Complaint Review: Westlake Financial - Los Angeles California

- Westlake Financial PO Box 54807 Los Angeles , California USA

- Phone: 8887399192

- Web:

- Category: Car Financing

Westlake Financial Rip Off Artists Los Angeles California

*Author of original report: Bottom Line

*Consumer Comment: Your arguing with an employee, this company is crap

*Author of original report: Really?

*Consumer Comment: Comment

*Author of original report: Actually

*Consumer Comment: Actually its not their word against your word

*Author of original report: Replacement Chek

*Consumer Comment: Okay...

*Consumer Comment: Get ready for a repo.

*Author of original report: New Loan

*Author of original report: Check Confirmation

*Consumer Comment: You didn't mention...

*Consumer Comment: Did the check clear your bank account?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Never been late with payments. Paid in advance and online at maximum interest for 26 months. I mailed the payoff to the PO Box which they claim not to have received. (against my better judgement, they claim never to have a problem receiving payments at this PO Box). However, the check has not come back to me and now they are claiming that I am behind on the payments. The intent was a new loan at a lower rate of interest with someone else. Now I've witnessed a stalker at my residence and fear retaliation ie repo of an automobile that is paid for. This is clearly a case of theft by check from this company and am seeking help from legal aid and law enforcement. Consumer BEWARE, this company is fraudulent and conducting illegal business practice at the expense of the consumer!

This report was posted on Ripoff Report on 12/05/2013 10:36 AM and is a permanent record located here: https://www.ripoffreport.com/reports/westlake-financial/los-angeles-california-90054/westlake-financial-rip-off-artists-los-angeles-california-1104572. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#13 Author of original report

Bottom Line

AUTHOR: Anonymous - ()

SUBMITTED: Tuesday, April 01, 2014

If you are considering doing ANY business with Westlake Financial out of Los Angeles, Ca just be ready for the ride! The company will play you for all that they can get away with! The option? Do yourself a favor and get a rental, use public transportation, bus, cab, friend, relative, walk, whatever you do, do Not subject yourself to dealing with them!

#12 Consumer Comment

Your arguing with an employee, this company is crap

AUTHOR: Rkirk - ()

SUBMITTED: Wednesday, January 08, 2014

First off, pay no Mind to this other person, he is obviously an employee, who else would waste their time on a rip off report site DEFENDING another company. They are on here responding to ALL reports about this company as well as Wilshire. It's a scare tactic and they are trying to discourage you from taking any further action. It's their job to make you feel stupid, dishonest, that to make it seem like you don't have any recourse. YOU DO HAVE RECOURSE! Along with my personal experience with this company I have done my own research on them as well, and you are in the right my friend. Please dont let anyone discourage you from taking legal action against them, that's what they are hoping will happen when they come on here and tell you things like this. This isnt some Q&A site or advice blog. Trust me, people on here are dealing with their own rip offs and don't have time to pick apart other people's stories. They should identify themselves when responding as an employee or ex employee, but if they did that would mean they can't treat you the way they can when they say they are a consumer as well. Second you are totally right about this company:

I have a $3,000 loan from them, always made on time payments and one morning I woke up and my car was gone. After contacting the police department I found out it was repo'd. After talking to Angel who I guess is my account manager, he said that I hadn't made a payment this month! Knowing this wasn't true cause I'm the one who wrote the checks myself AFTER trying to pay online, which is how i was told i could pay and actually prefer to pay. I checked the last three months of payment stubs where I had the check number and date mailed written on it. Angel insisted I never paid anything, so I checked my bank account and saw that the check was never deposited. I insisted that I had mailed it but at this point I knew I was screwed. I paid the payment right then, which had to be in cash through western union only. I also had to pay a $400 repo fee and some other minor fees that totaled like $120 or so. It then took them 5 days to send the release to the tow yard. Well, about a week or so later guess what I get in my mailbox? Three envelopes that have "return to sender not at this address" written on them, and whats inside? MY PAYMENTS! I checked the address on their payment coupon with the address I had written on the envelope and they matched, so I hadn't sent it to the wrong place. I figured they either knew I sent the payment and just wanted the extra repo fees or they lost it and instead of owning up to it when it was found, just sent it back to me. I called them to let them know that they had returned the payment back to me and that I had paid it, and that I expected to be reimbursed for the fees. They basically laughed at me and called me a liar. The next day I received another bill from them stating that I owe $680 in "other unpaid fees". When I called and asked about it they said it was their fee because I got my car repo'd. I told them that I already paid over $500 just in repossesion fees and they told me that that was the fee JUST TO GET MY CAR OUT, and that this fee was for the inconvenience of them having to repo the car from me. I tried explaining what had happened, but it was useless. Since then I have kept up with my payments, but I refuse to pay the extra $680 fees they added, and are trying to repo my car AGAIN for that. With all of that, I have already paid over $4000 to them and they say my payoff amount is just over $5000!

