Complaint Review: First Convenience Bank - Killeen Texas

- First Convenience Bank PO Box 937 Killeen, Texas USA

- Phone: 800-903-7490

- Web: http://www.1stcb.com/en/

- Category: Banks

First Convenience Bank First National Bank of Texas Steals from Customers in the form of "Over Draft Fees" Killeen Texas

*Author of original report: So why didn't you say you were psychic in the first place

*Consumer Comment: It is now very obvious...

*Author of original report: Re: Your're out of your leauge

*Consumer Comment: You're out of your league.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

After researching online I'm finding out this is a MAJOR problem with the bank that I wish I'd known prior to switching to them.

On 9/24 I had an account balance of $29.50 I made 3 transactions on the same day (one an ATM withdrawl and 2 at my local Krogers) bringing my balance to $0.78. The next day on 9/25 at about 8pm (after double checking to make sure the previous days transactions had already gone through) I pulled out $100 from the same ATM as the day before, intending on using my one time $35 overdraft fee until my check hit 4 days later.

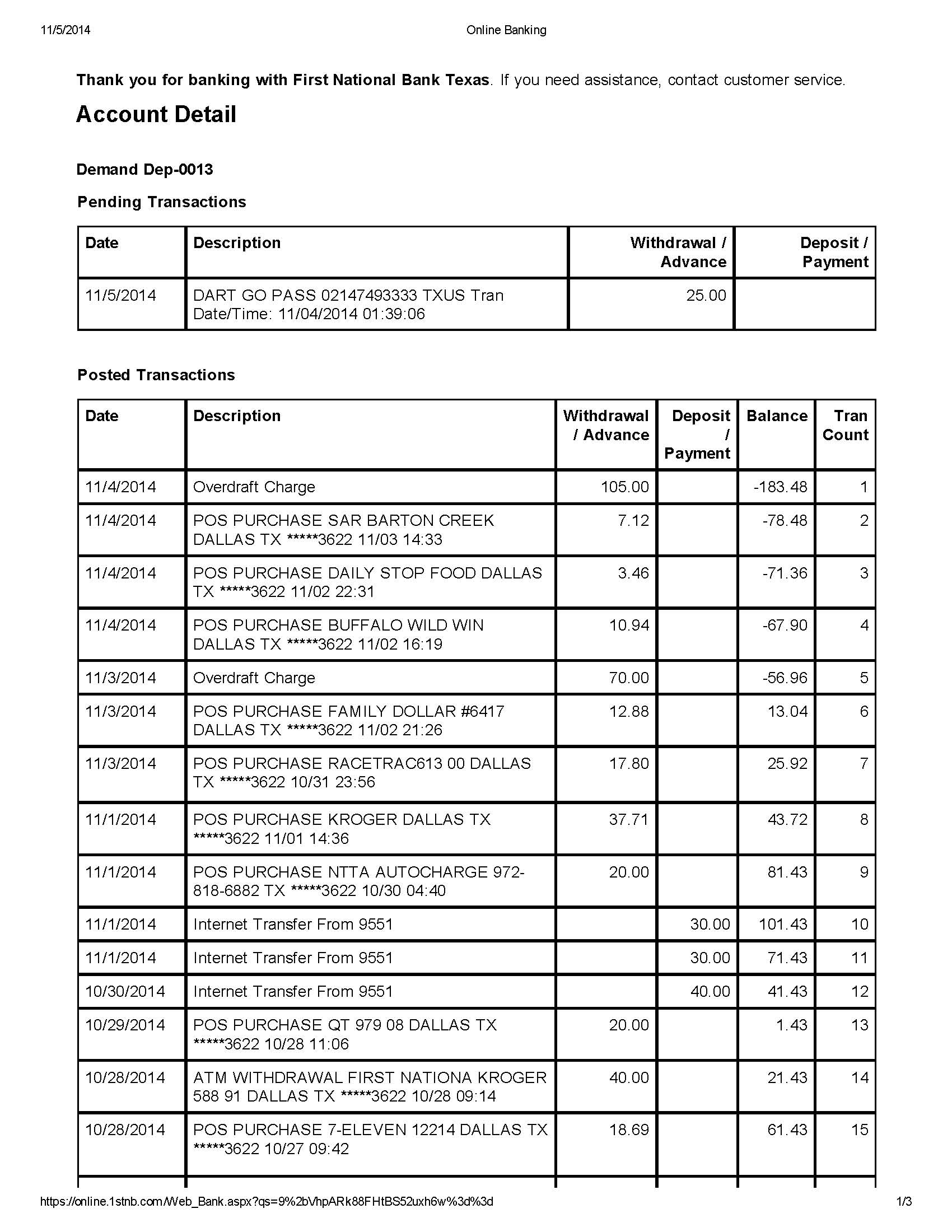

When I check my account online I see I'd been charged 4 over draft fees totaling $140. However the times the charges hit my account made no sense at all. It showed all 3 transactions made on the 24th pended until the 25th, leaving my balance at $0.78. Then the next day on the 25th I was charged $105 worth of ofterdraft fees when my balance still showed as $0.78. The ofterdraft fees then brought me into negative ($-104.22 to be exact). Then the next day on the 26th the $100 ATM withdrawl and seperate $35 overdraft fee hit my account bringing it down to $-239.22.

I called the bank to see how this could have happened and had the displeasure of speaking to one of the rudest supervisors I'd ever come across. I was told many different things that often contradicted what was just previously stated. At first I was told all ATM fees process automaticly. When I then asked how come the $20 ATM withdrawl made on 9/24 pended from the same ATM the $100 was immediately taken out, her story changed. She then said they had no idea which transactions would post immediately, and which would pend and for how long.

When I ask her to explain why I was charged 3 over draft fees on a positve balance, she then explained she had a different version of my bank account than the one I had access to online and on my phone. She claimed it showed the $100 ATM withdrawl posted immediately on 9/25 at 8pm at night leaving my balance at $-70.48. AN ofterdraft fee of $35 posted immediately as well at 8pm on the 25th, she claimed. On the 26th, the 3 transactions made on the 24th then posted, resulting in 3 more overdraft fees, which is how they claimed we arrived at the $-239.22 balance.

However my ATM receipt from the 25th showed other wise. As i previous said I made sure to double check my account before heading to the ATM that night to avoid this exact situation. My account was as I thought $0.78. My ATM receipt also reflects this showing an available balance of $-99.22. SO if the 3 transactions from the previous days were still pending how come this wasn't reflected in either my bank statement or ATM receipt? Again they could not provide an answer.

