Complaint Review: Care Credit - Nationwide

- Care Credit P.O. Box 981438 El Paso,Tx. 79998-1438 Nationwide U.S.A.

- Phone: 866-893-7864

- Web:

- Category: Credit & Debt Services

Care Credit (a.k.a.) Ge Money Bank A.k.a. Care Credit Cons Cardco Preditory Lending El Paso Texas

*Consumer Suggestion: How to Deal with CareCredit, GE MoneyBank et al

*Consumer Comment: File formal complaints with

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

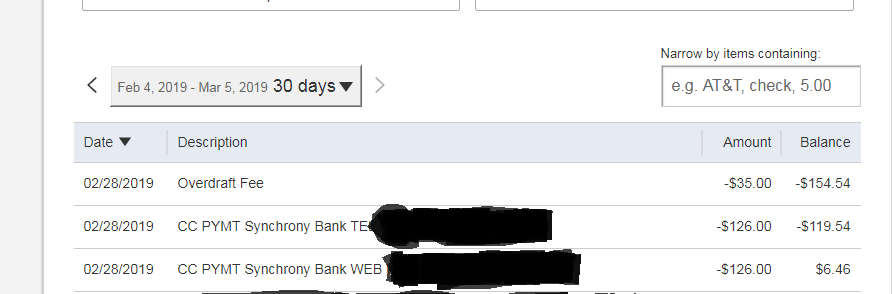

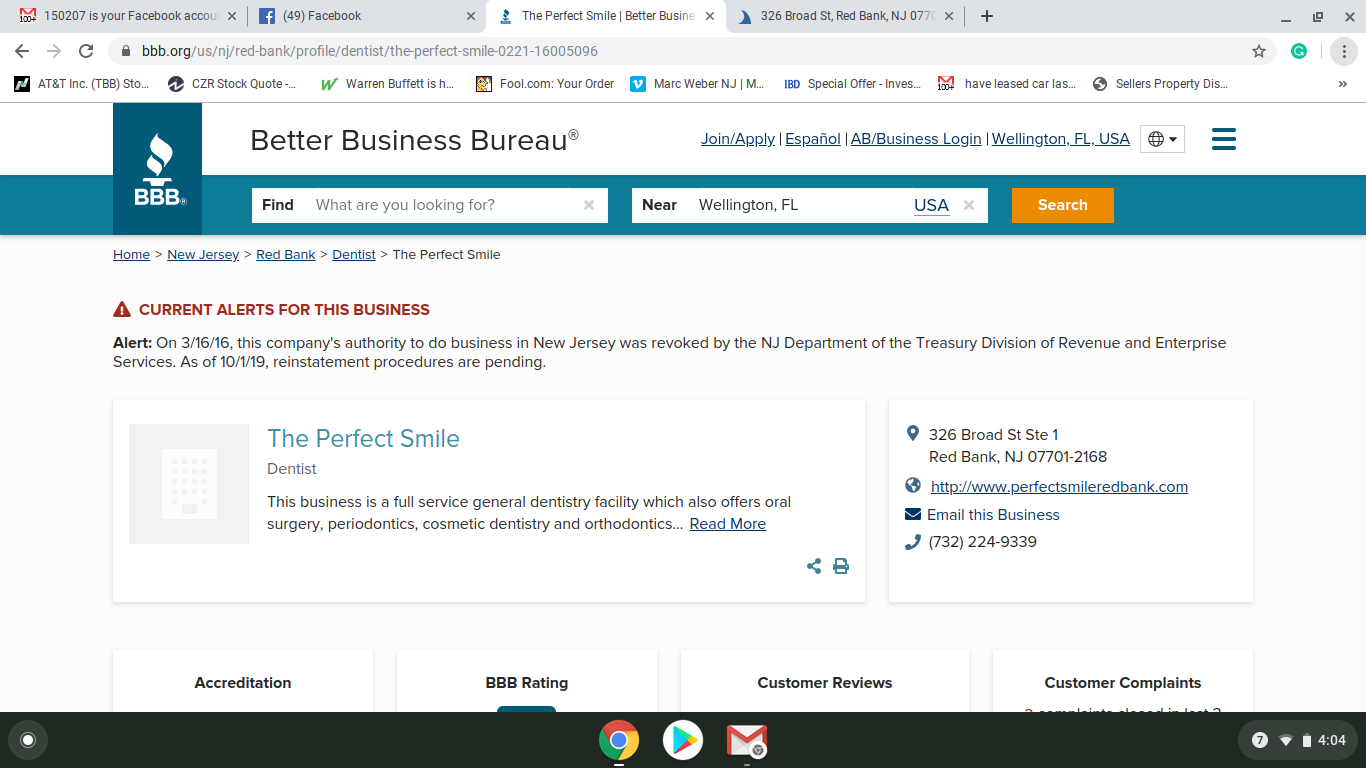

I first signed up for a loan with this company through my dentist Allcare.

They paid the dentist in full before I had any work done. I thought this was very odd. I soon noticed my monthly payments were getting higher and higher. So I purchased a loan from my bank after talking to them on the phone. They quoted me a price, and I obtained the loan for the amount I was quoted over the phone. Later, I recieved a new bill with a remaining balance and when I phoned them they told me the amount was for lates fees, and other miscellaneous charges. I filed a complaint with the State Attourney General's office and am still waiting for a reply. I do not intend to give them one more cent.

Kathleen

TAllmadge, Ohio

U.S.A.

This report was posted on Ripoff Report on 10/30/2008 04:00 PM and is a permanent record located here: https://www.ripoffreport.com/reports/care-credit/nationwide/care-credit-aka-ge-money-bank-aka-care-credit-cons-cardco-preditory-lending-el-pas-386462. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

How to Deal with CareCredit, GE MoneyBank et al

AUTHOR: Bajaskier - (U.S.A.)

SUBMITTED: Tuesday, November 04, 2008

CareCredit, GE Money, GE Moneybank, GEMB, JC Penney, KwikComfort Tips to end your problems Menomonee Falls Wisconsin

The first thing to do is go to the internet to search CareCredit, GEMB of GE Moneybank or GE Money. You will notice they have a running scam...you are not alone. Don't be embarrassed or give up.

