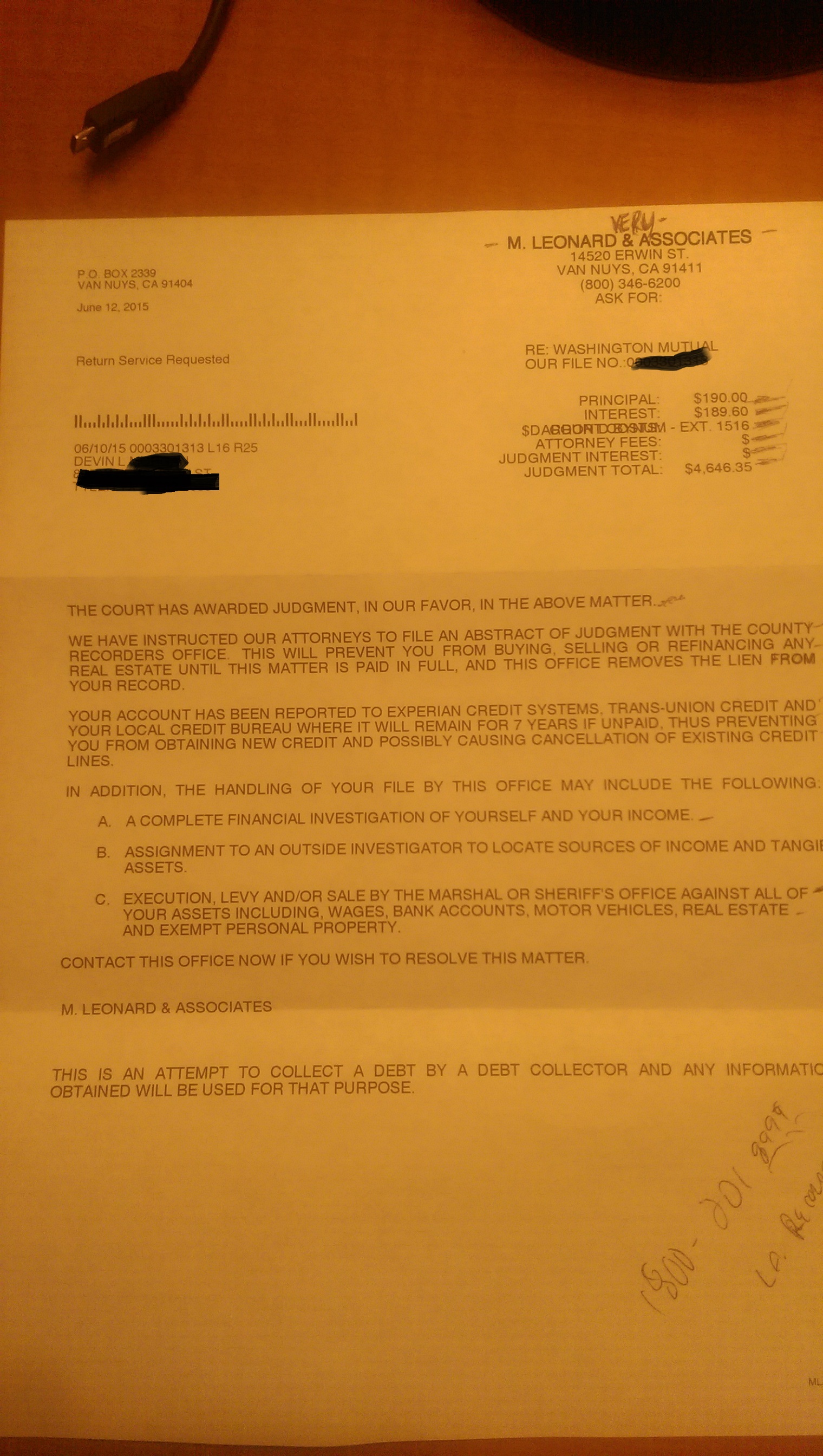

Complaint Review: Washington Mutual - San Bruno California

- Washington Mutual 1200 El Camino Real San Bruno, California U.S.A.

- Phone: 650-737-6100

- Web:

- Category: Banks

Washington Mutual false charges. broke federal banking laws, overcharging San Bruno California

*Consumer Comment: Washington Mutual is not a "Bank" and is not regulated as a "Bank"

*Author of original report: Wamu to Chase fraud now begins

*Author of original report: Study Law before replying

*Consumer Suggestion: Scott, you should explain what the violation of federal law was here.

*Consumer Suggestion: Scott, you should explain what the violation of federal law was here.

*Consumer Suggestion: Scott, you should explain what the violation of federal law was here.

