Complaint Review: World Financial Group, - Nationwide

- World Financial Group, Nationwide USA

- Phone: 770-246-9889

- Web: http://www.worldfinancialgroup.com/

- Category: Financial Services

World Financial Group, WFG. ** 10 Lies and Misreps That WFGers Tell You--And Themselves. Johns Creek, Georgia Nationwide

*UPDATE Employee: AEGON PURCHASE TRANSAMERICA CNN1999

*UPDATE Employee: WFG NOT A SCAM

*UPDATE Employee: WFG NOT A SCAM!!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Gentlefolk, here are the lies and misrepresentations that WFGers so often tell you and themselves. Please scroll down to read details on each lie/misrep and the hard reality.

Lie/misrep #1: "WFG works for many successful people. My upline’s a doctor/engineer/[enter respected profession here], who made [enter fabulous sum here] last month!”

Lie/misrep #2: "WFG is backed by Aegon Group, a Fortune 500 company."

Lie/misrep #3: "We focus on sales, not recruiting. We are not a ‘pyramid scheme’. "

Lie/misrep #4: "If WFG’s such as scam, why hasn’t it been shut down?"

Lie/misrep #5: “You can make ‘ridiculous’ money with WFG. You’re not a ‘wage slave.’”

Lie/misrep #6: “It’s not a J.O.B. You own your own biz.”

Lie/misrep #7: “Don’t judge us on ‘a few bad apples.’”

Lie/misrep #8: "WFG is competitive because it offers a wide range of products from many different companies.”

Lie/misrep #9: “FFIUL is the best kind of life insurance policy. It’s a ‘permanent’ policy with a cash value and a floor so ‘you’ll never lose money.’

Lie/misrep #10: “Forbes covered us.’”

WFG is a multi-level marketing (MLM) financial services company. The program WFG agents too often follow is based on LIES. For the vast majority of its clients and agents, the WFG experience is--or will become--everything from a mild brief let-down to a mind-bending nightmare that wrecks everything they have: family, friendships, wealth.

The system creators wove the web of deception so well, the agent-victim doesn’t know he’s trapped in it until it’s too late. Not until he’s invested too much time, money, and emotions into this abusive and deeply dishonest program. By which time it’s too late--he’s made himself part of the Big Lie. Acting like a highly animated zombie, he’s in deep denial and spreads the gross dishonesty.

*Harming* people and families--not helping them--is part of WFG’s DNA. At least as too often executed by its irregular army of high-fantasy low-fact agents.

How can this be? Why does WFG even exist?

As Deep Throat told us: “Follow the money.” WFG makes huge coin for a privileged few. Your WFG nightmare is a *dream* for this MLM’s corporate overlords and relative handful of agents. These privileged few are:

1) WFG Corporate;

2) participating carriers, Transamerica most of all, and;

3) the top 0.5% of agents who’ve effectively locked up the pyramid peak.

Many--maybe most--of these top 0.5% agents got in on the ground floor of this Multi-Level Marketing (MLM) organization in the 1990s when it was called World Marketing Alliance (WMA). For reasons I give below, these top agents can effectively pull up the ladder out of reach of newer associates. They can drop down the ladder every so often to let climb up a few folks. Just often enough to continue to propagate the sham of “opportunity for all” if only “you work hard enough.”

Transamerica and WFG Corporate cash in hugely from WFG’s high-profit ultra-low overhead model. Uplines press their agents to sell very spendy fat-commission products like Transamerica’s Financial Foundation Indexed Universal Life (FFIUL) policy. Pricey products that most buyers will give up so Transamerica avoids to pay even a dime in benefits. As far as recruits, the more the merrier! WFG Corporate “ka-chings” $100 per head. A huge amount of this fee is profit. Corporate spends almost nothing on overhead, because agents do nearly all the work, which includes all the recruiting.

