Complaint Review: First National Credit Card - SIOUX FALLS South Dakota

- First National Credit Card P.O. BOX 5120 SIOUX FALLS, South Dakota U.S.A.

- Phone: 888-883-9824

- Web:

- Category: Cross-Border Scams

Legacy Visa First National Credit Card CCS ripoff SIOUX FALLS South Dakota

*Consumer Comment: I think some of these people on here are nothing but crybabies

*Consumer Comment: Geeez....

*Consumer Comment: Don't have a problem with them

*Consumer Comment: in response

*General Comment: What a bunch of idiots

*General Comment: What a bunch of idiots

* : Using the Military is no excuse, Read, Read, Read

* : You only have to read

*Consumer Comment: Terms and conditions are clearly stated in writting

*Consumer Comment: Terms and conditions are clearly stated in writting

*Consumer Comment: Terms and conditions are clearly stated in writting

*Consumer Comment: Terms and conditions are clearly stated in writting

*Consumer Comment: Thanx you

*Consumer Comment: I am a Legacy Visa Customer

*Consumer Comment: Suggestions

*Consumer Comment: Don't See the Problem

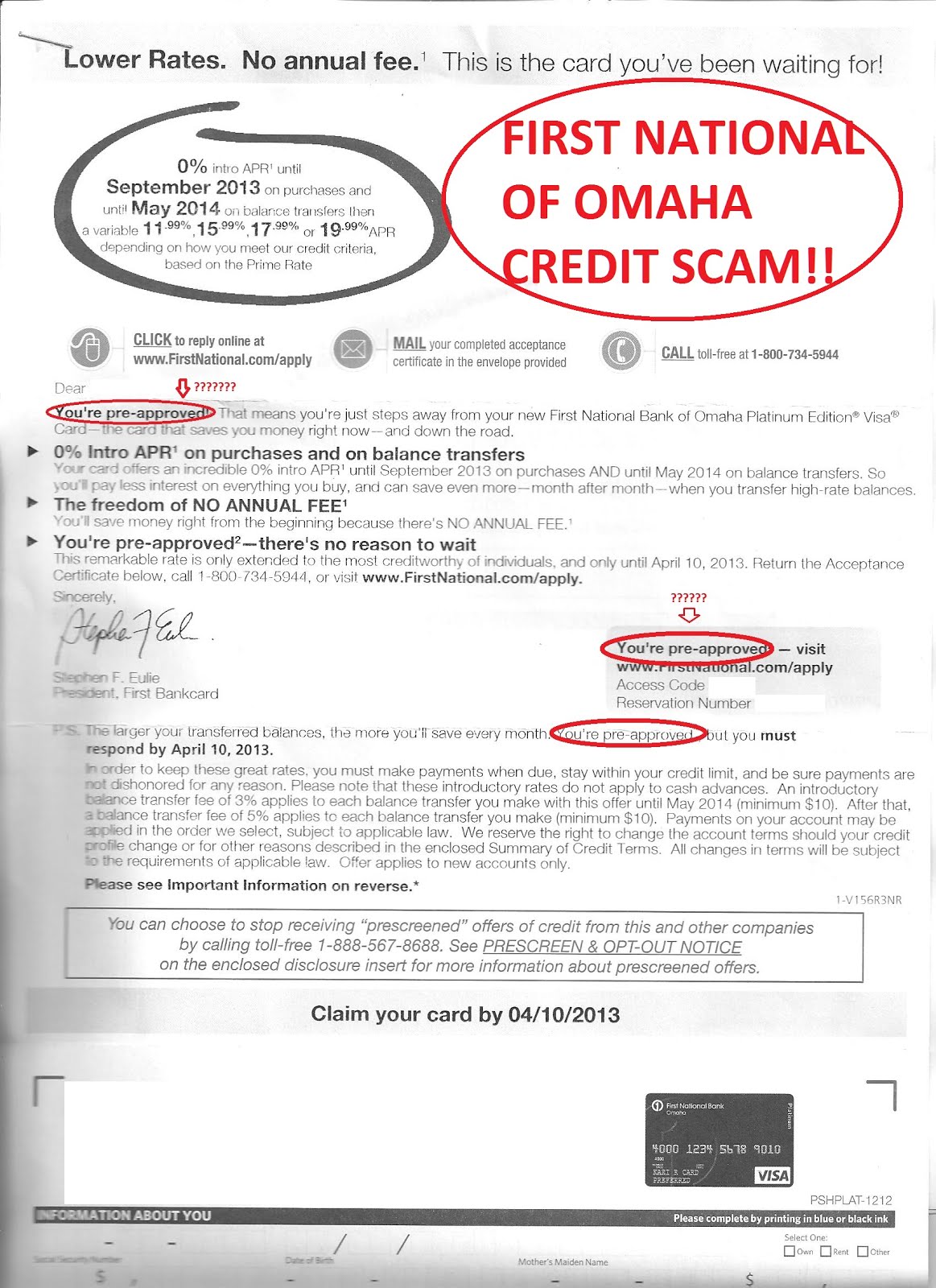

I Applied for this credit card in the mail. to fix my credit up..a cpl weeks later without even using it i was billed almost 200.00 my limit was only 250 .. when i called them they told me that was for activation. and fees. i have never used my card and i am still being billed late fees.. this company is a rip off.. they will continue to charge u tell u go blue in the face.. i recommend that no one apply for this card..

WHATS SAD IS MY HUSBAND IS MILITARY AND THEY TREAT US LIKE THIS..

Thank You...

KERI,

BAUMHOLDER, GERMANY...

Keri

APO AE

Germany

This report was posted on Ripoff Report on 02/05/2006 01:44 AM and is a permanent record located here: https://www.ripoffreport.com/reports/first-national-credit-card/sioux-falls-south-dakota-57117/legacy-visa-first-national-credit-card-ccs-ripoff-sioux-falls-south-dakota-174822. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#16 Consumer Comment

I think some of these people on here are nothing but crybabies

AUTHOR: Nita - (United States of America)

SUBMITTED: Tuesday, April 24, 2012

