Complaint Review: Capital One Auto Finance - Plano Texas

- Capital One Auto Finance 3905 North Dallas Parkway Plano, Texas United States of America

- Phone: 18009460332

- Web:

- Category: Sales People

Capital One Auto Finance I bought a 2007 Ford Escape off the car lot for close to 24,000.00 but when Capital One Auto Finance got through charging finances the vehicle end up with a sticker price of 48,000.00, I mean seriousl Plano, Texas

*Consumer Comment: The LEGEND

*Consumer Comment: That's incorrect

*Consumer Comment: See

*Consumer Suggestion: Incorrect Reyna

*Consumer Comment: Depends on where you live

*Consumer Comment: To the employee

*UPDATE Employee: He needs advice, not to be made out to look bad

*Consumer Comment: Before you "tinker"

*General Comment: comment

*Consumer Comment: tipical for someone "HOLIER THAN THOUGH"

*Consumer Comment: Reyna.

*Consumer Comment: Advice

*Consumer Comment: We all know what you are Robert

*Consumer Comment: Can you say High Risk?

*Consumer Comment: Couple of Questions

*Consumer Comment: You don't understand..

*Consumer Comment: It's called the "cost of money"

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

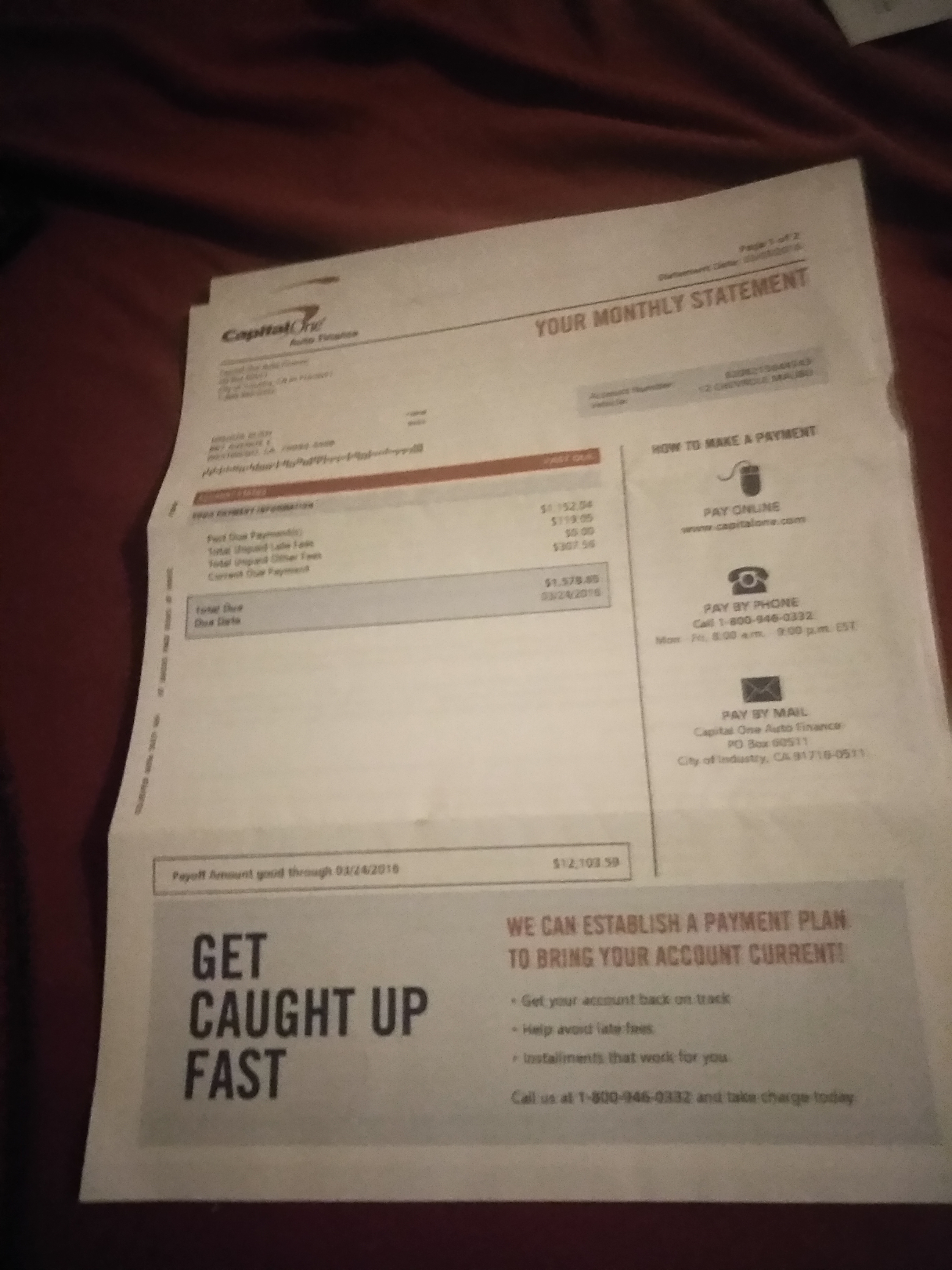

When I purchased a suv and the sticker price was close to 24,000.00 and when I got the papers on the finace charges I end up with a suv for 48,000.00 and I feel that I was rip off, the suv is a Ford Escape and really has nothing custom in it and it doesn't even have a cigarette lighter in it and its just the cheapest Escape you can buy, but being the most expensive vehicle I've ever purchased and now that I'm 279.15 arrears they sent me a notice of default and right to cure, at least I make payments and try and what about people who are 3 to 4 months behind and dont attempt to make payments, I mean wow people seriously is Capital One Auto Finance that hungry for money....

This report was posted on Ripoff Report on 03/30/2011 06:26 PM and is a permanent record located here: https://www.ripoffreport.com/reports/capital-one-auto-finance/plano-texas-750332/capital-one-auto-finance-i-bought-a-2007-ford-escape-off-the-car-lot-for-close-to-24000-712145. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#17 Consumer Comment

The LEGEND

AUTHOR: mr rik - (USA)

SUBMITTED: Monday, June 27, 2011

I know of a guy that bought a brand new car to drive around while he was workin on a "project".

