Complaint Review: Internal Revenue Service - Andover Massachusetts

- Internal Revenue Service PO Box1 Andover, Massachusetts U.S.A.

- Phone: 800-829-1040

- Web:

- Category: Internal Revenue Service

Internal Revenue Service did not pay health and human services Andover Massachusetts

*UPDATE EX-employee responds: How to get help from the IRS

*Consumer Comment: You Need Some Help.......

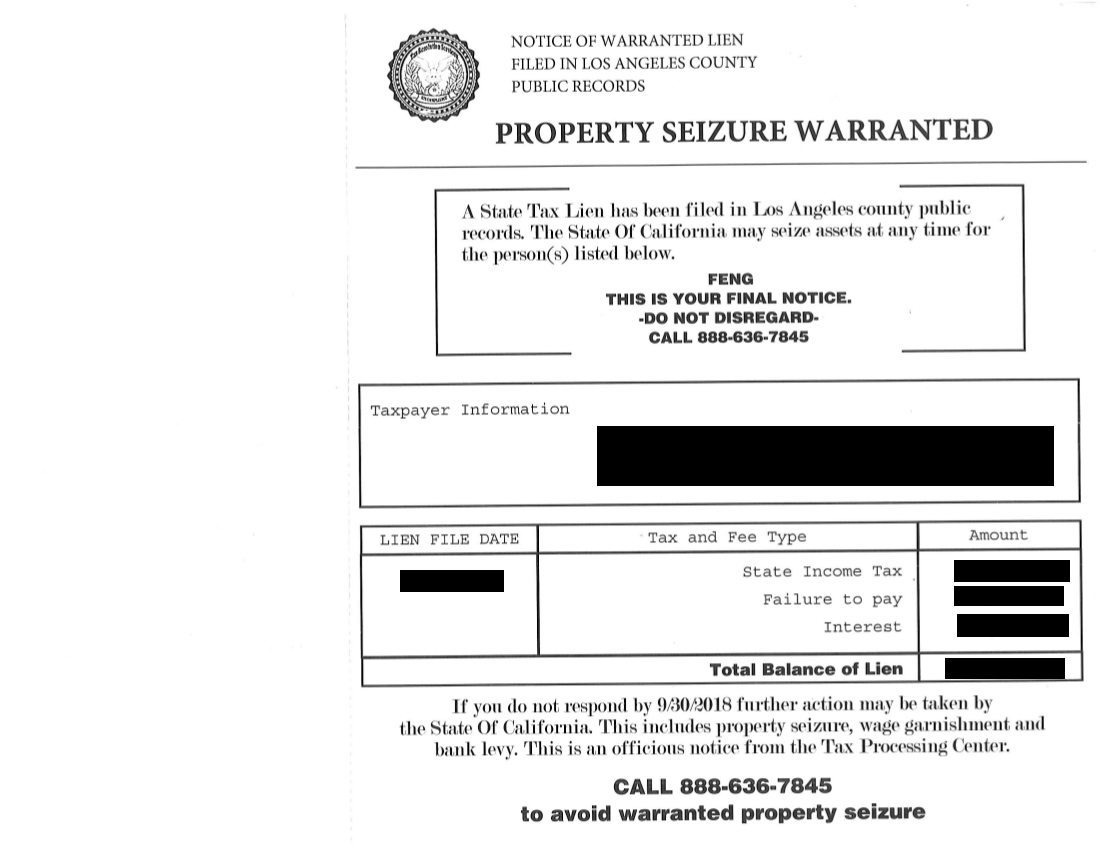

Back in 1999 I was mailed a letter from the IRS stating the fact that Health and Human Sevices was going to intercept my tax refund for the arrears child support that I owed. I get this letter ever year. This past year I stared wondering why my arrears was not caught up on because I owed 2,775.13 dollars. Come to find out Health and Human Services only recieved one of my refunds and that was back in 2002. So, where has all my refunds gone?

I have contacted the IRS on a few occassions and I can not get an answer.What can Americans do with deceptive practices of the IRS. I was so ripped off by the IRS because no one has recieved my refunds.

Matthew

Concord, New Hampshire

U.S.A.

This report was posted on Ripoff Report on 08/29/2007 11:12 AM and is a permanent record located here: https://www.ripoffreport.com/reports/internal-revenue-service/andover-massachusetts-05501/internal-revenue-service-did-not-pay-health-and-human-services-andover-massachusetts-271067. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 UPDATE EX-employee responds

How to get help from the IRS

AUTHOR: Lynn - (U.S.A.)

SUBMITTED: Friday, September 21, 2007

I am an employee of the IRS and can only apologize for your error and experience. I can tell you that the offset program is easily contacted by calling 18003043107.

You can also call the IRS customer service number and request a summary of account for all years in question to show what was paid when and where.

I would also go to child support and get a printout of your account to see what they have received exactly because they are infallible as well.

Finally if you cannot get a resolution through these avenues you can speak with the taxpayer advocate. You can contact them at 1-877-777-4778. They act on taxpayers behalves to resolve issues that taxpayers are not able to resolve on their own with the IRS. They are the watchdog group for the IRS. They get results. The taxpayer advocate was created by congress in answer to complaints in the past and were created during the restructuring of the IRS that began in 1998.

#1 Consumer Comment

You Need Some Help.......

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Wednesday, August 29, 2007

The IRS is not a bureaucracy the average citizen can go to for the purpose of resolving your tax issues. What you need is either a lawyer, a consultant who used to work for the IRS, or a taxpayer advocacy group to help you through the maze. Obviously, you get what you pay for and the last option is low cost but really slow and cannot always handle your issue. They will tell you to find a lawyer that handles tax matters, or a consultant that used to work for the IRS, which leaves you back at either option 1 or 2.

The only difference between the two that I can think of is if there is ever a court case related to this, your conversations with your lawyer are confidential, whereas the conversations with your consultant will not be. I would not waste further time on your own pursuing this because you will get nowhere - I would seek out someone who can help you.

Advertisers above have met our

strict standards for business conduct.