Complaint Review: 5/3 Bank - Fifth Third Bank - Internet

- 5/3 Bank - Fifth Third Bank www.53.com Internet United States of America

- Phone:

- Web:

- Category: Banks

5/3 Bank - Fifth Third Bank Overdraft, Vendictive, Wrong Fees, Reappearing Fees, Pick and Choose, Bad Service Murfreesboro, Tennessee

*Consumer Comment: They are Preditors Period!

*Consumer Comment: Ashley, I AGREE with you...to a point

*Consumer Comment: It IS protection

*Consumer Comment: But Jim..what is overdraft protection for then??

*Consumer Comment: Overdrafting is not Borrowing

*Consumer Suggestion: Solution

*General Comment: Predatory practices?

*UPDATE EX-employee responds: Employee Fees are not reversed

* : That bank is HORRIBLE..

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Hello, I am writing this report, not to file a suit, just to inform people about how confusing and vendictive this bank can get if you overdraft by as little as .01. I have read reports on this site as well as others, heard horror stories, and I agree that alot of these charges can be justified, however I was shocked when I looked at my account and it was charged to what seemed to be an unlawful amount of interest for using a debit card. I am a college student helping take care of my pregnant fiance' and a 5 year old and they showed absolutely 0 concern. Please take the time to read this report.

