Complaint Review: Washington Mutual - DALLAS Texas

- Washington Mutual P.O BOX 660487 DALLAS, Texas U.S.A.

- Phone: 866-892-9268

- Web:

- Category: Credit & Debt Services

Washington Mutual - WAMU INCREASED MY CREDIT CARD INTEREST RATE WITHOUT JUSTIFICATION DALLAS Texas

*Consumer Comment: Let me join the WaMu ripoff ranks....twice over!

*Consumer Comment: Swimming in the unfair interest hike

*Consumer Comment: Prove it..... Try 125% WAMU INTEREST

*Consumer Comment: WaMu charged late fees

*Consumer Suggestion: WAMU

*Consumer Comment: WAMU did the same thing to me!!

*Consumer Suggestion: What does HR 5546 have to do with it?

*Consumer Suggestion: What does HR 5546 have to do with it?

*Consumer Suggestion: What does HR 5546 have to do with it?

*Consumer Suggestion: An easy solution.

*Consumer Suggestion: An easy solution.

*Consumer Suggestion: An easy solution.

*Consumer Suggestion: An easy solution.

*Consumer Comment: They only justification they needed

*Consumer Comment: Prove it

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I was shocked to discover that the aforementioned credit card company increased my interest rate in excess of 50%. More importantly this increase occurred without my knowledge. To date I've never been late on a payment. Additionally, I always pay a significantly more than the minimum payment.

