Complaint Review: 5/3 Bank - Fifth Third Bank - Murfreesboro Tennessee

- 5/3 Bank - Fifth Third Bank 2927 South Rutherford Boulevard Murfreesboro, Tennessee United States of America

- Phone: 615) 848-2534

- Web:

- Category: Banks

5/3 Bank - Fifth Third Bank These people unjustly deducted $231 in overdraft fees. Stay away from Fifth Third Bank unless you want to get robbed blind! Murfreesboro, Tennessee

*Author of original report: Thanks everyone.

*Consumer Comment: I have to give RonnyG some major props...

*Consumer Comment: ***ALMOST 6 MILLION VIEWS***ALMOST 6,000,000 VIEWS***ALMOST 6 MILLION VIEWS***ALMOST 6 MILLION VIEWS***ALMOST 6 MILLION VIEWS***

*Consumer Comment: Don't depend on Obama, or this bank..

*General Comment: cant depend....

*Author of original report: I understand

*General Comment: to the author

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

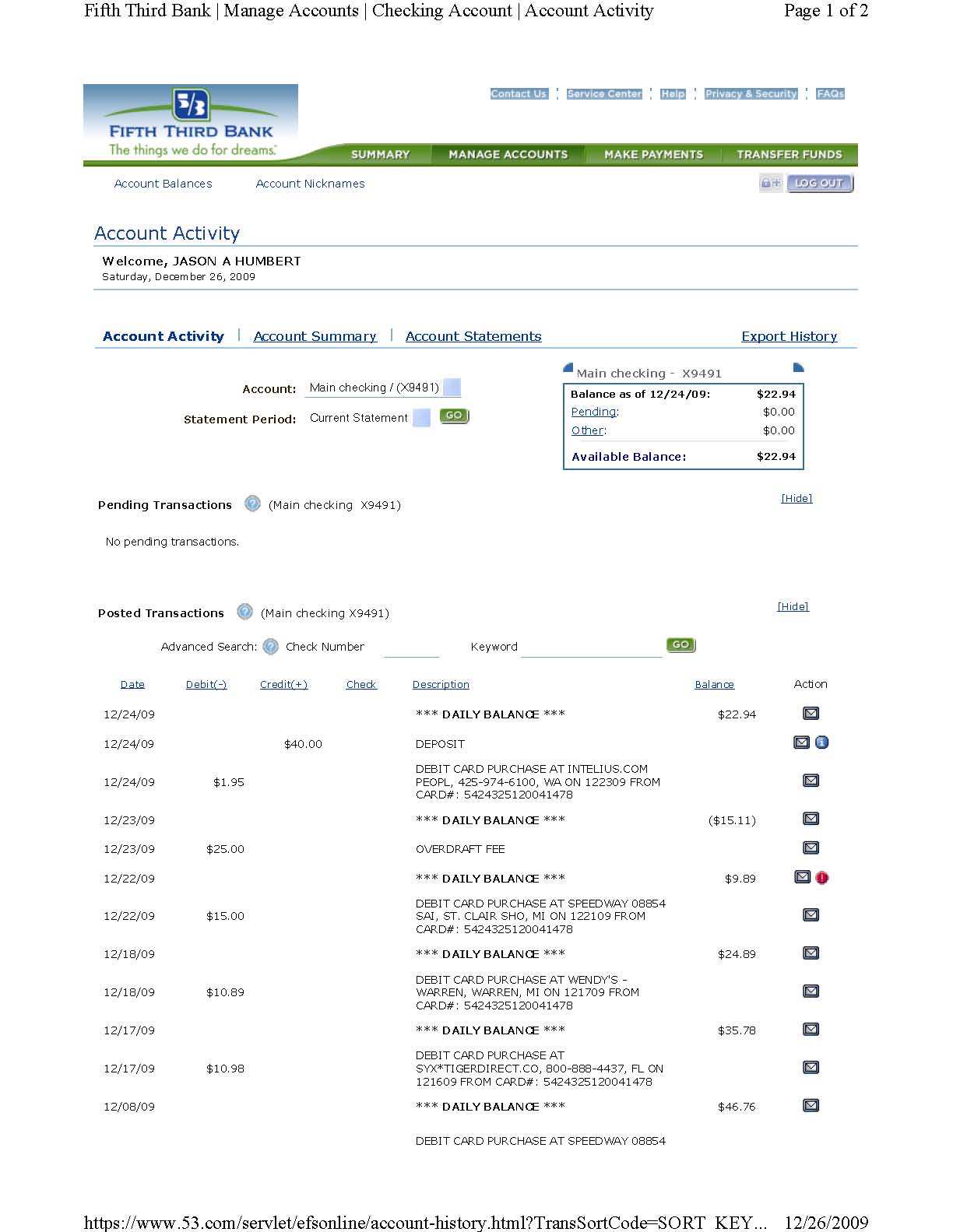

On May 18, 2010, I was charged $231 in overdraft fees for 7 transactions. This is completely unjust for a few reasons. Firstly, according to my balance online, I had $984. Secondly, they posted transactions before they posted a deposit made on May 17, 2010 which as we found out is their standard practice. Thirdly, they post the largest amount item first then trickle down to the smallest amount which to a rational person would reflect that they are trying to cause an item to be insufficient in funds so they can collect more fees. Their argument was that they do that so that customers can be ensured that their mortgage/car payments will be paid. What difference does it make when you are going to be hit with a service charge anyway? On May 17, 2010, we were showing a balance of $984 according to what was reflected online. We had the following items post that evening that incurred a charge of $33 each - $200 ATM withdrawal, $75 check, $29.50 debit, $15 debit, $4.95 debit, $2.20 debit, and another $2.20 debit. Afterwards, a deposit of $573 was posted. Does anyone besides me see that this appears crooked?!?

My husband and I printed out the statements and were told verbatim by a customer service rep that what we see on our screen does not reflect what they see on their screen?!? What?!? Should they not line up?!? This is my money we are talking about! Furthermore, my husband asked if he could cash the deposit before depositing into the account. It did not require verification - it was a refund from the state of North Carolina! But because of bank policy, they refused to do that. The check itself was actually for $773 but my husband took $200 out of it.

Irregardless, I have done bookkeeping for years and it does not take a bookkeeper or an accountant to see that a great injustice has been done to us. Their solution? If we opened up a savings account, they would credit back half the fees to our account! I had to agree because my son is a burn victim and I needed $50 to pay for his medicine.