Everybody noticed and envied him and he really took care of "his baby". He wouldn't even hot rod that car because he wanted to "break her in right".

Well one day "his baby" got stolen. He said he would've almost cried if he hadn't just finished "his project".

His project turned out to be even more of a head turner and purred like a wet kitten. Turned out he didn't even miss his baby any more.

Good thing because she turned up weeks later missing her engine, transmission and many other parts!

Legend has it he drove that car FOREVER and then the same story happened all over again! ;-)

Cap 1 employees fighting with shills? PRICELESS!

#16 Consumer Comment

That's incorrect

AUTHOR: shamrock - (United States of America)

SUBMITTED: Monday, June 27, 2011

In Texas a judgement is valid for TEN years, plus, it can be renewed indefinitely. Even worse, every time it's renewed for another 10, it will show up on your credit report again. Unless you declare bankruptcy and have the judgement discharged, it can (and often DOES) follow you for the rest of your life. The judgement will also continue to grow larger as interest is accrued.

As you pointed out, they cannot garnish your wages or seize any property that was not used as collateral for a consumer debt and I suppose there are many people that can get buy without a bank account. However, if you own deeded property, they can seize the funds if you ever sell that property or even block the sale altogether until the judgement is paid.

Attempting to transfer any deeded property to a party not named in the judgement is not an option either. 99.999999% of the time you WILL get caught and when you do, a civil judgement will be the least of your worries. Attempt to defraud is a felony.

Hanging on to any deeded property and avoid purchasing any new deeded property in your name for the rest of your life would solve your problems concerning the judgement, but you should tell any heirs you may have so they will know there's a good chance a claim will be filed on the estate so they don't get blindsided once you've departed.

#15 Consumer Comment

See

AUTHOR: mr rik - (USA)

SUBMITTED: Friday, June 10, 2011

See comment #10.

#14 Consumer Suggestion

Incorrect Reyna

AUTHOR: Robert - (USA)

SUBMITTED: Friday, June 10, 2011

You are mistaken. According to the Fair Credit Reporting Act, judgments may be reported on credit reports for the duration of the statute of limitations in the State of the court that granted the judgement.

