Complaint Review: Key Bank - Plymouth Indiana

- Key Bank 2701 N. Michigan St. Plymouth, Indiana United States of America

- Phone: 574-936-4023

- Web:

- Category: Banks

Key Bank NEW maintenance fee Plymouth, Indiana

*Consumer Comment: read that mail

*Consumer Comment: You hit the nail on the head.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

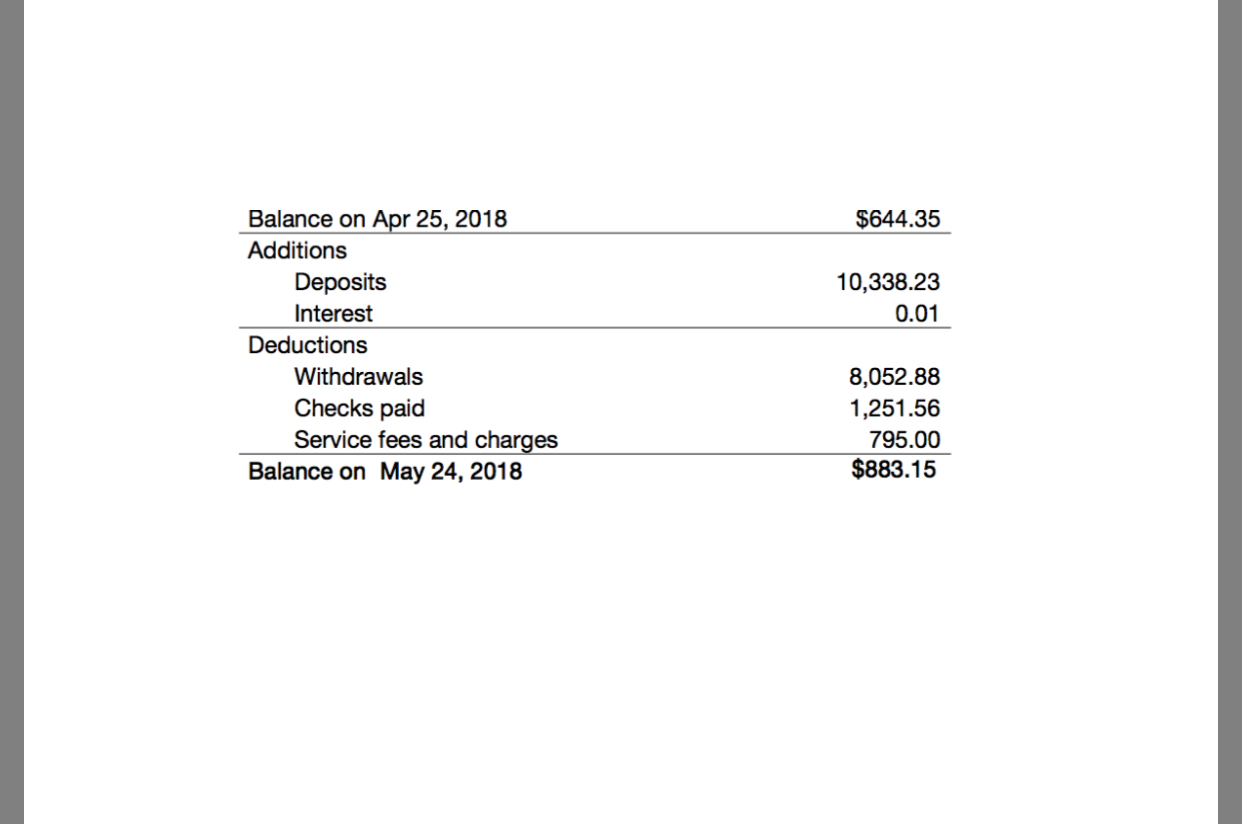

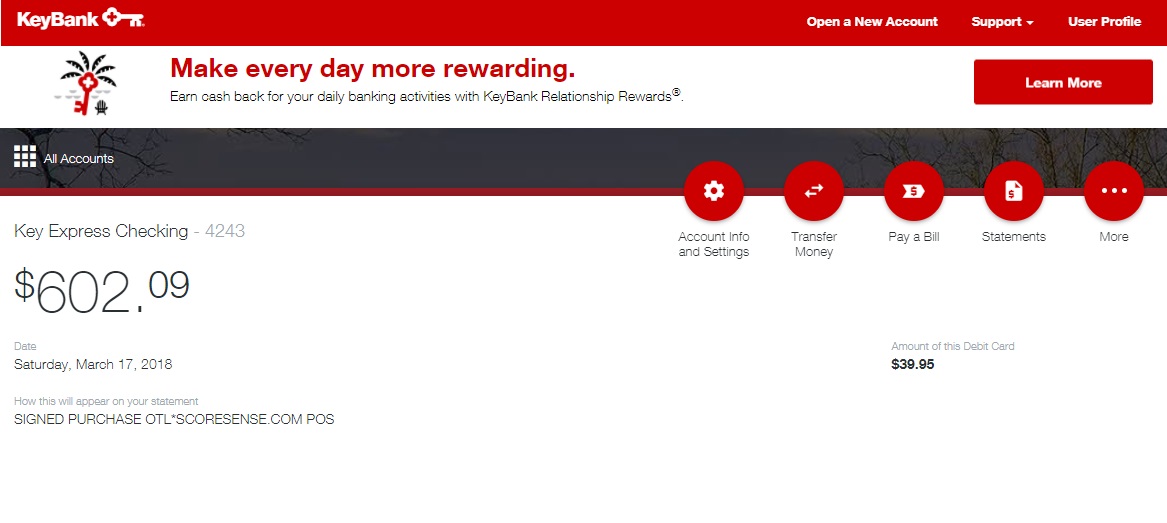

As of June, 2011 I am now being charged a $5.00 a month maintenance fee. I have had this account for 15 years but now the rules have changed. They say a letter was sent out in January which I did not receive or the fine print was buried somewhere and I didn't notice it (typical).

I have been recently just sitting on this account for personal reasons with only less than a dollar account balance. I have never had any maintenance or service fees.

NOW they say I have overdrawn the account because of this brand new monthly fee which is more than the balance I had in the account!

I called the Client Service Manager and was told ( a direct lie to my ear) this fee is to help cover the costs of mailing account statements. This is a BOLD lie....I have paperless statements! Where is the mailing cost???

This is just another scam method to collect billions in UNEARNED free money!!!!

This report was posted on Ripoff Report on 06/10/2011 12:06 PM and is a permanent record located here: https://www.ripoffreport.com/reports/key-bank/plymouth-indiana-46563/key-bank-new-maintenance-fee-plymouth-indiana-739242. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

