Complaint Review: First Premier Bank - Sioux Falls South Dakota

- First Premier Bank P.O Box 5519, Sioux Falls, South Dakota U.S.A.

- Phone:

- Web:

- Category: Credit Card Processing (ACH) Companies

First Premier Bank Ripoff Not posting Legitmate payments and no viable answer why on the phone Sioux Falls South Dakota

*UPDATE Employee: Read

*REBUTTAL Individual responds: Definitely READ THE FINE PRINT

*UPDATE Employee: $150 annual fee??

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Its funny how life hits you. One day, while scanning my credit report I found a credit card (First Premier Bank) that I didn't own. At first, I thought the worst, and started to file a dispute to the credit bureaus. Then I thought, I'll ask my wife first to see if she knows about this account. Low and behold, its a credit card from before we were married that she (unbenounced to me) added me to as an authorized user. Now keep in mind, I've been a mortgage lender for 9 years now, and know my fair share about credit... I immediately went to my bank and took out a small personal unsecured loan to pay the card off with.

In the meantime the card (which had been cancelled by customer), for the past year was supposed to be closed and not gaining intrest, according to the rep my wife spoke to with First Premier. However, it had gained intrest to the tune of 29.99% compounded daily, followed by a eye poking $150.00 annual fee. Like I said, I took out a loan to pay it off as quickly as possible, had my wife cut a check for $38.00 over to cover the per dium and went about my business.