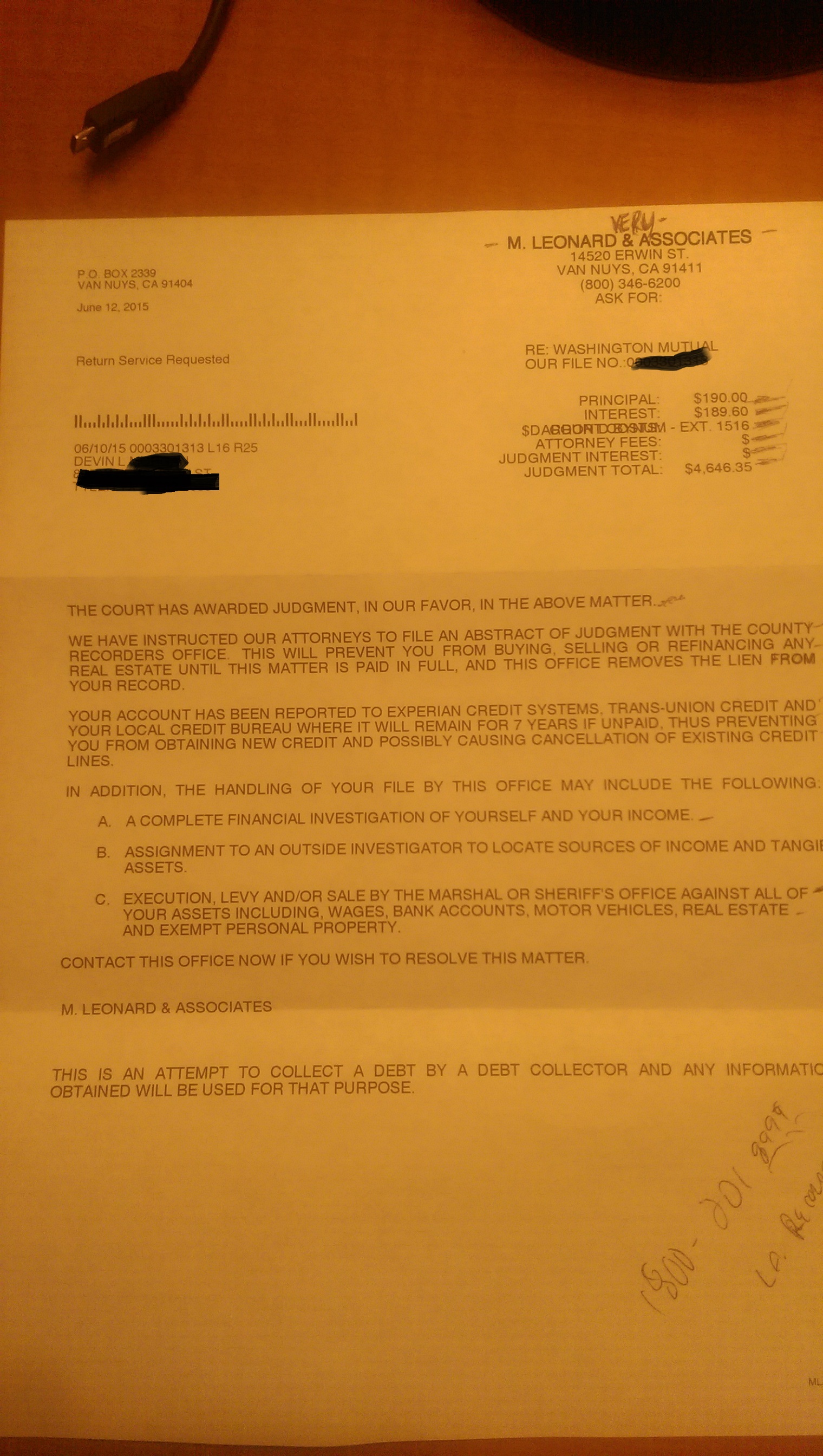

Currently my credit score is higher than when the company issued me the card! When I inquired about the rate increase WAMU could not provide me with adequate justification. Their response was " We sent out a letter in April"! It is my intent to pay off this card as soon as possible!

I have filed a complaint with my state representives urging them to support HR 5546, The Credit Card Fair Fee Act. Please pass the word; acts of consumer abuse such, as this should not be tolerated. Without the consumer this company would cease to exist.

Additionally, I will do what ever I can to help stop these abusive practices. If an individual or family were experiencing financial difficulties these practices only compound the issue! This is criminal. If you have been victimized by this company please consider utilizing the following is the link to contact your representative:

UnfairCreditCardFees.com

Jay

LEAVENWORTH, Kansas

U.S.A.

This report was posted on Ripoff Report on 09/04/2008 11:50 AM and is a permanent record located here: https://www.ripoffreport.com/reports/washington-mutual/dallas-texas-75266/washington-mutual-wamu-increased-my-credit-card-interest-rate-without-justification-dal-369740. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#15 Consumer Comment

Let me join the WaMu ripoff ranks....twice over!

AUTHOR: Sherry - (U.S.A.)

SUBMITTED: Tuesday, January 20, 2009

I too have experienced Washington Mutual's no-cause interest rate hike, the second one being just this month!

In May of 2008, after having my first account a year, I received a notice in the mail stating that my interest rate (which was at 9.99%) was going to be increased to 19.99%. It basically said that I had no options, but I could call with questions about this increase. Well, I called the number, and the only thing the representative could tell me was to read (verbatim, less the part of what phone number to call) the paragraph on the letter. The only recourse I had to keep my current rate was to close my account, which I did, but when I sent that request in writing I also gave them a good piece of my mind!

What bothered me at the time was not only this business practice, but the fear that this would happen with a second card I had *just* gotten from them the month before. Sure enough, this month I received a letter for them announcing the JP Morgan takeover, and that my interest rate was going to be increased from 9.99% to 15.99% starting in March. Again, no reason, no cause...

I am like most of the people posting on this site. I may use my card a lot, but I also pay on time and more than the minimum amount. My score has also increased nearly 30 points since I received these accounts from WaMu. This is my reward?

Needless to say, I too am in the process of finding "new homes" for my credit card balances. I may not like the phone spam that comes along with accounts with Household Bank, but I've already contacted them to do the transfers since at least they stand behind what interest rates, terms and conditions they've given me!

#14 Consumer Comment

Swimming in the unfair interest hike

AUTHOR: Tammy - (U.S.A.)

SUBMITTED: Tuesday, October 14, 2008

My story reads much along the lines as others here. I was so glad to see that my perplexed state wasn't unfounded. To the person who replied that they doubted the interest rate was more than 50%, just be lucky that it hasn't happened to you yet and don't be too quick to sling mud until you are there in the pit with the rest of us.

I too have become a unknowing victim of WaMu's incredibly high interest hike.

In June 2008, I noticed my interest rate had risen to 17.99% on purchases. When I called to ask why, they could not answer me and told me there were no special offers or incentives they could offer me to lower the rate.

Not paying much attention to the statements, as I pay online, imagine my surprise when I noticed on my October paper bill, the interest rate on purchases alone of 23.99%.

In the 6+ years that I have been a customer, I have never once missed a payment or been late. I have always paid more than the minimum payment- always.