Transamerica’s parent holding company, Dutch giant Aegon N.V. lends a hand here. It greases Congress pols’ palms to help keep legal such financial devices like the FFIUL insurance policy, an elaborate long-game fraud. Search on “Open Secrets Insurance Companies” and you’ll see Aegon ranks well up the list of donations, giving almost a million dollars of campaign contributions to these Fed elected officials so far this year. That’s a small price for Aegon to pay to help keep legal decades-long confidence games like the FFIUL.

To keep feeding the voracious WFG dragon with fresh green, uplines must push their agents to aggressively recruit, and sell harmful products to, everyone possible, even people near and dear to them. As such, WFGers are too often deeply deflective, deceptive, dishonest, and damaging. The dishonesty flows all the way down from the top, from the corporate level, which instructs its agents to hide important information.

Let’s look under WFG’s hood. Let’s take apart some of the more common lies and misrepresentations that WFGers tell us and themselves. Let’s discuss how YOU can protect yourself from this profoundly unhealthy parasitic organization. A company that, like a pathogenic virus, shows us how to feed the selfish devils of our natures and suppress our better angels, and to teach us how to replicate the same Big Lie into other people. A company that infects and harms many thousands of victims for the crass enrichment of a select soulless few.

10 LIES AND MISREPS WFGers TELL YOU AND THEMSELVES--AND THE HARD REALITIES:

LIE/MISREP #1: "WFG works for many successful people. My upline’s a CPA/engineer/[enter respected profession here], who made [enter fabulous income here] last month!”

REALITY: It’s very common for MLM agents to wildly exaggerate their earnings and other professions, even outright lie about them. They justify their deception by telling themselves that the end justifies the means. To “fake it till they make it.”

It’s common for agents to show spreadsheets and PowerPoint slides showing their earnings. Ask to see their actual paychecks and bank statements. Alas, some uplines have even doctored those sources so even these “direct” docs fail to offer ironclad guarantees the upline made what he or she claims. Look for other telltale signs. How well does the upline dress? Does she wear real or costume jewelry? Does that “$250k/year” upline drive a $10k car? It’s possible the costume jewelry and budget car is her choice. But that’s highly unlikely. It’s vitally important to project a successful image to succeed in sales. So if the upline really does earn well, she’ll likely be driving a Lexus, Benz, or other status-mobile as a necessary cost of doing biz. Sometimes the upline will claim a respectable title in a high-earning career, e.g. a doctor, engineer, or CPA. Comments you read here in Ripoff Report, P*ssed Consumer, Reddit, and elsewhere, discuss accounts of people who claim to come from a given profession, but who fail to show up in internet searches. Or they show up, but they only attended college or university for the given profession but never worked in that profession. Did they even graduate in their stated profession? Bottom line: Take NOTHING these people tell you on faith. Verify ALL you can.

LIE/MISREP #2: "WFG is backed by Aegon Group, a Fortune 500 company."

REALITY: Official public information on this relationship is sorely lacking, almost non-existent. You get conflicting information on it from various corporate employees. Bottom line: We simply don’t know for sure WFG’s current status vis-a-vis Aegon. What’s clear is that WFG largely disappeared from Aegon’s official financial reports in 2007. If Aegon does indeed own WFG, it isolated itself from WFG’s bad behavior. Indeed by definition, WFG Corporate largely isolated itself from the rampant dodgy dealings and outright fraud among its 53,000+ agents and near-198,000 new recruits (WFG 2015 figures). Because they are independent contractors, these agents must assume the legal burden for their own actions and conduct. Check out the 28 March 2016 review at P*ssed Consumer titled “Aegon/Transamerica DOESN'T own WFG after all?!” to read more on why WFGer’s proud claims that “Aegon backs WFG” are meaningless at best, and quite possibly wrong. When--folks not “if” but “when”--WFG runs into financial, regulatory, and legal troubles, you can’t assume Aegon will step in and bail out this deeply troubled little MLM.

LIE/MISREP #3: "We focus on sales, not recruiting. We are not a ‘pyramid scheme’."