Since we were talkiing in circles and this woman was clearing giving me scripted answers over and over again, I began asking much simpler questions she couldn't talk her way out of. Why are there 2 different versions of my bank account? This is my money and affairs, shouldn't I have access to an up to date and true reflection of my accounts and transactions? Couldn't answer me besides the same scripted rebuttal about how charges pend and they have no control. I explained I, nor my sister (who also banks there) has ever had an issue with charges posting out of chronological order. Except with online orders.

Her answer to my next question surprised me even more. Since my online bank statement, and whatever records she had access to were clearly different I asked her to give me the end of day balances for 9/23/ 9/24, 9/25, and 9/26. This is what she told me:

9/23- $29.50 9/24- $0.78 9/25- $29.50 9/26- $-239.22

So according to her records, since the 3 transactions from the 9/24 were still pending by days end the money was then put back into my account. I've never had this happen to me, EVER, with any bank. Anyways, after I made the $100 withdrawl on the 25th, they claim my available balance was $29.50. SO how come my receipt shows otherwise? Again, couldn't give me a legit answer. Starting to sense a pattern here? So what it seems to me is they held the 3 transactions when they seen the $100 pulled out on the 25th. That way they could charge me 4 over draft fees instead of 1.

I asked for a corporate office number since she was now talking louder so she could speak over me and not have to answer my steady flow of questions. However I was told after being placed on hold that they can't give that information out. All she could do was take a message, pass it on, and have someone get back to me in 24-74 hours. Here we are at 62 hours, haven't heard a word. I called back earlier today, hoping to get a more calm and sensible person to speak with who could provide me with the answers I needed. No such thing happened. I was told the exact same thing as a couple of days prior. Further convincing me, the answers to my questions were coming from a pre-written script. I've worked in telemarketing for years and am well aware of these rebuttal scripts often used to handle "difficult customers", as I've both had to use and create them in my past line of work.

Also yesterday I made two seperate transactions, just to see how they would pend and post to my account. Just as suspected, when I pulled out $40 from the ATM the $10 I'd just spent at Dollar General had already posted and been deducted from my balance. Even though both charges are still posting today, the money was not put back into my account as I was told is the standard proceedure, and they had done on 9/25. However the $50 that was pulled and posted to my account yesterday in 2 seperate transactions, is still deducted today, just as it's always been. When I asked about this on my phone call today, again no explanation could be given.

