Complaint Review: Internal Revenue Service - Mobile Alabama

- Internal Revenue Service 1110 Montlimar Dr. Mobile, Alabama U.S.A.

- Phone: 251-340-1794

- Web:

- Category: Federal Government

Internal Revenue Service Charged me with Penalties on unpaid taxes of a former employer Mobile Alabama

*Consumer Suggestion: Questions to ask your tax attorney...

*Author of original report: It Just Keeps Getting Better

*Consumer Comment: A tax lawyer may not be the way to go.

*Consumer Comment: This sucks!

*Consumer Comment: This sucks!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I worked as an hourly employee for a restaurant company from 1997 until 2004. During the latter part of my tenure, the company was suffering financially due to the mismanagement by the owner of the corporation. Employees and vendors were not getting paid and the owner made himself very scarce during business hours so as not to deal with bill collectors and angry employees.

I left the company in 2004 and in March of 2006 I received a notice from the IRS stating they were trying to locate someone from the restaurant company for past due taxes. The notice also stated that I may be held responsible for these taxes. I immediately contacted a tax lawyer who instructed me to go through the IRS Tax Advocacy office to resolve this issue.

I spent a year dealing with the Tax Advocacy people, filling out abatement forms, sending letters stating my case, etc. Early on, I was informed by an IRS agent at the Tax Advocacy office that somehow my social security number is cross-referenced with the restaurant's Federal Employer Identification Number (FEIN). The agent expressed some confusion, as did I.

After many months and many different agents handling my case, I received a letter stating the IRS had determined I am now responsible for civil penalties on the taxes that the restaurant company did not pay. I'm baffled how they could make this determination since they spoke to no one that I previously worked with at the restaurant company. I have never received any documentation from the IRS explaining how they determined I was responsible or how my social security number came to be associated with the company's FEIN.

I have contacted the tax lawyer once again, but the tax attorney only has the capability to settle with the IRS. They currently monitor my income and expenses and report it to the IRS quarterly. But they are NOT fighting to clear my name of the debt; they are just attempting to keep the IRS from taking all of my money. I am so confused as to how I am supposed to get my name cleared? If a tax lawyer cannot fight to clear my name, who is it that I need to contact to get my life back?

All I was doing at this restaurant company was my job and for that I am now linked to a tax debt of approximately $430,000. I was not an officer of the corporation, I was not a signer of the bank account, I was not even a manager in the company, and I had neither authority nor any financial responsibility with this company. I was just an hourly employee!

Going into the third year of this nightmare I came to conclusion that my identity must have been stolen by someone associated with the restaurant company. I have filed a claim with the Federal Trade Commission and my local law enforcement office. The local police say they cannot file my claim as a crime because I have no actual proof. My identity must have been stolen.