read that mail

AUTHOR: coast - (USA)

SUBMITTED: Friday, June 10, 2011

"I have never had any maintenance or service fees."

Fifteen years of free service and now that it's no longer free you call it a scam and post a rip off report. It's not a scam and not a rip off.

You should read documentation sent to you by your bank.

#1 Consumer Comment

You hit the nail on the head.

AUTHOR: Flynrider - (USA)

SUBMITTED: Friday, June 10, 2011

" I have had this account for 15 years but now the rules have changed."

Exactly! The rules have changed. In the old days, checking accounts always had a service fee if the balance was below a certain cutoff amount. With the advent of debit cards, banks found that they could make huge profits off overdraft fees charged to their more careless customers. This allowed them to offer free checking, in hopes of drawing in even more accounts that would genereate more overdraft fees.

Last year, new federal banking regulations effectively put a stop to the debit card overdraft revenues. As such, banks have to return to their old model of charging a service fee to maintain checking accounts. The simplistic explanation given to you by the bank employee was not entirely correct. It costs money for the bank to maintain checking accounts and process the transactions. Most of the major banks have already reverted to charging service fees for checking accounts that do not maintain a minimum balance. I think by the end of the year, "free checking" will have disappeared entirely.

Advertisers above have met our

strict standards for business conduct.