REALITY: WFG Corporate doesn’t tell agents to recruit more than sell. But the low-repeat sales of high-commission life insurance and retirement products like the FFIUL and variable annuities pretty much force you to recruit way more than you sell. Thus YOU, the WFG agent, will personally violate pyramid scheme laws.

The US Government's Federal Trade Commission (FTC) makes clear what’s a pyramid scheme:

"Pyramid schemes ... promise consumers or investors large profits based primarily on recruiting others to join their program... we bring cases against pyramid schemes under the FTC Act."

You can read the full text at www dot ftc dot gov/public-statements/1998/05/pyramid-schemes

WFG Corporate’s guideline of “3 sales and 3 recruits in 30 days” (“3/3/30”) keeps the official guideline oh-so-barely within legal limits. But the open secret among agents is that, given the low-repeat sales of life insurance and financial retirement products like annuities, agents must RECRUIT OR DIE. Life insurance is not a low-cost consumable like soaps or face creams. As my recruiter wrote to me: “how much can you sell?!” As such, it’s only a matter of time WFG’s contractors will firmly cross that sell/recruit borderline--and document their overwhelming recruitment focus in emails and web posts--to firmly establish a pyramid scheme pattern. Then the Fed and State regulators can “WHOOOSH” in. If you want to read more on this, check out this 16 May 2016 review at P*ssed Consumer: “Will WFG Die? Dissect this Evidence. Do your Homework. Decide for Yourself.”

LIE/MISREP #4: "If WFG’s such a scam, why hasn’t it been shut down?"

REALITY: Again, it’s only a matter of time before we see more formal action against WFG and/or some of its agents, which could result in prosecutions and shutdown. Sooner or later, the regulators and the courts will catch up to them once their collective malfeasance rises enough to grab the authorities’ attention. Starting in 2007, lawyers and regulators have had their hands full with biz titans like Lehman Bros, Enron, and Arthur Andersen, all of which fell from grace due to massive fraud and systematic gross wrongdoing. Recently Goldman Sachs agreed to pay $5B to investors to whom GS admitted it deliberately sold shoddy investments to clients. Let’s not forget bad behavior from Transamerica, the carrier that issues the Financial Foundation Indexed Universal Life (FFIUL) policy, WFG’s flagship insurance product. Google “Feller vs Transamerica” and you’ll read about a major class-action suit just launched against that insurer. Thousands of Transamerica xUL policyholders will have, or already had, to cough up massive premiums or lose their policies. Even if a company’s very big and been around a long time, it can still offer you a poor and even harmful deal and even act fraudulently.

LIE/MISREP #5: “You can make ‘ridiculous’ money with WFG. You’re not a ‘wage slave.’”

REALITY: Yes, and you can become President of the United States, Prime Minister of Canada, and be the first person to walk on Mars. While anything’s *possible* the way the WFG pyramid is set up makes it virtually impossible for you to earn a living at this business. Even worse, it just about requires you to sell loads of inferior and even very harmful products, especially Transamerica’s FFIUL policy. You have to ask yourself: Is the money worth deceiving and ripping off hundreds, even thousands, of people? Is the money worth the fact you knowingly deceive and rip off even *one* person? How much are you willing to violate your ethics and morals, to knowingly spread bad karma?

Let’s look at this in more detail. Search for “WFG’s Compensation & Promotion Guidelines Squarespace.” That 8-page PDF will pop up for you. Go to page 5. In the “Compensation Guidelines” chart, you see that WFG starts out its new Associates at, in effect, a pathetically low 25% of the commission on your sales. Most Independent Marketing Orgs (IMOs) pay their agents 70--80% of commission from their first day. That’s a greater percentage than what even WFG’s Senior Marketing Directors make.

In that same chart, see where WFG awards more points for “WRL” products? “WRL” stands for Western Reserve Life Assurance Co. of Ohio, which merged into--you guessed it!--Transamerica. WFG wants to project its independent “we offer many products from many carriers” image. The WRL label helps hide the fact that WFG heavily skews to Transamerica and esp that carrier’s favored fat-commission product, the FFIUL. WFG is, above all, a recruiting machine and a sales machine for Transamerica's FFIUL.