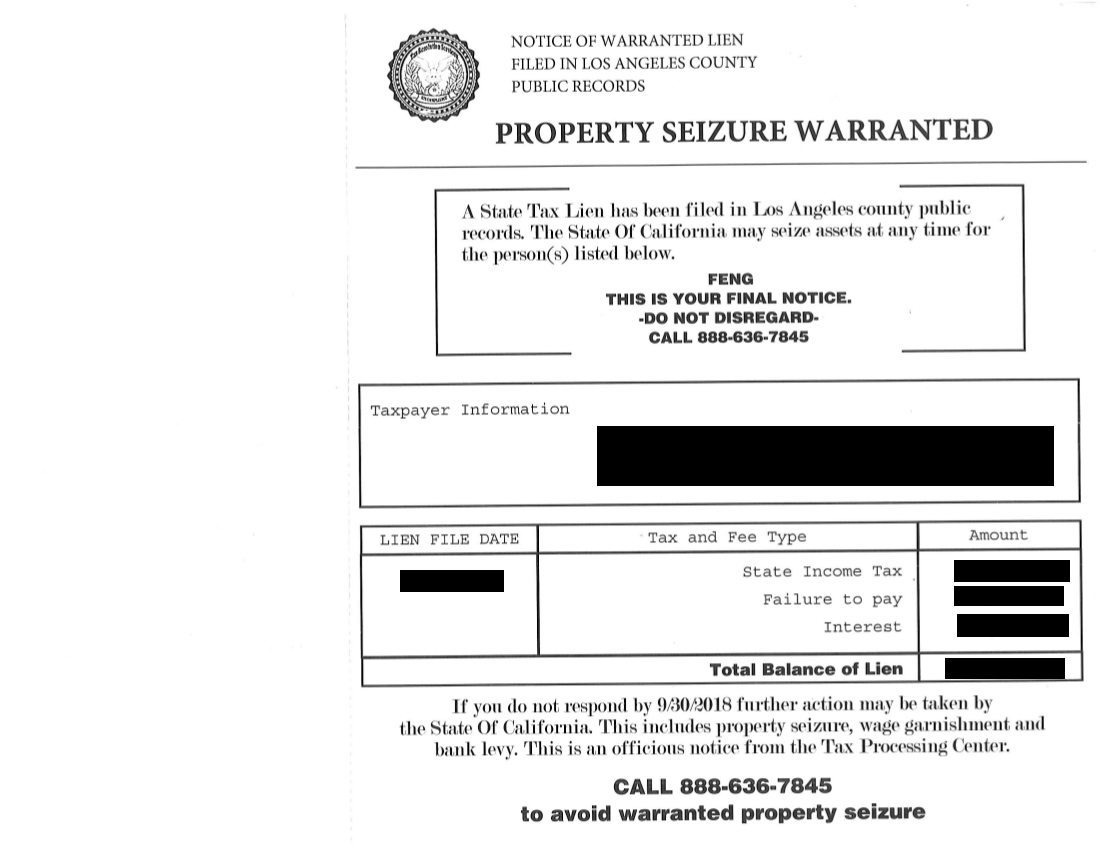

That is the only way my social security number could now be associated with the company's FEIN two years after I left the company. Because of that incorrect association, I now have a federal tax lien against me in my county for the $430,000 debt and as of today the IRS has placed a levy on my bank account and I cannot access my money to pay my bills or buy food.

I am a 52-year-old single woman. I've never been married. I've never owned a house and I live quite conservatively. I don't think it's fair that the IRS can come after me for something that is not my responsibility and turn my life into a living nightmare! My health is suffering from this. I now take medication for anxiety and depression. I cannot put money away in savings or the IRS will take it. They have taken whatever stimulus money was due to me because my social security number is cross-referenced with the restaurant company's FEIN.

I am an average US citizen. I work hard; I pay my bills and my taxes. Until this mess is cleared up I won't even be able to save for my retirement for fear the IRS will take what I save. I've been railroaded into this situation by my former employer and the IRS and I really don't know where to turn.

I was recently informed by my lawyer that I needed to sign an Installment Agreement with the IRS in order for them to release the levy on my bank account. Since this is not my tax liability I cannot bring myself to do such a thing. I have approximately $1600 to my name and it looks like the IRS is going to take it, since my bank account is still frozen and the deadline is Tuesday to have the levy released.

I've already spent about $2500 trying to fight this (not to mention the money spent on all the medication for my anxiety and depression) and now I'm desperate. My credit is ruined and I have no money. I don't deserve this!!

Miscyn57

Orange Beach, Alabama

U.S.A.

This report was posted on Ripoff Report on 03/29/2009 02:20 PM and is a permanent record located here: https://www.ripoffreport.com/reports/internal-revenue-service/mobile-alabama-36609/internal-revenue-service-charged-me-with-penalties-on-unpaid-taxes-of-a-former-employer-mo-438887. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Suggestion

Questions to ask your tax attorney...

AUTHOR: Tax Resolution Specialist - (U.S.A.)

SUBMITTED: Friday, April 10, 2009

Have they ordered the FOIA (Freedom of Information Act) file for your case?

Have you filed and paid the actual tax on one employee for one period? After doing this, you can file and claim a refund on form 843 and this will re-open the investigation in your case. At that time, you will have the FOIA records and can better assert yourself and defend yourself as "willful and responsible'. A knowledgable IRS appeals officer will investigate and listen to your side of the story and determine if proper procedure and law were followed.

Do you have the money to enter into an installment agreement with the IRS for this debt? If not, fill out the required 433 Collection Information Statement proving your income and expenses, and if you qualify, you can be placed into "currently not collectible" status, and they will not collect the debt.