1) Their typical offer is for "interest free" financing if the balance is paid in full after x-months, usually 18-24.

2) No matter if you mail in your payments, have autopay from your charge card, or direct debit from your bank account, GE will ALWAYS claim they did not receive your payment, or received your payment late. Why? Then they can add late charges! And of course, your last payment is always lost, therefore you did not pay-off your balance in the predetermined time frame. Then they try to collect a huge interest payment effective from the inception date.

3) You cannot contact the company via e-mail; they ignore e-mail.

4) You cannot get a response via snail mail; they ignore your letters.

5) If you are willing to sit on hold for 45-60 minutes, and punch in your account number countless times, you may be able to reach a person with a pulse. In most cases, the employees speak/understand English, but are not overly bright and get testy when you question them.

6) Said person will claim your payment was not received, or received late.

In my case, I had electronic records of every payment. I also paid extra every month. When asked that I provide the proof, I faxed copies of the electronic transaction records as well as e-mailed same. Of course, they "never received it" despite the fact that I was holding the FAX confirmation in my hand and looking at the e-mail receipt.

Advice:

1. Document everything!

2. Record any telephone calls you have with them. Be sure to inform them the telephone call is being recorded. It does not hurt to tell them the recording may be used in court.

3. Obtain whatever amount of money you originally owe less any payments already made. DO NOT PAY INTEREST OR LATE FEES (unless you actually were late). Send a CERTIFIED CHECK (from your bannk), RETURN RECEIPT REQUESTED (from the post office). IMPORTANT: Write your account number and Paid in Full in the memo section of the check (by cashing a check with "Paid in Full" in the memo, the recipient, by cashing the check, acknowledges payment in full).