OK, let’s say you don’t want to flog “WRL” products like the FFIUL? No problem right? You can just work harder to sell the other products, right? But what if your upline thinks you’re not being “coachable” enough? In those same WFG Guidelines, on page 8, you find these:

Footnote 2: Promotion requires approval of direct upline SMD.

Footnote 3: Promotion requires approval of direct SMD and CEO MD

Footnote 12: Meeting the minimum requirements does not guarantee inclusion in the Base shop Pool.

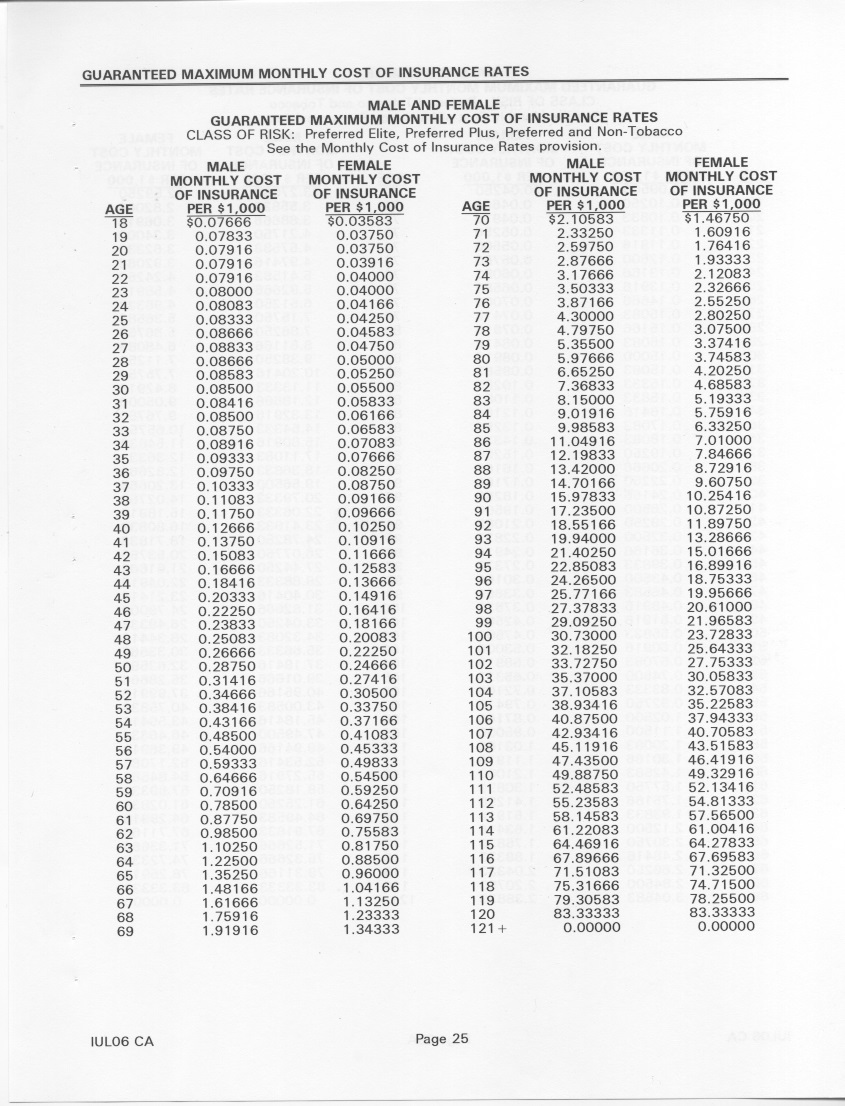

This means *even if you meet the sales and recruiting goals to move up* your upline can block your progress. WFG makes it clear that, regardless of its promises that you “own your own biz” and have “freedom of carrier/product choice,” you’re forced to play ball with your upline to move up to real money--which almost certainly means you have to recruit, recruit, recruit, and sell loads of the very expensive and very risky FFIUL. It’s small wonder I’ve seen agents push the FFIUL at pie-in-the-sky 8% average rates of return illustrations onto lots of people who can’t really afford it. In their later years as their premiums surge higher, these will force them to GIVE UP THE FFIUL and LOSE EVERYTHING.

