Complaint Review: Geico - Mays Landing New Jersey

- Geico 3524 Westmoreland Drive Mays Landing, New Jersey U.S.A.

- Phone: 609-569-0271

- Web:

- Category: Car Insurance

Geico ripoff and terrible customer service Bethesda Maryland

*UPDATE Employee: Take Responsibility - Read "YOUR" Policy

*Consumer Comment: Andrea

*Consumer Comment: Check your insurance documents.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

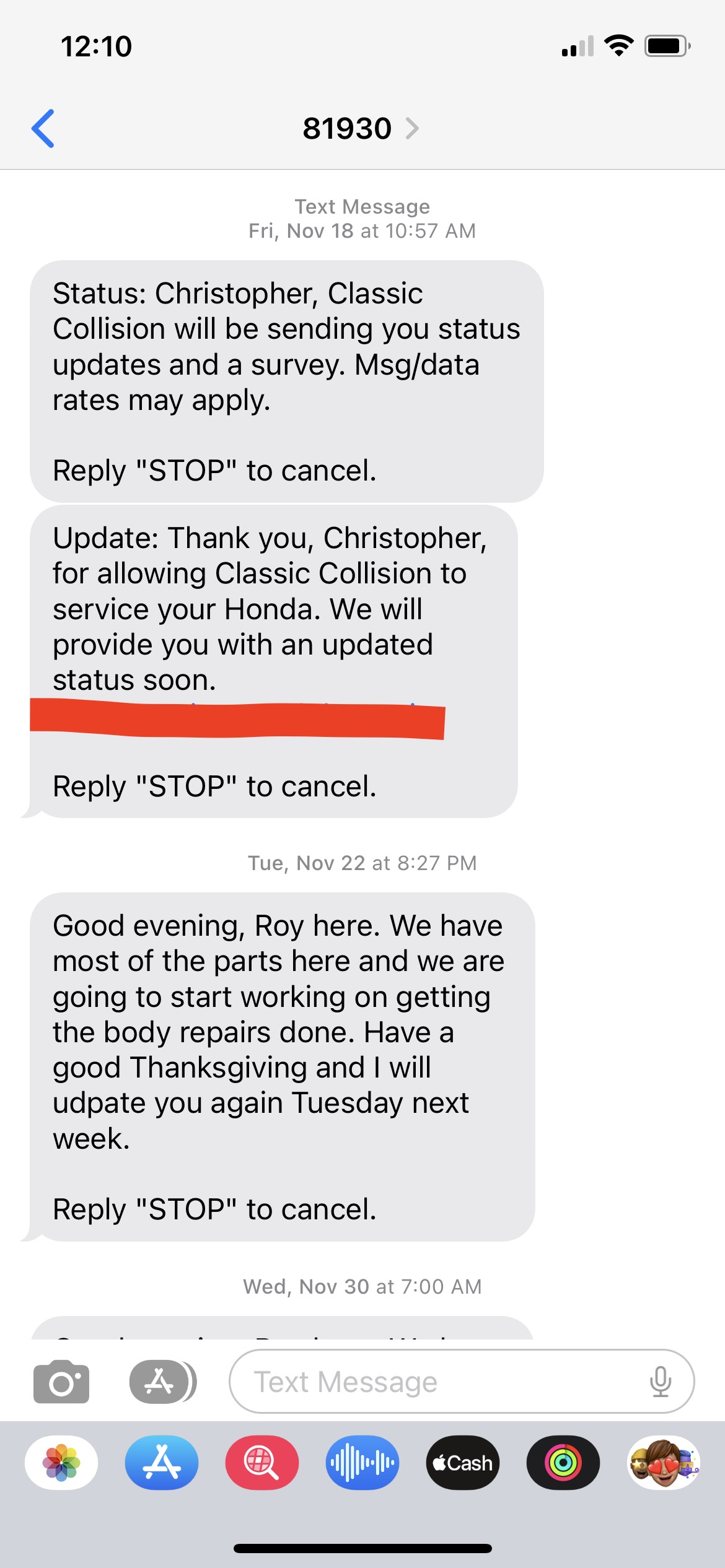

I was recently in a car accident with the other driver being cited and at fault after crossing over three lanes of traffic in front of me. I immediately called Geico and reported my accident even though it was on a Saturday. On the following Monday, Geico left a message on my voicemail that they need to speak to me to get a recorded statement from me so of course I quickly called them back to supply them with the information they were requesting. I also stated to the claims adjustor that I would be needing a rental car.

He then stated that I would need to go through the other drivers insurance for that. I then called my assigned claims adjustor and left several messages taht I needed to speak with her regarding my claim but never got a call back.

On the following Saturday I wrote an email to Geico requesting information on my claim. A nice gentleman phoned me right away to inform me that I should just go through my insurance and let Geico take care of going after her insurance for payments.

So with that said, he set me up for a rental car but nothing compared to what I was used to driving. I later that week called Geico and said that I would need a bigger car as I would be picking up my 3 children from the airport but was advised that I had reached my limit on my rental rate.