4. If you did direct debit or credit card payments, close the bank account or cancel the credit card IMMEDIATELY after the check has cleared or the debit is posted. They tend to post credit card debits almost immediately. Warning: GEMB tends to withdraw more than they were authorized.

5. Do not hestitate to take them to court. You may be awarded triple damages if you prove you have been scammed...and this is very easy to prove if you keep all of your documentation. I only had to threaten them with court and was refunded all interest and late fees.

6. Check for class-action suits in your area; there are many going on nationwide.

Here is a letter another gentlemen sent to CareCredit/GE MoneyBank:

To Whom It May Concern:

The purpose of this letter is to file a formal notification of complaint alleging numerous violations of the Consumer Credit Protection Act (15 U.S.C. 1601) on the part of CareCredit, in that CareCredit, aka GE Capital Cons Cardco aka GE Capital Consumer Card Company. GE Capital Consumer Card Co. is a ""creditor"" by definition of 15 U.S.C. 1601-103-f (Consumer Credit Protection Act) and therefore falls under the federal jurisdiction of the Federal Deposit Insurance Corporation (FDIC). GE Capital Consumer Card Co. has knowingly and illegally: - made a promotional offer of ""interest-free"" or ""deferred interest"" which, by its actions as enumerated below, it had or has no intentions of fulfilling, said offer falling within the definition of Section 226.2 of CCPA.

- levied late fees and finance charges when payments were actually received - and deducted from my bank account - PRIOR to the due date, - charged illegal and exorbitant ""account security"" fees without any form of legal disclosure or explanation as to what those charges may be, constituting a ""surcharge"" under sections 103 and section 167 of the Consumer Credit Protection Act (15 U.S.C. 1601), hereinafter referred to as CCPA. - has instituted retroactive ""terms and conditions"" without proper notification, in violation of 226.7 of the CCPA. - has provided such ""terms and conditions"" in a format that appears to be a third- or fourth-generation unreadable photocopy consisting of print so small and faded as to be illegible, in violation of 226.5.

- has made it virtually impossible for customers (clients) to contact them in a timely manner by failing and/or refusing to answer telephone calls for periods of up to 7.5 hours (by placing the customer on hold for such lengths of time) and by failing and/or refusing to provide any means on its web site of contacting CareCredit by email or any other means than an unanswered telephone line. - has acted to quash any meaningful payment inquiries by refusing to provide requested information to the bank upon which payments were drawn, in addition to failing to provide telephone-answering staff as alleged above. DETAILS: Application for the above-referenced account was made under a ""promotional offer"" (Exhibit A - promotional offer), which provided for no interest if the account was paid in full within 48 months.

This agreement was for the issuance of a ""medical credit card"" issued by GE Capital Consumer Card Co, 5300 Kings Island Drive, Mason, OH 45050, to cover dental (oral surgery) expenses in excess of that which were to be paid by the payee's dental insurance. The debt agreed upon was to be $1,500.00. The first payment was due September 4, 2004 (Exhibit B - statement of payment due).

Payment was received via electronic funds transfer on September 2, 3004 and was deducted from the payee's bank account prior to 2 pm the following business day, September 3, 2004 (Exhibit C - email from USBank, formerly and aka Firstar Bank). The minimum payment on the above account is $45 per month. The defendant states that ""payment is due by 5 pm on the due date"" to ""avoid additional finance charges."" Payment was received and cleared well before that time.

Electronic funds transfer payments through USBank is guaranteed to arrive on the date specificied. This form of payment was chosen specifically to ensure timely receipt of payment, since US Postal Service delivery to and from payee's address is often very unreliable. In four years, I have had no problem with electronic funds transfers reaching their destination late.

The payee then received on Sept. 13, 2004 a ""late notice"" (which bore no postmark and was, in fact, bulk mailed - Exhibits D-1 and D-2 - envelope and late payment notice) claiming that no payment had been received, when in fact, it had. In addition, the payee was informed that a late fee of $35.00 and an ""account security fee"" of $23.25 had been charged additionally. In a document received Sept. 13, 2004, after the contract was entered into, labelled ""Account Security Debt Cancellation Agreement"" (Exhibit E), there is no mention whatsoever of any ""account security fee"".

