Complaint Review: Geico - Bridgewater New Jersey

- Geico Bridgewater, New Jersey U.S.A.

- Phone: 716-2762763

- Web:

- Category: Car Insurance

Geico Not Paying Liability Damages Ripoff Bridgewater New Jersey

*Consumer Suggestion: Regarding your letter outline

*Consumer Suggestion: No letter to insurance company will help.

*Author of original report: How to draft a letter

*Consumer Suggestion: Some suggestions for you.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Hi,

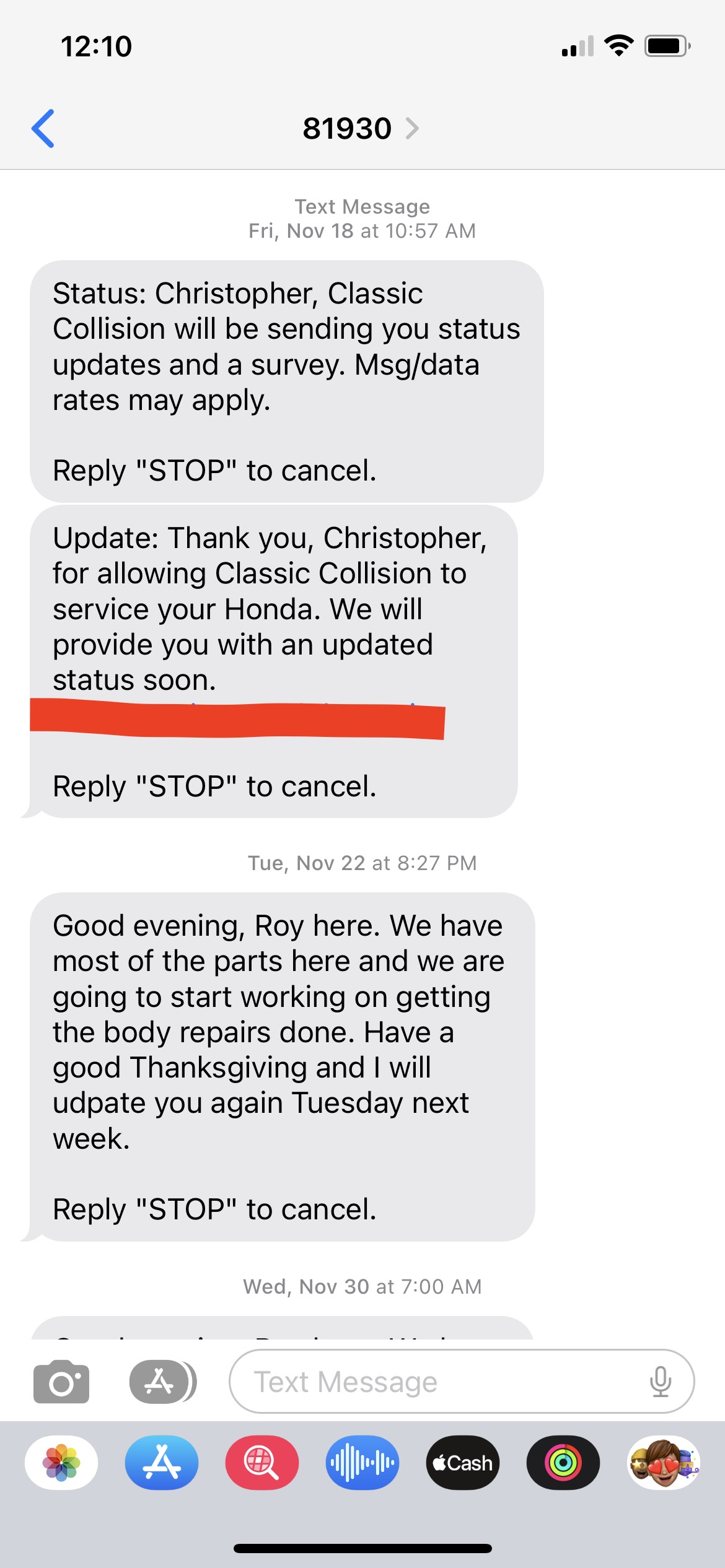

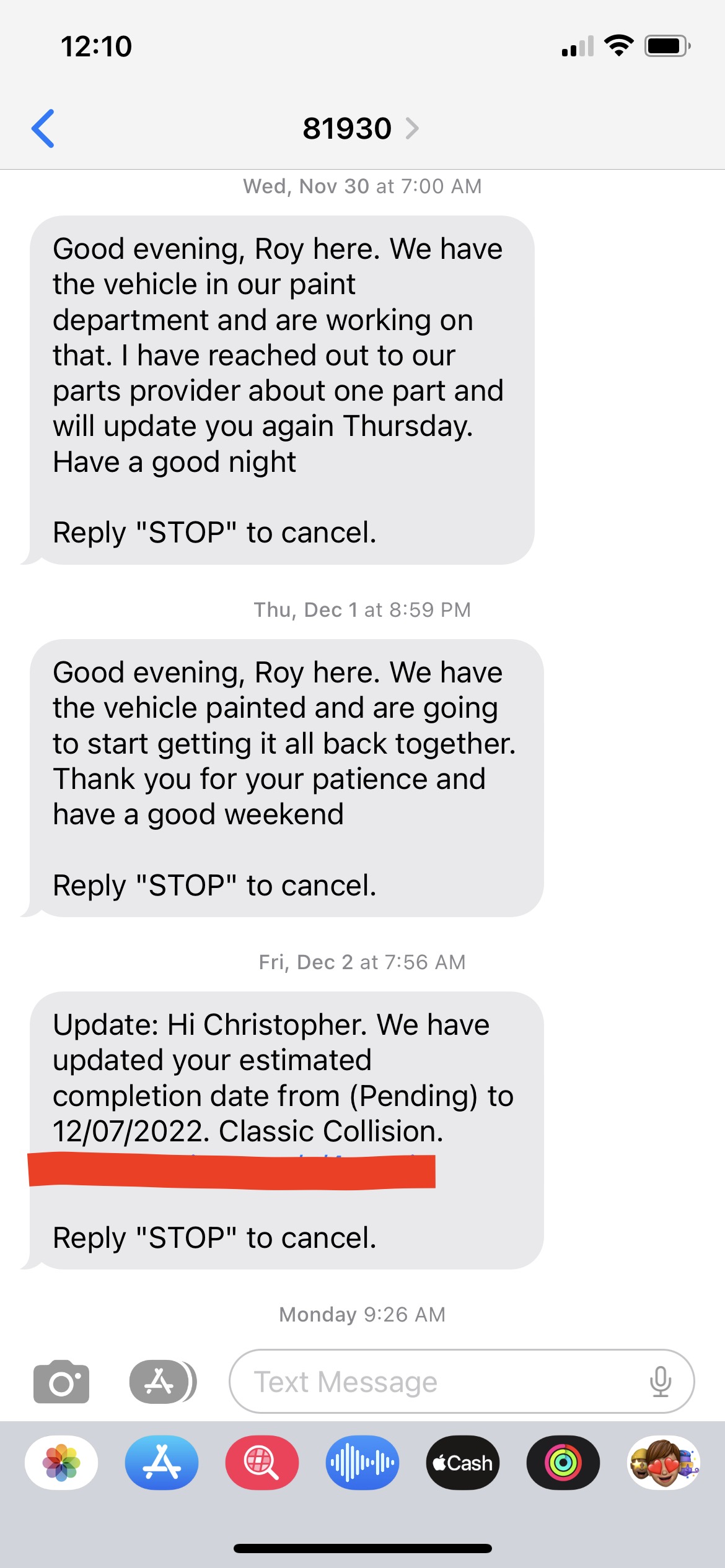

In the middle of a busy road where the speed limit is 55, Geico's policy holder crashed into the rear of my car. I sent police report to Geico 2 in the month of October. Till now they havent paid the damages.

Whenever I call them they say they couldnt contact their policy holder and this guy says "I STRONGLY recommend you to go through your insurance to fix your car".

But when they want customers, they say come 15 mins can save 15%.They want our money but give hard time to pay liabilities.

What are my options now. Why there is no law to the effect that Liabilities should be settled within one month of the occurrence of the accident.

Strange...

What are my options now? Can anybody give me some suggesstions.

Thanks

Chandra

Chandra

Piscataway, New Jersey

U.S.A.

This report was posted on Ripoff Report on 11/30/2006 09:42 AM and is a permanent record located here: https://www.ripoffreport.com/reports/geico/bridgewater-new-jersey/geico-not-paying-liability-damages-ripoff-bridgewater-new-jersey-223018. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Suggestion

Regarding your letter outline

AUTHOR: Greg - (U.S.A.)

SUBMITTED: Tuesday, December 12, 2006

Chandra,

Your outline for the letter is good. I would only suggest that you include in the body of the letter that GEICO denied the claim because they couldn't reach him/her. I would also include a sentence that politely asks them to call GEICO at the number listed on the copy of the GEICO letter you will be sending.

If you haven't already done so I would still try to reach them by phone before sending the letter.

Good Luck

#3 Consumer Suggestion

No letter to insurance company will help.

AUTHOR: Mike - (U.S.A.)

