Complaint Review: NCO Financial Systems - Horsham, Pennsylvania

- NCO Financial Systems 507 Prudential Road Horsham,, Pennsylvania U.S.A.

- Phone: 800-851-2554

- Web:

- Category: Collection Agency's

NCO Financial Systems Filed a Break of Contract Complaint Against Me - Never Heard of Them - Never Called, Letter Advising Me of Debt Horsham, Pennsylvania

*Consumer Suggestion: Robin....Good news and Bad news regarding NCO Financial Systems..

*Consumer Comment: Kick As*!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

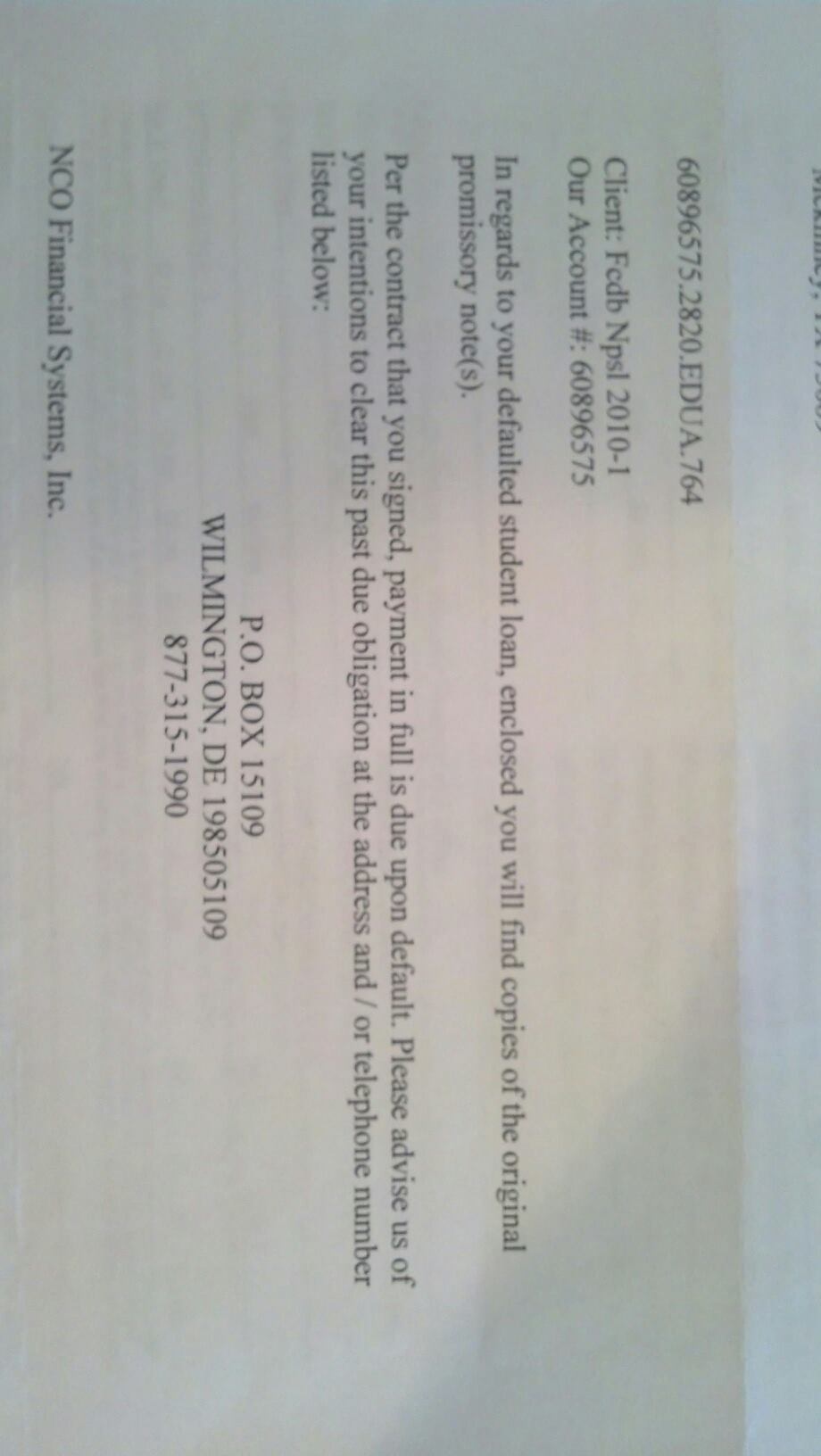

I was served with Summons and Complaint for Breach of Contract and NCO Financial Systems is the Plaintiff. This complaint is for $1700.00. My insurance company $3500 and $1700 was left owing as my share of that debt. I never received any telephone calls, never received a validated bill or statement from either the hospital or NCO. I never intended to not pay this debt. I never knew I owed anything. NCO failed to communicate any outstanding debt to me and has broken several collection codes in the State of California.

Due to the lack of any information from them, I started doing database checks in the state I live in, which is California, and the state that they that is listed in the California Secretary of State database, which is Pennsylvania, and guess what I discovered? NCO Financial Systems is not an active corporation in Pennsylvania or California, has no Fictitious Business Names filed in Pennsylvania or California, and also is not bonded or licensed in either of these two states to conduct collections.

In other words, they do not have the right to file a lawsuit for breach of contract as a collection agency or as a corporation, have violated many debt collection laws and privacy laws, reporting information to credit bureaus that is untrue, etc. etc. etc. Now who is in breach??? I plan on filing a cross_complaint and taking these issuas far as I can. If I lose in court, I will make sure that they spend at least more than $1700 with problems and complaints and investigations I plan on submitting to every agency I can think of including any private organization out there for this type of unlawful and fraudulent conduct. End.

Robin

san jose, California

U.S.A.

