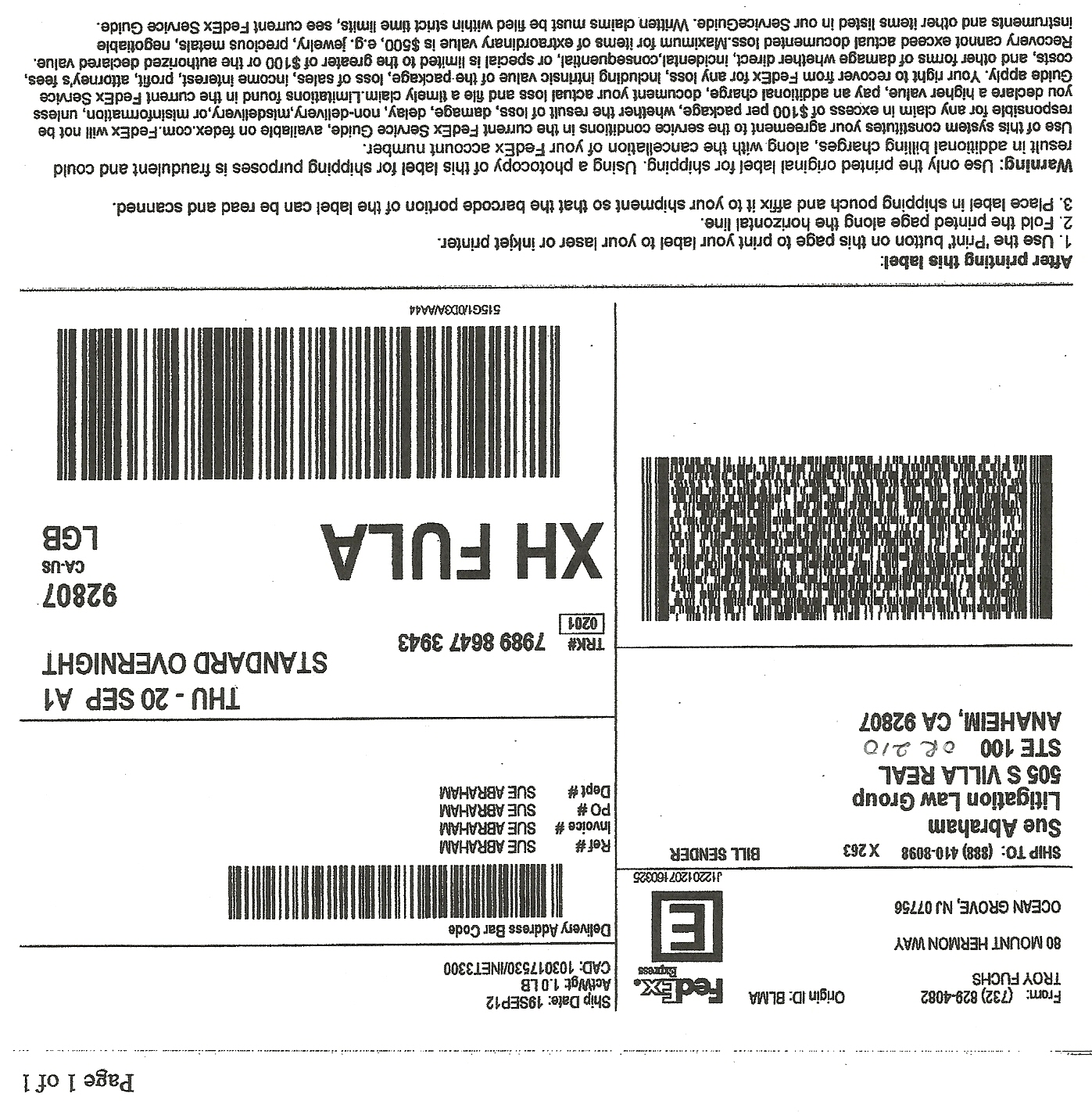

Complaint Review: LITIGATION LAW GROUP - ANAHEIM California

- LITIGATION LAW GROUP 505 S VILLA REAL DR #210 ANAHEIM, California United States of America

