Complaint Review: Yellow Book USA - Columbus Ohio

- Yellow Book USA 6300 C Street SW, Cedar Rapids, IA Columbus, Ohio U.S.A.

- Phone: 800-373-2324

- Web:

- Category: Advertising / Deceptive

Yellow Book USA Deceptive sales practices. Columbus Ohio

*Consumer Suggestion: post dating is ILLEAGLE

*Author of original report: Yellow Book USA

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

We are a small IT consultation firm located here in Columbus Ohio. For the last few years we have used different Directory advertising to promote our business locally, with great success. In 2004 we switched our advertising from AT&T Yellow Pages, due to the fact that they printed a number we didn't own, and refused to credit us for the advertising we didn't receive. We ended up with Yellow Book as a solution to this problem, since AT&T was unable to satisfy our needs.

At first we found them cheaper and seemingly care alot more about our needs as a young corporation. As time went on, they convinced us, with sales figures, charts, and other testimonials, as to why we should expand our advertising into other books in Central Ohio. So likewise, since we had great success advertising with them previously, we accepted the new books, and the likewise additional financial hit of increased advertising, based solely upon the information their sales rep provided us.

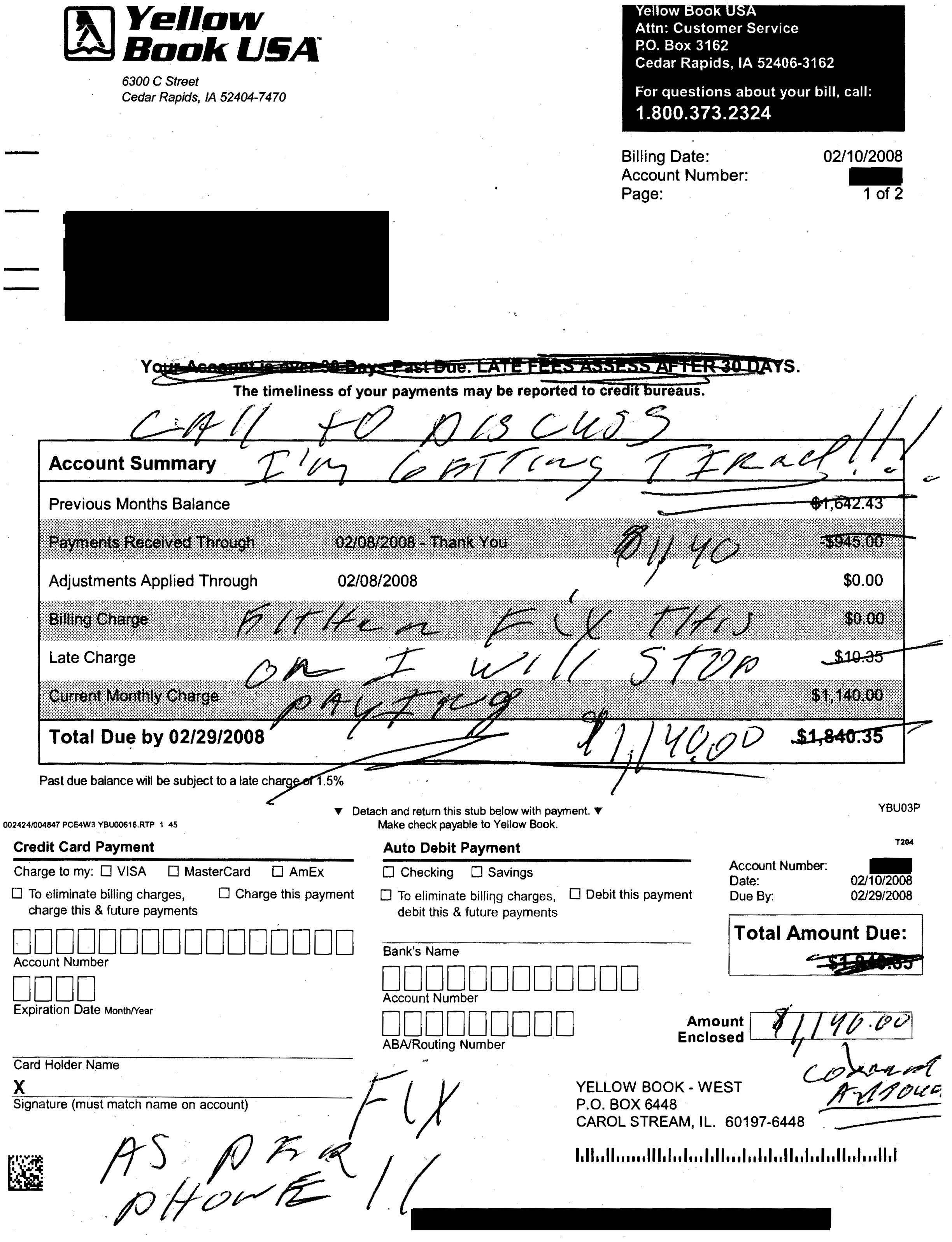

At over $1000 a month, we expected atleast twice the business from the increased service area, only to see calls trickle in, one at a time, and the increased exposure not increase our bottom line even by 1%. They tell us that if we modify our current advertising we will lose our placement in the Columbus Ohio book, but the quarter page they're selling us hasn't increased the bottom line of my business.

