Complaint Review: Greendot - Springfield Missouri

- Greendot greendot.com Springfield, Missouri U.S.A.

- Phone:

- Web:

- Category: Credit Card Processing (ACH) Companies

Greendot THEY ARE STEALING MONEY FROM PEOPLE AND NOT ALLOWING ACCESS TO MONEY THAT IS DEPOSITED Springfield Missouri

*Consumer Comment: Greendot.com website now redirects to an "entertainment rewards Visa card"

*Consumer Suggestion: Successful resolution with a Greendot problem -- how to work with a call center

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

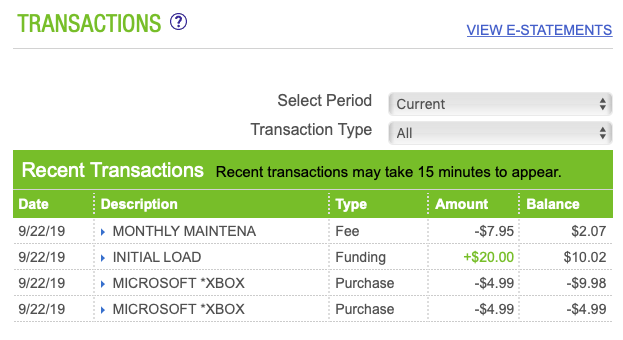

As of last week I decided to buy a GreenDot premier card thinking I could do wonders with it, but it isn't a good thing it is a nightmare. I put 500 dollars on the card just to tuck away some money and that way I won't spend it. Well first they tell me they can't verify my address. Then they tell me to fax my id and a signed utility bill from my fiance that i reside with him to get my personalized card. I made the deposit on the 26th and now its the 30 and I don't have access to my money. They told me it's going to be up until the 4-5 of november before I will recieve my card.