- Phone: 866-404-4141

- Web:

- Category: Financial Services

LITIGATION LAW GROUP HUGO VARGES SCAM PROMISED LOAN MOD 4 MONTHS IN ARREARS AND NOBODY RETURNS CALLS ANAHEIM, California

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Received letter for HAMP benefits for loan modification. Paid Litigation Law Group $3,500 to work with my current mortgage company on a loan modification. Agreement signed by me on October 19, 2012 and on January 3, 2013, my mortgage has not been modified. Agreement signed by me also has the name of Bruce Weiner, Attorney at Law as the bottom. I never received a signed copy of the agreement.

At the 2nd month into the process current mortgage company sent me Intent to Foreclose Letter. I was told not to worry by Hugo Varges. After all money was received by LLG a woman named Maan was then assigned to me to work solely along with me. I attempted to contact Maan and was told by her that Ms. Greene was now processing my application. After 3 months of waiting to get information from Litigation Law Group I spoke to Abigail (supposedly a supervisor) who stated she would contact Wells Fargo. Abigail gave me her direct line 888-232-7110 Ext 101 which goes directly to a busy signal.

Now this is the 4th month mortgage due on the first of the month and nothing has been done. There is no weekly updates as stated in their bogus contract that they send you. Read small print...."its attorney(s), has no obligation to client to file any legal action to stop a foreclosure trustee sale or regarding any legal action .....in working on clients file from inception through conclusion of clients file. " Litigation Law Group and/or their staff do hereby make no offer or representation that a lower mortgage payment and/or balance is guaranteed. "

Your current mortgage company does not have to accept their offer.

Called on January 3, 2013 and receptionist said my account is now with Luis Casile. Mr. Casile was of course busy with someone and could not speak with me. I left a voice mail and shockingly no return call. This is #4 or #5 which has handled my file!

This company does not guarantee anything. This Loan Modification is a total scam and a fraud. Do NOT WASTE YOUR MONEY, ATTEMPT TO WORK WITH YOUR MORTGAGE COMPANY!!!! See attached Senate Bill No 94...they should not collect money prior to work performed.

The State Bar of California

Senate Bill No. 94: Prohibition on Advance Fees; and Required Notice

FAQs

The State Bar of California continues to receive questions regarding the scope and applicability of Senate Bill 94 (SB 94), which took effect October 11, 2009 and prohibits attorneys from charging or collecting legal fees for loan modification services prior to the completion of those services. The following is a summary of the law enacted with the passage of SB 94 and a discussion of some frequently asked questions regarding the impact of the law.

This writing addresses only California attorneys, not any other licensee involved in assisting clients with loan modifications such as real estate agents and brokers.

Summary of the Law

On October 11, 2009, the following code provisions, referred to collectively as SB 94, became effective:

California Civil Code, section 2944.6(a) providing that any person who offers to negotiate, arrange or perform a mortgage loan modification or forbearance in exchange for a fee paid by the borrower, shall provide the borrower, prior to entering into a fee agreement, a separate statement advising the borrower of various points including the fact that it is not necessary to pay a third party to arrange for a modification or forbearance and that the United States Department of Housing and Urban Development provides a list of non-profit organizations that provide assistance to borrowers at no cost.

California Civil Code, section 2944.7(a)(1) providing that it shall be unlawful for any person who offers to negotiate, arrange or perform a mortgage loan modification or forbearance in exchange for a fee paid by the borrower, to claim, demand, charge, collect or receive any compensation until after the person has fully performed each and every service the person contracted to perform or represented that he or she would perform.

Section 2944.7(a)(2) prohibiting the taking of any wage assignment, lien or other security to secure the payment of compensation.

Section 2944.7(a)(3) prohibiting the taking of any power of attorney from the borrower for any purpose.