Because of such expenses, with little visable impact, our advertising bill went into default. I had numerous telephone conversations with their collections reps, and I agreed I would send them $4000 at the beginning of November to get within a few hundred dollars of being within 90days due. I was unable to send them money in December, because of Christmas.

It was then, days after the holiday, that I received an angry call from one of their collections reps. He told me that unless I gave them a post-dated check for over $1000 he would send my account to a collections attorney. I told him that previously I had given them post-dated checks and that they ran them early. He called me a liar, and said that that never happened. So I finally told him, I would not authorize a post dated check, and that I would mail them a check at the end of the month.

This check I did mail. It has posted to my account. I come back from vacation, and have received a collections letter from an attorney, demanding I pay the full amount of my advertising, all the way through to September 2008 (It's currently Feb 08) or they will sue me, attach garnishments on all checking accounts, and will come after my inventory and accounts payable.

Six months ago... I never thought a company I have done business with for years would treat a long term client in this matter, but all it took was one Collections Rep to get mad, and somehow all my previous payments to them don't show, and I don't even get offered a payment plan. I'm automatically sent off to an attorney, and now have work out a settlement or declare bankruptcy. The local boss of advertising here in Columbus, says it's very unusual that after paying $5000 on $15,000 of advertising, that I would be sent off to collections and not offered a payment plan. He's washed his hands of me, and has said their is nothing he can do.

This amount will be settled and paid for over time, and I am currently in contact with an attorney. I told my rep before I left town I wanted to settle the past due amount on this account, and never received a call back.

I feel cheated, since the advertising I bought never produced the leads I was promised. I feel lied to, since they deny they ever predated a post dated check that I wrote to them, when my ad rep shows me in person what was written in my file concerning it, when getting me to renew my current columbus ad. I also see what other people are saying on here in a new light, and why this company should probably be avoided at all costs.

This company wouldn't exist without post dated checks, it seems. I wonder how many other people they have "punished" by doctoring accounts, to have them sent off to collection attorneys, that refused to post date payments they couldn't afford, and not to offer payment plans, that almost every other business abides by.

Buyer beware. Don't trust claims on coverage, or how many households they deliver to. Any business can fall into the pitfall I have. We have gotten good clients from Yellow Book, but I feel we could of gotten better exposure elsewhere for ALOT less money and headaches.

Daniel

Columbus, Ohio

U.S.A.

This report was posted on Ripoff Report on 02/05/2008 01:28 PM and is a permanent record located here: https://www.ripoffreport.com/reports/yellow-book-usa/columbus-ohio-43229/yellow-book-usa-deceptive-sales-practices-columbus-ohio-306383. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

post dating is ILLEAGLE

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Sunday, February 24, 2008

Post dating a check is ILLEAGLE. YOur attorney should ahve told you that. I would ahve told the otehr attorney to "go ahead and sue mw post dating is illeagle. If you get your checkes returned to you (or even if you don't you can get a copy) look on the back of the check, it should ahve to exact time and date that it was processed. IF that diate is before the date on the check, then you ahve proof. People seem to be sooo afraid of being sued. LEt them sue, THEY have to proove thigns and since they are doing illeagel stuff they probably would not really sue anyway.

Good for you for NOT blaiming the bank for chasing the post dated check. I used to work for a major bank in the proof department (had to quit becasue of carpel tunnel) We do not look at dates or signatures or anything. If the teller accepts it, ( especially if it is in a batch of checks-they dont check each one) then it goes threw. We ahve to process about 3500 items an hour so there it no time to check anything but an amount.

#1 Author of original report

Yellow Book USA

AUTHOR: Daniel - (U.S.A.)

