Complaint Review: Hayt, Hayt & Landau - Miami Florida

- Hayt, Hayt & Landau 7765 S.w. 87 Avenue Miami, Florida U.S.A.

- Phone:

- Web:

- Category: Lawyers

Hayt, Hayt & Landau UNFAIR DEBT COLLECTION PRACTICES, NOT A LAW FIRM, DEBT COLLECTORS Miami Florida

*General Comment: Missing Factual Information

* : Update

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

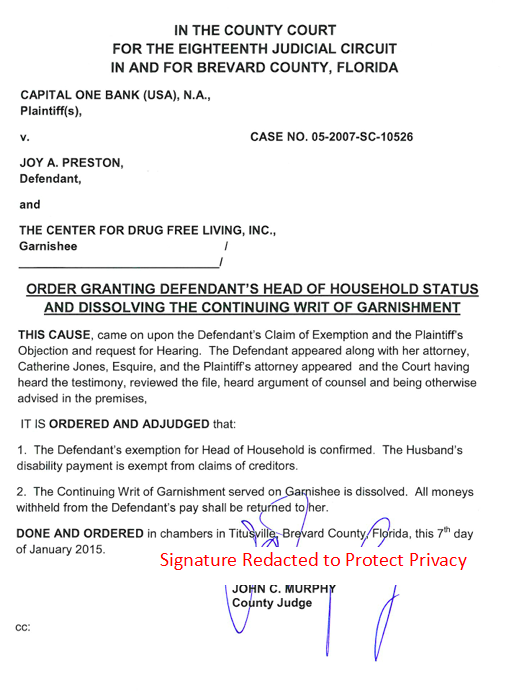

There are actually a debt collector and misrepresent themselves as lawyers. I have found 2 lawsuits now against them, one in Pennsylvania and one in New York. They scare you into agreeing and settling by representing themselves as attornies when they are actually debt collectors. If you have been sent anything by them, contact your attorney general immediately. In fact if you call them, their answering machine after hours tells you they are only a debt collector. Wish I had called them before they took me to court. I thought I was in court with an attorney. BE CAREFUL with Hayt, Hayt & Landau. I am currently contacting another attorney against hayt. On May 23, 2007, they took me to court for a Capital One credit card that has a balance of $700 when my son was hospilized and I could no longer make payments. I did everything I could to try and make arrangements, but they would do nothing. I finally went to First American Debt and they were of course useless also and only increased my debt. The account was finally turned over to Hayt. We went to mediation as I said on May 23, 2007. The lawyer representing them wanted nothing to do with listening to what I had to say, he told me after reviewing my financial information, he said there was no way I could pay this bill. He suggested to me a judgment agreeing to the amount, told me in 3 months they would contact me with a questionairre and see if my financial situation changed at all and if not, when it did, I could make arrangements even if it took a couple years. He said the judgement would sit on file for the next 20 years. I am a single Mom of a 12 year old son with severe asthma with no child support, this sounded like the perfect solution, I figured it gave me enough time to eventually come up with the money and since he didn't want to listen to anything else and the mediator explained it over to me and agreed to what he was saying, I went and signed the form. Today I got a phone call from Hayt at my office even after they were told numerous times NOT to call my office and I put it in writing and they had a copy of the letter where I wrote it, they still called. They began threatening me with wage garnishment of 25% if I didn't pay it. I explained what the attorney told me and without any argument at all I was told the attorney at the mediation no longer worked with the firm and that the woman I was speaking with didn't even recognize the attornies name even though he signed the judgement also. I don't have the money they are demanding and I feel quite strongly after researching their firm and seeing there Pennsylvania office had a lawsuit brought against them regarding their debt collection practices, that they are completely aware of what the lawyers are doing. I would be more than happy to discuss any thing with them because as I was told by Hayt today, my financial information is all public anyway and I truly have nothing to hide. I have an appointment with an attorney for a free consultation on Monday. I signed that judgement under false pretenses and I am sure they knew exactly what they were doing. My number is 321-947-6645. If anybody else can give me any help dealing with this now, it would be so greatly appreciated.

Nancy

Clermont, Florida

U.S.A.

This report was posted on Ripoff Report on 11/14/2007 03:30 PM and is a permanent record located here: https://www.ripoffreport.com/reports/hayt-hayt-landau/miami-florida/hayt-hayt-landau-unfair-debt-collection-practices-not-a-law-firm-debt-collectors-miam-284855. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 General Comment

Missing Factual Information

AUTHOR: LEC - (United States of America)

SUBMITTED: Friday, October 13, 2017

I work for a debt buyer and specialize specifically in Florida litigation. I work with this law firm on a daily basis. The consumer who posted this report does not understand debt law or how it works; most people are not familiar with it and it causes a lot of problems for that consumer once their accounts go into collections. Law firms regularly specialize in debt and debt collection. It is part of debt collection law to state clearly at every interaction with a consumer that the person calling is calling in relation to a collection of debt. Hayt represents various banks and debt buyers, and will also run collection services for them. This is common practice. It is also common practice to employee appearance attorneys to show up and litigate on behalf of a law firm. These attorneys are not part of the original law firm. They're like rent-a-lawyers who show up for hearings where the handling attorney is too far or too booked to show up. I don't think I've ever had a handling attorney from a Florida law firm show up for a mediation. All of this is 100% legal according to state and federal law. During the mediation, they should have signed a stipulated judgment that outlined the payment plan and when it was to start - in the writing. If that doesn't happen, how they decide to collect on the judgment is completely at the discretion of the law firm and the company they represent. They are 100% entitled to garnish you after you've signed an open-ended judgment. At the very least, calling whoever owns your debt after you've signed an open ended judgment is the best way to get a payment plan on the books and avoid garnishment. Mediations are the softest form of litigation and nothing said during the mediation holds any weight if this went to trial. The only thing that mattered coming out of that, was any signed document.

The consumer should have reached out for legal counseling before she ever went to that mediation. No one at the mediation had to tell her anything past explaining how a mediation works. Many times over, the advice that was given could have worked, but every lender is different. How this happened is a direct result of who owned their debt. Many financial institutions have incredibly strict guidelines for debt collection and don't waiver. The terms and conditions of any debt you sign up for is the most important document. It tells you flat out the kind of fees and charges you're likely to receive if you miss payments/stop paying. The idea that banks/lenders will work with you if something happens to where you can't pay, is almost always garbage; those in the military have the best chance of getting help. The FCLA and FDCPA are the laws that govern the debt law in this country. They're not difficult and the websites for both, break them down to where someone with no legal background would be able to understand.

There is no office for this law firm in Pennsylvania. That is a completely different law firm. This firm only has offices in Florida and Georgia.

The only violation is calling her work number after the cease and desist; even then, it depends on how the letter was written. In her letter to cease and desist, it should have included a number where should be reached, should have followed the outline given on any debt law website, and should have been sent certified mail so she could prove that the law firm and lender received it. At that point, it would be better used in court. I am not an attorney, but I've worked in the law field long enough to know that you should always send certified mail to protect yourself.

Watch out for Florida defense attorneys. Some will settle out a debt for you and move on, but most are 100% in it for the attorney fees. There could be a case you just want to go away, the other side would agree to a mutual dismissal, but your defense attorney may never tell you this or they'll try to talk you out of it - and then drag this out forever to increase their fees. Florida is one of the most profitable statements to make money off of fees. Her $700 case could have easily turned into $7,000 in fees for her attorney - none of that money would have gone to her.

#1

Update

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Thursday, September 10, 2009

The phone number is the original complaint has been disconnected.

Advertisers above have met our

strict standards for business conduct.