Complaint Review: Santander Consumer USA - Internet

- Santander Consumer USA Internet USA

- Phone:

- Web: https://www.santanderconsumerusa.co...

- Category: Car Financing

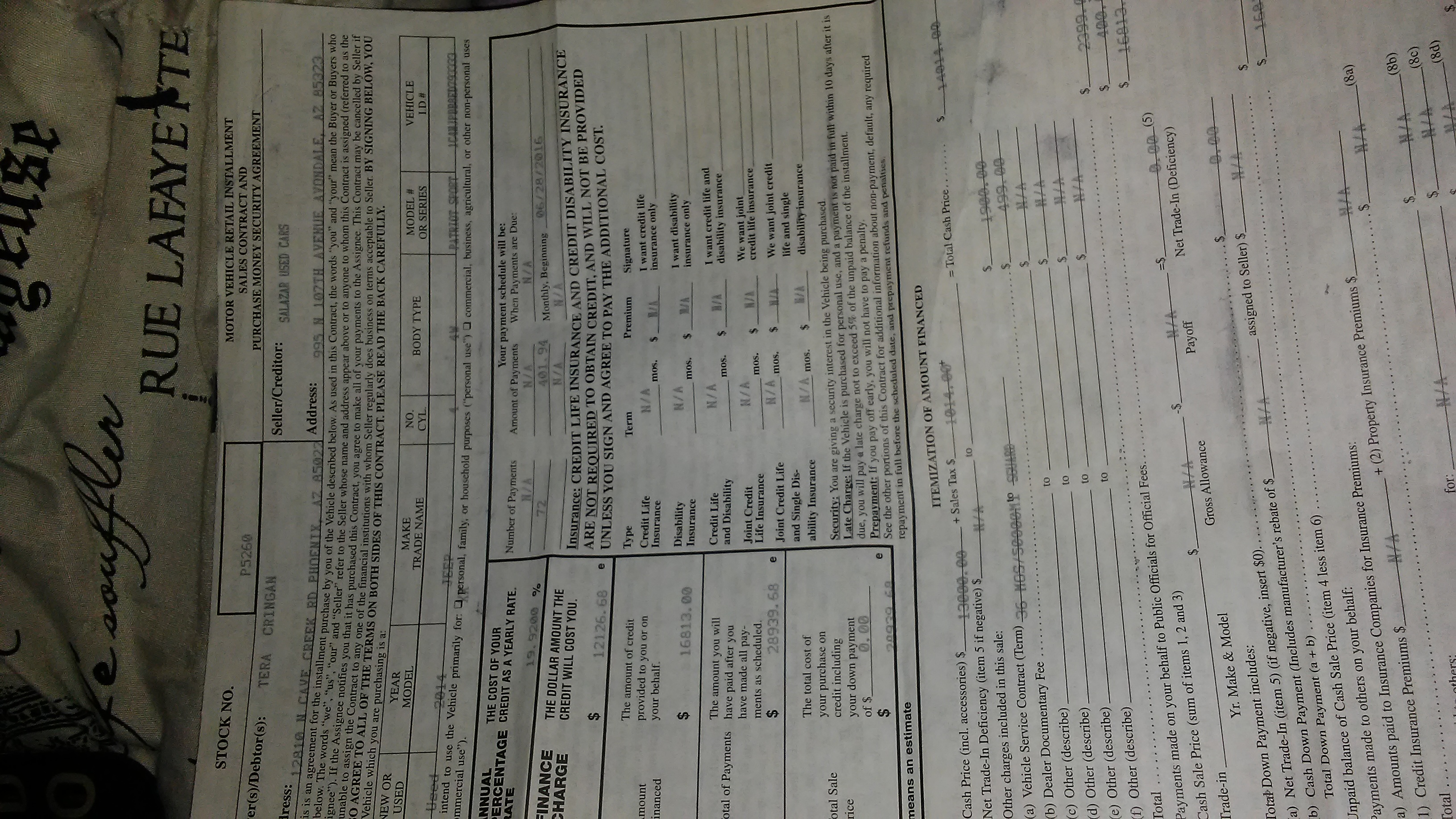

Santander Consumer USA I filed bankruptcy recently, which I did not include my car loan. Ive had a loan with Santander for 3 years now. I don't know how much I owe, they do not send bills, they do not allow me access to my account. The reason they keep giving me is because I filed bankruptcy they said I had all the help I needed which is confusing. Because of this I have fallen behind on my bill which is creating great problems for me and a whole lot of stress. Texas Internet

*Consumer Comment: Some information...

In October of 2013, I purchased a mid size SUV from Carmax, with Santander providing the loan. A year after that I filed bankruptcy. When I filed bankruptcy, the lian was not apart of the bankruptcy. Santander cut off access to my online account and they stopped sending bills to show payments and my balance. They have made it very difficult to work with them on the loan. Every time I ask for these things they tell me that I had enough help when I filed bankruptcy. I do not know how much I have left on the loan and there is no summary of paymentsunami. This issues have been causing stress because the car gets repossessed.

This report was posted on Ripoff Report on 06/26/2016 01:04 AM and is a permanent record located here: https://www.ripoffreport.com/reports/santander-consumer-usa/internet/santander-consumer-usa-i-filed-bankruptcy-recently-which-i-did-not-include-my-car-loan-1313576. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Some information...

AUTHOR: Robert - (USA)

SUBMITTED: Monday, June 27, 2016

You can not just arbitrarily not include a debt in your Bankruptcy. You must include ALL of your known debts. Failure to disclose a debt, while not as bad as not disclosing income could still have consequences. Such as that debt being disallowed, to your entire bankruptcy being dismissed without discharge. If you decide to keep the car you have two choices. To continue to pay on the loan with or without "Reaffirming" the debt.

If you reaffirm the debt, nothing really changes. You are still responsible for the loan in such that the payments you make get reported to the credit reporting agencies. The downside is that if at any time you then again can't make your payments if it gets repossessed you are responsible for any deficiency balance and have a repossession on your credit.

Now, if you don't reaffirm the debt. You make your payments to them under the "bankruptcy". It is not your regular account and handled by a different department. With this it won't show up on your credit, you won't have any "regular" account access, including things such as the Online payments and receiving statements. So in this part they would be right, itt is because of your Bankruptcy. At the end of your payments you get your title. Now, in this case if you fail to make your payments and it gets reposesed. It is still considred under your bankrutpcy and it won't show up on your credit and you won't be responsible for any deficency balance.

Based on your description it sounds like you have the later. In this case all terms remained the same. So you should have continued to pay the regular payment in your agreement. They may or may not have given you a separate address to make them to. Had you done this at the end of the regular term your loan would be paid and you would get your title.

These are all things your attorney should have explained to you during the Bankruptcy. If you for some reason were dumb enough to try and do this on your own, you are now suffering the consequences. Either way I am not an attorney, this is just some comments and not any sort of legal advice. So you need to consult an attorney now to verify your options.

Advertisers above have met our

strict standards for business conduct.