I am in California and I URGE anyone else in California to file a small claims suit against them, report them to your local DA, and the attorney general. I haven't had my court date yet, but after much research I have found A LOT of their business practices are illegal! Not to mention their collection practices being that they have contacted almost all of my family members several times after each one has asked them not to, and have come to my house ringing the doorbell and kicking the door several times late at night, once they came at 4:30am.

They lie about being able to pay online, they lie about fees, they lie about not receiving payments, their collection practices are illegal, and their interest rates are usury. I would like to suggest that everyone, and their are plenty of us, who have been ripped off by this company colaborate together. They can only get away with this as long as we let them.

feel free to contact me vis email at: rochellekirk@ymail.com

#11 Author of original report

Really?

AUTHOR: Anonymous - ()

SUBMITTED: Monday, December 09, 2013

So you think I inadvertently am shelling additional moneys just because I feel like it? Think again! Why would anyone do that this time of year (even if they did have it.) Cmon now. They continue to change the payoff amount and I need to get the title. Sorry to say, but I thought you might actually have something. But you are creating fictitious holes that do not exist. There are no holes in this story, only the truth.! I don't have time for drama and false reports in my life! You take care and good luck with your fictitious assumptions!

#10 Consumer Comment

Comment

AUTHOR: Robert - ()

SUBMITTED: Sunday, December 08, 2013

In the beginning it sounded like you had a legitimate issue and even though there were some holes it seemed like there may have been a problem. But your last update put this into the WTH category and makes one wonder what else is really going on here.

The payoff amount should have been to the penny. If you are given a specific Payoff Amount why..why..why would you send them $30-$50 over? Also, why is it $30-$50 and not a specific amount over? You did actually talk to them and get a specific amount..didn't you? I mean you didn't just take a guess and figure that is what you should owe?

The only reason I can see this is that there was a significant delay between the time they gave you the payoff amount and you actually sending the check(regardless of if they got it or not), and you somehow sent a random amount "hoping" it would cover the new balance. If this is the case or a similar case then the extra $57 may also be very legitimate and has nothing with them trying to collect this balance because they "lost" the check.

But in the end, good luck and hope it all works out for you.

#9 Author of original report

Actually

AUTHOR: Anonymous - ()

SUBMITTED: Saturday, December 07, 2013

I made some contacts, visits and online complaints and guess what? They found the check! Big coinkidink right? Wrong! Those lil vatos were holding out to collect more interest, when the check I sent was already over the payoff amount by $30-$50. They still asked for an additional $57. They are some money hungry fools! And so it is a lesson learned for me. Stay away from those lil vatos!

#8 Consumer Comment

Actually its not their word against your word

AUTHOR: FloridaNative - ()

SUBMITTED: Saturday, December 07, 2013

You have the burden of proof to show you made the payment per the financing agreement you signed with them when you purchased the vehicle. That would involve the check actually clearing your account to show that the payment was made on time. If you sue, all they have to do is show you didn't meet the terms of the contract you signed.

Unfortunately if each and every payment is made on time throughout the course of the contract but the very last payment, the company can repo the vehicle. There is no exception for paying ontime for all the payments but one. Is it frustrating that the last payment didn't arrive or that they didn't cash it? Yes. Best to put a stop payment on the check right away now and send the funds another way. I would wire the funds if I were in your situation in order to not lose the vehicle.

Law enforcement is powerless in this situation as it is a civil matter. Maybe legal aid can help, but you are best off protecting yourself and your collateral by making the payment before they pick up the car.