I have never, I mean never, seen such banking practices. Posting transactions at midnight before deposits! Not reflecting the correct balances online. My advice to anyone who has an account watch out or take your money out and go somewhere else because if they did this to us, loyal customers of years, they will do it to you.

This report was posted on Ripoff Report on 05/20/2010 10:37 AM and is a permanent record located here: https://www.ripoffreport.com/reports/53-bank-fifth-third-bank/murfreesboro-tennessee-/53-bank-fifth-third-bank-these-people-unjustly-deducted-231-in-overdraft-fees-stay-a-605260. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Consumer Comment

I have to give RonnyG some major props...

AUTHOR: Truth Detector - (U.S.A.)

SUBMITTED: Saturday, May 22, 2010

Seriously...this isn't snark. What he posted is some really good advice:

Keep extra close watch on your spending, keep a register..DO NOT depend on the online statement, it is part of the SHAM...and opt out of overdraft coverage on the debit card. This way if the account is overdrawn due to human error, or an unknown or unauthorized merchant hold occurs which would not show up on your register..as well as a check that did not clear, the transaction will be declined at any point of sale, or an ATM withdrawal...maybe cause a bit of inconvenience or embarrassment..but you won't have to beg the bank for your sons medicine ever again.

Just be careful of any autopays or checks (I would consider burning the check book if i were you), since those fall under ACH rules, and can always be subject to fees unless the transaction is proved fraudulant.

If the bank refuses to allow you to opt out of the overdraft coverage on the debit card..they will have to soon by law..you will be getting a notice soon if you have not already.

I think we can all agree that banks have forever been trying to maximize profit via their policies of processing and posting transactions. Ronny, I never begrudged you that point. I think my bigger issue with you was your predilection toward blaming the bank for trying to make as much money as possible - when, in fact, that is an implicit goal of a bank.

However, in this post you have accomplished two things:

1. You have empathized with the OP, which is admirable. But you have also...

2. Provided EXCELLENT input to avoid the <sigh> "rip-off" in the future - including a clear and concise explanation of the consumer options and caveats beginning 8/15.

We have had, and will likely continue to have, disagreements on this issue, but I'm happy to give credit where credit is due.

Very well done.

#6 Author of original report

Thanks everyone.