I'm not asking for anything other than the $105 that was wrongly taken because all of the sudden they decide how and when my transactions post to my account. Not chronological order like they always have before. I've found pages upon pages of complaints very similar to my own, and very few resulted in a refund so I'm not hopeful. But I now see how such a small bank is so very successfull. They steal from their customers in the form of "charges" they can't explain, all the while insisting on being so very convenient. This is without a doubt the most unconvienent customer services representatives I've ever dealt with. And this is coming from someone who's had Comcast for 6yrs so that's saying something.

So now I'm $100 short on rent and they say they're not at fault. Even though they can't show me anything proving they didn't overdraft my account on a positive balance, they refuse to do anything but throw the same lame answers that contradict themselves. I refuse to accept this until they can give me proof to back up what they're claiming. They have def not heard the last from me yet...

This report was posted on Ripoff Report on 10/02/2014 12:30 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/killeen-texas-76540/first-convenience-bank-first-national-bank-of-texas-steals-from-customers-in-the-form-of-1180553. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Author of original report

So why didn't you say you were psychic in the first place

AUTHOR: L - ()

SUBMITTED: Friday, October 03, 2014

Based on your 2 comments it would appear that your psychic. You who know nothing about who I am other than who I bank with, a few transactions I made in a couple of days over the period of my entire life, and I overdrafted my account. You now know my finances, how I spend them and whether or not I keep track of them. All without knowing my age, sex, occupation, name, marrital status, or life situation. With your superhuman know it all powers, you even know what I eat for dinner, amazing! I know your time is probably very vaulable, especially to someone as important and condescending as yourself, but I'd love for you to take a few minutes to teach some of us measly humans how you do it! While we're at it, could I please ask a questions since you know absolutely everthing there is to know about my account and the transactions in it. How come an ATM withdrawl made at their ATM right outside the branch location ( They were closed, I hadn't made it in time as I'd planned to do this transactions with a teller). posted immediately in real time at 8pm on at Friday in order these 3 extra overdraft fees to be possible. One of the transactions I'm referring to was made at the exact ATM the day prior around the exact same time frame, and it took 2 days to post? Also if you still have time (fingers crossed) I was hoping you could also explain why my available and current balance both showed the 3 transactions had already posted when I overdrafted the $100? This isn't my first rodeo, I know how pending VS posting and current VS available balances work. Yet somehow the rules are able to bend for them if it means they can juggle and process payments to ensure the most possible overdraft fees occur. Also the transactions I'm questioning weren't posted in order of their amounts. They posted in chronological order of the hour I was in Krogers and in the order I made them. However when they seen me pull put $100 and my account would fall into negative they claim transactions that had already posted now would take 2 days, however the withdrawl I was making at that time was posting, pending, and deducting in real time. Yet there is no proof anywhere in my bank statement other then them saying I told you so. My statements show all transactions made took one day to post and pend as they always do from that location, and 3 overdraft fees occured on a postive balance.

PS- Really cool for someone as awesome as yourself to troll the sites thrusting your mind power skills upons all us morons to fawn over. I bet you're a blast at parties, Hey quick what's my favorite color, better yet can you even attempt to begin to fathom to legions of f**ks I dont give about your incorrect assumptions or the fact that a stranger behind a keyboard gets sassy with me?......Well......do you? Anyways thanks for your time, and hope to hear back soon about that pyschic tutoring session.

:)

#3 Consumer Comment

It is now very obvious...

AUTHOR: Robert - ()

SUBMITTED: Friday, October 03, 2014

It is now very obvious that you do not understand banking.

First of all regardless of if a bank "allows" you to overdraft doesn't matter. It is still in the long run a bad financial planning strategy and one you need to look at correcting. Let me give you an example. How much money did you spend in your last paycheck eating out, for "entertainment" or for luxuries such as Cable TV and yes even (gasp) Internet? I bet you can not give that answer off of the top of your head, but I will also bet it was more than $100. So yes, if you are struggling that much perhaps you should cut the Cable, and instead of eating out..eat at home.

So onto the Overdrafts.

SO if the 3 transactions from the previous days were still pending how come this wasn't reflected in either my bank statement or ATM receipt? Again they could not provide an answer.