*Consumer Suggestion: Scott, you should explain what the violation of federal law was here.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

This report is tied in with 1800flowers.com which I posted about a while ago. Normally I never had problems with the bank until this problem cropt up. When I informed wamu about the overcharge and showed proof of it, plus not much lator the dead and damaged product I figured it was going to be a cut and closed case. Turns out, even with the evidence wamu sates its a merchant dispute and their not responsible wether the charge was correct or incorrect. Federal banking law, and CA banking law states otherwise.

What is actually happening, Wamu owns part of the huge flower company, so what gets sold they get comission on. The deal they have is they wont do chargebacks even if the law states they have to.

After talking with Wamu's credit card devision, and having the head superviser telling me I have to deal with merchant who made the illigal charge in the first place who said they would fix it in email but refused on phone, I file in small claims court. Send a copy of the subpoena which despite the fact where they are informed they cant touch or charge my account till a decision is made in court do it anyway and Wamu stated "As long as we didnt sign the subpoena, we dont have to follow it" Which several Certified attempts were made and the manager involved in evading a court order is about to find out what happens when a court order is purposely evaded which Ill post about shortly, as I hate to spoil suprises.

When I saw the few hundred complaints about Wamu, decided to post my 2 cents as well. The bank breaks as many laws as they can get away with and they do it becasue the few who try taking them to court they try getting out of it by evading court orders.

Scott

Sanbruno, California

U.S.A.

This report was posted on Ripoff Report on 06/08/2007 01:44 AM and is a permanent record located here: https://www.ripoffreport.com/reports/washington-mutual/san-bruno-california-94066/washington-mutual-false-charges-broke-federal-banking-laws-overcharging-san-bruno-califo-253127. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Author of original report

Wamu to Chase fraud now begins

AUTHOR: Scott - (U.S.A.)

SUBMITTED: Thursday, October 29, 2009

Last year Chase aquired Washington Mutual bank to my horror. Reason being, once living in NY II dealt with Chase and as big a bank as they are, they got that way from scamming the customers. One of the types of scams they would do, if you deposited $500 cash, then in the same day used your debit card for lets say $200 but the account only had $40 before your deposit, they would pay the debit but in a few days send you a notice of overdraft for back then was $15 telling the customer that they were aware there was a deposit, but it was on hold to the next business day despite it being cash, but they had no problem doing the charge the moment you used the card.

Now, in California, a few days ago their website went from wamu.com to chase.com and their old pending cash deposit system has now kicked in. In case many of you who are reading this arent aware, in California all banks are required by law that if they take a cash deposit, no matter what day it is, it MUST be available. Also, if you make a transfer from one account to another, it must also be imidiately available. The only exception is a personal check, and high amount checks they can have pending holds on. I discovered their old trick just a few moments ago when paying my phone bill. I have multiple accounts set up with no overdrafts on them, so when I origionally planned on paying a bill or making a purchase, soon as I saw the amount, I transfered that ammount to the account of the card I used. Now, many company's try scamming you, and will secretely as Im sure many are aware try adding hidden fees and taking more then what the sale was suppose to be for. With no overdraft, the sale would get declined unless they charged exactly what I transfered into the account. As of a few days ago, I cant do that. They have made it so if you transfer cash from one account to another, instead of it being instant as CA law requires it to be, they are making it last a few days. Moment I see one fee, I will clear out my other accounts and find a new bank. I actually am looking for one as I write this. Anyway, good luck for all of you who got pulled into CHASE's bank of horrors.

#6 Consumer Comment

Washington Mutual is not a "Bank" and is not regulated as a "Bank"

AUTHOR: Roy - (U.S.A.)

SUBMITTED: Friday, July 06, 2007

In researching an issue that I had with Washington Mutual NA, I found that it is what is classed as a "Savings Bank". As a savings bank, Washington Mutual falls under the oversight of the Office of Thrift Supervision (OTS) only. In a conversation with an OTS lawyer, I found out that much if not all of the state and federal laws regulating banks and other lending organizations do not apply to a savings bank. I also found out that because of the nature of the OTS, a savings bank under the OTS does not have any regulations controlling their "consumer" products, such as checking accounts, credit or debit cards, or any other "banking" activity not directly related to savings accounts and certain types of loans. I was told that in most cases the only way to deal with a savings bank like Washington Mutual is to sue them. I was told that even though OTS will accept complaints, most are dismissed because they deal with areas that are not under OTS supervision. This type of information may be good for all consumers to be aware of.

#5 Author of original report

Study Law before replying

AUTHOR: Scott - (U.S.A.)

SUBMITTED: Saturday, June 09, 2007

Since you seem to be fairly knowlegable of CA state and federal laws, heres a copy of federal banking law in which the bank ignored. All banks must follow federal law, and WAMU must follow state as well.

16.06 Paragraph 7 16-85 states (only pasting paragraph pertaining to responce) If the instution determines on that no error has occured, it must explain its findings to the consumer within three business days after completing the investigation.

