Complaint Review: Comenity Bank - Columbus OH

- Comenity Bank P O Box 182273 Columbus, OH United States

- Phone: 800-776-9859

- Web: www.comenity.com

- Category: CREDIT CARD CHARGE

Comenity Bank Woman Within Credit card imposed late fee and refused explanationfor doing this, Columbus OH

*Author of original report: Balance due

*Consumer Suggestion: Balance due

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

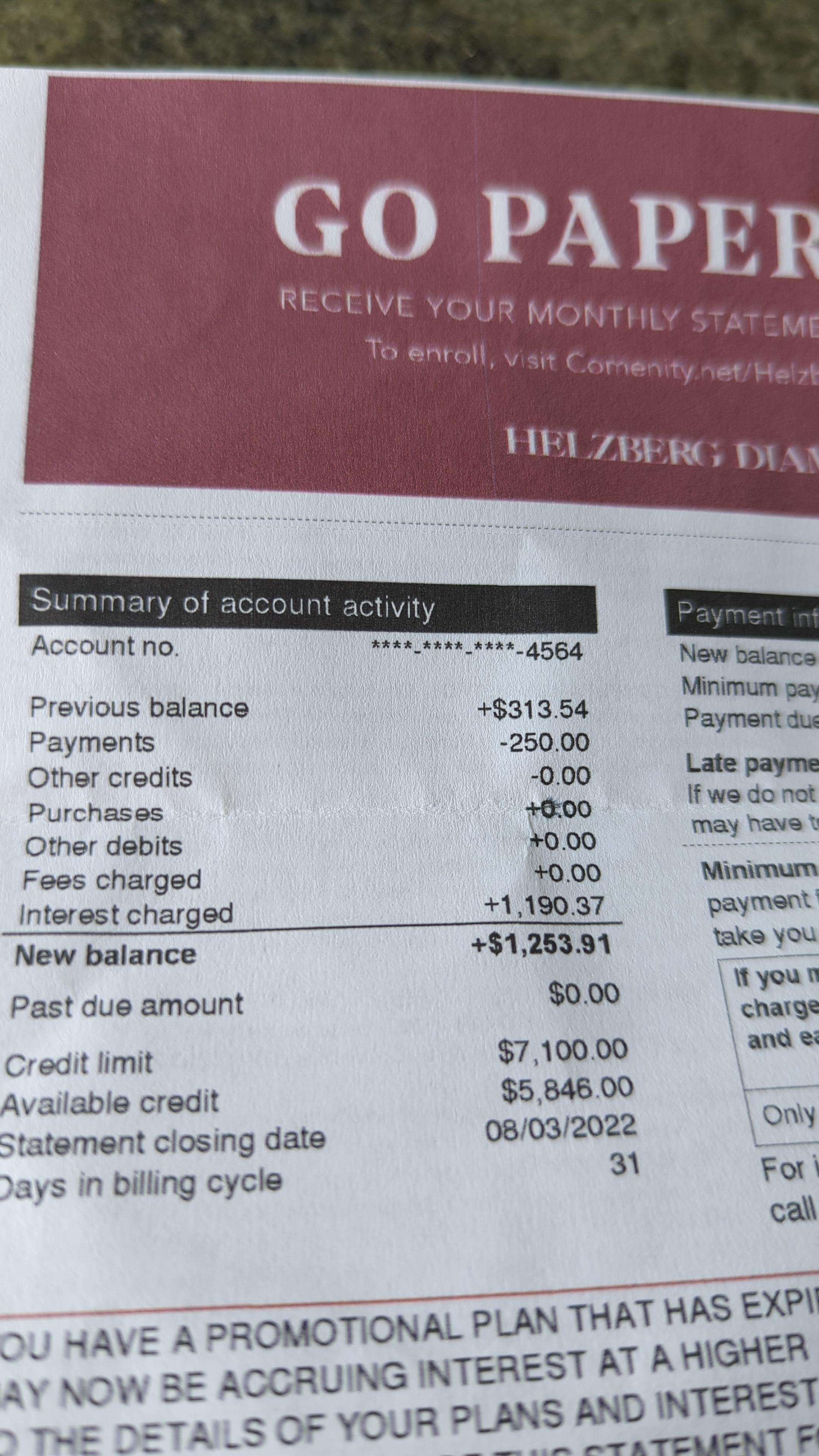

Returned large order to Woman Within before end of billing cycle for that month. Comenity started adding a Late Fee charge with the next month's billing and when contacted, sent me a form letter informing that they would investigate which would take up to three months.This is an electronic record of my account and bank advised that charge