Complaint Review: Geico - Dallas Texas

- Geico 4201 Spring Valley Road Dallas, Texas U.S.A.

- Phone: 800-841-3000

- Web:

- Category: Car Insurance

Geico rip-off! Dishonest, fraudulent! Dallas Texas

*UPDATE EX-employee responds: just want to point out

*Consumer Comment: Be grateful they paid your claim.

*Consumer Comment: Richard

*Consumer Comment: Rare that the other party will admit fault.

*Consumer Comment: just because you are issued a ticket by the police does not mean you are at fault for the accident

*Consumer Comment: The original post sounds familiar...

*Consumer Comment: Not discrimation

*Consumer Comment: Insurance is a government endorsed fraud.

*Consumer Comment: Insurance is a government endorsed fraud.

*Consumer Comment: Insurance is a government endorsed fraud.

*Consumer Comment: Insurance is a government endorsed fraud.

*UPDATE Employee: General Response to complaints

*Consumer Comment: Kay, it's not just Geico that does this.

*Consumer Comment: amazing

*Consumer Suggestion: One thing to remember

*Consumer Comment: READ AND LEARN FROM THESE COMMENTS!

*Consumer Comment: READ AND LEARN FROM THESE COMMENTS!

*Consumer Comment: READ AND LEARN FROM THESE COMMENTS!

*Consumer Comment: The blame game Where was the damage to the vehicle?

*Consumer Comment: JUST BECAUSE YOU ARE TICKETED, DOES'NT MEAN YOU ARE GUILTY

*UPDATE Employee: You were at fault and Geico pays it's claims

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I had Geico as my insurance company for about 13 years until they decided to treat me like i was some kind of criminal. I was involved in a very minor accident back in the summer of 2003 when a lady in a suburban moved over into the left lane, without a blinker, to make a right turn. Not seeing a blinker i was unaware that she was about to make a right turn into me. Since there was no one around to see this accident, it was her word against mine.

She than told the cops that i was trying to pass her on the right and hit her( who in their right mind would pass someone on the right, especially if they had their blinker on??). Her suburban had a total of 500-600.00 damage and my car had a total of 1600.00 damage. When i got a ticket for "passing on the right," she saw her ticket to sue me and my insurance company.

Geico said that they would help me through this and even supply me an attorney. Their attorney turned out to be the worst attorney i have ever met. over a year and a half, i spoke to him maybe twice, and thats only because i called him (even then he was rude to me). Their attorney talked to me as if i was this awful person that so-called "Severely-injured" this women and her two kids. oh, i forgot to say that i was only traveling about 10mph.

From the very beginning of this accident until it finally settled, Geico made me feel like they wanted to pay this woman off what ever it took to make her happy and not once did they seem interested in defending me. I had even told Geico that i had sat outside the place where she takes her children to karate and watched her pick those "severley-injured" kids up not even a week from the date of the accident. Geico just seem to not care enough to fight off a fraudulent claim. Instead my insurance went up and they gave this woman and her kids for "fake injuries" 32000.00.

If i would have known that Geico (my insurance company) was giving away money, i too would have made an injury claim for myself and son that was with me and was 3 at the time. So if any one wants to know why everyones premiums go up, you can thank people like this lady who made a fraudulent claim to my insurance company. Geico should have fought for this one instead of wanting to pay people for fake injuries and making me out to be the bad guy.

Kay

san angelo, Texas

U.S.A.

This report was posted on Ripoff Report on 12/23/2004 11:05 AM and is a permanent record located here: https://www.ripoffreport.com/reports/geico/dallas-texas-75244/geico-rip-off-dishonest-fraudulent-dallas-texas-124185. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#21 UPDATE EX-employee responds

just want to point out

AUTHOR: Ldeit3tk - (U.S.A.)

SUBMITTED: Friday, August 03, 2007

I just want to point out that it makes no sense for the insurance company to pay a fraudulant claim. Insurance is just like any other business and wants to make profits - why would they piss away profits to fraud. GEICO has an entire team dedicated to investigating fraudulant claims that are paid full time whether there are investigations or not, so why would they "just settle??" Even taking court cost (for which they have full time attorneys) into account it is't logical.

#20 Consumer Comment

Be grateful they paid your claim.

AUTHOR: A - (U.S.A.)

SUBMITTED: Tuesday, May 15, 2007

If Geico had taken your position and not paid the other party in your claim, went to court and defended you and you lost for an amount that was in excess of your policy limit, what would you expect GEICO to do then? I am guessing that you would demand that GEICO pay the full judgement stating that they should have settled within your policy limit when they had the chance. GEICO or any insurance company has an obligation to settle any claim within the insureds policy limit when it is reasonable and there is an opportunity.