Still this doesn't seem fair that this accident was plainly not my fault but I was forced to drive a little car and squash 3 children into it. So I got the rental car and I was requested to go to the impound lot of the local police department and pay out of my pocket the storage fees for the car that was still sitting there because Geico wasn't moving forward on my claim and the fees were piling up.

And then the claims adjustor called and asked if I could take my wrecked car to my residence not once did she request this but 3 times after I told her no each time! Of course my answer was no in taking my wrecked vehicle to my residence in which I live in a 5 star community!

After paying out of my pocket for the storage fees the claims adjustor called and asked if i would mind paying the towing fees as well. Upset I said, if I'm paying the towing fees and storage fees. Why am I paying for car insurance each month?!!

My car is finally deemed totaled after the inspector, after two weeks finally got out to inspect my car. He recently called me and stated that they would be making me an offer on my car which would only leave me $2000 left on my lien to pay. This may sound good to some of you but I find it completely unfair that one day I'm driving a car that I've been paying on for months and the next moment I have no car and the insurance company doesn't seem to mind that.

He also stated that he would extend my car rental for 10 days only upon which that will leave me again with no vehicle and three children to drive to school, sporting events, doctor visits, etc. I'm curious if Geico would mind picking up the tab for cab fees? I'm very unhappy with Geico and the customer service they have provided to me. I'm sure the insurance commission would love to hear about this incident as well as the others I've seen on here.

Andrea

Mays Landing, New Jersey

U.S.A.

This report was posted on Ripoff Report on 08/29/2006 01:41 PM and is a permanent record located here: https://www.ripoffreport.com/reports/geico/mays-landing-new-jersey-08330/geico-ripoff-and-terrible-customer-service-bethesda-maryland-208494. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 UPDATE Employee

Take Responsibility - Read "YOUR" Policy

AUTHOR: Brandy - (U.S.A.)

SUBMITTED: Friday, September 15, 2006

I am an insurance agent and with that said I talk to people everyday about: What their coverages are; How they are at risk if an accident where to occur! And of course we are blood sucking bottom feeders that want to make a quick buck so no-one ever listens!

So let me tell you what you were "more than likely" told when you got your policy - you were told that on RR you should carry a min of $750-900 limit (depends on the state) for an average size car; however if you want to car similar to yours (an SUV) - you will need to consider a higher coverage in the amount of $1500 limit, that is $35 a day for 30 days or max of 1500 per occurrence (again depends on state).

And like most of the Insurance Illiterate people (that is not an insult by the way) I speak to on a daily basis your bottom line was price!

What people fail to realize is that we "blood sucking bottom feeder" are very well educated in how that people get into situations like this!

I am sure you never even read thru the "Legal Contract" you entered into or you would have know what to expect in the unfortunate event of an accident! As an agent I would be curious to look at your policy liability limits as well! From your complaint you are a "wealthy person" - if your not careful you could find out just what you really don't have if you've chosen to skimp on that coverage too! You also must have opted out on the towing coverage!!!!

At some point YOU the consumer must take the responsibility to READ your paperwork - Helloooo it is sent for a reason!

Buck up and say oops I should have at least glance at it.... If you care to get SOUND insurance adv call GEICO and ask to have all of your coverages explained - and then you the consumer - ask is my coverage adequate!!!! Guarantee they will tell you!!!!

PS: Just a little information for all readers to ponder:

FOR THE LOVE OF GOD - IF YOU GET NOTHING ELSE OUT OF THIS COMMENT - PLEASE TATTOO THIS ON YOU ARM FOR FUTURE REFERENCE!!!!!!!

*****POLICE DO NOT DETERMINE FAULT IN AN ACCIDENT ***** THEY WILL HOWEVER ADVISE IF YOU BROKE A LAW ******

****** Best example in the world ---- I am drunk driver - minding my own business driving home from the bar; you swerve to miss a deer that ran out in front of you; instead of hitting the deer you hit me ---- YOU caused the ENTIRE accident ****** YES I BROKE THE LAW BUT YOU HIT ME!!!! YOU WILL BE THE ONE WHO GETS HIGHER RATES AND GUESS WHAT I CAN SUE THE PANTS OFF OF YOU*******

KNOW THE LAW OF INSURANCE BEFORE YOU MAKE SOME RETARDED COMMENTS ABOUT "POLICE; FAULT; TICKETS; ACCIDENTS; AND YOUR AUTO INSURANCE!!!"

#2 Consumer Comment

Andrea

AUTHOR: Chip - (U.S.A.)

SUBMITTED: Wednesday, August 30, 2006

I was in a similar situation. I was hit by an Allstate driver who was 100 percent at fault. I went through my own insurance company for repairs to my vehicle, medical payments and rental. I drive a new SUV, yet had to drive a compact car complete with a marijuana leaf air freshener. Did I like it? No, but it had a gas tank and 4 wheels.

After my policy limits were met on the rental and medical, I paid out of pocket for the rental and health insurance co-pays. I paid out of pocket for the police report. YOU WILL HAVE OUT OF POCKET EXPENSES. Is it fair? That's debateable.