If the institution determines that no error has been made, the burden is on the consumer to make the next move. But if the consumer alleges that the transfer was unauthorized, the burden is transfered back to the instution.

There is also right of chargeback 5.08 4-212.

That being said, the merchant charged more then was agreed to, and even admitted so yet management stated no refund would be given which since the bank was notified before the charge was put in, and ignored the facts the bank is responable for the error. Also, being notified that what was sent was damaged, and that merchant was only willing to give discount and not replace, the bank was also responsable by law to chare back merchant.

Because WAMU owns and collects part of the profits from 1800flowers, they feel they do not have to follow state and federal laws which this matter is both highly conflict of interest, and can also be considered net/mail/banking fraud.

Ill post the final court decision here after the case is done and then well see the final responce to what you said is correct?

#4 Consumer Suggestion

Scott, you should explain what the violation of federal law was here.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, June 08, 2007

Scott,

First of all, banks are tightly regulated. They spend big bucks on teams of compliance people. I doubt very seriously they violated any laws, and you did not specify which law they broke.

Just because something doesn't go your way, does not mean the law was broken.

The bank is correct. Your dispute is with the merchant, like it or not.

FYI.. An "illegal" charge would be if someone charged your account without your knowledge or consent. You obviously gave them your banking information for them to charge your card. Nothing illegal here.

If you ordered flowers that were defective, your dispute is with the merchant. How can WAMU be responsible for the actions of the merchant? That is absolutely ridiculous.

The ONLY obligation your bank has under state and federal laws is to process your dispute of the charge with the merchant. That's it.

Furthermore, there is no requirement for someone to sign for a subpoena. It is considered served whether or not the recipient signs for it.

I think you should actually read and understand some of the laws you are referring to before saying someone is in violation of the law. Please quote the law[s] that they broke, and why.

#3 Consumer Suggestion

Scott, you should explain what the violation of federal law was here.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, June 08, 2007

Scott,

First of all, banks are tightly regulated. They spend big bucks on teams of compliance people. I doubt very seriously they violated any laws, and you did not specify which law they broke.

Just because something doesn't go your way, does not mean the law was broken.

The bank is correct. Your dispute is with the merchant, like it or not.

FYI.. An "illegal" charge would be if someone charged your account without your knowledge or consent. You obviously gave them your banking information for them to charge your card. Nothing illegal here.

If you ordered flowers that were defective, your dispute is with the merchant. How can WAMU be responsible for the actions of the merchant? That is absolutely ridiculous.

The ONLY obligation your bank has under state and federal laws is to process your dispute of the charge with the merchant. That's it.

Furthermore, there is no requirement for someone to sign for a subpoena. It is considered served whether or not the recipient signs for it.

I think you should actually read and understand some of the laws you are referring to before saying someone is in violation of the law. Please quote the law[s] that they broke, and why.

#2 Consumer Suggestion

Scott, you should explain what the violation of federal law was here.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, June 08, 2007

Scott,

First of all, banks are tightly regulated. They spend big bucks on teams of compliance people. I doubt very seriously they violated any laws, and you did not specify which law they broke.

Just because something doesn't go your way, does not mean the law was broken.

The bank is correct. Your dispute is with the merchant, like it or not.

FYI.. An "illegal" charge would be if someone charged your account without your knowledge or consent. You obviously gave them your banking information for them to charge your card. Nothing illegal here.

If you ordered flowers that were defective, your dispute is with the merchant. How can WAMU be responsible for the actions of the merchant? That is absolutely ridiculous.

The ONLY obligation your bank has under state and federal laws is to process your dispute of the charge with the merchant. That's it.

Furthermore, there is no requirement for someone to sign for a subpoena. It is considered served whether or not the recipient signs for it.

I think you should actually read and understand some of the laws you are referring to before saying someone is in violation of the law. Please quote the law[s] that they broke, and why.

#1 Consumer Suggestion

Scott, you should explain what the violation of federal law was here.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, June 08, 2007

Scott,

First of all, banks are tightly regulated. They spend big bucks on teams of compliance people. I doubt very seriously they violated any laws, and you did not specify which law they broke.

Just because something doesn't go your way, does not mean the law was broken.

The bank is correct. Your dispute is with the merchant, like it or not.

FYI.. An "illegal" charge would be if someone charged your account without your knowledge or consent. You obviously gave them your banking information for them to charge your card. Nothing illegal here.

If you ordered flowers that were defective, your dispute is with the merchant. How can WAMU be responsible for the actions of the merchant? That is absolutely ridiculous.

The ONLY obligation your bank has under state and federal laws is to process your dispute of the charge with the merchant. That's it.

Furthermore, there is no requirement for someone to sign for a subpoena. It is considered served whether or not the recipient signs for it.

I think you should actually read and understand some of the laws you are referring to before saying someone is in violation of the law. Please quote the law[s] that they broke, and why.

Advertisers above have met our

strict standards for business conduct.