If you were ticketed, even though you may not have been at fault, and it is just your word against the other person as to who was in what lane then GEICO is taking a big chance in court.

#19 Consumer Comment

Richard

AUTHOR: Richard - (U.S.A.)

SUBMITTED: Thursday, March 16, 2006

I had the same thing hapeen with Nationwide. An old man does a left turn in front of my son's car and gets T-boned. The old man is ticketed for Failure to Yeild the Righ-Away. Yet, he sues my son and our insurance company. The insurance company and attorney seemed only interested in settling the case instead of defending it. They settled for 25 grand and the old mand was at fault.

Only in America people!

#18 Consumer Comment

Rare that the other party will admit fault.

AUTHOR: David - (U.S.A.)

SUBMITTED: Thursday, March 16, 2006

It's going to be rare that the other party will admit fault.

In a case where both parties say they are not at fault and one is issued a ticket as a cause of the accident, not for something not related to the accident, it's usually going to fall against them 99.9% of the time I would assume, unless they fight the ticket.

You pay the ticket, you're pretty much saying you are guilty.

#17 Consumer Comment

just because you are issued a ticket by the police does not mean you are at fault for the accident

AUTHOR: Robin - (U.S.A.)

SUBMITTED: Friday, March 03, 2006

I just wanted to point out to everyone that just because you are issued a ticket by the police does not mean you are at fault for the accident. Insurance companies will do thier own investigation for who is at fault and not rely entirely on the police.

I know this because my husband was in a car accident back in April of 2004. He and a girl were at a four way intersection, no stops signs either way and he hit her. The cop was issuing him a ticket for failure to yield to the right, but the girl kept claiming that she was speeding and not paying attention because her kid was in the back seat screaming and she was turned around looking at him. The police issued my husband a ticket anyway. The girl did not make a claim against our insurance, but her husband did because the car was in his name. Our insurance company (Geico) did their own investigation and found the girl to be at fault for the accident. They in turned went after her insurance company (Progressive), and her insurance company ended up paying to fix our car. My husband did still pay the ticket he was issued though.

Just goes to show the police are not always right, and insurance companies can.

#16 Consumer Comment

The original post sounds familiar...

AUTHOR: Leticia - (U.S.A.)

SUBMITTED: Tuesday, November 08, 2005

Oh I know, It sounds just like an old Will Smith rap when it was still DJ Jazzy Jeff and the Fresh Prince.

I don't know the real name, but the main line is, "you saw my blink, b****"

It's all about him getting into an accident (that wasn't his fault.) When the police came they blamed him because the old lady started crying, when it went to court she came arrived in a wheel-chair and neck brace.

I'm sorry if this really happened but the similarities made that song get stuck in my head.

#15 Consumer Comment

Not discrimation

AUTHOR: Kay - (U.S.A.)

SUBMITTED: Monday, November 07, 2005

When rating insurance policies the practive cannot be discriminatory. All persons within certain demographic groups must be treated the dame if all other facotrs such as driving record are the same.

Rates can be based on where the person lives, how much they drive and what they drive. Rates are also based on credit (yes statistics, including a public document by the Texas Department support this) that people with good credit tend to be better risks and have better driving records.

Employment and education is also a factor because again the statistical risk. What may suprise you is that nurses, firemen or policemen are often rated higher due to the number of hours they work and the fatigue levels and likelyhood of being on the roads at off hours.

Age...yep big factor...check the reports for your state department of motor vehicles and see what age groups and genders have the most accidents. Very high incidence your young drivers until age 25 or so and then lower incidence until reaching the 70's.

Educate yourself...shop after doing your research.

#14 Consumer Comment

Insurance is a government endorsed fraud.

AUTHOR: Jeff - (U.S.A.)

SUBMITTED: Tuesday, November 01, 2005

Jason speaks often of state regulatory bodies & commissioners, but neglects to mention that the insurance industry is one of the least regulated industries in the nation. The state of California budgets less than $125,000 per year on its regulatory commission.

Charging a person a higher premium because of age, race, credit history, or occupation smacks of blatant discrimination. It is only "logical and legal" because our government has taken it upon itself to champion the cause of these companies.

There is really no such thing as fair compensation to an insurance company. They will pay what they consider to be a fair amount and no more. John Q. Public can retain an attorney if he chooses, but he's hopelessly outmatched by a company that can spend $10,000 to his $1.

The general public should not be misled into thinking that an insurance company will ever represent their best interest. Geico and all the others are only concerned with the bottom line, and they will go to any length to protect it.

#13 Consumer Comment

Insurance is a government endorsed fraud.