- Okay so let me provide an answer, that hopefully you understand..oh and is the same for EVERY bank. There is a difference between "Pending" and "Posted". When you swipe your debit card an "authorization" is created that puts a hold for that amount. It gets deducted from your balance to show your new AVAILABLE balance. So yes your ATM receipt will show you have attempted to debit that much money, and give you a new balance.

But there is a second part. The money isn't finally deducted("posted") until the merchant sends in the final authorization and the bank processes it during their regular banking days(ie. not weekends or holidays). There is also a cut-off time for this posting, depending on the bank it could be anywhere from about 8PM to 11PM at night. Meaning anything that is processed after that cut-off time will not be POSTED until the next business day.

Depending on the merchant it could take 1-3 days to process this final authorization, so something done on a Friday may not actually get posted until Monday or Tuesday. Now, your bank will also automatically remove these "authorizations" if the final debit does not come in, within 3-5 days(depending on the bank). But if at a later date the merchant finally submits it..the debit will still go through.

Now, in your case you intentionally overdrafted your account with the 3 other transactions still pending, as a result the bank per the terms YOU agreed to deducted all of the withdraws in order from highest to lowest giving you the overdrafts. But they did NOT steal from you because when you got this bank account this is EXACTLY what you agreed to.

I would at this point normally talk about balancing your checkbook, keeping a written register..etc. But when you INTENTIONALLY spend more money than you have in your account it doesn't matter how good you are at balancing your checkbook.

But I will give you some advise if you still desire to intentionally spend more money than you have. Before you get an account at your next bank be sure to ask them the following.

- How much is your overdraft fee

- Do you charge an "extended" overdraft fee if you stay in overdraft more than a few days

- What is your posting order(highest to lowest, order of transactions..etc).

- What is your funds availability policy and do you post debits or credits first.

Oh and no I am not now or have I ever been an employee of this or any bank. And if you had spent half the time you did researching how "bad" this bank is you could have found out the exact same things I have just told you.

#2 Author of original report

Re: Your're out of your leauge

AUTHOR: - ()

SUBMITTED: Thursday, October 02, 2014

Thanks for your comment to my report. I went into the bank at Krogers with my sister who banks there, and the young lady of course asked about who I banked with and started telling me about how I should open an account with them, as they do at most banks. I was in the market but hesitant because I'd heard multiple stories from family and friends about how they'd had issue after issue with them. However my sister had been with them for months and loved them so I listened to the young lady's pitch. One of the MAIN point she made was how they'd let you overdraft up tp $700 for a one time fee of $35. She pointed out it was much cheaper than the interest on payday loans and worked much the same way but with your bank. My sister agreed she'd used the service mutiple times and had no problems. And I knew how much payday loans cost the hard way in my early 20's. So after what I have to admit was a pretty good sales pitch, and thinking on it for a couple days, I shut down my account with my old bank and opened up with FCB. I've had no issues with any transactions posting out of chronological order the past 3 months, nor has my sister. I find it strange as well they can give me no proof showing their claims, and my bank statement (screenshot attached above) shows the transactions posted in an order much different than they say. I also find it strange there are pages upon pages of pages of complaints online that read extremely similar to mine. I would think if 100's of customers have had the same complaint with your business practices for years, perhaps changing things to provide better cutomer service might be the answer.

PS- Over the course of 7yrs with my previous bank unexpected expenses had come up. Numerous times I'd done the same thing I attempted on 9/25 with FCB and had no problem at all covering $40 or $60 until payday. Not once did a problem even close to this occur. Every time the negative balance and one time $35 overdraft fee where charged when my check went in a few days later. I personally never experience this problem with my previous major bank, which I'll most likely being going back to very soon.

#1 Consumer Comment

You're out of your league.

AUTHOR: Crucible - ()

SUBMITTED: Thursday, October 02, 2014

" I pulled out $100 from the same ATM as the day before, intending on using my one time $35 overdraft fee until my check hit 4 days later. "

The fact that you thought the bank's one-time overdraft forgiveness was equivalent to a free short term loan tells me everything thing I need to know.

If you're going to try and game the system, you'd do well to know how the system actually works first. You're learning the expensive way. By reading your post I can tell exactly how you managed to get multiple overdrafts. Your downfall was ignorance of debit card posting schedules and bank's nightly batch processing procedures. Rather than go into all of that, I'll just let you know that you would have had the identical (or worse) result had you tried to pull that stunt at any other major bank. The problem is actually you.

Advertisers above have met our

strict standards for business conduct.