But, according to you, you live in a '5-star community,' one so nice that a junked car in the driveway would be too embarrassing, so the out of pockets, while an inconvenience, shouldn't break your bank, and you should also be able to afford a good attorney who can help you collect damages, out of pockets, and generally try to make you whole again.

Sometimes you have to focus on the things that really matter, like the fact you were able to walk away from this accident which was apparently serious enough that your vehicle was totaled. Think about THAT when you have one of your children in your substandard rental car.

#1 Consumer Comment

Check your insurance documents.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, August 30, 2006

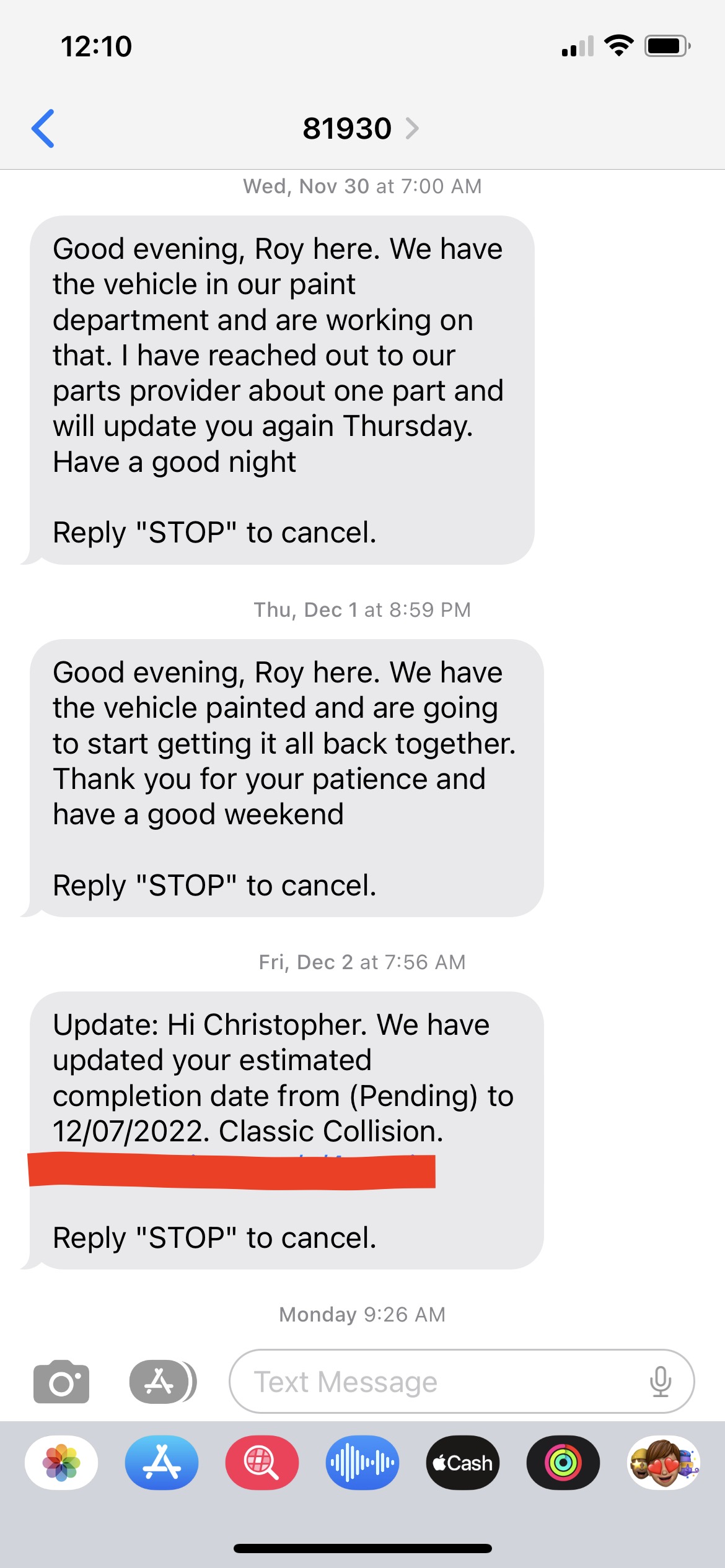

There should be a maximum coverage amount, per day and total, that you have coverage for. Anything over an above that would have to be at your expense.

I believe that auto insurance coverage is usually for property damage and medical expenses. I'm not so sure about fees. Again you'll have to check your insurance documents for any exclusions. It pretty much depends on what coverage you have on your policy.

If they are paying you less than bluebook for the car that would be unfair. If they are paying you the bluebook value of the car at the time of the loss, how is that unfair? Just because you paid too much for the car doesn't make it worth more.

The other thing you can possibly do is to sue the other drive for any expenses that are not covered by your insurance. Just be sure that they are legitamate expense.

Sure, auto accidents are a major disruption, just be thankful there were no serious injuries.

Good luck.

Advertisers above have met our

strict standards for business conduct.