Section 2944.7(d) and (e) providing that the section applies only to mortgages and deeds of trust secured by residential real property containing four or fewer dwelling units and that it expires on January 1, 2013.

California Business and Professions Code, section 6106.3, providing that a violation of Civil Code sections 2944.6 or 2944.7 by a member of the State Bar of California constitutes a cause for the imposition of discipline.

Questions

1. Does SB 94 apply to contracts or fee agreements entered into prior to October 11, 2009?

No. The law is not retroactive. Advanced fees paid to an attorney prior to October 11, 2009 are not affected by SB 94.

2. May an attorney accept an advance fee if the borrower agrees to waive the application of SB 94 to their matter?

No. SB 94 does not provide for a waiver of its application by the borrower.

3. May an attorney accept an advance fee if he or she places the fee in a Client Trust Account or escrow account until such time as he or she has completed all contracted services?

No. The language of Civil Code section 2944.7(a)(1) is sufficiently broad and prohibits the collection or receipt of any fee for loan modification services prior to the completion of all contracted services.

4. May an attorney accept an advance fee if he or she offers a full refund of the fee if a loan modification is not granted?

No. Again, the language of Civil Code section 2944.7(a)(1) is sufficiently broad and prohibits the collection of any fee for loan modification services prior to the completion of all contracted services.

5. May an attorney who provides a borrower loan modification or other forbearance services agree with the borrower that the services requested will be broken down into component parts and that a fee for each component part will be earned and collected as each part is completed?

If an attorney has been employed by a borrower to assist the borrower in obtaining a loan modification or forbearance, then the answer is "no." It is a violation of SB 94 to attempt to obtain a payment for any portion of the services contracted for in pursuit of the modification or forbearance prior to the completion of all the services required by the employment contract.

6. If the services to be provided are in fact loan modification services or other forbearance services, or are an integral part of such services, but the services are not expressly designated as "loan modification" services in the fee agreement, then does SB 94 apply?

Yes. SB 94 would apply even if the services are labeled as something other than loan modification services.

7. May an attorney, who has complied with SB 94, accept payment for loan modification services he or she has provided if the lending institution denies the modification or forbearance?

Yes. An attorney may accept payment once he or she has completed all loan modification services he or she contracted to perform. SB 94 does not mandate that an attorneys entitlement to a fee is contingent on a lending institutions agreement to grant a modification or forbearance.

8. Does SB 94 apply to circumstances where an attorney who represents a borrower in a civil action against a lending institution (for example, alleging that the lender engaged in predatory or unlawful loan practices) receives an offer from the defendant to settle the civil action by granting the borrower a loan modification?

No. SB 94 applies only to employment contracts which are entered into for the purpose of obtaining a loan modification or forbearance for a borrower. If the genuine purpose and goal of an employment contract is to pursue remedies other than a loan modification or forbearance, SB 94 does not apply.

9. Does SB 94 apply to an attorney who has been employed to enforce an existing loan modification agreement?

No. SB 94 applies only to employment contracts which are entered into for the purpose of obtaining a loan modification or forbearance for a borrower.

10. How do the Federal Trade Commissions rules on mortgage assistance relief services (16 Code of Federal Regulations Section 322.1) apply to lawyers who provide loan modification or other forbearance services in California?

The Federal Trade Commissions rules on mortgage assistance relief services also regulate the provision of loan modification and other forbearance services in California but an exemption is included for attorneys who meet certain criteria. The criteria include compliance with all state laws and regulations relating to mortgage relief assistance. Therefore, the FTC rules require compliance with SB 94 and an attorney who fails to comply with SB 94 would be subject to the penalties provided

This report was posted on Ripoff Report on 01/03/2013 05:48 PM and is a permanent record located here: https://www.ripoffreport.com/reports/litigation-law-group/anaheim-california-08742/litigation-law-group-hugo-varges-scam-promised-loan-mod-4-months-in-arrears-and-nobody-ret-990899. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.