AUTHOR: Jeff - (U.S.A.)

SUBMITTED: Tuesday, November 01, 2005

Jason speaks often of state regulatory bodies & commissioners, but neglects to mention that the insurance industry is one of the least regulated industries in the nation. The state of California budgets less than $125,000 per year on its regulatory commission.

Charging a person a higher premium because of age, race, credit history, or occupation smacks of blatant discrimination. It is only "logical and legal" because our government has taken it upon itself to champion the cause of these companies.

There is really no such thing as fair compensation to an insurance company. They will pay what they consider to be a fair amount and no more. John Q. Public can retain an attorney if he chooses, but he's hopelessly outmatched by a company that can spend $10,000 to his $1.

The general public should not be misled into thinking that an insurance company will ever represent their best interest. Geico and all the others are only concerned with the bottom line, and they will go to any length to protect it.

#12 Consumer Comment

Insurance is a government endorsed fraud.

AUTHOR: Jeff - (U.S.A.)

SUBMITTED: Tuesday, November 01, 2005

Jason speaks often of state regulatory bodies & commissioners, but neglects to mention that the insurance industry is one of the least regulated industries in the nation. The state of California budgets less than $125,000 per year on its regulatory commission.

Charging a person a higher premium because of age, race, credit history, or occupation smacks of blatant discrimination. It is only "logical and legal" because our government has taken it upon itself to champion the cause of these companies.

There is really no such thing as fair compensation to an insurance company. They will pay what they consider to be a fair amount and no more. John Q. Public can retain an attorney if he chooses, but he's hopelessly outmatched by a company that can spend $10,000 to his $1.

The general public should not be misled into thinking that an insurance company will ever represent their best interest. Geico and all the others are only concerned with the bottom line, and they will go to any length to protect it.

#11 Consumer Comment

Insurance is a government endorsed fraud.

AUTHOR: Jeff - (U.S.A.)

SUBMITTED: Tuesday, November 01, 2005

Jason speaks often of state regulatory bodies & commissioners, but neglects to mention that the insurance industry is one of the least regulated industries in the nation. The state of California budgets less than $125,000 per year on its regulatory commission.

Charging a person a higher premium because of age, race, credit history, or occupation smacks of blatant discrimination. It is only "logical and legal" because our government has taken it upon itself to champion the cause of these companies.

There is really no such thing as fair compensation to an insurance company. They will pay what they consider to be a fair amount and no more. John Q. Public can retain an attorney if he chooses, but he's hopelessly outmatched by a company that can spend $10,000 to his $1.

The general public should not be misled into thinking that an insurance company will ever represent their best interest. Geico and all the others are only concerned with the bottom line, and they will go to any length to protect it.

#10 UPDATE Employee

General Response to complaints

AUTHOR: Jason - (U.S.A.)

SUBMITTED: Tuesday, November 01, 2005

I have read quite a few of the complaints on this site about GEICO and the way it conducts business. It seems to me that most of the complaints stem from a general lack of understanding how insurance policies are rated and how insurance companies handle claims.

I believe it would be benificial for anyone who reads this site to have at least a basic understanding of how insurance works no mater what company you have your insurance through.

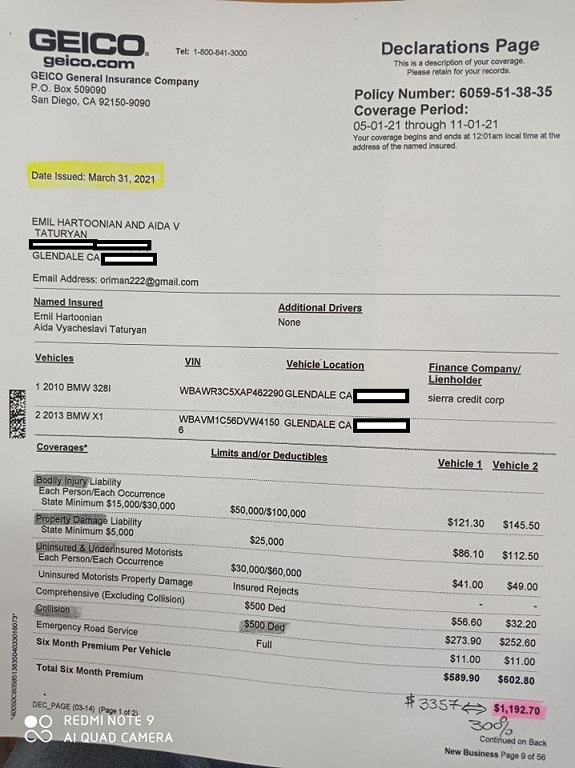

First let me give you some basic information about what insurance is and its purpose. For the purpose of this discussion we will refer only to property and casualty insurance as it pertains to auto insurance. Insurance is a promise that your company will pay for any damages you become legally liable for up to your policy limits if you are involved in an auto accident. In exchange for that promise you as a consumer pay a premium.

