Complaint Review: NCO Financial Systems - Horsham Pennsylvania

- NCO Financial Systems 507 Prudential Road Horsham, Pennsylvania U.S.A.

- Phone: 800-747-5206

- Web:

- Category: Collection Agency's

NCO Financial Systems Ripoff Rude and Agressive Collection Company that forces people to garnish their own wages Horsham Pennsylvania

*Consumer Comment: Re: Bud Hibbs

*Consumer Comment: NCO Financial Boise, ID

*Consumer Suggestion: K - Wichita, Kansas - YOU ARE CORRECT BUDDHIBBS.COM IS A GOD

*Consumer Suggestion: Frank ignore Elaine - Boise, Idaho

*Consumer Suggestion: Frank ignore Elaine - Boise, Idaho

*Consumer Suggestion: Frank ignore Elaine - Boise, Idaho

*Consumer Suggestion: Frank ignore Elaine - Boise, Idaho

*Consumer Suggestion: yes

*Consumer Comment: NCO Financial

*Consumer Suggestion: FRANK - DON'T BE DISCOURAGED BY "K - Wichita, Kansas" COMMENTS .... UNLESS I MISS MY GUESS STEVE - FLORIDA; DON - ILL AND SEVERAL OTHERS WILL BE ALONG

*Consumer Comment: A Better Idea

*Consumer Suggestion: easy

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

This year has sucked most of my creditors have dumped my debts off to NCO and I am annoyed with them to the max. There is only a few collectors that work for them that are nice. Other than that they have tried to collect multiple debts off of me in the same month which has somewhat worked. I am just annoyed with them to max. I am still waiting for a settled in full letter for the one debt that I paid. I wish I could just make it so that they could never collect off of me ever again in my life. I am trying to pay my debts, although its just the one they coollect is taking to much money out of me for what I make a month. I wish I could just get some legal advice on this one debt and a way to make it so that they can never collect off me again.

Frank

East Aurora, New York

U.S.A.

This report was posted on Ripoff Report on 05/18/2007 07:40 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems/horsham-pennsylvania-19044/nco-financial-systems-ripoff-rude-and-agressive-collection-company-that-forces-people-to-g-249281. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#12 Consumer Comment

Re: Bud Hibbs

AUTHOR: Tim - (U.S.A.)

SUBMITTED: Wednesday, February 10, 2010

Bud Hibbs is certainly well-intentioned, and alot of the information on his site is very valuable.

But DO NOT, under ANY circumstances, assume that information from his site is competent legal advice. I've seen MANY erroneous and misleading statements on his site.

Most importantly, in perusing budhibbs.com, don't ever assume or believe that the credibility of a collection agency, or the volume of complaints it has received, or even legal actions brought against it actually prevent them from being able to sue you.

This is my biggest issue with Bud - he erroneously, and maybe unintentionally, leads consumers to believe that certain collection agencies can not file lawsuits, or that the consumer can go ahead and ignore legal process that comes from certain collection agencies. This is NEVER true!

So check out his site - it IS a wealth of information. Just be sure to verify that his information is correct before you act upon it, and ALWAYS answer legal complaints and show up for court!

#11 Consumer Comment

NCO Financial Boise, ID

AUTHOR: Shel - (United States of America)

SUBMITTED: Tuesday, February 02, 2010

Ok, I admit, I have been scared to death to call them back. I have been in the credit dumper since May of 2009. I OWE EVERYONE due to an illness and then when I tried to find work (me and 3 million other people) I could not even get an interview anywhere despite my qualifications. I FINALLY had a job offer, in the business I used to be in, and the pay was off the charts. (Stock Brokerage). The catch 22 was that I had to show I was entered into a payment plan with my creditors in order to get this job. So I had to call NCO where I was about $4000 in debt for 2 medical bills. I asked to speak to a supervisor and a "nice" one if possible. Julie came on the line, I explained my entire situation to her, which she listened to without interruption, I told her I did not want to settle I wanted eventually to pay the whole amount off (as if you "settle" for lesser amount it still shows on your Credit Report that you did not pay the whole amount off) but that I couldn't begin that process for at least 6 months. I could, however pay a minimal amount to get me started and so I could get this job. I had 2 outstanding accounts with them. I told her I could pay only $50 a month for the first 3 months. Julie "linked" my accounts into 1 and then offered me $25.00 for each account per month. I had thought I would have to make payment arrangements for both and she offered this to me without me asking. She was kind, courteous, caring and innovative. She seemed to believe me and was more than willing to work with me. Now, this is in Boise, ID and I imagine a nicer, gentler type of people work there, but I just wanted to relay MY experience as it was a positive one.