AUTHOR: Tiffany - (United States of America)

SUBMITTED: Saturday, May 22, 2010

First I want to thank everyone very much for your responses and your helpful hints and support. It is very very much appreciated.

I have signed on with a community bank that has only four branches, not a corporate bank. They offer FREE overdraft protection, something Fifth Third never offered me, their overdraft fees are $25, not $33, and they post deposits FIRST before debits and checks at midnight. Also, they start with the lowest amounted transaction and work their way up to your highest amounted transaction when they do the deductions from your account.....if Fifth Third would have done this we would have incurred only one service charge, if any.

I live in a small town and this is a small town bank. They only have four branches. They are not big business and out to line the pockets of their higher ups so that they can support their Porsche and Jaguar payments.

My advice to those who have been ripped off like me is to either go to a small town bank (no corporates like Fifth Third, Bank of America, Suntrust, etc.) or a credit union. Credit unions are governed by a different body than banks and are usually more apt to give loans from my understanding. My brother, who is a veteran of the U.S. Marines, has been with one for years and has never had any problems getting a loan for anything even with bad credit.

I would go to a credit union but I do not have one locally. I would have to drive 30 minutes to get to the closest credit union here. The small town bank was my next best option as they are all people I know that work in there since everyone knows everyone here.

#5 Consumer Comment

***ALMOST 6 MILLION VIEWS***ALMOST 6,000,000 VIEWS***ALMOST 6 MILLION VIEWS***ALMOST 6 MILLION VIEWS***ALMOST 6 MILLION VIEWS***

AUTHOR: Karl - (USA)

SUBMITTED: Saturday, May 22, 2010

If you 'Google' this- YOUTUBE THE OBAMA DECEPTION, you can plainly see that it has almost 6 million views, correct?

#4 Consumer Comment

Don't depend on Obama, or this bank..

AUTHOR: Ronny g - (USA)

SUBMITTED: Friday, May 21, 2010

There is however a law going into effect beginning August 15th that will opt you out of overdraft coverage on the debit card.

What you were a victim of..is a calculated plan by the bank, to pillage you like this in the event of a mistake that caused you to overdraft...simple...

1) you depended on the online statement, which the bank does not tell you is unreliable when you open the account..they just promote the ease and safety of online banking..

2) they automatically enrolled you into overdraft protection with the DEBIT CARD..hence allowing them to charge you 33 dollars in the event of an overdraft for your 2 dollar purchase..when in all common sense, you would have preferred to have the transaction declined instead..correct? This would have saved you the fee..and gave you opportunity to figure out how the account is overdrafting.

3) They are re-ordering the times of your transaction by manipulating the transactions, and processing highest to lowest..which correct...can and does cause overdraft fees to be applied to transactions that actually had the funds available at the time of said transactions..a swindle at the very least..and many of the large banks are currently defendants in a class action lawsuit for conducting such robbery on their customers.

Now..ask the bank..which transaction did they think was for your mortgage? The $200 ATM withdrawal (yeah..we all pay our mortgage with cash..right?)..or maybe the $15.00 debit???, or could it have been the $4.95?..how would they know? They wouldn't..so they simply approved them all.

Easy way to prevent this. The reason this never happened to you before is two fold. Number one..you are probably having a tougher financial time and keeping a lower balance then ever before...and 2, the banks have been very sneaky the last few years.

Keep extra close watch on your spending, keep a register..DO NOT depend on the online statement, it is part of the SHAM...and opt out of overdraft coverage on the debit card. This way if the account is overdrawn due to human error, or an unknown or unauthorized merchant hold occurs which would not show up on your register..as well as a check that did not clear, the transaction will be declined at any point of sale, or an ATM withdrawal...maybe cause a bit of inconvenience or embarrassment..but you won't have to beg the bank for your sons medicine ever again.

Just be careful of any autopays or checks (I would consider burning the check book if i were you), since those fall under ACH rules, and can always be subject to fees unless the transaction is proved fraudulant.

If the bank refuses to allow you to opt out of the overdraft coverage on the debit card..they will have to soon by law..you will be getting a notice soon if you have not already.

Best of luck.

#3 General Comment

cant depend....