Here's an example: I sue you in a New York court and I win a money judgment against you for $1000 and you do not satisfy the judgement. In NY State, the SOL for a money judgment is 20 years. This money judgement can remain on credit reports about you for 20 years from the date the court made the award.

You should brush up on the law before you make such general statements.

#13 Consumer Comment

Depends on where you live

AUTHOR: Reyna - (U.S.A.)

SUBMITTED: Friday, June 10, 2011

If you live in Texas, which thank God is a debtors state, there is not really much they can do if there is a balance left. Here they can only garnish your wages for Taxes and Child Support. They can go for your bank account, but with so many pre-paid cards that you can put your money on you can always close your bank account and then they can't touch your money. So if they get a judgement all it will do is ding your credit for 7 years then will be gone. I know there are other states like this hopefully this person lives in one, they need to check into it, if they do and the finance company isn't willing to work with them best thing is to let it go back, and if possible get another car financed before they take it and put it on their credit. Sonetimes what else is there to do when scumbag companies won't help when they know how the economy is these days.

#12 Consumer Comment

To the employee

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, June 10, 2011

Not once have I ever suggested that I work for Capital One. Not once have I ever suggested someone not talk to a finance company. Not once have I ever said they should "tinker" with a vehicle.

Yes of course people should talk to the finance company. But no matter how you want to put on the corporate "spin", if you don't pay eventually you are going to get your car reposessed. It doesn't matter what bank or finance company you are with. If that wasn't the case then the car would not be used as security for the loan.

You give a lot of generalizations that we don't know this person. Okay so please explain this. This person apparently talked to Capital One, has been paying "something"(we don't know what), and they were STILL sent a "Right to Cure" notice. Why? I thought you always try to work something out. It seems like someone else(above you?) at Capital One has said enough is enough.

Read through your agreement you obtained when you got the car. If you do not understand some of the wording or terms I encourage you to research those as a start.

- Great advise, but wouldn't it be better to understand what you are signing BEFORE you actually sign.

If this person did not understand the loan then help them, don't try and use your industry knowledge as a scare tactic.

- If this person didn't understand the loan then they shouldn't have got the loan in the first place. As for it being a "scare tactic". Remember this person looks like they did everything you said..they were paying, they were probably in contact with Capital One. Yet they still have a "Right to Cure" notice. So you tell me...

Is Reposession a "Scare Tactic" or a real possibility?

If they have a reposession on their record is higher interest rates a "Scare Tactic" or a real possibility?

If they get the car reposessed is still owing the deficency balance a "Scare Tactic" or a real possiblity?

These comments would be the same for any person posting the same information about any company not just Capital One. Also, I have had several different finance companies over the years, Capital One being one of them. During my time with them I didn't have any problems and if they had the best rate I would be open to going back to them at some point in the future.

#11 UPDATE Employee

He needs advice, not to be made out to look bad

AUTHOR: cap1employee - (Virgin Islands (US))

SUBMITTED: Friday, June 10, 2011

Sir or Ma'am,

There could be a lot of factors that go into your unfortunately common situation. I can certainly understand how it feels to struggle, especially in today's economy. The previous posts are correct about the $48k vs the $24k (if those are the correct figures), however, the $48k is more than likely what you pay for the vehicle if you were to make minimum payments for the agreed upon finance term length as opposed to paying more or extra sooner. Whether or not you understood the ramifications of your loan are moot at this point, that will not offer a solution to the dilemma now. If it is $24k for an Escape I am assuming it is new. I am sympathetic to your situation. I know how hard things are right now. It is hard to offer detailed advice without knowing everything but I can give you some positive advice. For one, that says something if you are at least trying to make payments and communicate with your loan company. You could try and avoid them or not communicate with them which is what a lot of people do. Trying to hide from it is a good way to make things worse. We are all people here...granted, Cap One Auto Finance is a business but it is not one that is unwilling to see if options are available. I believe the first thing that should be addressed is you and your situation. Were you injured or did you lose your employment? What other factors contribute to this? There may be a way to help. If none of those things have happened and you simply cannot afford the car then there are other routes to go as well. How long have you had the car and where did you get it? Read through your agreement you obtained when you got the car. If you do not understand some of the wording or terms I encourage you to research those as a start. Do not "tinker" with the vehicle, commit fraud, or try to avoid any Capital One phone calls or correspondence. Also, you should have received a welcome letter from Capital One by now that has info on how to create a profile and log on to your account. See if you can find any info that might be helpful to you. I encourage you to be proactive and communicate with Capital One. Keep in mind that they are people too. If you can call and be honest and positive you might be surprised. Repost to this if you have trouble locating this info or do not have a computer. A good phone # to start is 800 946 0332...if you have not called already. Explain what you are trying to do and you will be directed to the right place. We have not stayed in business by being unfair or unjust. Our best interest is to do the best job we can to help you...things are tough financially right now for everyone. Any great company will want to keep their customers for life. It sounds "cliche" but it is a relationship, ultimately.