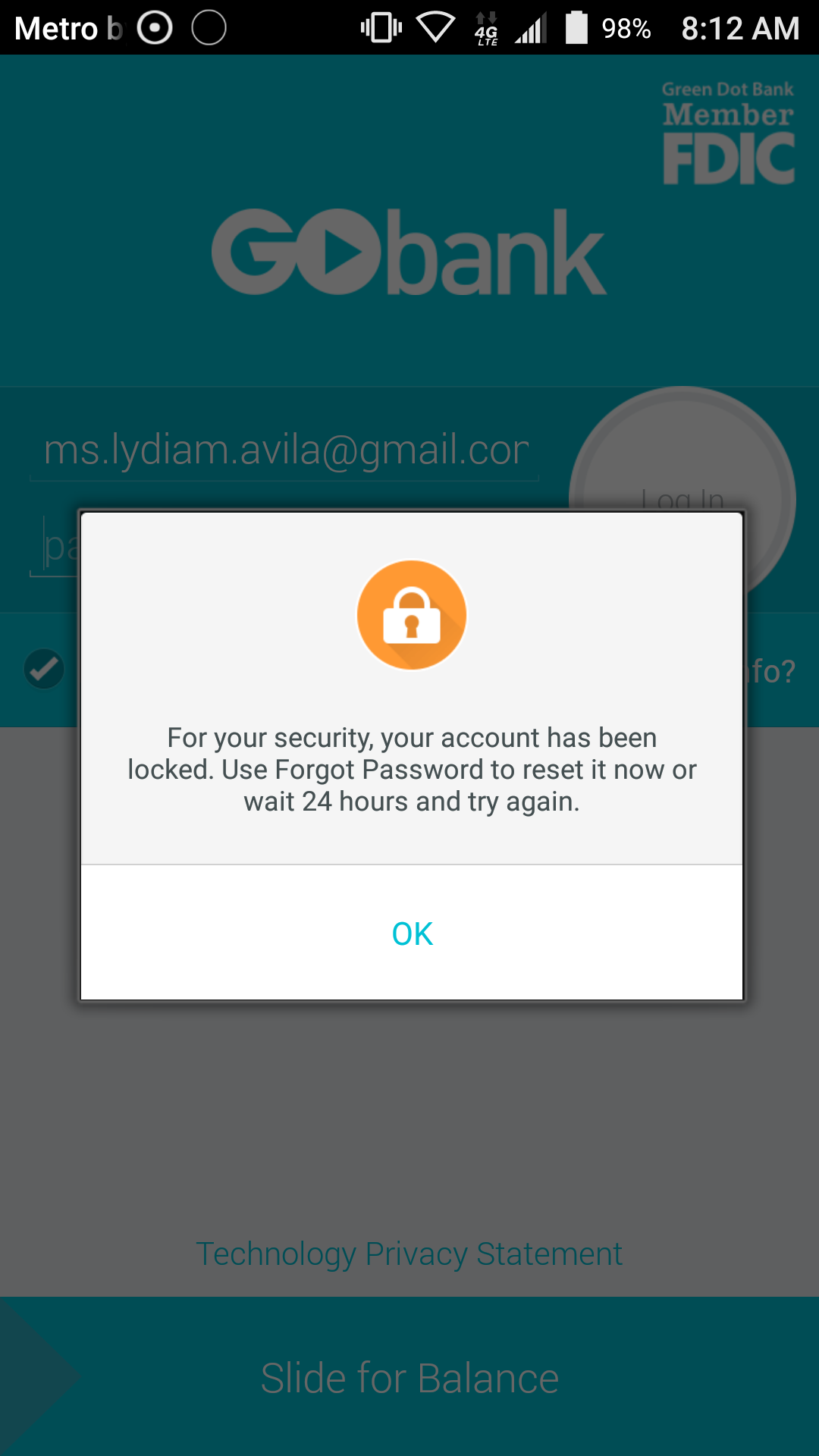

It is impossible to speak to a live person better yet an american that you can understand. And don't think they won't disconnect you when you ask for a manager or try to act like they are one and change there voice. I still have not seen my money and now I have recieved a notice on my phone my balance for the account which should be 500 since I don't have access to it is now 490. How can they take money from me when I haven't even had a chance to use it.

Then they tell you to get on line for free access to you account. When you go to there site you can't get to your account it take you to other sales deals and sends you to other sites when you try to access. This is crazy. When I get the card I am going to withdraw all my funds. But I am going to try something first. I'm going to try to go to the store and get a refund....

Wish me good luck...

Carri

Springfield, Missouri

U.S.A.

This report was posted on Ripoff Report on 10/30/2007 10:34 AM and is a permanent record located here: https://www.ripoffreport.com/reports/greendot/springfield-missouri-65803/greendot-they-are-stealing-money-from-people-and-not-allowing-access-to-money-that-is-depo-281861. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Greendot.com website now redirects to an "entertainment rewards Visa card"

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, January 21, 2008

Go figure.

Looks to me as though Greendot.com packed up or switched gears.

I would guess that the problem with the direct deposit not going through is that they are no longer in business.

I would suggest that anyone with any type of direct or autopay deposit to a greendot credit card stop any such payments immediately.

#1 Consumer Suggestion

Successful resolution with a Greendot problem -- how to work with a call center

AUTHOR: Dori - (U.S.A.)

SUBMITTED: Monday, January 21, 2008

I had a direct deposit going to my Greendot card for about ten weeks with no problem. All of a sudden starting with the first pay period of 2008, my deposit was rejected. I have a special perspective; I worked for two years at another bank's call center so I know something about how to work the call center maze.

I wound my way through the automated phone system to the option to speak with a person. This took more than half an hour -- it's hiding as Option 6, after the pleasant offer to return to the previous menu. Keep listening, you'll find it.

If you have trouble understanding an operator, ask for a supervisor. Be nice; it isn't easy on the operator's side either.

If the operator gives you an answer that's obviously nonsense or you don't understand the answer, ask for a supervisor.

If the operator keeps trying to take back ownership of the call, remain nice but be firm. Say clearly that you have asked to speak with a supervisor, you don't want to speak any more with the operator, please put you through to the supervisor, you will wait. Most call centers penalize first-line operators for not taking ownership of calls and brushing people off to supervisors. They also penalize the operators for "extended" call times, even though the operator has no way to control the complexity of the calls that come in. That was the single reason why I left my call center job (and another $5 per hour at my new job).