I think some of these people on this website are nothing but crybabies. I admit I haven't read every report but from the ones I have read, I see very little evidence of being ripped off. People are complaining about things like fees they should have known about when they applied for whatever they were applying for. I have yet to receive any credit card that didn't come with a little slip of paper with the terms and conditions spelled out for me.(In fact with the credit rebuilding cards I have applied for the fees were stated on the application on the other side.) If you don't read them its not the credit card companies fault, its your fault.

I have Legacy Visa and most of the credit rebuilding cards and I have yet to have any problems with any of them. Legacy in my opinion has been the best. They must have changed their program because I didn't pay a $199 fee. I paid $75.00 for a $300.00 credit line. After a few months they sent me a letter saying they approve of the way I have been handling my credit line and to call because they wanted to raise my limit. I did and they raised it by $250.00. I can't say anything bad about them.

You make a choice when you apply for these credit cards. Nobody twisted your arm to make you apply for these high fee cards. I realized having bad credit you have deal with sub-prime banks if you want to start rebuilding your credit. If you think American Express, Chase, and Discover are going to give you credit, you will greatly disappointed. If you ruined your credit like I did, you have to start somewhere. You might not like the fees, but that's what you have to put up with until you get back on track.

Stop complaining and read the terms and conditions. If you don't like them, don't apply. Simple as that.

#15 Consumer Comment

Geeez....

AUTHOR: koolriderz - (United States of America)

SUBMITTED: Monday, June 07, 2010

I can only think of two subprime credit providers that will not hose you with fees upfront (Capital One, and Orchard Bank). Regardless, if you are not priveledged enough to qualify for them, you just gotta take offers like this one...or leave them. If you manage your balance well, the only fees you will pay from now on are an annual fee, and monthly maintenance fees. I have Legacy Visa, much better than First Premier Bank, so I cancelled FPB recently. I know my credit will take a hit, but regardless, FPB scares me! Legacy will work with you in the future to lower your interest, and maybe lower the annual fee. In the meantime stay focused, and work your way to prime consumer-hood.