The amount you pay for that insurance is determined based on factors set by the insurance company and approved by your states regulatory body, usually the insurance commissioner. The factors used by each company allow them to try and predict what your frequency of loss will be and set your individual rate accordingly. Keep in mind that the goal of any company is to make money, but most people dont understand how insurance companies make money . They operate under the assumption that the insurance company charges a premium and then try to pay as few claims as possible to hold onto as much money as they can. The reality of it is much different. most insurance companies do not make any money on underwriting and in fact loose money on underwriting usually 2 to 6 cents on the dollar. Insurance companies make money by investing the premiums people pay in various places so they make a return on their investment. The more accurate the prediction of loss frequency and the better the return on investments, the better the profit.

As I mentioned above each insurance company sets the factors that will be used to determine your rates. In GEICO's case some of the factors used are prior driving record, occupation, education, geography, and in some states even credit. These are not all the factors but only a sampling. These factors are chosen because statistically they are a good indicator of the frequency of loss. For example in one of the postings I read a former GEICO employee made the comment that GEICO gives better rates to Doctors and Lawyers than to average Joes like a truck driver or office worker such as myself. It may be true that a Dr or Lawyer gets lower rates but only because when you look at each occupation historically Doctors and Lawyers have fewer losses that does the average Joe. You can take any occupation out there, and that occupation will fall somewhere along the range from high risk to low. Another factor mentioned by the former employee is annual mileage. This one should be self explanitory, the fewer miles you drive the less likely you are to be in an accident. While it does not seem fair to judge someone on anything other than prior loss history and usage of the vehicle being insured, it is legal and logical.

I feel it is important for me to state here that although I work for GEICO I am not insured with GEICO. based on GEICO's underwriting guidelines I only qualify for a high risk policy. I am insured with another insurance company as a prefered risk whose rates in my case are around half the GEICO rate. I am high risk with GEICO and Preferred with the other company only because of the method used to predict risk. I am not upset at this fact and I do not feel I am being cheated by GEICO because I understand how the rates are determined and that it is my responsibility as a consumer to do my homework in finding the best rate.

I feel sorry for those people who think an insurance company has somehow done them wrong when they get a quote for insurance and it is higher than what they are currently paying or another quote they receive. That company is not trying to take advantage of them, they are just following the guidelines that the state has approved. For those who complain about having paid to much for insurance for years and then got a lower rate with a different company let me say this,take personal responsability for your own mistake. As a consumer it is your responsibility to check around periodically to see how your rates and companies service compare and make whatever adjustments need to be made.

I want to address one thing suggested by a former GEICO employee who said to just say you drive 3000 miles a year and you will get better rates. It is against the law to give false inforamtion or intentionally omit material facts when applying for insurance. Doing so is considered insurance fraud and if you are caught you may be subject to criminal prosecution. For those who want to take the chance that they will not get caught, understand that most insurance companies find out the truth usually when the car is inspected from an accident and can and do cancel policies to be effective back to the date the policy is started. If your policy is canceled back to the inception date because you lied on your application, and you were involved in an accident you will not be covered for the date of the accident and you will be personally responsible for paying any damage or injury claims made against you.

Lets talk a little bit about coverage. There is no such thing as "full coverage". Full coverage is subjective to each individual. You as a consumer and citizen in society in general have a responsability to know what coverages you carry and how they protect you.

Lets talk first about Liability coverage. Liability coverage is designed to pay for any damages to property of other people or their injuries if you are held legally liable or responsible for them. these coverages include BI ( bodily injury) and PD (property damage). These coverages do not pay for any of your injuries or damages to your personal vehicle.

These coverages are generally required by the state government.

When determining what level of coverage you should carry you need to take into consideration several factors including what your personal assets are, your occupation, type of vehicle you drive, etc... If you are a Doctor driving a Mercedes Benz with alot of monitary assets you will be at a higher risk of being sued if you are at fault in an accident than a janitor driving an old beat up truck. In our litigation happy society we all know the first thought that goes through many peoples minds when they know you are at fault and are a doctor showing evident wealth are dollar signs.

Be aware that your insurance company is only going to pay up to the limit specified in your insurance policy for each occurance. If you have accumulated alot of wealth it is in your best interest to look into an umbrella liability policy but I will not discuss that here.

