Complaint Review: Key Bank - Port Clinton Ohio

Key Bank Over Draft Rip off Port Clinton, Ohio

*Consumer Comment: Let's reword that statement

*Consumer Comment: Your friend..

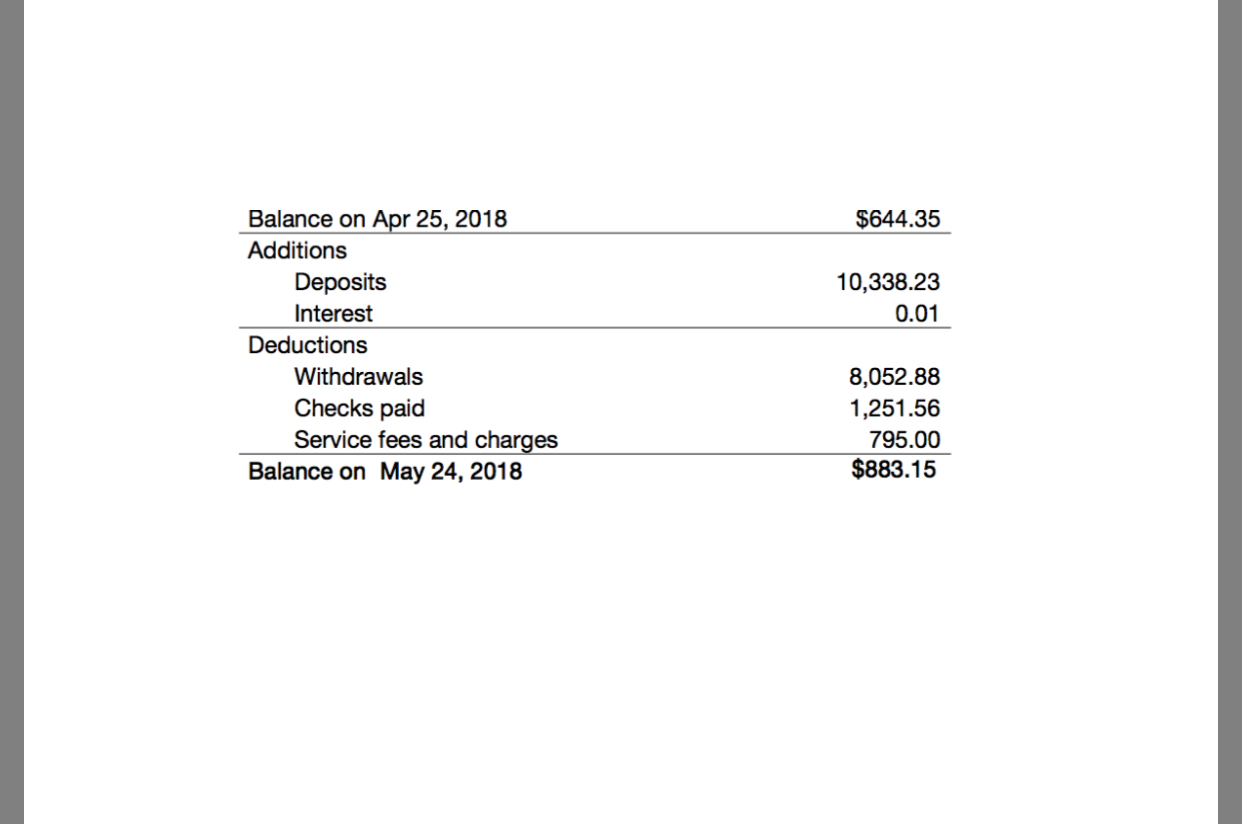

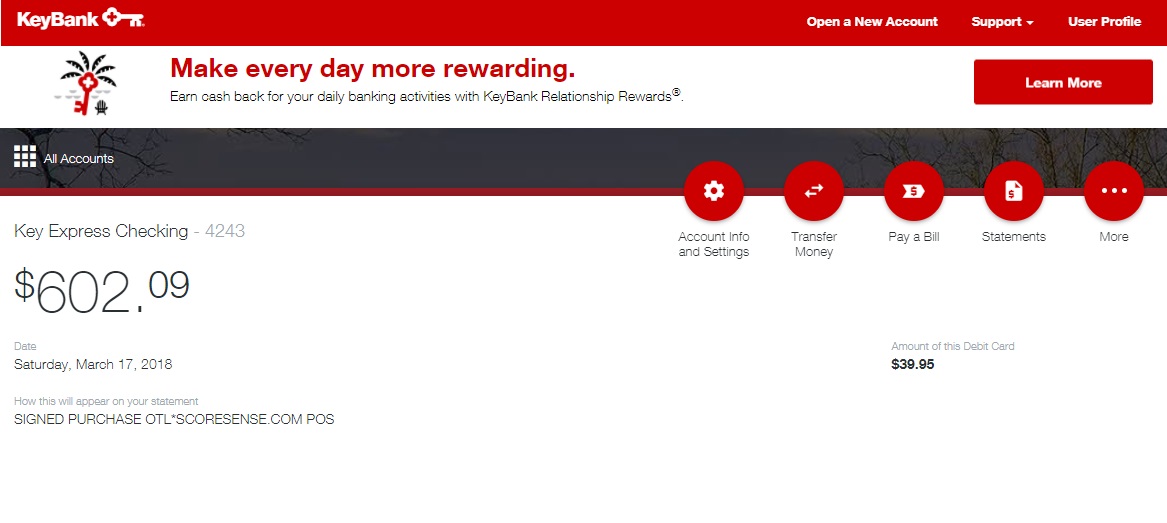

Don't make an overnight deposit if you are trying to insure that a check or debit doesn't bounce. They won't process the deposit (on purpose) until late in the day to insure they are able to charge NSF charges.

I was told by a bank employee friend that they purposely wait so that they can collect fees!

This is wrong!!

This report was posted on Ripoff Report on 03/23/2013 03:31 AM and is a permanent record located here: https://www.ripoffreport.com/reports/key-bank/port-clinton-ohio-43452/key-bank-over-draft-rip-off-port-clinton-ohio-1037279. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Let's reword that statement

AUTHOR: coast - ()

SUBMITTED: Saturday, March 23, 2013

"Don't make an overnight deposit if you are trying to insure that a check or debit doesn't bounce."

Let's reword that statement: Don't write checks or authorize debits against unavailable funds. Much better.

#1 Consumer Comment

Your friend..

AUTHOR: Robert - ()

SUBMITTED: Saturday, March 23, 2013

..is an idiot.

The only way a bank can get an overdraft fee is if you overdraft. They don't force you to write checks your account can't cover..that is 100% on you. The only reason you would be doing an "overnight" deposit to insure a check doesn't bounce is because you wrote the check when you didn't have money in your account. This is called "floating" and regardless of what bank you are with is a sure way to get overdraft fees.

EVERY bank has a deposit cut-off time, depending on the bank and method of deposit that could be anywhere from about 2PM in the afternoon to about 8PM at night. If you go in and ask a bank employee(not your friend) what that time is they will be glad to tell you. In fact it is probably posted at a few places at the bank and ATM. After that time, the deposit is treated as if it came in the next business day. Which of course means that if you did the deposit on a Friday night..it won't be counted until Monday. In addition to this the type of deposit(Cash, Check.etc) can determine how long it is before the money becomes available. So of course if you wrote a check that is going to come in on a Thursday(for example) and you made a deposit after the cut-off time on Thursday..yep it will overdraft your account..just like it would at any other bank.

If your friend was truly a friend they would be telling you the exact same thing. They should also be talking to you about how to keep a register. Oh and the very obvious item of NEVER spending money you currently don't have available in your account. If they are truly a bank employee I can just about guarantee you that they do not tell a customer who had an overdraft what they told you..because a)it is not true and b)if their manager heard them they would be fired. They most likely try to explain that the account holder needs to manage their account, and probably going after what was just mentioned.

Advertisers above have met our

strict standards for business conduct.