In my case, neither the operator nor the supervisor could tell me anything more than the deposit had been rejected. Why this had happened after many weeks of success, they couldn't say. They also could not confirm that the ADA and account numbers were correct -- for security reasons that information is not available to them. Print off and keep your original sign-up sheet!

I remained calm and repeatedly reminded the supervisor that my interest was as much to identify the problem as to get my money back. I knew it would come back, it just would take a few days.

Eventually a supervisor called me back (I'm told this almost never happens) to tell me she was very sorry but they had not been able to determine exactly why the deposit had been rejected. She offered to refund my monthly transaction fee. Too bad for me that the delay in getting access to my funds meant that I had to spend $26 at Western Union Quick Collect instead of $10 to pay two bills over the phone using the Greendot card, but what the heck.

My payroll department got the money back into their account with no indication of where it should go and to whom it should be returned. Yikes, more delay before I could get my replacement check, but I did eventually get it.

I reduced the amount of my direct deposit from $300 to $50 to test the system. This would be an inconvenience but not the disaster that the first rejection had been.

It wasn't in my account by Monday morning (it's supposed to be there on Thursday). I called Greendot. The first operator (very clearly native English speaking) said it had not been rejected, it had never been received and I should check with my payroll department. I asked immediately to speak to a supervisor because this was obviously (to me) a nonsense answer designed to get me off the line quickly.

I had to wait about ten minutes for a supervisor (not 40 minutes like the previous week) -- thank goodness I could keep working while I waited. She confirmed that the first operator's answer was incorrect; the deposit had again been rejected for "credit entry refused".

From my previous banking experience I knew to ask her to translate that reason into English for me. She had to put me on hold to answer it. It meant that the "transaction code" coming from my payroll bank was incorrect. I had to ask her to translate "transaction code". It means the code that tells the receiving bank's computer if this amount is a credit, a debit, or a pre-note (whatever _that_ is).

Okay. Although my payroll person was still swearing that nothing had changed in our system, maybe something changed at the bank level -- possibly at the start of the new calendar year. Stranger things have happened.

I could not get her to wrap around this idea to follow through with my employer's bank and she was getting agitated about how this was disrupting her workday. This of course is not Greendot's problem. It's also completely still possible that something happened on Greendot's side.

So I'm going to the next troubleshooting level -- cancelling this direct deposit, letting the card sit for a week or two without any deposits, then trying a new direct deposit with a small amount. And I think from now on I'll just use it like a little convenience account and not rely on it to work large amounts of money. I can get money orders at the grocery store (although those can have their own disaster stories).

The paranoid side of my brain says that it isn't in Greendot's interest for free direct deposits to work when they can collect $4.95 for every manual reload. But Mark Twain or somebody said we should not suspect intrigue when incompetence can be an adequate explanation (or words to that effect).

I have tried to clearly address my concern to Greendot that if the direct deposit worked okay for ten weeks and then suddenly was rejected with no reason for that rejection provided back to my payroll bank (and no audit path back to which account it should go back to), that's a big problem with their system and it deserves a very thorough investigation on their side. I'm a professional technical writer -- I'm usually pretty good at explaining complicated things at an understandable level. But they are locked into the simple explanation that my payer (employer) must have somehow changed something so that the transaction (type) code is not recognized by the receiving bank.

They were very nice and gave much more direct answers at my first call after I mentioned my willingness to send written complaints to the Consumer Protection Board and the Attorneys General of New York, Georgia, and California.

BTW, it took a lot of arm-twisting to get their home bank and home office info out of them on the phone and they never did give me a direct address or phone number for either one. This information is now available at their home page, I notice.

I'm not a Greendot employee, just a customer who had a problem who also has a few insights about how to work successfully with a call center. To be fair to Greendot, we consumers have to also do our part -- keep our records, stay calm, and work to actually solve problems instead of just beating up the call center people when we feel frustrated by system problems.

Advertisers above have met our

strict standards for business conduct.