The next coverage I will mention is the coverage for your vehicle. Comprehensive and Collision coverage pay for the damages to your vehicle up to the value of the vehicle as determined at the time the accident happens. Many different methods are used to determine the ACV(actual cash value) of your vehicle by each company. In GEICO's case we generally perform a comparative market analysis of your area to find several of the same year make and model vehicle with similar options and average them together. this seems to give the most accurate value for each individual area.

Be aware that most policies do not take into consideration optional equipment such as wheels, ground effects, stereos, or other aftermarket modifications unless they came on the vehicle from the dealer. You will have to let your insurance company know about them so they can adjust your policy to cover them.

Comprehensive coverage pays for damages caused by things like animal strikes, vandalism, theft, storm damage, etc.. collision coverage pays for damage from the vehicle colliding with something. This also includes something colliding with the vehicle, for example a shopping cart hitting your parked car.

These coverages are required by any finance company when you are financing a vehicle in order to protect the colateral on the loan. These coverages can pay regardless of whether you are at fault or not.

In addition to the basic coverages listed above there are optional coverages for your injuries. these include PIP(personal injury protection) or MED (medical payments)and vary by state. You can also add coverage for a rental car referred to as RR(rental reimbursement), ERS(emergency road service/ roadside assistance), or MBI (mechanical breakdown/ extended warranty on your vehicle). There is also a coverage called UM(uninsured motorist) which pays if you are hit by an uninsured driver. there are three parts UM, UIM (underinsured motorist), and UMPD(uninsured motorist property damage). what UM coverage is available and how it applies varies by state.

Basically the coverages listed above will be the same from one state to the next but will vary slightly. The one major exception to this is the state of Michigan whose coverages are very different.

Let me say once again here that it is your responsability to do your research and get the best coverage for your individual situation. There is no excuse for not knowing what coverage you have durring any policy period, as your insurance company sends you a declarations page that shows what coverage is on each vehicle insured under the policy. EVERY renewal you should review it to be sure you are getting the coverage and limits you want.

As an agent for GEICO I carried agents Licenses for 13 states across the Southeast and Midwestern US. As a claims adjuster I surrendered my agents Licenses to secure my adjusters licenses. I currently hold Licenses in the 4 states that I handle that require a license.

Lets talk a little bit about claims. In one of the postings I read a former policyholder complained that GEICO had made decisions about his liability in a claim arbitrarily and without merit. While I understand his frustration based on his description of the accident, as an insurance company the adjusters that handle your claim have to remember that our obligation to you as our policyholder is to protect your interest above all else. Let me remind everyone that we are speaking in a legal sense, our promise to you is to pay all claims you are LEGALLY responsible for. When we investigate a loss we gather the available evidence and make a descision to pay or not based on what is in your best interest. If the evidence available supports that you are LEGALLY liable for the loss we pay it and if not we dont. In the specific case mentioned previously the former policy holder stated he was ticketed for passing on the right by the officer on the scene, he mentioned the point of impact to his vehicle was on the drivers side and the point of impact to the claimants vehicle was the right side, if I remember correctly he also mentioned that there were no independent witnesses. so you have a word against word situation where the physical evidence and the ticket support the claimants story and nothing other than the insureds statement to refute that. From the compalaint GEICO paid the loss and in the interest of protecting the policyholder should have.

What do you suppose would have happened if GEICO had denied the claim against the insured? With the evidence provided the claimant probably would have sued the insured directly and that would have subjected the insured to the termoil of a potential trial, the financial burden of litigation, and ultimately exposure to substatial financial loss. While the insured may not be happy with the descision sometimes you have to do the unpopular in order to do the right thing.

No insurance company just throws money around. and they certainly do not pay claims without sufficient evidence to support the claim. I have been in the insurance business for many years and have seen many different situations and often you have to deal with a difficult situation. Many times someone is going to be angry at the decision made and that is just the reality of the job, but I go to work everyday with the intention and goal of making my insureds ordeal a little easier. I handle each situation with the insureds best interest ALWAYS in mind and I know that the vast majority of my coleagues in the insurance industry do the same. To those who feel that insurance is a scam or that the company only cares about the bottom line let me be very clear ALL insurance companies work tirelessly some 24hrs a day to do what is right for each of our insureds, whether you agree with it or not.

This is not to say that sometimes mistakes are not made, we are afterall human. but if we make a mistake we take ownership and correct the mistake one way or the other as best we can.

We deal with things on a daily basis most people will never have to experience in their lifetime. I do this everyday because I know that for all the things I have to deal with, for that one individual I am able to trully help and ease their pain or anxiety I have made a difference.

So before you start complaining about what was done to you or why your rates are so high educate yourself, take responsability for your own situation, and make sound decisions in your best interest.