Yes, credit card companies are evil. So are banks. But if you owned one of these companies, wouldn't you charge for your services. Or, would you just give away money for nothing in return? If you don't like fees, starting saving money in a s****.>

I have a 561 FICO since my bankruptcy. So what. Credit is hard for some of us to keep up with, especially when we are young, dumb (inexperienced), and struggle to stay employed. Oh well, I have been moved on, with much better credibility, and a stable income.

#14 Consumer Comment

Don't have a problem with them

AUTHOR: Maggie - (United States of America)

SUBMITTED: Sunday, January 31, 2010

Just wanted to add my own experience to this. I had to file bankruptcy in 2008. I thought I'd not get another credit card again for years. However, the same month my bankruptcy was discharged, I got an offer from Legacy Visa. I did understand the terms and fees but accepted the invitation to start repairing my credit. It's been a little over a year now and I've had no problems with them at all. Since my first Legacy Visa, I've acquired other and better cards. I keep this card open for this good history with them but don't really need it anymore. Hard to believe with my bankruptcy I now have two prime cards, but I do believe that Legacy Visa helped with that, so it was definitely worth the fees. The only thing I don't like is that they only gave me one credit line increase and I had to pay $25 for that. They assured me that future increases were free, but I've yet to see any other increases.

#13 General Comment

What a bunch of idiots

AUTHOR: Les - (U.S.A.)

SUBMITTED: Monday, November 02, 2009

I CANT BELIVE WHAT I AM READING RIGHT NOW, A WHOLE BUNCH OF IDIOTS TRYING TO JUSTIFY A CREDIT CARD COMPANY CHARGING THEM 150.00$ FEES BEFORE THE CARD IS EVEN USED ?? ARE YOU OUT OF YOUR MINDS?? THIS IS EXACTLY WHY PRESIDENT OBAMA PUT CONTROLS IN PLACE TO SAVE US FROM GREEDY CREDIT CARD COMPANYS DESTROYING OUR LIVES, TAKING OUR HARD ERNED MONEY AND YOU PEOPLE ARE JUST HANDING IT OVER BECAUSE "IT WILL HELP MY CREDIT SCORE"?? THAT IS THE MOST ASSINGNINE THING I EVER HERD . YOU ARE SIMPLY BAIT. THEY KNOW YOU HAVE FINANACIAL PROBLEMS OR A BANKRUPTCY THAT IS WHY YOU ARE BEING GIVEN THAT OFFER IN THE FIRST PLACE. HE LISTEN I WANT TO COLLECT ALL OF YOUR NAMES AND ADDRESSES I HAVE A NICE BROOKLY BRIDGE TO SELL YOU CHEAP. GOOD GOD SAVE US ALL

#12 General Comment

What a bunch of idiots

AUTHOR: Les - (U.S.A.)

SUBMITTED: Monday, November 02, 2009

I CANT BELIVE WHAT I AM READING RIGHT NOW, A WHOLE BUNCH OF IDIOTS TRYING TO JUSTIFY A CREDIT CARD COMPANY CHARGING THEM 150.00$ FEES BEFORE THE CARD IS EVEN USED ?? ARE YOU OUT OF YOUR MINDS?? THIS IS EXACTLY WHY PRESIDENT OBAMA PUT CONTROLS IN PLACE TO SAVE US FROM GREEDY CREDIT CARD COMPANYS DESTROYING OUR LIVES, TAKING OUR HARD ERNED MONEY AND YOU PEOPLE ARE JUST HANDING IT OVER BECAUSE "IT WILL HELP MY CREDIT SCORE"?? THAT IS THE MOST ASSINGNINE THING I EVER HERD . YOU ARE SIMPLY BAIT. THEY KNOW YOU HAVE FINANACIAL PROBLEMS OR A BANKRUPTCY THAT IS WHY YOU ARE BEING GIVEN THAT OFFER IN THE FIRST PLACE. HE LISTEN I WANT TO COLLECT ALL OF YOUR NAMES AND ADDRESSES I HAVE A NICE BROOKLY BRIDGE TO SELL YOU CHEAP. GOOD GOD SAVE US ALL