#10 Consumer Suggestion

K - Wichita, Kansas - YOU ARE CORRECT BUDDHIBBS.COM IS A GOD

AUTHOR: P - (U.S.A.)

SUBMITTED: Tuesday, May 22, 2007

... and he is probably blushing over the recognition .... : )

Frank listen to the other posters and go to buddhibbs.com for excellent and insightful information on this junk debt dealer ....

#9 Consumer Suggestion

Frank ignore Elaine - Boise, Idaho

AUTHOR: Dennis Ray - (U.S.A.)

SUBMITTED: Tuesday, May 22, 2007

Hi Frank,

Fight NCO to clear the debt and don't listen to Elaine and Steve [Not a Lawyer]. NCO will take a lot less than what they are asking.

Regards,

#8 Consumer Suggestion

Frank ignore Elaine - Boise, Idaho

AUTHOR: Dennis Ray - (U.S.A.)

SUBMITTED: Tuesday, May 22, 2007

Hi Frank,

Fight NCO to clear the debt and don't listen to Elaine and Steve [Not a Lawyer]. NCO will take a lot less than what they are asking.

Regards,

#7 Consumer Suggestion

Frank ignore Elaine - Boise, Idaho

AUTHOR: Dennis Ray - (U.S.A.)

SUBMITTED: Tuesday, May 22, 2007

Hi Frank,

Fight NCO to clear the debt and don't listen to Elaine and Steve [Not a Lawyer]. NCO will take a lot less than what they are asking.

Regards,

#6 Consumer Suggestion

Frank ignore Elaine - Boise, Idaho

AUTHOR: Dennis Ray - (U.S.A.)

SUBMITTED: Tuesday, May 22, 2007

Hi Frank,

Fight NCO to clear the debt and don't listen to Elaine and Steve [Not a Lawyer]. NCO will take a lot less than what they are asking.

Regards,

#5 Consumer Suggestion

yes

AUTHOR: K - (U.S.A.)

SUBMITTED: Tuesday, May 22, 2007

budhibbs is god...listen to him and hopefully you will get sued.

#4 Consumer Comment

NCO Financial

AUTHOR: Michael - (U.S.A.)

SUBMITTED: Monday, May 21, 2007

WAIT A MINUTE!!!

Before you listen to "K" from Wichita, Kansas let me say this:

Go to budhibbs.com

His site is a wealth of information on debt collectors and how to deal with them.

Don't roll over on these parasites. Fight back!

#3 Consumer Comment

A Better Idea

AUTHOR: Elaine - (U.S.A.)

SUBMITTED: Monday, May 21, 2007

File Bankruptcy and screw NCO. And start over fresh.