#7 Author of original report

Replacement Chek

AUTHOR: Anonymous - ()

SUBMITTED: Friday, December 06, 2013

Oh for sure, I do plan to replace this check, however it will take some time. No the new loan is not from a bank. It is a personal loan which i still must repay. You know I don't have any proof that they received the check however at the same time they don't have any proof that they didn't either. At the end of the day it is one word against the other. This consumer is not the villan here. The company has a bad reputation for shady business and that says a lot for who is at the disadvantage here.

#6 Consumer Comment

Okay...

AUTHOR: Robert - ()

SUBMITTED: Thursday, December 05, 2013

If they have not cashed the check then the answer is simple. Stop payment on the check, write them another check. But this time when you send it be sure to send it with some form of tracking such as UPS or FedEx and get the address to send this from them. Then if you have any debate over additional fees pay it to get the title. THEN go back and if you have proof of the first check and what you are saying sue them for the difference.

Oh and as for getting a 0% loan..I have yet to see any bank give a loan with no interest. There is ZERO(pun intended) incentive for a company to do that, Yes car dealers do this but that is because you are buying a car. This is just a straight loan.

This becomes even less likely when you include the fact that you are coming off of a loan at a SUBPRIME Lender at 24%. So I guess we can figure that this 0% is a loan from mommy or daddy? If not then I hope you come back and tell us the name of this very generous bank that is just giving away the use of their money for nothing.

#5 Consumer Comment

Get ready for a repo.

AUTHOR: Crucible - ()

SUBMITTED: Thursday, December 05, 2013

"As of a few days ago the check had not been cashed or returned to me. It's had plenty of time to come back. "

This idea that you have about their sinister plot is all speculation on your part. It is more plausable that your check never made it to their P.O. box (unless you have some tracking information that you didn't mention). The U.S. Postal service is far from perfect.

If you are correct that there is a sinister plot, you are playing right into their hands.

"This is clearly a case of theft by check from this company and am seeking help from legal aid and law enforcement."

No, it is far from clear. You have no proof that they even received your check.

Here are the simple facts. They have not either received or processed your check (doesn't matter why). Until that happens, you are responsible for keeping the loan current. If you fail to do that, they have every right to repo your vehicle.

If your intent is to have your vehicle repoed, then you're on the right track. Otherwise, you need to get current on the loan, stop payment on the missing check, send another payoff with tracking, signature and receipt requested.

#4 Author of original report

New Loan

AUTHOR: Anonymous - ()

SUBMITTED: Thursday, December 05, 2013

It would be odd if I continued to pay a loan at 24% when I got another at 0%. ie when I still owe over a year on that loan.