SUBMITTED: Tuesday, December 12, 2006

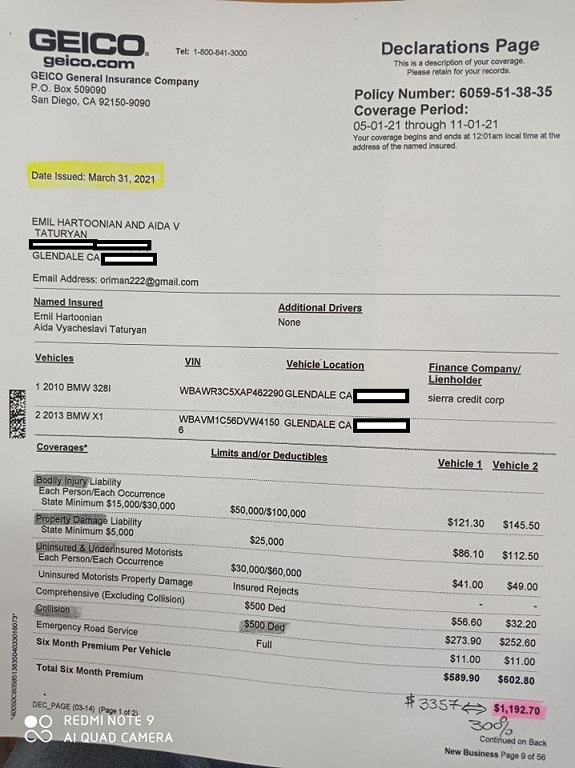

Did you have Collision on your policy at the time, and was your company not GEICO? If so, you really could take care of this fast by calling your company. They will get GEICO to pay you and it will not count against your record.

Now if you didn't have Collision coverage, your company won't help you. Writing letters to GEICO won't help either. Really the only recourse you have now is to sue-- the OTHER DIRVER. You don't sue GEICO directly, but they are obligated to pay if the other driver loses the case. It is really not a big deal assuming you can find the other driver because you must be able to have him or her served with a summons for the lawsuit. Depending on the amount of damage, you may be able to use a small claims court.

You could also try reporting this to your state's insurance commission, though technically GEICO hasn't done anything wrong until you have a court decision against the other driver and they still refuse to pay.

Also realize that your legal money damage is limited to the "actual cash value" of your car as of just before the crash. If the amount to repair the car is more, it is a total loss and you still only get the replacement value.

#2 Author of original report

How to draft a letter

AUTHOR: Chandra - (U.S.A.)

SUBMITTED: Monday, December 11, 2006

Hi,

Geico today sent me a letter of denial. They mentioned that they couldnt contact the policy holder.

I want to draft a letter to policy holder something like ...

--------------------

Dear XXX

This is regarding the accident that occurred in Bridgewater NJ on in which you were involved. Please see the attached police report to find more details.

I am writing this letter to let you know that Geico declined to pay liability damages to fix my car. Attached is the letter from Geico for your reference.

I am also enclosing the estimates given by Body shop to fix my car.

Please send me check or money order to the below mentioned address

---------------------

Is there anybody who can help me drafting this letter for me. I couldnt find anything on internet.

Thanks

#1 Consumer Suggestion

Some suggestions for you.

AUTHOR: Greg - (U.S.A.)

SUBMITTED: Thursday, November 30, 2006

I've been a claims adjuster for many years but never in NJ so I'm not sure how things work out there but I have some general comments, questions and suggestions for you. I'm assuming from your brief description that the other driver rear-ended your car. If that is not the case you might want to post more complete accident details so people here can try to better help you.

In some states companies can deny a claim because they can't contact their policyholder. However, most of the time if the police report shows the policyholder driving the right vehicle the claim can be taken care of. If somebody other than the policyholder was driving GEICO has the right to verify that the person was driving with the policyholder/owners permission.

If you have a copy of the police report with the other parties phone number on it. Call them and politely explain that they need to call GEICO, give them the 800# and the claim number. DO NOT yell, threaten or get angry with the other driver it won't help get the matter resolved because they won't call GEICO just to spite you.

If that doesn't do any good, information from an independent witness can help. Were they any listed on the police report? If so, ask GEICO if they have talked to the witness.

If you have collision coverage you can have your company pay for the damages. Of course, you're stuck paying your deductible to the body shop. However, then your company will pursue the other company through a process called subrogation. That way you don't have to do any of the dirty work. Your company will try to collect back the money they paid and your deductible. Other than the fact that you will be out your deductible for awhile, it is the easiest and far less stressful way of taking care of the situation.

Good Luck

Advertisers above have met our

strict standards for business conduct.