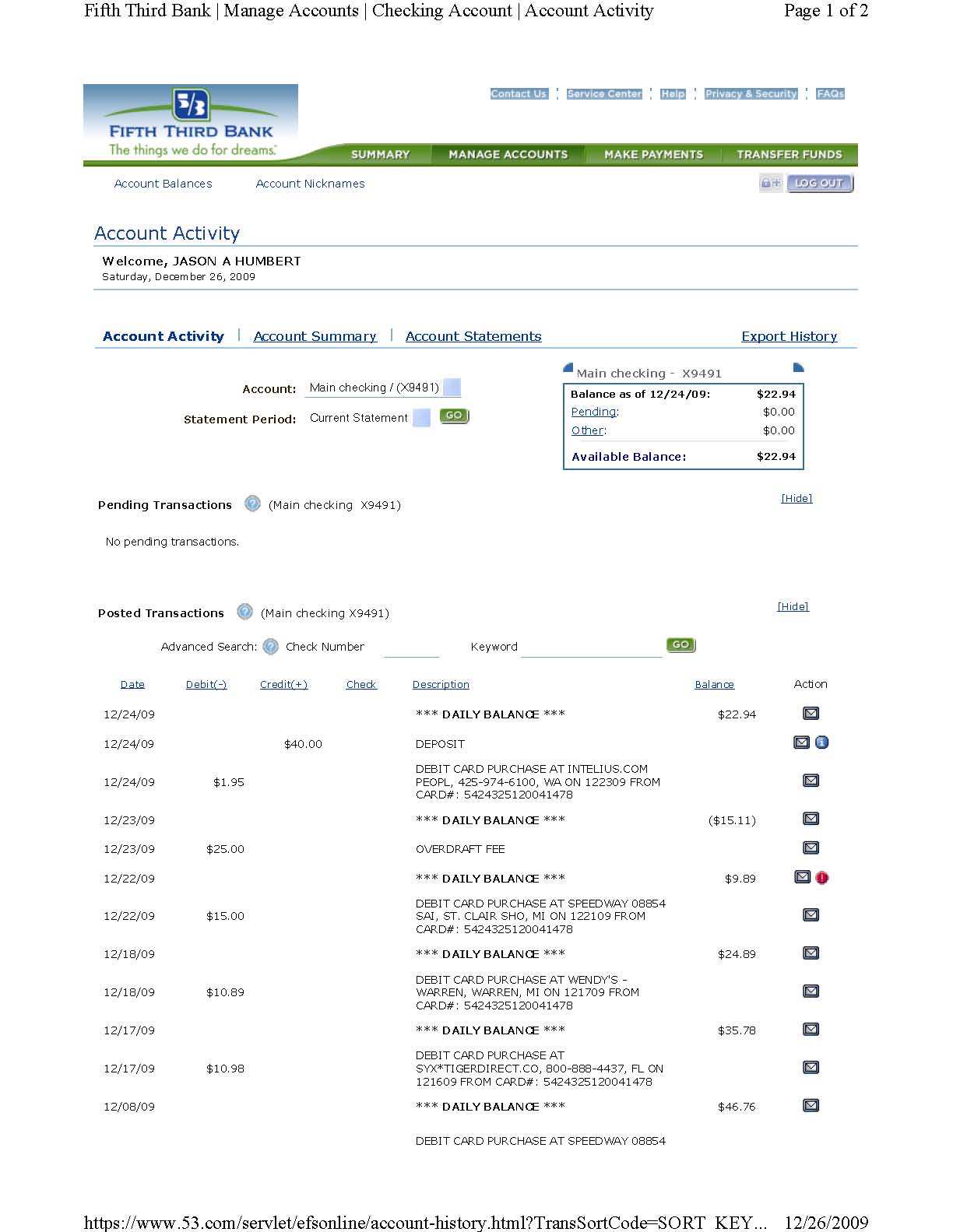

The first time this occured, I recieved a phone call stating that I had overdrawn in the amount of 0.29 and that I needed to make a deposit. I was ok with this and even though it was time to pay bills, I went and deposited my check to cover the 0.29 and the HUGE 37.00 overdraft charge, but boy was I mistaken. I came to find the next day that I was charged 185.00 in overdraft charges for going over 0.29 in my account. I can understand paying a fee for the one charge that caused me to go in the negative by 0.29, but they charged me for every transaction that went through that day! When I inquired about this 185.00 charge, they simply said that they take every charge that was made in that day and if it is overdrawn, they charge you for each individual card swipe. 185.00 on a .29 overdraft? I understand that when you do not have the money, it's like you are "borrowing" from the bank, but that is almost 1,000% interest! Didn't we make the loan shark business illegal quite some time ago? This kind of profit is insane for ANY company. I went into the branch office to try to talk to someone about it and noone would help me. I informed them I had a young family and asked for some kind of mercy and they told me NO. I had deposited everything I had and was still negaive 54.19. They told me to open a savings account so that I would have money to transfer over. That wouldnt stop the overdraft system they have, that would just insure them of the money they would get in the event.

I know for a fact people have had overdraft fees waived numerous times. I know one person that has proof that HER fees were reversed NUMEROUS times, but mine couldn't when I needed it the most? I guarantee every employee they have gets a free pass if they were to overdraft by less than a dollar! So how is it this paticular bank is going to withold such a standard with this policy, yet pick and choose who they help out? It just isn't right!

So back to my account luckily, and I mean LUCKILY, we came up with the money to save my account and put it in good standing. After it was all said and done, I had paid close to 300.00 in fees for 29 cents. I was in the good for about a week when 2 charges appeared out of nowhere with yesterdays date and caused me to overdraft AGAIN by .92. This overdraft was caused by 2 things. One was the 2 charges to a video store that just appeared after having the money in the account for 5 days. The other thing that caused this was a "pending" charge. That's right, they see your pending charges the same way they do the ones that have already went through. I went and made a cash deposit today, which you would think would have posted immediately, however they are still going to charge me a 37.00 charge for the "pending" charge and possibly, as it has went in the past, a charge for every transaction I made yesterday. There were 9 of them.

Thats where these magical charges come into play. When I asked about these, I found that they were charges that hadn't showed up yet. Why didn't they take these charges as soon as my account was right? It's almost like they waited until I had so much activity in one day before they put them through.

In closing, I would just like to say that I am closing my account with 5/3 and I just want to inform all other students, parents, and professionals what they are actually getting into before they find out the hard way. I am going to contact every media source I can about this and welcome your feedback as well.

This report was posted on Ripoff Report on 08/18/2009 09:46 PM and is a permanent record located here: https://www.ripoffreport.com/reports/53-bank-fifth-third-bank/internet/53-bank-fifth-third-bank-overdraft-vendictive-wrong-fees-reappearing-fees-pick-and-482118. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#9 Consumer Comment

They are Preditors Period!

AUTHOR: Regina79 - (United States of America)

SUBMITTED: Thursday, December 10, 2009

For fiscal year 2007, Fifth Third reported revenues of $8.49 billion and net income of $1.07 billion.

Under Fifth Thirds overdraft protection plan, each time the service is activated a fee is charged to the customers checking account.The bank also imposes overdraft charges of $33 per overdraft even though industry sources report that the actual cost to process overdraft checks is only 50 cents to $1 per check. It is reasonable to infer that the cost of processing overdraft debit card charges is even less.