#2 Consumer Suggestion

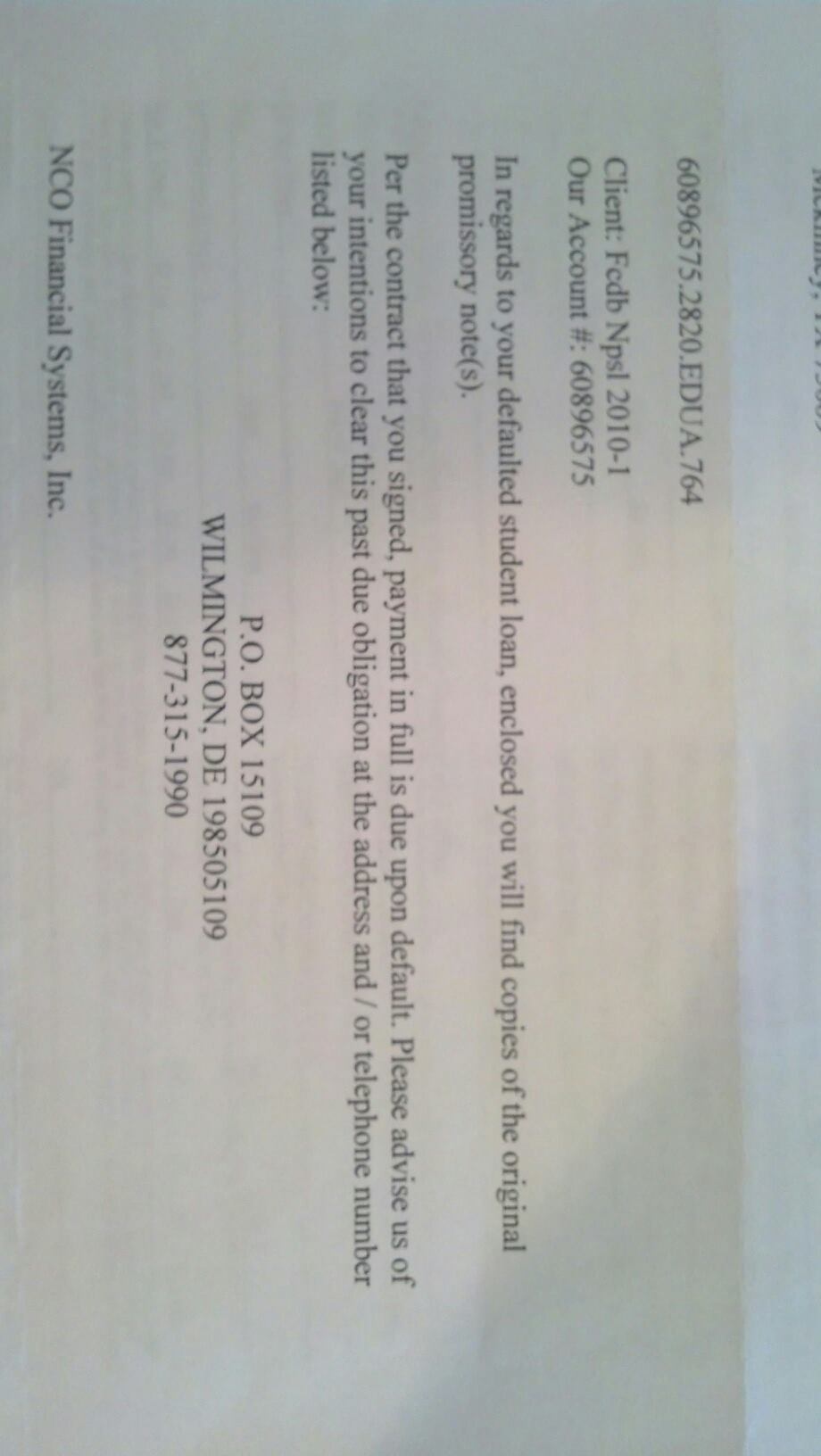

FRANK - DON'T BE DISCOURAGED BY "K - Wichita, Kansas" COMMENTS .... UNLESS I MISS MY GUESS STEVE - FLORIDA; DON - ILL AND SEVERAL OTHERS WILL BE ALONG

AUTHOR: P - (U.S.A.)

SUBMITTED: Monday, May 21, 2007

shortly to respond to her comments .... K - Wichita, Kansas is a collector (or supposed to be I don't believe we ever got the real story from her) ... but I digress ...

First and most importantly, DO NOT TALK TO THE DEBT COLLECTOR ON THE PHONE. AS YOU SEE, THEY MAKE PROMISES THEY HAVE NO INTENTION OF KEEPING ..

Send all your communications certified, return receipt requested AND put the cert number on the letter itself in case it ends up in court. DO NOT SIGN ANYTHING BECAUSE YOUR SIGNATURE WILL APPEAR ON DOCUMENTS YOU NEVER SIGNED ...

If you feel you do not owe the debt, then you need to tell the creditor to validate the debt.

What does a debt collector need to provide as debt validation?

P Proof that the collection company owns the debt/or has been assigned the debt. This is basic contract law. It is very difficult to get a judgment without a direct contract between collection agency and the original creditor.

P At a minimum, some account statements from the original creditor. If you really want to get sticky, you can pin them down on the amount of the debt by requiring complete payment history, starting with the original creditor. This requirement was established by the case Fields v. Wilber Law Firm, Donald L. Wilber and Kenneth Wilber, USCA-02-C-0072, 7th Circuit Court, Sept 2004..

P Copy of the original signed loan agreement or credit card application. However, account statements from the original can fulfill these requirements.

When a creditor hires a collection agency, the debt has been assigned to the collection agency.

If a collection agency is successful at collecting the money on the account, they usually keep a percentage of what is collected as payment for services.

Original creditors sometimes sell debts in large portfolios to collection agencies. This is starting to be the norm, and several of these companies, called Junk Debt Buyers (JDBs), are now being traded on Wall Street. The companies do not spend much money at all for these debts, sometimes paying less than 1 cent on the dollar.

Even if the debt is not a large debt, they often hire attorney to send out mass form-letters to debtors in the hopes of collecting. As you can see, even if they get a small percentage of the debtor to pay, profits are enormous. For more on JDBs, you can read our article here.

