I the consumer was not even spoke to. I could have paid that car off. I could have been refinanced and my car had full coverage plus gap insurance plus a under warranty why didnt my insurance get a chance to pick it up? they knew about this accident. How about this also if my car autioned for over $15,000 then$ 3,800 is all they want to wipe it off my credit. Thats strange to me I know they know there wrong and I am sure the truth will prevail. The contract is me not a stranger in my home and them just picking up my car ruining my credit. I am right sorry.

#1 Consumer Comment

Wrong

AUTHOR: Robert - (USA)

SUBMITTED: Saturday, April 08, 2017

When you got the loan you made a legal agreement that they could reposess your vehicle at any time they feel you will be unable to complete the loan.

There is NO minimum amount of time you must be delinqnent for before it becomes a "valid" reposession. Accident or not, you are still required to make the payments as you had agreed to.

In your case they contacted your residence and were told to come and get it. There is also no obligation for them to allow you to just pay the delinquent balance. If they feel you aren't going to be able to complete the loan they can require you to pay off the balance in order to get your car back.

The $3800 now(figuring you never got the car back) is the deficency balance between the loan balance and the sell price at auction minus any fees. If you fail to pay this they can come after you in civil court and attempt to get a judgement against you.

As for them contacting someone at your house. Sorry that is NOT illegal, you are most likely thinking about laws such as the Fair Debt Collection Practices Act(FDCPA) that states a Collection Agency is not allowed to discuss your account or mention the reason they are calling except to you. Chrysler is an ORIGINAL Creditor and the FDCPA does not apply and they do not have any such restrictions.

Now before you even say it NO I do not work for them, just familar with how auto financing works. Also, that it doesn't matter what company you are talking about they all basically work the same.

Advertisers above have met our

strict standards for business conduct.