#11

Using the Military is no excuse, Read, Read, Read

AUTHOR: Randy - (USA)

SUBMITTED: Monday, September 21, 2009

You sound like one of those military dependents that runs up every credit card that your claws and get a hold of, and has the military member in debt for the rest of his career. Which leads him to filing bankruptcy at the end.

I am retired Navy with over 20 yrs of Honorable Service, and yes I did pass Grammar school.

With all credit card companies there is always along with the application form a Terms & Conditions pamphlet (contract) you know, the white paper with small black lettering thats folded about 5 or 6x

It clearly STATES: you start with about $250.00 Subtract $50 for Annual Membership Fee, Subtract $119 for Acceptance Fee, Subtract $6 monthly servicing Fee on balance owed. For a grand total of $175 in finance charges. (as they call it)

Credit available $75.00. Don't forget about the monthly finance charge on balance owed.

My point is, Stop using the military as an excuse because you can't read or add.

Any Questions!

#10

You only have to read

AUTHOR: LvScience - (USA)

SUBMITTED: Friday, August 28, 2009

Hello-

I am quite saddened to hear of an army spouse thinking that she was "ripped off" when all she had to do was read the details of the offer. They were quite clear and upfront about all of the charges, fees, etc that one will be charged upon acceptance. Using the military as an "excuse" to help you get out of doing your due diligence is reprehensible, in my opinion. Your spouse is putting his life on the line and you can't take the time to read a simple and straightforward credit card agreement? Shame on you.

LL

#9 Consumer Comment

in response

AUTHOR: Tom - (U.S.A.)

SUBMITTED: Friday, January 16, 2009

Legacy is not a ripoff. My wife and I have dealt with them for years. Yes, they do charge an activation fee and such, but you are warned ahead of time that your initial credit line will be greatly reduced prior to any purchases. They are a really good company to work with and I have had absolutely zero problems with them.

#8 Consumer Comment

Terms and conditions are clearly stated in writting

AUTHOR: Debbie - (U.S.A.)

SUBMITTED: Saturday, December 22, 2007

I received an application for the First National Bank Legacy Visa recently and the terms and conditons are clearly stated in writting in more than one place on the application.

Your husband being in the military does not make you exempt from paying bills.

#7 Consumer Comment

Terms and conditions are clearly stated in writting

AUTHOR: Debbie - (U.S.A.)

SUBMITTED: Saturday, December 22, 2007

I received an application for the First National Bank Legacy Visa recently and the terms and conditons are clearly stated in writting in more than one place on the application.

Your husband being in the military does not make you exempt from paying bills.

#6 Consumer Comment

Terms and conditions are clearly stated in writting

AUTHOR: Debbie - (U.S.A.)

SUBMITTED: Saturday, December 22, 2007

I received an application for the First National Bank Legacy Visa recently and the terms and conditons are clearly stated in writting in more than one place on the application.

Your husband being in the military does not make you exempt from paying bills.

#5 Consumer Comment

Terms and conditions are clearly stated in writting

AUTHOR: Debbie - (U.S.A.)

SUBMITTED: Saturday, December 22, 2007

I received an application for the First National Bank Legacy Visa recently and the terms and conditons are clearly stated in writting in more than one place on the application.

Your husband being in the military does not make you exempt from paying bills.

#4 Consumer Comment

Thanx you

AUTHOR: Amy - (U.S.A.)