It's Preditory Practices

#8 Consumer Comment

Ashley, I AGREE with you...to a point

AUTHOR: Ronny g - (USA)

SUBMITTED: Friday, September 25, 2009

Okay..so we can all go back and forth with word games, hypotheticals..examples and always find a contradiction or a defense..or possible scenario..kind of part of the problem actually..nothing seems to make sense to everyone..but it is what we have to work with for now.

From your response.. we may conclude that the only way overdraft protection has potential to protect anyone..is if a check was to bounce..and the bank would cover it. I can understand that, and...the SOLUTION according to you is to take away the debit card from consistent overdrafters.

But what about all the reports here where the poster was not a "consistent" overdrafter?? What about them? Seems the banks themselves are prepared to make some changes soon..care to explain why? Not that I will agree..but I just wonder about your feelings on this.

#7 Consumer Comment

It IS protection

AUTHOR: Ashley - (U.S.A.)

SUBMITTED: Friday, September 25, 2009

It doesnt mean as much in this day of debit cards, but if you actually wrote a paper check and it overdrafted, the bank would cover the check instead of bouncing it. If they bounced the check, you would owe the bank a fee fee for writing a bad check AND you would owe the merchant for writing a bad check, PLUS you could face criminal charges.

#6 Consumer Comment

But Jim..what is overdraft protection for then??

AUTHOR: Ronny g - (USA)

SUBMITTED: Thursday, September 24, 2009

Jim..you stated...

"Borrowing is an act which involves permission."

Does the bank not imply we have permission to overdraft if they offer a "service" (mandatory at some banks) that supposedly provides "protection" from overdrafting? Hence they so eloquently call this service "overdraft protection"..and charge a "fee" for the service?

According to the way you described it here...it is implied that an overdraft is a form of theft, a crime if you will..and the "fee" is actually a penalty. Can you explain?, I just don't understand..perhaps I need to go back to school?

It seems crystal clear to me the bank highly encourages this form of "protection" by including it as standard with our checking account...often referring to it as a "courtesy" (you've heard the one before..right Jim?), and often requiring us to enroll in this service without due notice or choice..or asked if we choose to sign up for it?

Wow..imagine that?..the bank encouraging us to commit theft..why do they do that Jim?

The way I see it..they are fully aware many of their customers can incur an overdraft..as a "courtesy they cover it", press no theft charges against said customer..and cover then overdraft (which seems to be a "loan" does it not?), and charge the fee accordingly as per our agreement with the bank...am I not understanding how this works? Explain if I am not please? Thank you.

Personally I put ALLLLLLLLLLL let me say it again...ALL the blame on the bank..and I will tell you why...for calling it "overdraft protection" in the first place. It is as misleading as when they use the term "available funds" on our statement. Fortunately change IS coming as you notice...because words like "protection" and "available" have pretty easy to comprehend definitions.

So in closing Jim I ask you..if the bank uses the term "overdraft protection"..and the overdraft is allowed to occur regardless..and all the associated additional fees caused by an overdraft..what did it protect, and how? Did it actually protect from overdrafting in any way shape or form as implied by the terminology?

That is all.

#5 Consumer Comment

Overdrafting is not Borrowing

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Thursday, September 24, 2009

Borrowing is an act which involves permission. Borrowing without permission is known as stealing. That's what overdrafting is. Moreover, the fee of $36 is a penalty for stealing - sort of like when you run a red light, you're assessed a penalty for breaking the law. Before anyone jumps in and says OD and breaking the law are not the same; for banking purposes - they are.

Since overdrafts are based on pending charges, all of this that you describe is correct...Moreover, these charges didn't come out of nowhere - you clearly indicate these debits to your account are yours and you knew where they came from.

Changing banks is up to you. Just know all banks, when it comes to what you're talking about, are all the same. I encourage you to look up any of the large banks on ROR - go ahead and do it. You'll find the same practices, the same reports, and the same complaints. Keep your mind open to the likelihood that this one is on you.

#4 Consumer Suggestion

Solution

AUTHOR: Marcia - (U.S.A.)

SUBMITTED: Thursday, September 24, 2009

Yesterday, it was announced on the news that BOA and Chase are going to stop charging overdraft fees for amounts under $5 or $10. YAY!!!