would continue to accrue interest. My history with this bank has been to maintain a zero balance for several years: invoice in/payment in full out.

A second letter sent after second month of the "investigation" again asking for explanation. Response was another copy of same form letter launching an investigation. Meanwhile, I called the vendor and found that vendor had made error in failing to report one of the items that had been returned. Vendor was to notify Comenity Bank.

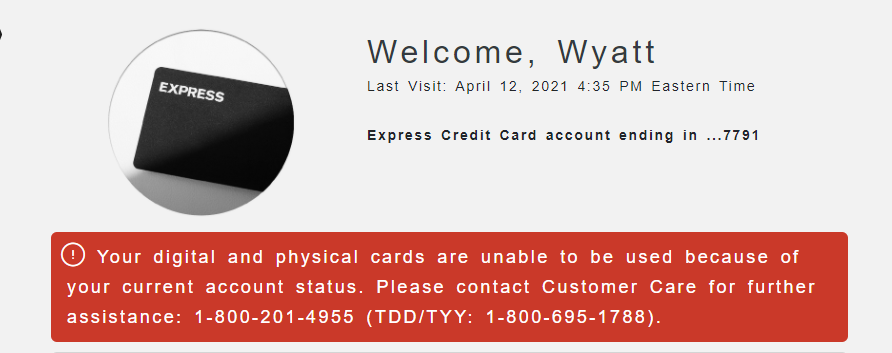

Next responses came from three credit reporting agencies all of whom informed me of a adverse action on my credit and a drop in my score from the 800 level. Again, contacted Comenity, again no explanation. Following month, another drop now into the 660 level of credit scoring.