For Robert who posted below...if you are a Capital One AF employee, and I hope you are not, you are one of the ones that gives us a bad name. Maybe you should think about how you would want to be treated next time instead of coming off like a condescending know-it-all. You do not know this person nor are you in any position to make any reference what he should consider as a purchase price for a next vehicle. I read what you wrote...nothing of use was offered. I certainly hope you do not treat everyone like that. If this person did not understand the loan then help them, don't try and use your industry knowledge as a scare tactic. What you have done on this public forum is misrepresent Capital One Auto Finance entirely, but done a good job of showing your character. I really hope you are not a Capital One employee. In the instance that you are, I strongly suggest that you start treating each customer as a person and not a name. Behind each name there is a real, live person with a family, problems, and is just trying to make it just like you and I. You probably would not have acted like that on the phone when things are monitored. If you cannot do your job with some courtesy, respect, and a genuine wish to help...then find another job. All you are doing is hurting other employees that try to do the best they can. Sure, vehicles do get repo'd. So do houses...which in a lot of cases can ruin ones future to an extent. Why don't you take that into some consideration? If you think that just because you are hiding behind a computer no one can find out who you are then you are wrong. So if you are a Capital One employee...take heart.

#10 Consumer Comment

Before you "tinker"

AUTHOR: mr rik - (USA)

SUBMITTED: Thursday, June 09, 2011

Check into your options for bankruptcy or becoming "judgment proof"- this will help you avoid the contingency thing. Also make sure the tinkering most likely makes the car undriveable.

Or

You are probably paying for "full coverage" insurance anyway, be a real shame the thing got totalled or stolen. (or even parted out for some extra cash)

#9 General Comment

comment

AUTHOR: axxx - (United States of America)

SUBMITTED: Thursday, June 09, 2011

The reason not to "tinker" with it is called "Deficiency Balance." That is the amount of money you still owe the lender after they take the vehicle back, sell it, and apply the money from the sale to the amount you owe. They can sue you to recover the deficiency balance. If you destroy the car, the deficiency balance will be higher. Also, if you really think that anyone at a huge bank like CapOne is going to stay up at night crying because you messed up the car you are fooling yourself. No one will care, all they will do is hit you with a huge bill that will follow you around for years and ensure that no one will lend to you any time soon. If you actually have any assets they can sue you, they may even be able to garnish your wages. Also, depending on what you do when you "tinker" you might want to keep in mind that the CEO of CAP one is not going to be driving your used truck, and is not going to take it home on the weekend and fix it. They will sell it at an auction to someone who needs a car or to a dealer. If the buyer is unaware of what you did, and what you do causes a safety hazard you could hurt someone who had nothing to do with your situation. If you knowingly and purposely sabatoge a vehicle and someone gets hurt, you mighth be (and should be in my opinion) charged with a crime.

#8 Consumer Comment

tipical for someone "HOLIER THAN THOUGH"

AUTHOR: Reyna - (U.S.A.)

SUBMITTED: Wednesday, June 08, 2011

if they want it back why not "TINKER" with it let them get what they get.

#7 Consumer Comment

Reyna.

AUTHOR: Flynrider - (USA)

SUBMITTED: Tuesday, June 07, 2011

Did Robert post any information that was incorrect? If so, please point it out.

The OP of this post is obviously clueless as to the basic principles of auto finance. Of course Capital One is "money hungry". They are in the business of collecting interest on the money they lend. It is their reason for existence. No rocket science required to figure that out.

I would think that the OP might find the information in Robert's post to be very enlightening. I think you, on the other hand, would just like to make the OP feel better about his troubles with the big, bad bank. While that is compassionate, it will not help the OP the next time he is faced with a decision about auto finance (with any lender). The info that Robert provided will.