LIE/MISREP #6: “It’s not a J.O.B. You own your own biz.”

REALITY: WFG itself makes clear, in several places, that this favorite WFG selling point is a myth. You can find the hard truth spelled out in your Associate Membership Agreement (AMA) and in WFG's Compensation and Promotion Guidelines. You most definitely *don’t* “own your own biz.” You are not master or mistress of your WFG destiny.

First, see here on page 8 of that AMA:

“B. ...The Associate acknowledges that WFG owns all rights in and to the following: ...(ii) the identities of and all lists of the members comprising WFG; and (iii) the identities of and all lists of the Customers of WFG...which constitute **property owned solely by WFG.** Associate agrees that Associate shall have no proprietary interest in, or ownership of, any Customers, other associates of WFG including Downline Associates, or Products and Services. **WFG shall have exclusive proprietary interest in, or ownership, of all Customers, and contractual relationships with other associates and the Product Providers**.”

You can read this for yourself. Search for the 22-page AMA-US.pdf. You’ll find it at mywfg dot com. Even some veteran WFGers are shocked to learn that, when they leave the MLM, they can’t take their Book of Business with them.

Second, see WFG’s Compensation & Promotion Guidelines. These make clear that, even if you meet sales and recruiting goals, you get no guarantee you'll advance up the WFG pyramid. See Lie/misrep #5 above for more info on that.

Sounds more like your J.O.B. all the time doesn't it? Except worse. All you are is a contractor who pays for everything that is usually paid for by traditional companies (training, books, travel etc) meanwhile WFG restricts you from performing in a truly independent manner. It’s no big shock then we see an even *bigger* earnings gap in WFG than at your “J.O.B.” Last year (27 Aug 2015) HuffPo ran a piece decrying the “outrageous” 204-to-1 pay gap between the CEO and rank-and-file workers, with 4 CEOs at the top of the list earning more than 1,000-to-1. We can put WFG right up there with the worst of them with its staggering *1,321*-to-1 gap. (3m ring earners compared to the 99.7% who earn, on average, $2,272/yr.) So much for WFG giving you the fair shot at the big bucks your J.O.B. kept you from.

LIE/MISREP #7: “Don’t judge WFG by ‘a few bad apples.’”

REALITY: WFG’s policies set the stage for widespread deceptive and unethical behavior that spreads WAY beyond “a few bad apples.” This MLM pushes its contractors to *restrict information* to its prospects, both to customers and to fellow associates. This guidance comes straight out of WFG’s System Manual: “Avoid the Scenario of Disaster. *If you start answering too many questions*, it takes the edge off the prospect’s curiosity.” This is, of course, absurd advice. Honest people will agree: You WANT to satisfy a prospect’s curiosity. That’s a GOOD thing. How can you make rational decisions about products and work opportunities if you don’t get solid info on them?

My experience showed me how deeply WFGers deceive its clients and even themselves. My recruiter did everything he could--and succeeded--to keep me from reading the FFIUL contract. He *owns* this policy and locked himself into really high fees and onerous surrender charges that extend out 15 years. Yet he couldn’t answer basic questions like “what are the guaranteed maximum fees?” He owned this policy and obviously had every right to let me read it. Yet he felt he needed to call his upline, who advised him against letting me read it, giving empty even laughable excuses such as “we just don’t do that” and “we’re not sure that’s legal.” I saw more of the same deflective and deceptive behavior in WFG workshops. My upline expected to promote the same in Business Presentation Meetings (BPMs).