I immediately called thinking there must be some mistake. They told me I should have received a letter in the mail. Not that I know of. They then told me I would receive a letter in the mail within the next 7-10 business days. They would not tell me anything by phone due to the privacy act even though I verified who I was by answering every question about myself correctly to their satisfaction. They would not even email me the problem- had to be sent by snail mail.

I told them to cancel my card and note it canceled at the customer's request due to unfair treatment and extremely high interest rates. I told them I wanted a letter confirming this along with their reason letter.

They then offered that if I would keep the card, they would give me 1% cash back along with free credit reports, yada, yada. This was like a smack in the face. This would only lower the 23.99% to 22.99%, which is still outrageous and more than some department store cards. No thank you- cancel the card.

She then told me I would still be responsible for paying the balance (duh, I'm not a total moron) and interest would continue to incur till the balance was paid in full. She told me the amount owed.

Being the pack rat I am, I save everything. I went through my whole collection of WaMu paperwork. Monthly statements, a couple card renewals, letters saying my limit had been increased for being such a wonderful customer and those balance transfer forms they continually send. No letter about raising rates.

Today- one day later after my call to them, I go on-line to pay my balance in full and find additional amounts tacked on. I make another time consuming call, only to be routed around through customer service, collections and finally a supervisor who did a very good job of round-a-bouting. She told me they occasionally look at credit records and might have seen something that bumped my rate up. What? I have never been late, always paid more than the minimum, have a better credit rating now than when I first got the card..... you'll have to wait for the letter.

So here I sit puzzled and in disbelief, yet relieved to have found this site and others that have the same problems with WaMu.

#13 Consumer Comment

WaMu charged late fees

AUTHOR: Lynn - (U.S.A.)

SUBMITTED: Friday, September 26, 2008

To update my previous post. WaMu also charged me several late fees, 5 to 7 days before my payment was due. Confronting WaMu on this, I am sure help get my interest rates up. WaMu seemed to rellish on the fact that their customer can't read.

Forced out of business, OH WELL, when you do WRONG, things happen WRONG.

Butter my butt and give me a Biscut.

#12 Consumer Comment

Prove it..... Try 125% WAMU INTEREST

AUTHOR: Lynn - (U.S.A.)

SUBMITTED: Friday, September 26, 2008

Attn; PROVE IT,

Had to write and post my 125% WAMU interest rate. It goes like this:

1.] Purchase Line 25.74%

2.] Cash Line 26.99%

3.] Promo Offer 25.74%

4.] Custon Cash 2 26.99%

Monthly Interest collected by WAMEU $182.00.

They put the charges on any section that will give them more collectable interest. This has all taken place since January 2008. My Interest at that time was 14%. Wamu raised my interest to 19%. I called and ask why, I was told to read my credit agreement. In Feburary 2008, a direct result of this phone call my interest was raised to 23%. In March 2008 my interest jumped to 25.74%, no questions asked or answered. In April my interest jumped to 26.99%, no reason given.

This morning Wamu is owned by JP Morgan Chase. I called and ask for the interest on my care to be reduced, It is completely out of line.

JP Morgan said NO, we can not lower interest rates just because you want us too.!!

Well....... I think they understood this ....CLOSE MY ACCOUNTS.....

I am balance transfering the amounts I owe to LOWER INTEREST CARDS.

I could never pay this debt to Wamu/JP Morgan off. Even now the new Company is unwilling to work with their creditors

GOOD RIDANCE TO THESE PREDITORS.

Mr. Prove It, Unil you pay PAY THE PRICE keep your mouth shut.

Respectfully,

Another WAMU VICTIM

#11 Consumer Suggestion

WAMU

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Thursday, September 25, 2008

All you WAMu whinners, might be happy (or maybe not) to know taht JPMorganChase just bought WaMu after the FDIC took it over.

#10 Consumer Comment

WAMU did the same thing to me!!

AUTHOR: Cindre0104 - (U.S.A.)

SUBMITTED: Thursday, September 25, 2008

I always use my credit cards for all my purchases every month and pay off the entire balance. This past month I was a little strapped for cash. I had a $3400 balance and paid $1000, leaving a balance of about $2400. I got my statement the next month shocked to find finance charges of $91.00. That is over 50% APR!!!! It is not illegal yet but it should be!! My credit score is around 760. I have never missed a payment. Last I had check my APR was 14.99%. Don't know when it skyrocketed but I am fuming! Washington Mutual is one of the many banks holding on by a thread from the current credit crisis and this is just a shady way of trying to recoup some of the money. Shameful!!!