#6 Consumer Comment

Advice

AUTHOR: mr rik - (USA)

SUBMITTED: Tuesday, June 07, 2011

-" is Capital One Auto Finance that hungry for money.."

Yes VERY HUNGRY, they're probably the HUNGRIEST!

Just think of all that money you can SAVE if you default on this overpriced deal. You can probably pay cash for a BETTER VEHICLE.

Also make sure to "tinker" with the vehicle before it goes back.

#5 Consumer Comment

We all know what you are Robert

AUTHOR: Reyna - (U.S.A.)

SUBMITTED: Tuesday, June 07, 2011

Seems funny you have all this time to post on these boards and tell everyone they are wrong and the BIG MONEY HUNGREY s****.>

#4 Consumer Comment

Can you say High Risk?

AUTHOR: Tcm - (U.S.A.)

SUBMITTED: Monday, April 11, 2011

You choose to finance your vehicle. Based on the information you have given you have a very high interest rate. You decided to sign the contract for this very high doller loan and high interest rate. Now you say that was a rip off? If I have a 1969 VW and say I want 50 thousand for it and if you want to make payments that will come to 100 thousand if you still choose to buy it I didn't rip you off you had all the info and choose to get the vehicle anyway. So not not a rip off. If you are past due they sent you a notice of default and intend to repo your vehicle I'm guessing that your very high risk. People who are 3 or 4 payments past due could also be losing their vehicle or possibly they are much lower risk. There is all sorts of data that companies look at before they make a loan and when they decide to recover a vehicle. You didn't say but how many payments have you made to them? how many have been late? By the way every company in business is hungry for money thats why the are a business and not a charity (or your family). They loan it because they expect you to pay if back ...On time.

#3 Consumer Comment

Couple of Questions

AUTHOR: Cory - (U.S.A.)

SUBMITTED: Thursday, March 31, 2011

On the "papers", what is the interest rate, how long do you have to pay the monthly payments, either in months or years and what is your monthly payment?

#2 Consumer Comment

You don't understand..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, March 31, 2011

Apparently you not only don't know how car financing works, you don't understand the legal obligation you agreed to and the actions they can take if you don't pay.

First of all when ever you finance a vehicle you pay what is known as interest. This is what the bank or fianance company charges you to borrow their money. When you saw the total amount of the vehicle in the papers you could have gotten up and walked away if you didn't like it.

As for being in arrears. It does not matter if you are $2.79 in arrears, $279.15 in arrears or $2791.50 in arrears..you are delinquent. The finance company has every right, because the vehicle is security for the loan, to reposess it. Some companies will reposess it if you are only a few days delinquent, others may wait 2-3 months. I do not think there is a single company that will let you go 4 or more months.

As for Capital One being "money hungry"...you have $24,000 of THEIR money and are not fullfilling your legal obligation to pay it back. Perhaps next time you go to buy a car you may want to to look for one a bit cheaper.

Of course if(when) this car does get reposessed, if you thought the amount of interest you are paying for this car was bad. Just wait until you try and get another one with a reposession on your credit report.

#1 Consumer Comment

It's called the "cost of money"

AUTHOR: MovingForward - (United States of America)

SUBMITTED: Thursday, March 31, 2011

You are confusing the two transactions: the cost of the vehicle and the cost of the money. When you bought the SUV, you agreed to pay $24,000 for the vehicle. That price is what you would pay if you paid cash.

Because you chose not to pay cash for the vehicle, but to borrow the funds from a third party, you signed a contract agreeing to the repayment terms. The third party, Capital One Auto Finance, charged you based upon the risk factor your financials represented at the time you made application; and, frankly, based on the most that they could get away with on the vehicle purchase. You could have shopped the financing with various lenders before you purchased the vehicle. You didn't do that. You accepted their terms the moment you signed the financing contract. The time to have negotiated the interest rate and terms (a/k/a 'cost of money') was before you signed.

As long as you continue to look at the purchase of a vehicle as a single transaction, you will be duped into paying more for the vehicle AND more for the money to purchase the vehicle than you planned. Shop for the money first, then buy the vehicle.

Advertisers above have met our

strict standards for business conduct.