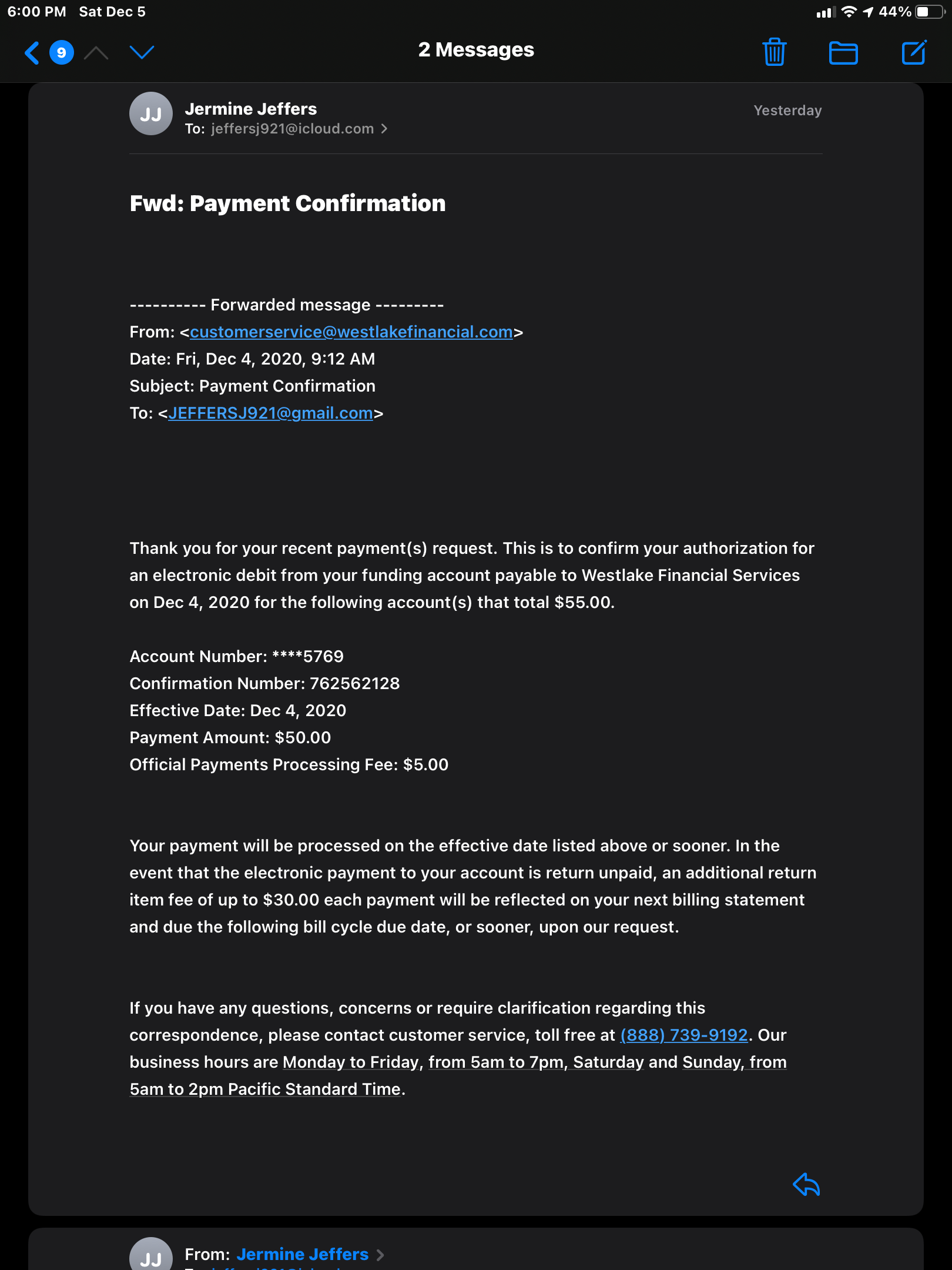

#3 Author of original report

Check Confirmation

AUTHOR: Anonymous - ()

SUBMITTED: Thursday, December 05, 2013

As of a few days ago the check had not been cashed or returned to me. It's had plenty of time to come back. I believe their game to be "sorry, check not received!" They hold it til they get the auto then cash out. Then they send it to the auction and cash out again. Inhumane way to conduct business wouldn't you say? They're simply organized crime, which makes them gangstas! Lil vatos! And you know what, they're not even lying when they say "not received." Of course it didn't get received if they don't go to the PO Box and pick it up!

#2 Consumer Comment

You didn't mention...

AUTHOR: Robert - ()

SUBMITTED: Thursday, December 05, 2013

You failed to mention one little item.

You say it didn't come back to you. So does that mean that it is just gone and hasn't cleared your bank? If the check cleared your account it should be a simple case(hopefully) to get a copy of the check and deal with them to credit your account correctly. If the check didn't clear then you should have this payoff amount still in your account and need to send them a new check.

But there is one odd thing. If this was a "payoff" amount why would you need to get a new loan with another company?

#1 Consumer Comment

Did the check clear your bank account?

AUTHOR: FloridaNative - ()

SUBMITTED: Thursday, December 05, 2013

You have the perfect evidence if your check for the full amount of the current balance was paid and cleared your bank account prior to the lender sending over a repo person for your vehicle. It was hard to tell from your post if the check has already cleared or if you have mailed it and it hasn't yet been processed.

I'm not defending the lender at all. Just pointing out that if they do repo your vehicle and it was already paid off, then you have recourse through the court system. However you will need to supply proof that the payment was received, processed and cashed through your account prior to the repo order. If you have the proof and if they repo, then take them to small claims court for restitution.

Advertisers above have met our

strict standards for business conduct.