Continue to treat any collection agency, junk debt buyer or law firm who says they own the debt as a collection agency subject to the FDCPA. You can still request validation and proof of the purchase, because if they can't validate it, the collection agency can't prove you owe the debt. Often a JDB will tell a consumer that since they purchased the debt, they are not subject the the FDCPA. It's simply not true

FDCPA Section 809. Validation of debts [15 USC 1692g]

(b) If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector.

Plus, they must show proof positive that you owe them this debt. It's not enough to send you a computer-generated printout of the debt.

Nor can they ask you to pay for digging up records of your debt:

So, if a creditor can't verify a debt:

P They are not allowed to collect the debt,

P They are not allowed to contact you about the debt, and

P They are also not allowed to report it under the Fair Credit Reporting Act (FCRA). Doing so is a violation of the FCRA, and the FCRA states that you can sue for $1,000 in damages for any violation of the Act.

You need to also look at whether or not the statute of limitations has been exceeded - especially with NCO ...

If you feel you do owe the debt, and need to negotiate it then do it in writing - BUT i WOULD go with the validation request first .... NCO is a junk debt buyer .... they entered the picture when the OC (original creditor) has written your account off. They paid literally PENNIES on the dollar for your account .... Go to BUDHIBBS.COM for valuable information on NCO ....

=======================================

SAMPLE LETTER TO DISPUTE CLAIM

Date

Your Name

Mailing Address

City, State, Zip

Name of Collection Agency

Mailing Address

City, State, Zip

CERTIFICATION NUMBER _________________

Re: Dispute of Collection Action: Case # ________

[If the collection agency has sent written notice, your case number is likely in the letter. If you have not received a written notice from the collection agency, tailor this line accordingly. For example, show the date you were contacted by the collection agency and/or identify the creditor by name if you can.]

To [person whose name appears on agency's notice to you]:

On [date] I was contacted by [name of person who called you] of your agency, who informed me that [name of collection agency] is attempting to collect [amount of claimed debt]. This individual is collecting on behalf of [name of creditor]. [OR] This individual would not tell me for whom you are supposed to be collecting.

Please provide me with the following:

h What the money you say I owe is for;

h Explain and show me how you calculated what you say I owe;

h Provide me with copies of any papers that show I agreed to pay what you say I owe;

h Provide a verification or copy of any judgment if applicable;

h Identify the original creditor;

h Prove the Statute of Limitations has not expired on this account

h Show me that you are licensed to collect in my state

h Provide me with your license numbers and Registered Agent

[OR]

On [date] I received a written notice of the claimed debt, a copy of which is attached.

This is to inform you that I dispute the debt because [insert reason for dispute, e.g. the agency has confused you with someone else or the debt was paid. Include copies, not originals, of any correspondence that proves your point]. I am hereby requesting that you confirm the fact that I owe this debt as required by any applicable state and federal laws. Please contact the creditor to obtain verification.

Please provide me with the following:

h What the money you say I owe is for;

h Explain and show me how you calculated what you say I owe;

h Provide me with copies of any papers that show I agreed to pay what you say I owe;

h Provide a verification or copy of any judgment if applicable;

h Identify the original creditor;

h Prove the Statute of Limitations has not expired on this account

h Show me that you are licensed to collect in my state

h Provide me with your license numbers and Registered Agent

In addition, under the provisions of state and federal Fair Debt Collection Practices Act (FDCPA), Fair Credit Reporting Act (FCRA), and related consumer statutes, I am hereby instructing you that you are to cease collection of the debt while efforts are made to obtain verification. Until you resolve this error with the creditor, you should neither contact me nor anyone else except the creditor about this collection.

Furthermore, any reporting of this matter to a credit reporting agency is premature. Until you have investigated my dispute, you should not relay negative information to a credit reporting agency. If negative information has already been reported, you will need to notify the agency to remove said report until the investigative process is over so that my credit report remains accurate, or at the very least, my credit report should be updated to reflect my dispute.

I am instructing you not to contact any third parties such as my employer, neighbors, friends or family members. In addition, you may not contact me by phone at work or at my home about this collection activity. All future correspondence should be sent to me in writing.

Sincerely,

PRINT OR TYPE YOUE NAME DO NOT SIGN

============================

#1 Consumer Suggestion

easy

AUTHOR: K - (U.S.A.)

SUBMITTED: Monday, May 21, 2007

pay the bill in the first place and then you wont have to deal with them. Or pay NCO off in full and then they wont collect from you again. How hard is that?

Advertisers above have met our

strict standards for business conduct.