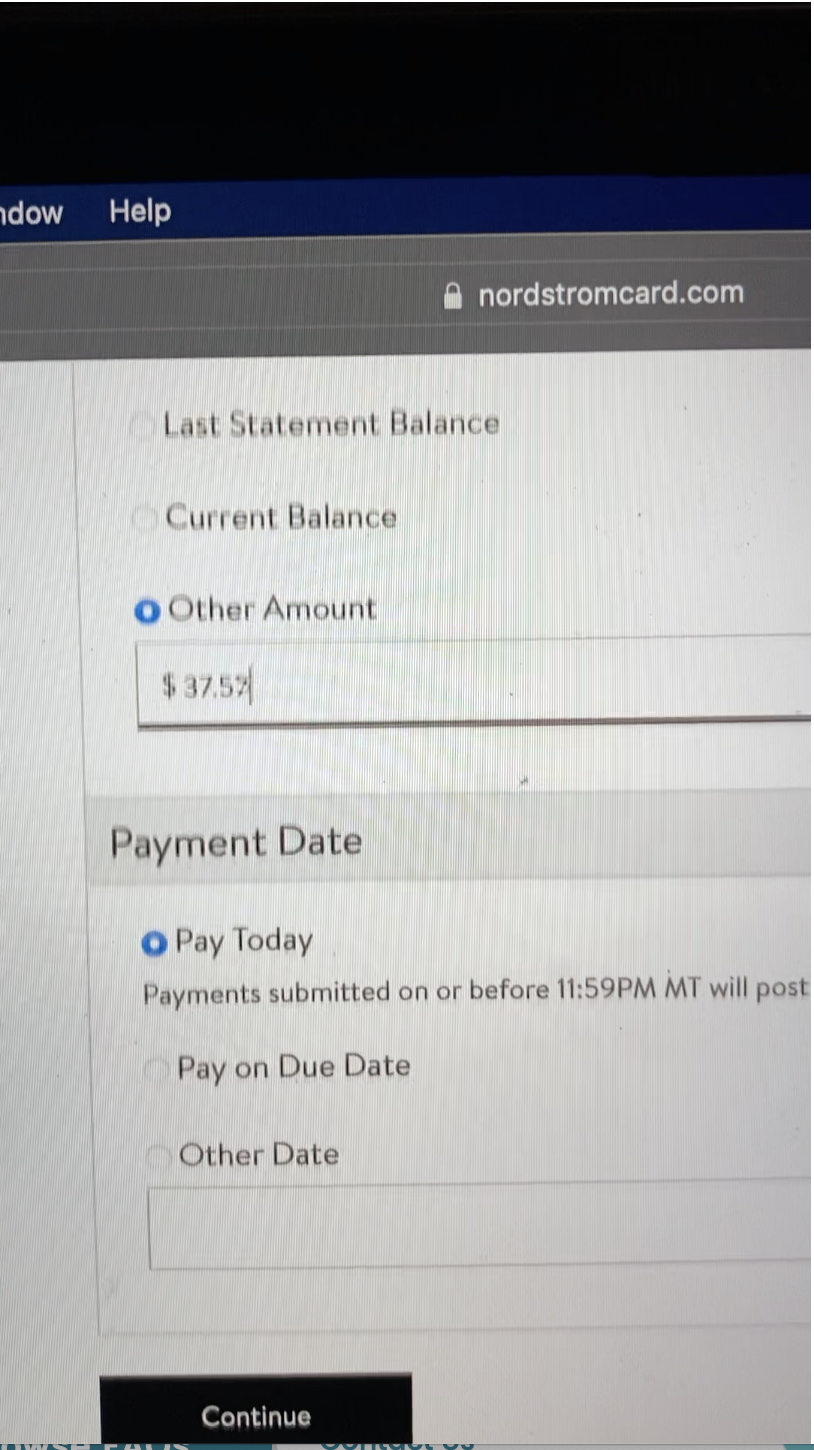

After at least 5 transfers, I spoke with a "Payment Solution Team" member at Comenity and my $23.00 original late fee had blossomed to above $100.00. To pull the plug on the greed, I agreed to pay $29.59 on January 20,2022.

To this date(June 16,2022) Comenity has 1. Not notified credit agencies of resolution, 2. Not sent me a zero balance invoice, 3. imposed the "adverse action" to stay alive on my credit reports for 7 years. All for a charge Comenity Bank imposed that though not warranted, became fraudulent by the bank's failure to act ethically, honestly and appropriately.

This report was posted on Ripoff Report on 06/16/2022 07:38 AM and is a permanent record located here: https://www.ripoffreport.com/report/comenity-bank/columbus-oh-woman-credit-card-1519146. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Author of original report

Balance due

AUTHOR: Ms. P - (United States)

SUBMITTED: Friday, June 17, 2022

There was NO balance due as all of the merchandise was returned. The vendor has a system that a tag or checkmark goes with the merchandise back to warehouse or wherever returns end up. One item went without that tag(an error identified by the vendor) so there was NO fee or late charge due.

#1 Consumer Suggestion

Balance due

AUTHOR: Flint - (Afghanistan)

SUBMITTED: Friday, June 17, 2022

Are you serious? The bank doesn't know and doesn't care about your problems with some store, or whether you returned something or not. If you have a a minimum payment due at the end of the billing cycle, you have to pay it. If it gets refunded later, you'll get a credit on your account. If you don't pay it, you just defaulted on your obligations, with all the corresponding effects on your credit score. And no, this is not an error, it's the agreement you signed when you opened the card.

I'm not sure why you are opening disputes instead of just paying off your balance due. Even if a store made a mistake and failed to refund you for something, that's between you and them. You still have to pay the credit card company.

And no, paying your defaulted balance is not going to magically fix your credit score. Your report will still (correctly) show that you defaulted on your obligations, but it will at least show that you don't have an open bad debt.

Advertisers above have met our

strict standards for business conduct.