#9 Consumer Suggestion

What does HR 5546 have to do with it?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, September 05, 2008

""I have filed a complaint with my state representives urging them to support HR 5546, The Credit Card Fair Fee Act. Please pass the word; acts of consumer abuse such, as this should not be tolerated. Without the consumer this company would cease to exist. ""

What does HR 5546 have to do with the interest rates that credit card companies charge? The act is about the FEES that MERCHANTS PAY to access electronic payment systems.

#8 Consumer Suggestion

What does HR 5546 have to do with it?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, September 05, 2008

""I have filed a complaint with my state representives urging them to support HR 5546, The Credit Card Fair Fee Act. Please pass the word; acts of consumer abuse such, as this should not be tolerated. Without the consumer this company would cease to exist. ""

What does HR 5546 have to do with the interest rates that credit card companies charge? The act is about the FEES that MERCHANTS PAY to access electronic payment systems.

#7 Consumer Suggestion

What does HR 5546 have to do with it?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, September 05, 2008

""I have filed a complaint with my state representives urging them to support HR 5546, The Credit Card Fair Fee Act. Please pass the word; acts of consumer abuse such, as this should not be tolerated. Without the consumer this company would cease to exist. ""

What does HR 5546 have to do with the interest rates that credit card companies charge? The act is about the FEES that MERCHANTS PAY to access electronic payment systems.

#6 Consumer Suggestion

An easy solution.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, September 04, 2008

Send them a certified letter informing them that you never recieved such a notice. Then demand proof that you recieved it. Then tell them they are required to lower your interest back to the old rate.

They must do this. Although your charging on the card will be suspended, or then you agree to the new rate by using the card.

Also let them know that failure to respond to your request, and comply will result in you stopping your payments on the card. You can do this legally!

I have done it. Bend them over the barrel and see how they like it!

#5 Consumer Suggestion

An easy solution.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, September 04, 2008

Send them a certified letter informing them that you never recieved such a notice. Then demand proof that you recieved it. Then tell them they are required to lower your interest back to the old rate.

They must do this. Although your charging on the card will be suspended, or then you agree to the new rate by using the card.

Also let them know that failure to respond to your request, and comply will result in you stopping your payments on the card. You can do this legally!

I have done it. Bend them over the barrel and see how they like it!

#4 Consumer Suggestion

An easy solution.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, September 04, 2008

Send them a certified letter informing them that you never recieved such a notice. Then demand proof that you recieved it. Then tell them they are required to lower your interest back to the old rate.

They must do this. Although your charging on the card will be suspended, or then you agree to the new rate by using the card.

Also let them know that failure to respond to your request, and comply will result in you stopping your payments on the card. You can do this legally!

I have done it. Bend them over the barrel and see how they like it!

#3 Consumer Suggestion

An easy solution.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, September 04, 2008

Send them a certified letter informing them that you never recieved such a notice. Then demand proof that you recieved it. Then tell them they are required to lower your interest back to the old rate.

They must do this. Although your charging on the card will be suspended, or then you agree to the new rate by using the card.

Also let them know that failure to respond to your request, and comply will result in you stopping your payments on the card. You can do this legally!

I have done it. Bend them over the barrel and see how they like it!

#2 Consumer Comment

They only justification they needed

AUTHOR: Laurie - (U.S.A.)

SUBMITTED: Thursday, September 04, 2008

Was the fact they have been losing money due to their involvement in the Sub-prime mortgage mess.

They were one of the banks that over-inflated appraisals to increase the amount of the loan

They are the biggest offender in approving loans to people who never should have been approved in the first place

They are making you their customer pay for their mistakes.

MISMANAGEMENT AT ALL LEVELS DESTROYED WAMU AND IS COSTING THEIR CUSTOMERS WAY TOO MUCH

#1 Consumer Comment

Prove it

AUTHOR: Awfully - (U.S.A.)

SUBMITTED: Thursday, September 04, 2008

They say they sent it out. Prove you didn't get it. Blame your post office or someone in your household (including yourself) that may have just thrown it away thinking it was junk mail. I highly doubt they're charging you 50% interest rate. That's illegal and I'm sure WaMu wouldn't risk it.

Advertisers above have met our

strict standards for business conduct.