#9 Consumer Comment

Kay, it's not just Geico that does this.

AUTHOR: Marc - (U.S.A.)

SUBMITTED: Monday, October 31, 2005

Any inurance bandits will take the easy way out, that's the racket. She struck first, you lost, just get over it. Myself, I was hit from behind from kids racing, and the kid that hit me filed against me. We went to court and I won the case without trying, and this jerk ended up paying me $1,500 as a result. My insurance company slapped my on the back, then cancelled me two weeks later. My agent told me that the company just wanted to dump 20,000 long-term customers so they could raise rates. Bottom line is that the insurance business is of lawyers, for lawyers, and by lawyers. The cops are just their enforcers.

#8 Consumer Comment

amazing

AUTHOR: David - (U.S.A.)

SUBMITTED: Monday, October 31, 2005

Angie you obviously missed quite a bit. The police also found him at fault and ticketed him.

Why would any insurance company fight it and spend more fighting it in court? They wouldn't.

Think about court:

It wasn't my fault.

Well the witnesses say you did it. The policy investigated and gave you a ticket. You paid the ticket which is an admission of guilt.

Please get a clue.

I would do more research on insurance. What GEICO did is not illegal. The guy was clearly at fault and GEICO stepped up and paid it.

You come here with your, this happened to me sob story because you are also an angry excustomer of GEICO and think you have been treated wrongly, when you most likely are not educated with the working of insurance.

It's hard to think that this guy had all this happen to him and he not be at fault. GEICO wasn't driving his car, he was.

It's a lose lose situation for GEICO. They are now out money and a customer here saying he was ripped off.

Be happy that GEICO just paid out a couple times more than you have ever paid them due to your accident that you caused and got ticketed for. that's there job right you may say.

He was found at fault for the accident, GEICO paid. They could have fought it and lost in court very easily and even if they won, then you have the other person on here saying geico would pay me my money what a ripoff.

Give me a break. The half truths and full lies on this website amaze me. This is a rant, not a ripoff.

Find a different site.

#7 Consumer Suggestion

One thing to remember

AUTHOR: Christine - (U.S.A.)

SUBMITTED: Thursday, October 27, 2005

Any time an insurance company "supplies" you with an attorney, the attorney is actually representing the best interests of the insurance company, not you. You should always hire an independent attorney if you want your interests represented.

#6 Consumer Comment

READ AND LEARN FROM THESE COMMENTS!

AUTHOR: Angie - (U.S.A.)

SUBMITTED: Thursday, October 27, 2005

THIS WEBSITE IS EXCELLENT FOR ALL WHO ARE GETTING READY TO BUY INSURANCE FROM GEICO OR ANY OTHER COMPANY.

JUST READ AND LEARN FROM IT!!

SAN ANGELO,TX. IS RIGHT CONCERNING HER REPORT. I HAD A VERY SIMILAR TO THAT ONE. I TOO WAS TREATED VERY BADLY BY GEICO AFTER ALMOST 18 YEARS WITH THEM.

THEY ARE NOT AT ALL CONCERNED WITH THEIR INSURED, ALL THEY WANT IS THE MONEY, AS LONG AS YOU PAY THEM, THERE IS NO PROBLEM, BUT DON'T YOU DARE GET INTO A SITUATION WHERE YOU EXPECT THEM TO HELP YOU, OH NOOOOOOO, NOT THEM, THEY WILL LEAVE YOU HANGING, THEY WILL PAY OUT THE MONIES TO THE OTHER PARTY JUST TO KEEP EVERYTHING ON A

HUSH, HUSH. ALL FOR THEIR BENEFIT.

I AM SO GLAD I'M OUT OF GEICO, SO HAPPY WITH MY NEW COMPANY. (3 YEARS NOW WITH THEM)

I BELIEVE WE STAY SO LONG WITH THESE TYPES OF COMPANIES THAT WE BECOME UNFAIR TO OURSELVES AND DON'T GIVE OURSELVES A CHANCE TO LOOK INTO A DIFFERENT COMPANY WHICH OFFER LOWER PREMIUMS. WE ALL NEED TO DO THIS OFTEN BECAUSE IN THE LONG RUN IT WILL COST US LOTS OF MONEY WITH COMPANIES LIKE GEICO.

PEOPLE THAT RESPOND NEGATIVELY TO SUCH REPORTS LIKE SAN ANGELO,TX, HAVE NO IDEA WHAT IT MEANS UNTIL IT HAPPENS TO THEM.

PEOPLE, YOU NEED TO BE A LITTLE MORE OPEN MINDED, YOU NEED TO PUT YOURSELVES IN OUR SHOES.