SUBMITTED: Sunday, February 24, 2008

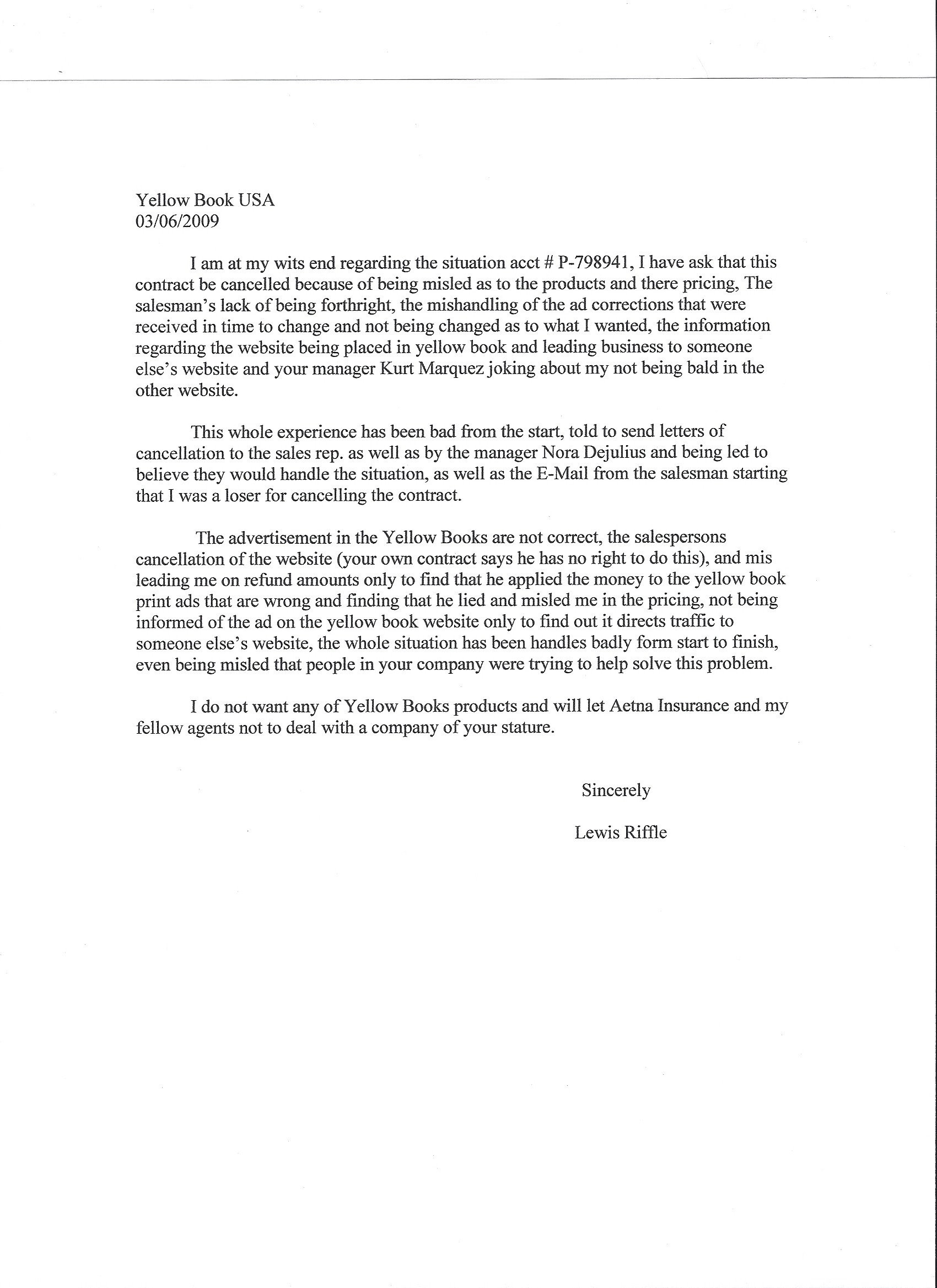

After days of talking with my attorney, Yellow Book reps, and their attorneys we finally figured on settlement payments. Of course Yellow Book added over $2000 to my final tab, by some obscure passage, in the contract on the back, and late fees, etc, etc. Of course they want all this paid with post dated checks or "we're going to file against you and prosecute you". My attorney worked out that we'll open a checking account just for Yellow Book to draft from, and I'll approve their drafts, so there's no need for post dated checks. What a hassle.

Their attorney was especially peeved that I got my attorney involved, and we were investigating ways to chip this bill lower, which my attorney was all too helpful with. At first the Yellow Book attorney threatened to file against me immediately, and "we'll run up his (your attorney's) meter", but after speaking with him, my attorney was finally able to come to an agreement.

After 15 months, at $830 a month, I'll have this bill paid. The last 3 payments will be the $2000 plus they've added to my account, since they sent it off to an attorney, because I refused to give them a post dated check. This company employs some of the most dispicable collection practices in the industry, and although I'm left with a settlement, $2000+ over a bill I was trying to work with my rep to settle, I don't have to go to court and lose everything to these bastards.

I've complained to my local attorney general's office, which can't do anything because it's a business / business complaint, and also to the FTC. If the FTC gets enough complaints they will investigate. I encourage anybody else on here that's had to deal with the unscrupolus ways this company collects on past due debts, or has had one of their checks rushed by this outfit to complain as well.

Yellow Book USA will never get any more business from my company, and if you're thinking of doing business with them, don't. There's other ways, a lot cheaper that get you the exposure you need. If you do do business with them, read their contract, they hide on the back of what they get you to sign. You will be horrified to see all the rights you are signing away with this company, the right to fair collection practices, etc, and how they can "accelerate payments" at any time of their choosing, if you get behind on payments.

With Yellow Book advertising declining nationally, these companies will do literally anything to assure payment, even break the law, and/or run their clients out of business. Without my legal representation I know they would run the gambit on me. What is most frustrating is that I'm at this point because a certain Yellow Book rep didn't get his commission by taking a post dated check from me, when I was trying to work with my ad rep directly to get the past due amount settled. I wonder how many other people they've done this to, and how many other good clients Chris Rice (Senior Rep for Yellow Book) and other collection reps have thrown to the wolves because they didn't get their commission on a post dated check.

Advertisers above have met our

strict standards for business conduct.