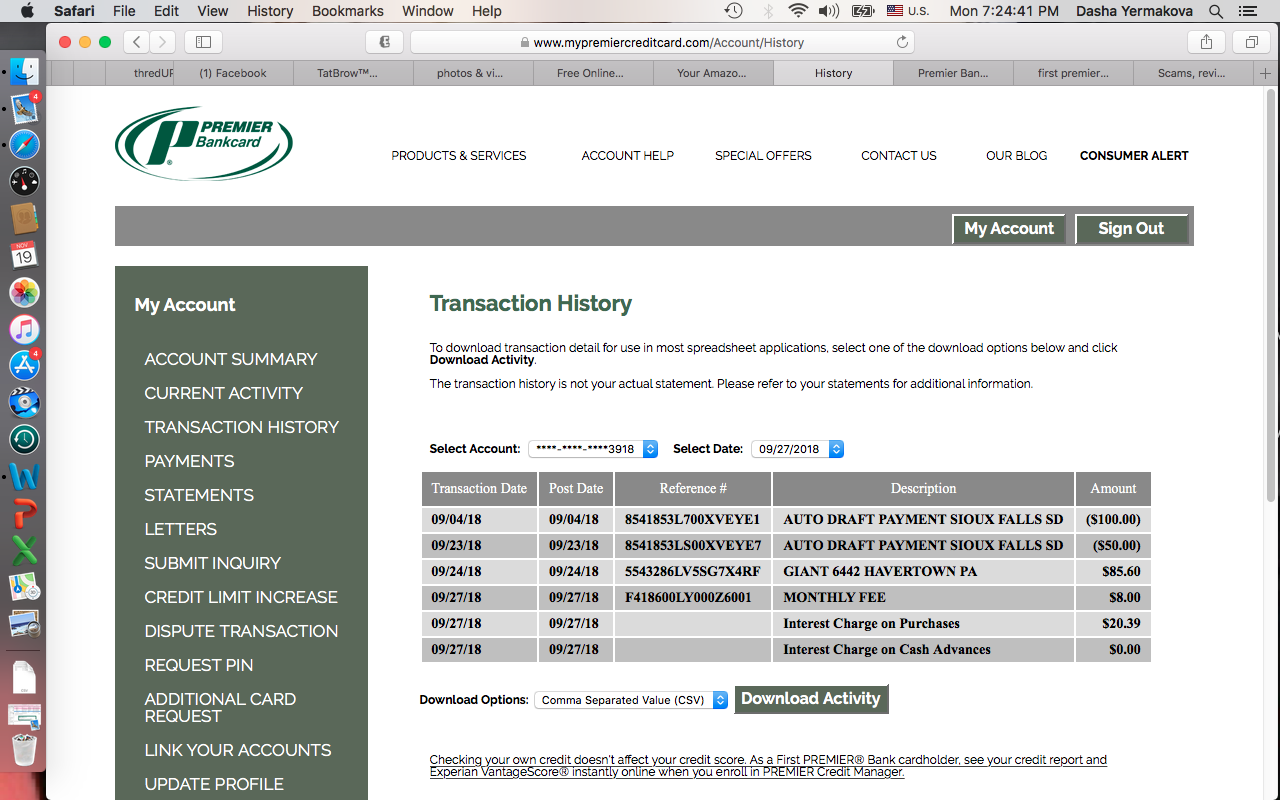

I get a statement in the mail today from First Premier showing the payment for $38.00 posted to the account, but not the loan check, which was in the same envelope. I called and spoke to a rep, who said she didnt know why it wasnt posted, was patched over to a "senior" person (Sara) who curtly told me that the check was missing banking information. Now, when I did this loan I went ahead and consolidated 8 other accounts into this new loan, and all other 8 accounts posted my checks without any issue or question. Not First Premier, they said there was banking information missing, and didnt know what information it was.

The check was sent back, but I was told would take about 30 days to get to me. Now I've heard of snail mail, but thats a little excessive since I was told that it was mailed out on Feb. 25 I should expect to see it around mid to late March. First Premier of course will not waive any late fees or intrest on the account even though they sent back a perfectly good check.

Just so you know what kind of customer service they have I will quote the "Senior" rep Sara; "We've only charged you $8 to date on the account, its not like we're charging you $60.00 or something." to which I replied $8 is more than you should charge for a payment you intentionally would not process. I personally sent the check, I know there was nothing wrong with it. Sara's reply was "It's not like we sent it back and said HAHA, here pay some more intrest!". Funny, seems that way to me.

Regardless, they will never get my business, and every client I meet that has an account with them will be immediately told to pay them off! And luckily for me, I deal with subprime lending and get to see thier lousy name come up at least once daily.

To all who consider an account with them, I tell you: Beware they are no better than a common thief! I know the truth now and hope you heed my warning.

Dave

San Antonio, Texas

U.S.A.

This report was posted on Ripoff Report on 03/06/2006 08:24 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-premier-bank/sioux-falls-south-dakota-57117/first-premier-bank-ripoff-not-posting-legitmate-payments-and-no-viable-answer-why-on-the-179676. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 UPDATE Employee

Read

AUTHOR: Al - (U.S.A.)

SUBMITTED: Friday, January 12, 2007

Well to the last comment, yes you need to read the terms and conditions thats what the bank sends to you so you know of the terms, they can't call every single customer and tell them all the terms of the credit card. If you have questions about the terms don't just assume call the bank thats why they set up customer service centers.

Now banks have to treat every customer the same way and with the same terms, they can't treat one customer with better rates just because they have been with the bank for a couple of years or have better credit. Its called Fair Lending Laws, that they do have to abide by.

The payment hold is not a personal attack on any certain person, it can and will happen to every one of the customers with the bank. Its a high risk company and they deal with high risk customers that is why the policies and terms are different from other crediters.

#2 REBUTTAL Individual responds

Definitely READ THE FINE PRINT

AUTHOR: Natalie - (U.S.A.)

SUBMITTED: Friday, September 15, 2006

I just canceled this card after several years of having it. I got this card when I was faced with hard times that impacted my credit, and never got rid of the card because I really did not have any particular issues with it. The fees were ridiculous but at the same time I had placed a $2K security deposit on this card, had things being automatically billed to it each month, and it just became more convenient to keep it than to cancel it.

A couple of weeks back I made an online payment to First Premier, and exactly 14 days ago a bank transfer (electronic funds transfer) was posted to my bank account reflecting the payment was made.

Still, when I went to use the card, it was declined. I logged into the website and it simply showed the last payment as $7, the current balance due as $7, the available credit as $7, it basically showed $7 across the board. It wasn't even updated.

When I contacted First Premier, I was told they reserve the right to hold onto the payement for 20 days or longer if they deem it to be "suspicious" in any manner. I spoke to one rep named "Jamie" and then the "account supervisor", Beth.