WFG’s compensation structure promotes unethical and even illegal behavior in other ways too. It’s true this MLM doesn’t directly pay you to recruit. Instead it simply awards points to you to recruit. You MUST recruit to move up the pyramid, especially since WFG’s main products, the FFIUL and variable annuities, are usually not repeat sells. As my recruiter wrote to me: “You have to see yourself as a “builder” [“builder” is code for “recruiter”] rather than a seller. How much can you sell?!” To make real money and to advance you have to recruit enough that you will almost certainly run afoul of pyramid scheme laws.

LIE/MISREP #8: "WFG is competitive because it offers a wide range of products from many different companies.”

REALITY: WFGers love to tell us “we offer many different life insurance products from many companies.” In practice, WFG serves mainly to recruit and to distribute Transamerica’s very pricey very risky fat-commission FFIUL. WFG wrote the Compensation and Promotion Guidelines to push agents to sell that dangerous paycheck-sucking policy. The FFIUL is especially risky in later life when your Cost of Insurance (COI) rates--aka Mortality Charges--soar through the roof. Check Lie/misrep #5 above for more info on WFG’s C&P Guidelines.

So what’s so bad about the FFIUL anyway? That brings us to:

LIE/MISREP #9: “FFIUL is the best kind of life insurance policy. It’s a ‘permanent’ policy with a cash value and a floor so ‘you’ll never lose money.’”

REALITY: For the damning numbers on this “assurance” abomination, please check out the 29 June 2016 review here titled “Plan to live long? Will your FFIUL--WFG’s “top” product--FAIL and leave you with NOTHING? Here's the MATH.” This explains why Transamerica’s FFIUL--at least as typically configured and sold through WFG--is a truly terrible deal from which you need to *run* not walk. The FFIUL is a super-expensive policy that, if you live a reasonably long life, is virtually guaranteed to FAIL, leaving your heirs NOTHING after you spend decades pumping hundreds of thousands of dollars into it. This, because skyrocketing late-life Cost of Insurance (COI) charges *will* force you to give up the FFIUL. It’s as simple and awful as that. The FFIUL is not a “permanent” life policy as much as it is an auto-renewing 1-year term life policy. It’s “permanent” only until you can no longer afford to pay the astronomical late-life charges--which applies to just about everybody if you live long enough.

LIE/MISREP #10: “Forbes Magazine covered us.”

REALITY: WFG appeared in Forbes only in *advertisements* so of course gives a rosy picture of the company. What else would you expect? It amazes me any WFGer would embarrass themselves and WFG to tell such a weak and easily verifiable lie. Yet many do.

Five lessons from my WFG experience:

1) Take NOTHING a WFGer tells you on faith. Verify *everything* with full documentation and your own independent research.

2) Read the fine print before you sign anything. Every word of it!

3) Before you sign anything or give WFG a dime, make sure your agent gives you FULL DOCUMENTATION to take home and thoroughly read over. If you consider any policy, especially a policy with many moving parts like the FFIUL, demand a FULL QUOTE on your FFIUL *including all the contract terms and conditions and Policy Data.*

4) Give it to an independent qualified fee-ONLY (not just “fee-BASED”) Financial Advisor who does NOT sell life insurance. If your agent won’t give you this full documentation, WALK AWAY.

5) Your best bet: Never start with this deeply dishonest organization!

This report was posted on Ripoff Report on 07/01/2016 09:42 AM and is a permanent record located here: https://www.ripoffreport.com/reports/world-financial-group/nationwide/world-financial-group-wfg-10-lies-and-misreps-that-wfgers-tell-you-and-themselves-1314593. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 UPDATE Employee

AEGON PURCHASE TRANSAMERICA CNN1999

AUTHOR: Outtahere - (USA)

SUBMITTED: Thursday, February 02, 2017

HELLO ALL I'M BACK,

In regards to number two. I have the info from CNN Money 1999. I could continue to find false with your statesments. But your rant seems like that you are falsifying your records to falsy accuse a great company. Every company has people working for them that should not be. But I have seen first hand that WFG will clean house when they find someone is doing a bad thing. I don't know why you could not find this data. I found it in a few seconds. If you are having this much trouble finding data I know now why you didn't make it in WFG.