There is a statute of limitations on collections... 10 years from the date assessed.

You could try to set up the minimum payment, based on your income and expense and ride out the collection statute.

If you truly feel and know you are not the responsible party, were not a check signer, were not an officer of the corporation, and should not be held responsible under 'willful & responsible" guidelines, you may want to try filing an offer in compromise under 'effective tax administration".

If you would like, I can offer other helpful advice upon request.

#4 Author of original report

It Just Keeps Getting Better

AUTHOR: Miscyn57 - (U.S.A.)

SUBMITTED: Tuesday, April 07, 2009

Well, as of April 1, 2009, the IRS has taken every last penny I had from my bank account...HA! They even left me with an NSF fee that occurred after they froze my account. The thing that pisses me off the most is that I had that bank account for 14 years and now I'll have to close it or come up with money to put into it. I now have no income (the nature of the economy nowdays) and going on unemployment gives me a whopping $200 per week. I just got off the phone with my lawyer and, once again, I have to fax over 3 months of bank statements and some type of notification that I have no income.

I have written to my senators, ABC Good Morning America, Erin Brockovich, even the President himself! The best response I've gotten so far was from a lawyer in Colorado. Even though his fees are way too high for me to hire him, he insisted that he would keep in touch with me and that I could email him anytime with questions. I'm also thankful for the user comments I've received. Thanks!!! I've run the gamut of feeling so desperate as to commit suicide to just not caring at all. I actually saw the former owner, my former boss the other day walking down the street. I was in my car...but I waited until he had completely crossed the street before I drove on. He acted like he never saw me.

I have no idea what the outcome will be...I don't have anything the IRS can get anymore. I should find out in a couple weeks from the lawyer what will happen with all this.

#3 Consumer Comment

This sucks!

AUTHOR: Jennifer - (U.S.A.)

SUBMITTED: Sunday, March 29, 2009

I cannot comprehend the stupidity of the IRS on this one! Nice going government, not! An hourly employee cannot ever be held liable for the tax debt of the place they work for. I don't know what this particular agent is smoking telling you otherwise. Your tax attorney doesn't seem to be doing much good either for you. Fire him at once and file a Bar complaint against him or her for bad representation. Hire a new attorney who knows his or her stuff. Bring copies of W2s and pay stubs to prove that you were, in fact an hourly employee. That should be the end of it right there or should have been if your attorney was worth anything other than a parasite! You have been had, big time! W2's should have proved right then and there and with especially prior year tax returns should list your occupation and I am willing to bet dollars to donuts it was not any officer of the corporation, which would in fact, negate the IRS's claims of responsibility. This is what I would have insisted upon the first meeting with the attorney and the IRS agent handling the case.

#2 Consumer Comment

This sucks!

AUTHOR: Jennifer - (U.S.A.)

SUBMITTED: Sunday, March 29, 2009

I cannot comprehend the stupidity of the IRS on this one! Nice going government, not! An hourly employee cannot ever be held liable for the tax debt of the place they work for. I don't know what this particular agent is smoking telling you otherwise. Your tax attorney doesn't seem to be doing much good either for you. Fire him at once and file a Bar complaint against him or her for bad representation. Hire a new attorney who knows his or her stuff. Bring copies of W2s and pay stubs to prove that you were, in fact an hourly employee. That should be the end of it right there or should have been if your attorney was worth anything other than a parasite! You have been had, big time! W2's should have proved right then and there and with especially prior year tax returns should list your occupation and I am willing to bet dollars to donuts it was not any officer of the corporation, which would in fact, negate the IRS's claims of responsibility. This is what I would have insisted upon the first meeting with the attorney and the IRS agent handling the case.

#1 Consumer Comment

A tax lawyer may not be the way to go.

AUTHOR: John - (U.S.A.)

SUBMITTED: Sunday, March 29, 2009

I think I would go talk to a business/corporate lawyer.

I think he would better be able to steer you to where you have to look.

It sounds like the former owner may have changed some paperwork and added your SS number.

I would have to think that the IRS should be able to produce some sort of paperwork since they claim your SS number is on it. You would be entitled to it.

In order to find that out, you would have to know where to look.

You could check the county records as I would think the business should be on file there.

Advertisers above have met our

strict standards for business conduct.