THERE ARE CORRUPT PEOPLE EVERYWHERE, COMPANIES LIKE GEICO JUST FIND A WAY TO GET AWAY WITH IT.

MY ADVICE: LOOK AROUND FOR A BETTER COMPANY, THEY ARE OUT THERE. DON'T LET YOURSELVES BE TAKEN BY THEIR CHEAP COMMERCIALS! THEY ARE WRONG,

THEY ARE NOT THE LOWEST INSURANCE COMPANY. I KNOW, I HAVE DONE MY HOMEWORK AND FOUND AT LEAST THREE THAT ARE LOWER.

#5 Consumer Comment

READ AND LEARN FROM THESE COMMENTS!

AUTHOR: Angie - (U.S.A.)

SUBMITTED: Thursday, October 27, 2005

THIS WEBSITE IS EXCELLENT FOR ALL WHO ARE GETTING READY TO BUY INSURANCE FROM GEICO OR ANY OTHER COMPANY.

JUST READ AND LEARN FROM IT!!

SAN ANGELO,TX. IS RIGHT CONCERNING HER REPORT. I HAD A VERY SIMILAR TO THAT ONE. I TOO WAS TREATED VERY BADLY BY GEICO AFTER ALMOST 18 YEARS WITH THEM.

THEY ARE NOT AT ALL CONCERNED WITH THEIR INSURED, ALL THEY WANT IS THE MONEY, AS LONG AS YOU PAY THEM, THERE IS NO PROBLEM, BUT DON'T YOU DARE GET INTO A SITUATION WHERE YOU EXPECT THEM TO HELP YOU, OH NOOOOOOO, NOT THEM, THEY WILL LEAVE YOU HANGING, THEY WILL PAY OUT THE MONIES TO THE OTHER PARTY JUST TO KEEP EVERYTHING ON A

HUSH, HUSH. ALL FOR THEIR BENEFIT.

I AM SO GLAD I'M OUT OF GEICO, SO HAPPY WITH MY NEW COMPANY. (3 YEARS NOW WITH THEM)

I BELIEVE WE STAY SO LONG WITH THESE TYPES OF COMPANIES THAT WE BECOME UNFAIR TO OURSELVES AND DON'T GIVE OURSELVES A CHANCE TO LOOK INTO A DIFFERENT COMPANY WHICH OFFER LOWER PREMIUMS. WE ALL NEED TO DO THIS OFTEN BECAUSE IN THE LONG RUN IT WILL COST US LOTS OF MONEY WITH COMPANIES LIKE GEICO.

PEOPLE THAT RESPOND NEGATIVELY TO SUCH REPORTS LIKE SAN ANGELO,TX, HAVE NO IDEA WHAT IT MEANS UNTIL IT HAPPENS TO THEM.

PEOPLE, YOU NEED TO BE A LITTLE MORE OPEN MINDED, YOU NEED TO PUT YOURSELVES IN OUR SHOES.

THERE ARE CORRUPT PEOPLE EVERYWHERE, COMPANIES LIKE GEICO JUST FIND A WAY TO GET AWAY WITH IT.

MY ADVICE: LOOK AROUND FOR A BETTER COMPANY, THEY ARE OUT THERE. DON'T LET YOURSELVES BE TAKEN BY THEIR CHEAP COMMERCIALS! THEY ARE WRONG,

THEY ARE NOT THE LOWEST INSURANCE COMPANY. I KNOW, I HAVE DONE MY HOMEWORK AND FOUND AT LEAST THREE THAT ARE LOWER.

#4 Consumer Comment

READ AND LEARN FROM THESE COMMENTS!

AUTHOR: Angie - (U.S.A.)

SUBMITTED: Thursday, October 27, 2005

THIS WEBSITE IS EXCELLENT FOR ALL WHO ARE GETTING READY TO BUY INSURANCE FROM GEICO OR ANY OTHER COMPANY.

JUST READ AND LEARN FROM IT!!

SAN ANGELO,TX. IS RIGHT CONCERNING HER REPORT. I HAD A VERY SIMILAR TO THAT ONE. I TOO WAS TREATED VERY BADLY BY GEICO AFTER ALMOST 18 YEARS WITH THEM.

THEY ARE NOT AT ALL CONCERNED WITH THEIR INSURED, ALL THEY WANT IS THE MONEY, AS LONG AS YOU PAY THEM, THERE IS NO PROBLEM, BUT DON'T YOU DARE GET INTO A SITUATION WHERE YOU EXPECT THEM TO HELP YOU, OH NOOOOOOO, NOT THEM, THEY WILL LEAVE YOU HANGING, THEY WILL PAY OUT THE MONIES TO THE OTHER PARTY JUST TO KEEP EVERYTHING ON A

HUSH, HUSH. ALL FOR THEIR BENEFIT.