AUTHOR: Dino - (USA)

SUBMITTED: Friday, May 21, 2010

you can't depend on Obama. he just a silly kid who thinks he is the smarest guy in the room, wants everyone else to KNOW he is smartest guy in the room

that is what he cares about, he don't give a hickory nut about your plight

#2 Author of original report

I understand

AUTHOR: Tiffany - (United States of America)

SUBMITTED: Friday, May 21, 2010

Thank you for responding and your understanding. Unfortunately, we too live on a very tight budget. My husband has been out of work for a while and just got a job he starts next week. I have a very low income, it's not the same as it used to be. I went to a local bank, that is not part of a corporation today, and opened an account. Oh, and as an update, our fees have been increased another $297. They did credit back the $115 they promised, however the customer service rep lied when she said we would have $115 after our outstanding purchases we figured up posted. So now our account is negative $455! That is plain ludicrous. I thought Obama talked about putting a cap on these fees in with his bill to regulate credit card companies - when is that going to happen, ever? Or are we all going to sit back as hard-working Americans and do nothing and allow corporate America to keep getting richer? We're sure not profiting from the service charges! My husband's last check from a job he did have a while back will run through Fifth Third on Monday and they will get every cent of it in their fees so I hope their higher ups enjoy it when they take their kids to Aspen this summer!

#1 General Comment

to the author

AUTHOR: Bill d - (U.S.A.)

SUBMITTED: Friday, May 21, 2010

if your a bookkeeper and they were able to rob you--that is sad--most people that get robbed are those that live check to check and have 5$ left in there account before they get paid--here is what has happened to me many times--MANY F*ING TIMES--i have 5$ in my account on the 1st---on the 2nd--i spend 3$--on the 3rd i get paid direct deposit of all things--on the 5th i check online and see the deposit posted(350$)--on the 5th i use my atm/debit to spend 3$ here and 4$ there--on the the 6th i spend 5$ here and 10$ there---i look online on the 7th and find 4 overdraft fees totaling say 130$--why??--when looking online the information changed from the day before--when i looked online on the 5th it showed my deposit posted--now all of a sudden i look online on the 7th--i see the deposit posted on the 7th rendering the 4 transactions i made with my atm card on the 5th and 6th overdraft!!!!--the banks love to play with your dates--wehn you go to a branch and say what the f*--there screen does show something completely completely different than what you may have just saw online--in other words--the bank has 2 different records for your account--then you have your records--so all total--there is 3 different books for your account!!!!!!!!!!!!!!!!!!!!--you are not the only one this has happened to and this is not the only bank--this happened to me at suntrust and every f*ing week for months and months i was charged 4 overdraft fees-sometimes more---------here is tips to avoid this

#1--REDUCE YOUR TRANSACTIONS!!!!!!--i notice you said you had a debit here and there and there and here(totaling 4)---try not to use your debit cad for small purchases and use it to withdraw cash--use cash for purchases not debit-this will also drastically cut the number of transactions---THIS IS THE MOST IMPORTANT TIP!!!!!!!!!!!!!!!!!!!!

#2--live by the banks schedule---there was a time my monthly statements i got were 3 pages long from all the debit purchases---if you always use your debit--there will always be things pending!!!!--when things are always pending this is how they get you-even when you make a deposit to cover it---basically--i wait and have no account activity for many days-sometimes a week before i do anything else-why?--when i actually look online--my numbers now actually match my book--again with nothing pending

#3--minus more than you spend--to be on the extra safe side--i minus more than i spend---i go food shopping and use my debit card--the bill is 22$ i put down in my book i spent 25$----this seems drastic but this has helped and gives me a false cushion--every couple weeks or so--my bank will show i have more than my books--then i reflect the online balnce--if you have nothing pending and no checks out--this is no problem

in any case good luck to you--if you were a bookeeper that means you may have got paid a descent wage and don't live check o check unless you are a huge spender--you probably just made a mistake that the bank capitalised on----me--i have a low paying job and every week i would have 5$ sometimes less in my account at the end of the week until i got paid--this was due to normal expenses and spending a few dollars here and there------in any case--don't feel bad--your not the only one they f*ked----the way the world functions--as long as you got mother f*ers that want to buy that new 200ft yacht every year--they will continue to collect billions in overdrfat so a few can have millions in bonuses---you know-greedy people---and they only way to get rid of them is to kill one after the other after the other after the other--eventually they will realize greed doesn't pay---then there may be a few stragglers and it would be best to kill them 2!!!!!!!!!--but we don't do this in this world andi am not dictator so this story continues and every day the rich rob from the poor

Advertisers above have met our

strict standards for business conduct.