#3 General Comment

Predatory practices?

AUTHOR: Inspector - (USA)

SUBMITTED: Thursday, September 24, 2009

"I understand that when you do not have the money, it's like you are "borrowing" from the bank" Um, I don't think that is how the bank sees it. When you take money from the bank without prior approval, it is theft not borrowing, and the fees are penalties.

At least that is how I understand it.

#2 UPDATE EX-employee responds

Employee Fees are not reversed

AUTHOR: anonymous - (USA)

SUBMITTED: Wednesday, September 23, 2009

I want to say as an ex employee, we DO NOT get our fees reversed, if anything they are harder on us than they are regular customers. I was charged fees for a bank error and the employee number that we have to call would not reverse my fees, they told me I had to go to my regional manager, who refused to reverse my fees as well. So, as an ex employee trust me they rip off the employees also. There is a "guideline" for overdraft fee reversals that the bank wrote for employees to follow if it is not a bank error, but if the owning branch is not within their % of fee reversals they cannot reverse the fees, without possibly getting in trouble, even IF the customer falls within the guidelines. So I don't blame anyone for closing their accounts, because I will be.

#1

That bank is HORRIBLE..

AUTHOR: Ronny g - (U.S.A.)

SUBMITTED: Thursday, August 20, 2009

Yes..you overdrafted..but for 29 cents they can't cut you a break?? You see the thing is someone like you is a prime target for their predatory practices.. a student..probably living paycheck to paycheck..just making ends meet and no savings account there. I bet they have some kind of notification on their computer system that flashes a red light.."we got a live one here!" The only way the bank can really profit off a consumer like you..is if you overdraft..and the way some banks have set it up..ONE legitimate overdraft..like you said even .01..will wipe your account clean. And trust me when I say..the bank will make it as easy as possible for you to overdraft for that very reason..more on that later.

I won't dwell on the obvious which is you need to watch the spending if you are cutting it that close..and now you are well aware of what a SINGLE overdraft can cost you and your family..but you must be aware many of the big banks..and some smaller ones as well are now doing the same thing. You might want to consider a credit union...ask around you will see there are plenty that do not practice the transaction "manipulation" and re sequencing..give you one overdraft 'forgivness' per month..charge a reasonable fee in the event you do overdraft..instant reimbusment of ANY ATM fees...you know..NOT a ripoff like most of these banks.

With this said..you should still try to get some of those funds back...speak to the bank manager..keep calling and asking for supervisors...stay at it..you may get some back. I got all mine back but it was a time consuming. You also have to try to be nice and not get too defensive..it seems regardless what anyone tells you..almost anyone at the bank can make the decision to refund any or all of the fees..but I had to work up to the manager.

As well I know you stated you did not write here to file a suit..but there is a law firm we are working with that is conducting an "investigation" regarding some of the tactics these banks are doing.

If you would like to participate or help in the investigation google "Finkelstein Thompson LLP" if you have believe you have been a victim of this "re-sequencing" which directly caused the ADDITIONAL fees on top of the actual legitimate overdraft(s). Well instead of "victim" it should be "Plaintiff".

It is alleged that some banks, are in violation of 12 U.S.C. 4303(b)(1) for their failure to disclose that the condition precedent of a pre-existing overdraft could cause the assessment of additional overdraft fees. Instead, the banks have been lying to consumers that the condition precedent was insufficient funds.

[The true reason why you were assessed the additional overdraft fees that you did NOT cause is because you actually had a pre-existing overdraft in your account that the bank used to manipulate your account to create additional overdraft fees by a creative accounting practice].

[The bank then falsely accused you of being at fault for the additional overdrafts you didnt cause by lying to you about having insufficient funds in your account. In fact, without the pre-existing overdraft(s) in your account (condition precedent), it would have been IMPOSSIBLE for the banks creative accounting practice to have assessed additional overdraft fees against you that you did not create].

[That is why the bank engages in tactics to make you overdraft your account. For example, the bank will not immediately post your correct available balance or the bank will drop a hold on your account to only apply it later to make you believe you have more available funds in your account then you do. The bank will also split two pre-existing overdrafts created on the same date so it can create additional overdraft fees on two different posting dates instead of one].

Advertisers above have met our

strict standards for business conduct.