Beth could not explain what happened - first she said it may have been insufficient funds. To which I said that this was not the case because not only were the funds there, but they had been transferred out of my account already two weeks ago. She then replied that this was not a "wire transfer" so it wasn't considered a cash payment and they didn't have to post it right away according to the fine print. I reiterated that I understood it was not a wire transfer, that it was an ELECTRONIC FUNDS TRANSFER, and that if the money had already physically LEFT my bank, and First Premier was not showing it as available credit on my account, I wanted to know where the money had gone. After a ridiculous amount of rhetoric, tap dance and no particular explanation as to why they took my money and held onto it for weeks, Beth explained that MAYBE the fact that I had made two payments within the same month appeared "suspicious".

So, let me pull this together now. I had the card for years, I made my regular monthly payment, and when I received another payment from a client I took advantage of the extra cash to pay the card off - - - which resulted in a 20 day hold while they investigated the two back to back payments. I'll state this again - my card was not suspended for LACK OF payment - it was suspeneded for timely and consistent payment, and no one had to give me a heads up that this had even happened until I tried to use the card. This was not a past due card, nor a large balance on it. But the fact that I paid it twice in a month made me look peculiar, apparently. Had I NOT paid it, I would have been able to continue charging without a problem until my payment became due again.

When I complained about the embarrassment of having had the card declined despite the fact that it was current, and told them it would have been nice if First Premier had advised me that my payment was no being reflected, Jamie advised me that First Premier doesn't *have to* let me know they're holding on to the payment, and kept reminding me to read the agreement.

To the employee that basically posted that First Premier customers needed to deal with it because we essentially brought it on ourselves and First Premier is "helping" us, let me be the first to advise you that a bad run of luck does not make us all delinquents. Some of us are highly educated, well employed and well paying, and neither deserve nor appreciate being treated as morons that deserve everything they get.

To potential customers, go to www.orchardbank.com. They also have a decent credit rebuilding card and their customer service - and service across the board - runs circles around First Premier.

To current customers, unless you're still in dire straits, cut up that card. And don't expect First Premier to try to keep you - they're used to having accounts cancelled regularly once people realize they're being ripped off. They don't care because they're onto the next group of people that have been hit by hard times.

If you do sign up to First Premier, DO READ THE FINE PRINT. They're out of South Dakota - do some research to find out why. The law there basically allows them to do whatever they want because SD is desperate to keep their economy going and that's one of few good sources of employment in that area.

And remember - if you don't pay, they can cancel your charge priviledges. And if you DO pay, they can do the same. READ THE FINE PRINT - and don't throw the contract in the bottom of the junk drawer. With this company YOU WILL NEED to refer to this later.

But what do I know? I'm nothing but a no-good no-credit no-paying nobody. If you don't believe me, ask First Premier. They think that of all their customers.

#1 UPDATE Employee

$150 annual fee??

AUTHOR: Holly - (U.S.A.)

SUBMITTED: Monday, June 12, 2006

As an employee of Premier Bankcard, I would like to apologize if you feel your wife and yourself were wronged in any way by the company.

However, also as an employee, I do know that we do not, nor have we ever, offered a credit card with a $150 annual fee. In addition to this, there are no credit cards that have per diem interest, that's reserved for mortgages and auto loans.

As a credit card company, we charge interest once a month when the statement prints, usually at 9.9%. I cannot think of a card we have that has a 29.9% interest rate. The highest interest rate I've seen on an account is 23.9% and that is because the account had been out of terms for 3 consecutive months.

As far as your check being returned, that can be for a number of reasons. The most common reason I see is for an invalid account number on an ACH payment. It's a really common mistake and can be fixed if you make a payment to cover the check plus any fees, just like any other credit company. And, if you were concerned about not having any of the fees credit back to the account, all you had to do was ask. If the account had not had that particular fee credited before, customer service would have been happy to do it as a one-time courtesy.

And again, I am sorry for the poor service you feel that you received and hope only the best for both yourself and your wife in the future.

Advertisers above have met our

strict standards for business conduct.