This report was posted on Ripoff Report on 08/10/2006 07:26 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems/horsham-pennsylvania-19044/nco-financial-systems-filed-a-break-of-contract-complaint-against-me-never-heard-of-them-205540. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

Robin....Good news and Bad news regarding NCO Financial Systems..

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, August 11, 2006

Robin,

First of all, NCO Group is the parent company and is licensed in Pa as the HQ is in Horsham Pa. NCO group is the largest collection agency/debt buyer in the world. They are also the worst and have paid the largest FTC fines in history.

However, Michael J. Barrist, President and CEO of NCO, just created a new company in an attempt to hide and start fresh. This was treated as a sale to throw everyone off.

Search other posts here on Rip Off Report for all details on them. I have posted the info here dozens of times.

Therefore, you should take the "lawsuit" seriously as they will follow through. You do not want to give them a default judgement which is what will happen if you fail to respond. Make them work for it.

Respond to the summons right away and also to NCO. Just stipulate that you never did business with NCO and do not even know who they are, and that you owe them nothing.

Also, the statute of limitations in CA is 4 years on any type of debt other than an oral contract. This date is calculated from the date the original "creditor" charged off the debt. Hospitals do not engage in collections as long as regulare creditors like credit cards, etc. They usually attempt collections for like 2 months then either assign it or sell it to a collection agency.

Understand that the original creditor is most likely no longer in the picture here at all. NCO most likely purchased that "debt" for far less than a penny on the dollar.

NCO must prove that you owe THEM the money. Therefore, they must prove that they own the debt or have a legal right to collect it.

Be sure all communications are in writing, and send only by certified mail, return reciept requested. Be sure to put the certified# on the letter itself and keep a copy for your records.

#1 Consumer Comment

Kick As*!

AUTHOR: D - (U.S.A.)

SUBMITTED: Friday, August 11, 2006

I hope you kick their sorry bottom feeding a**es and collect mass quantities of cash in FDCPA violations! I hate these low life grease trap sucking bottom feeder collection agencies.

Advertisers above have met our

strict standards for business conduct.