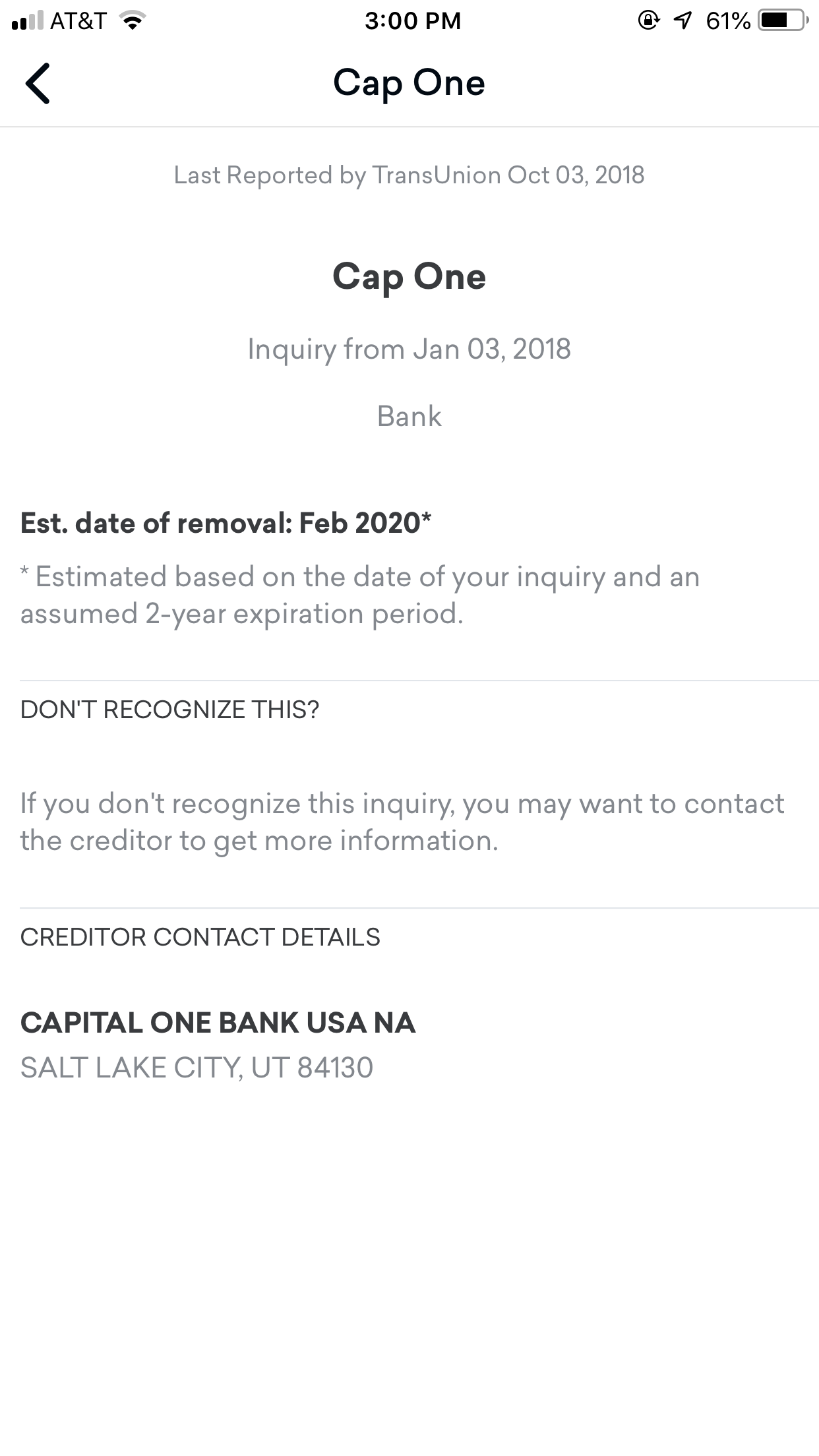

Complaint Review: Capital One Bank - Salt Lake City, Utah

- Capital One Bank PO box 30281 Salt Lake City,, Utah United States of America

- Phone: 800-955-7070

- Web:

- Category: Collection Agency's

Capital One Bank i have never used nor opened a capital one bank credit card account. they're reporting a negative payment of $1515 against me on my credit report. Salt Lake City, Utah , Utah

*Consumer Suggestion: Bottom line here is the burden of proof is on the bank

*Consumer Comment: Some possibilities

They did not answer there phone and when you contact them they do not listen to the consumer to resolve the misinformation. I have lived outside of the US for over 27 years while in the US armed forces and working as a private contractor and during this timeframe when this account was opened i was not even in the US. If this account was opened via the internet then there should be an electronic chain to this accounts opening! All credit agencies are useless because their investigations do not dig deep enough to resolve this matter.

This report was posted on Ripoff Report on 10/28/2010 01:30 PM and is a permanent record located here: https://www.ripoffreport.com/reports/capital-one-bank/salt-lake-city-utah-84130-0281/capital-one-bank-i-have-never-used-nor-opened-a-capital-one-bank-credit-card-account-th-656246. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

Bottom line here is the burden of proof is on the bank

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, October 28, 2010

It may be a big hassle, but only if you make it harder than it is.

First, STAY OFF THE PHONE!! All disputes MUST be in WRITING!! Telephone calls do not protect your rights under the law.

Send all disputes via CERTIFIED MAIL / RETURN RECIEPT REQUESTED. Be sure to put the certified # on the letter itself to prove exactly what you sent.

Keep the communications short and to the point. Dispute the item for the reason that it is not your account. DEMAND to see a signed contract. Without a signed contract, they could NOT ever win in court. Let them know that failure to remove this from collections and from your credit report WILL result in a FDCPA lawsuit. Tell them that you consider 30 days to be a "reasonable" time to get this done.

Make a demand to the credit bureaus that want to see any "validation" they get from the creditor and/or collector. They will try to get out of this, but it is your legal right. The bottom line is that they are responsible for the information THEY report on YOUR credit report. The creditor is THEIR customer and they are responsible for that relationship, not you.

On the 35th day you file the lawsuit. You file against both the credit bureaus, and the creditor and any collector involved. You are entitled to up to $1000 plus costs for FDCPA and FCRA violations. Let them know that you know this, and that you are more than willing to proceed in that direction.

Good luck.

#1 Consumer Comment

Some possibilities

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, October 28, 2010

The three biggest possibilities are

1)You actually do have a "Store Branded" Account that Capital One mananges. Most of the time it should show up on your Credit Report as Store Name/Capital One, but sometimes it won't.

2)You had an account with another bank that Capital One took over

3)You are a victim of Identity Theft.

This is going to be the toughest to deal with, and unfortunatly you may be the one who ends up having to do a lot of the work. The FTC has a pretty good site on what you need to do if you are a victim of Identity Theft. So you may want to look at the following link

http://www.ftc.gov/bcp/edu/microsites/idtheft/consumers/defend.html

If for some reason this site redacts the link you can put "ftc.gov victim of identity theft" into your favorite search engine and it should be the very first link.

Advertisers above have met our

strict standards for business conduct.