I AM SO GLAD I'M OUT OF GEICO, SO HAPPY WITH MY NEW COMPANY. (3 YEARS NOW WITH THEM)

I BELIEVE WE STAY SO LONG WITH THESE TYPES OF COMPANIES THAT WE BECOME UNFAIR TO OURSELVES AND DON'T GIVE OURSELVES A CHANCE TO LOOK INTO A DIFFERENT COMPANY WHICH OFFER LOWER PREMIUMS. WE ALL NEED TO DO THIS OFTEN BECAUSE IN THE LONG RUN IT WILL COST US LOTS OF MONEY WITH COMPANIES LIKE GEICO.

PEOPLE THAT RESPOND NEGATIVELY TO SUCH REPORTS LIKE SAN ANGELO,TX, HAVE NO IDEA WHAT IT MEANS UNTIL IT HAPPENS TO THEM.

PEOPLE, YOU NEED TO BE A LITTLE MORE OPEN MINDED, YOU NEED TO PUT YOURSELVES IN OUR SHOES.

THERE ARE CORRUPT PEOPLE EVERYWHERE, COMPANIES LIKE GEICO JUST FIND A WAY TO GET AWAY WITH IT.

MY ADVICE: LOOK AROUND FOR A BETTER COMPANY, THEY ARE OUT THERE. DON'T LET YOURSELVES BE TAKEN BY THEIR CHEAP COMMERCIALS! THEY ARE WRONG,

THEY ARE NOT THE LOWEST INSURANCE COMPANY. I KNOW, I HAVE DONE MY HOMEWORK AND FOUND AT LEAST THREE THAT ARE LOWER.

#3 Consumer Comment

The blame game Where was the damage to the vehicle?

AUTHOR: David - (U.S.A.)

SUBMITTED: Sunday, May 08, 2005

Have you ever read the back of a ticket. It usually states paying this ticket is an admission of guilt.

If you are not guilty, fight in court. Get a lawyer, GEICO even supplied a lawyer to this guy, who knows if he was good or not, i assume you lost and are mad. If you saw he was a bad lawyer and not contacing you why did you not get one.

Just because someone doesn't use a blinker, isn't going to justify if you hit them. just like if you behind a car and they slam on their brakes for no reason.

The story seems wierd, the damage to the vehicle would show who was in the wrong by the story you gave and the possible way your story would make sense is if you were passing her on the right.

Where was the damage to the vehicle? What lane were you in? Were you behind her, I mean set it up.

Don't get me wrong, i just find it hard to believe 90% of the people on rip off report because they are usually not being riped off, but in most cases, have a severe case of ignorance. Not saying you do, but come on, you say GEICO rip off, when someone else is ripping off GEICO for money.

Insurance companies routinely settle out of court, wether the accident is your fault or not. You say they paid, 30000 maybe, and they probably would have spent 100,000 definding in court, so they just saved their policy holders 70,000.

I would settle to.

#2 Consumer Comment

JUST BECAUSE YOU ARE TICKETED, DOES'NT MEAN YOU ARE GUILTY

AUTHOR: Angie - (U.S.A.)

SUBMITTED: Thursday, April 14, 2005

If you live in a town like I live in, you would understand that just because you are given a ticket, that does'nt make you guilty.

My husband was also ticketed after HE was hit by a police officer.

I guess it was like he was hit by God himself., because he was treated so unfairly.

The accident was the fault of the police officer, who had NO LIGHT ON, NO SIREN AND WAS SPEEDING IN A RESIDENTIAL NEIGHBORHOOD.

But we all know how these officers cover up for each other, My cousin is an officer in Brooklyn, NY, so I got the inside scoop on how this works.

GEICO APPARENTLY IGNORES THIS FACT AND IGNORES THE PAST DRIVING RECORD OF THE PEOPLE THAT HAVE BEEN WITH THEM FOR MANY YEARS.

#1 UPDATE Employee

You were at fault and Geico pays it's claims

AUTHOR: Melissa - (U.S.A.)

SUBMITTED: Monday, February 14, 2005

I clearly understand that you feeel that you were not at fault in the accident but there are soem things you should consider. You were ticketed by the police that is proof of your fault under your auto liablity GEICO is obligated to handle that claim. You could have fought the ticket in court. That would have been on your personal time and not covered by insurance and there was really no need for the attorny to contact you because you were already deemed at fault. GEICO would not have paid the claim unless they had supporting information. Unless you are a medical Doctor can you really say the injuries were fake?

Advertisers above have met our

strict standards for business conduct.