I tried to copy the link but it would not. So, just go to Google and type, "When did Aegon Purchase Transamerica?" It came up right away. Its' from CNN Money International. Aegon bought Transamerica February 18th 1999.

#2 UPDATE Employee

WFG NOT A SCAM

AUTHOR: Outtahere - (USA)

SUBMITTED: Wednesday, February 01, 2017

WFG NOT A SCAM!!

I forgot to address the Lies. I don't know if their are perfect people. The only perfect one died on the cross a few years ago. Sorry you ran into some people that clouded your judgement. The business requires you think of it being a easy as possible. Once again, you can leave anytime you want. You are 1099. So you can do what you want.

Its not an MLM. Their is no product to buy to get started. You don't have to keep product in the garage and try to sell it. I don't know how to advance people in a environment like WFG or Real Estate and not get advanced based on the number of sales. Insurance is not a bad thing. It's something I can now help people with. People have insurance on our home, car, apartment, boat, in case something happens. But we don't dare put insurance on ourselves or business. That is not right.

#1 UPDATE Employee

WFG NOT A SCAM!!

AUTHOR: Outtahere - (USA)

SUBMITTED: Wednesday, February 01, 2017

WORLD FINANCIAL GROUP NOT A SCAM!!

I decided to say something her because I've never known someone to repeat the same thing over and over to make their view seem like the whole world should think like them. World Financial Group is not a scam and let me tell you why. I dont need to write alot because it's a simple great business.

Now I don't know which is the worst scam. The thought that if you work for a company for a number of years you will have your retirement waitiing for you. Or, that the cubicle is the best and only way to go through life.

World Financial Group gives your the opportunity to dream and grow. People are so stuck in the cubicle and the false thinking that the company they work for cares about them. How many people have worked for company's and lost all of their retirement because the company went BK. That sounds like a real great way to spend your life. If you want that kind of life fine..leave the corporate overview WFG is not for you. But just because you want a cubicle life doesn't mean that people reading this have to live their life that way.

WFG also focuses on you growing as a person. They believe that reading books written by some of the worlds top authurs is a way to change your thinking. If you want to be a grown man and a guy younger than you is your boss, does that seem right. You have to ask him for time off. If that is the type of life you want. Fine! My ex loves it. Not me. I want my time and life back. Books by Dale Carnegie, John C Maxwell, Tony Robbins, Steve Siebold. If you don't want grow and understand people. Then its' not for you.

If you think not getting Life Insurance so your Family or friends have to come up with the money to bury you is, "OK", that is a very selfish way to think. Why would you want your loved ones have to go on a website to ask for money to put you in the ground. Or your family have to have a Car wash to help pay for your long term care. My neighbor and his siblings had to come together to come up with the money to pay for his fathers funeral and hospital bills. The dad had no insurance. Here in Ca. it can cost 15-20k to put your loved ones in the ground. And you don't know when its' going to happen.

As far as the FFIUL goes. One of the ladies in the office put a her kid through college with the FFIUL before she new of WFG. TAX FREE!!! It is no scam it works. But its' not for everyone. Talk to your own Insurance Associate.

I like WFG because my managers are great people. I don't get what is wrong with helping people be prepared for things that happen to us unexpectedly. Reading those books is good stuff. I don't know who you are. But the business isn't for everyone. Some people want just to go to work and be under someone else's thumb. Not me! At the very least you learn about money and how to choose the best product for youself. You did work very hard for your money. And to leave it up to someone else to tell you where to put it is scary. Then you have to pay them on top of that. That is just dumb. Learn where to put YOUR money in the best place for YOU and your FAMILY!

Advertisers above have met our

strict standards for business conduct.