SUBMITTED: Thursday, September 28, 2006

I just received a preapproval from Legacy. The fees were not disclosed, but implied, and somewhat difficult to find. I think all credit card companies are scum and needing a credit score is bull. You can buy anything without credit today - except people "deserve" things instead of saving for things like our parents and grandparents did. Your description of what this company did to you is further proof of the deceptive tactics of credit card companies and why marketing of debt is a multi-billion dollar industry. I wouldn't pay this card at all, but tell them if they do not erase the debt and remove it from your credit rating (I hope you didn't use the card) that you will report them to the Federal Trade Commission. They are predatory lenders.

#3 Consumer Comment

I am a Legacy Visa Customer

AUTHOR: Belinda - (U.S.A.)

SUBMITTED: Wednesday, September 27, 2006

Legacy Visa was one of my first credit cards, they did charge me alot of fees, but it's a small price to pay considering it made my score soar from the low 500's to almost 700 in less than 2 years. I still have them and they do report my good payment record to all 3 bureaus every single month. One thing they are not good about is raising your credit limit. I've been with them over 2 years and they've only raised my limit $50.00. I have 2 other secured cards and one of them "Credit One Bank" started my limite out at 300.00 and the limit has been raised to $750 in less than 2 years. But I will not cancel Legacy because canceling a card that is established will hurt your credit score ususally.

#2 Consumer Comment

Suggestions

AUTHOR: Stephanie - (U.S.A.)

SUBMITTED: Sunday, March 26, 2006

My husband (who is also military) and I use Legacy Visa, and we have never had a problem. The acceptance form clearly states on the back that you will be billed an acceptance fee and you may recieve your bill prior to recieving your card. It also states that you may cancel your account within the first 30 days and they will credit the acceptance fee back, as long as you haven't used the card.

Your husband being military doesn't make them have to do anything for you. Most companies are sick of people thinking they are entitled to special privledges because they or their spouse is military. The only time they have to do anything for you is when your spouse is deployed. Throwing the fact that your husband is military in their face does nothing to help your case. It only upsets them.

This credit card company has responded to our SCRA request promptly and made all necessary adjustments required. That is all they have to do.

They have reported to our credit report regularly and positively as we have maintained good standing with them.

In the future read the fine print or call the company and ask them what the up front charges that will be billed to your account are.

#1 Consumer Comment

Don't See the Problem

AUTHOR: Courtney - (U.S.A.)

SUBMITTED: Sunday, February 05, 2006

Keri, I'm not sure what you are saying, exactly. When you applied for the card, I'm almost certain that the terms and disclosures were laid out for you in black and white, including the fact that the card would be charged with fees that you would have to pay down before using it. When I had crappy credit, I got a First Premier Visa, I think it was, and it had the same deal. Credit limit of $200 with $150 already assessed for fees, activation, etc. Was it a shitty deal? YES, but it did start me on my way to good credit. Bear in mind, though, that even though you saw the fees and now you don't want the card, not paying it will still reflect negatively on your credit report, and that's probably something you want to avoid. Unfortunately, people get into messes like this by simply NOT READING THE TERMS THAT WERE OUTLINED AT THE TIME OF THE APPLICATION. One of the surest ways to avoid a "rip off" is to always READ READ READ what you are signing. Another thing would be that had you paid your bills on time in the past, you likely wouldn't need a card like this one. I KNOW, I KNOW: I don't know you or your "situation", I'm just merely stating the truth. Now, if by some chance the terms were NOT given to you, then I would say that you certainly have some legal recourse, but I doubt that is the case. Sorry if this sounds harsh or rude, but that was not my intention.

Also, I'm curious as to why you thought your husband being in the military would have any bearing on this. When I was in the Army (briefly), do you think Capital One stopped sending me my credit card bill? HA! Not likely. It is honorable that your husband is in the service, but to me, it doesn't have a thing to do with your complaint.

Good Luck

Advertisers above have met our

strict standards for business conduct.