Payee contends that this ""account security fee"" constitutes a hidden and therefore unlawful interest or finance charge, in violation of federal law. On that date, Sept. 13, 2004, payee attempted to call the phone number provided (1-800-333-1071) and was informed by a voice recording that ""due to a high volume of calls"" there would be ""a lengthy wait time"". Payee kept the line open and was on hold for 3 hours 47 minutes before finally giving up, unable to speak to single human being during that time.

Additionally, the payee contacted the bank (Exhibit F - email) to notify them of the allegation by GE Capital Cons Cardo that no payment had been received, even though existing bank records clearly documented otherwise. USBank aka Firstar Bank responded to the payee on Sept. 14. 2004 (Exhibit G - email) that it was investigating the matter, then followed up with another communication - also Sept. 14, 2004 (Exhibit H - email) that ""GE Capital Cons Cardco will not discuss customer accounts with third parties"" and suggested that the payee call 1-800-333-1071 - the same phone number which GE Capital Cons Cardo will not answer.

An additional payment of $55.00 was made by the payee and received September 17, 2004 and deducted from the payee's bank account on Sept. 18, 2004 for the payment of $45.00 due October 4, 2004. No statement was received for a November payment, due Nov. 4, 2004; however electronic payment was made and received Sept. 29, 2004 in the amount of $100.00 (Exhibit I - details of USBank transaction printout), even though the payment due was $45.00. For the December payment, due Dec. 4, 2004, an electronic funds transfer in the amount of $100.00 was scheduled to be received Nov. 18, 2004, though the amount due was $45.00.

On November 12, 2004, payee received a statement from GE Capital Cons Cardco (Exhibit G - statement) claiming no payment was received for October and that a late fee of $35.00 had been assessed, as well as a ""finance charge"" of $106.64 and an ""account security fee"" of $22.38. The payee was also informed that the ""promotional offer"" had expired on an unstated expiration date, in violation of the agreement made and the promotional offer (Exhibit A). Also on November 12, 2004, the payee again attempted to call both toll-free numbers provided and was informed by a recorded message that ""due to a large volume of calls"" there would be a ""long wait time."" After 2 hours and 17 minutes, the payee again gave up, and on November 13, 2004, sent this document with a certified letter to the defendant.

In summary, payee has so far paid $400 on a $1,500.00 debt and is informed the balance is $1,563.13. All payments have been made and received before the due date. The payee asks for full restitution of the unlawful and exorbitant fees in the amount of $463.13 charged by GE Capital Cons Cardco, as well as all attorney fees and costs pursuant to this matter, and for full reinstatement of the ""promotional offer"" terms which were, and are, part and parcel of the agreement between the payee and GE Capital Cons Cardco.

The payee hereby notifies you, under the requirements of the Consumer Credit Protection Act. [15 U.S.C. 1601], that the aforesaid charges of $463.13 are contested for the reasons outlined above and that no such charges will be paid in the future. Payments will be made to repay the original amount of $1500, as contracted, in the time length necessary to avoid interest fees, per your ""promotional offer."" It is my intent to file legal action - as a class action suit if possible - and to seek full restitution and double damages as provided for in the Consumer Credit Protection Act

Bajaskier

Menomonee Falls, Wisconsin

#1 Consumer Comment

File formal complaints with

AUTHOR: Laurie - (U.S.A.)

SUBMITTED: Friday, October 31, 2008

Federal Trade Commission and Office of Thrift Supervision. These are the government regulatory agencies that can make GEMB fix this.

Otherwise they will continue to charge you interest and late fees for not paying the interest they tacked on after giving you the payoff amount.

They will ruin your credit if you do not stay on top of this

Advertisers above have met our

strict standards for business conduct.