Complaint Review: Harvest Moon Loans - Boulevard California

- Harvest Moon Loans 8 Crestwood Road Boulevard, California USA

- Phone: 888-797-6064

- Web: CustomerService@HarvestMoonLoans.c...

- Category: Loans

Harvest Moon Loans Payday Loans Boulevard California

*Author of original report: Response To Did You Read Your Contract

*Consumer Comment: Didn't you read your contract?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

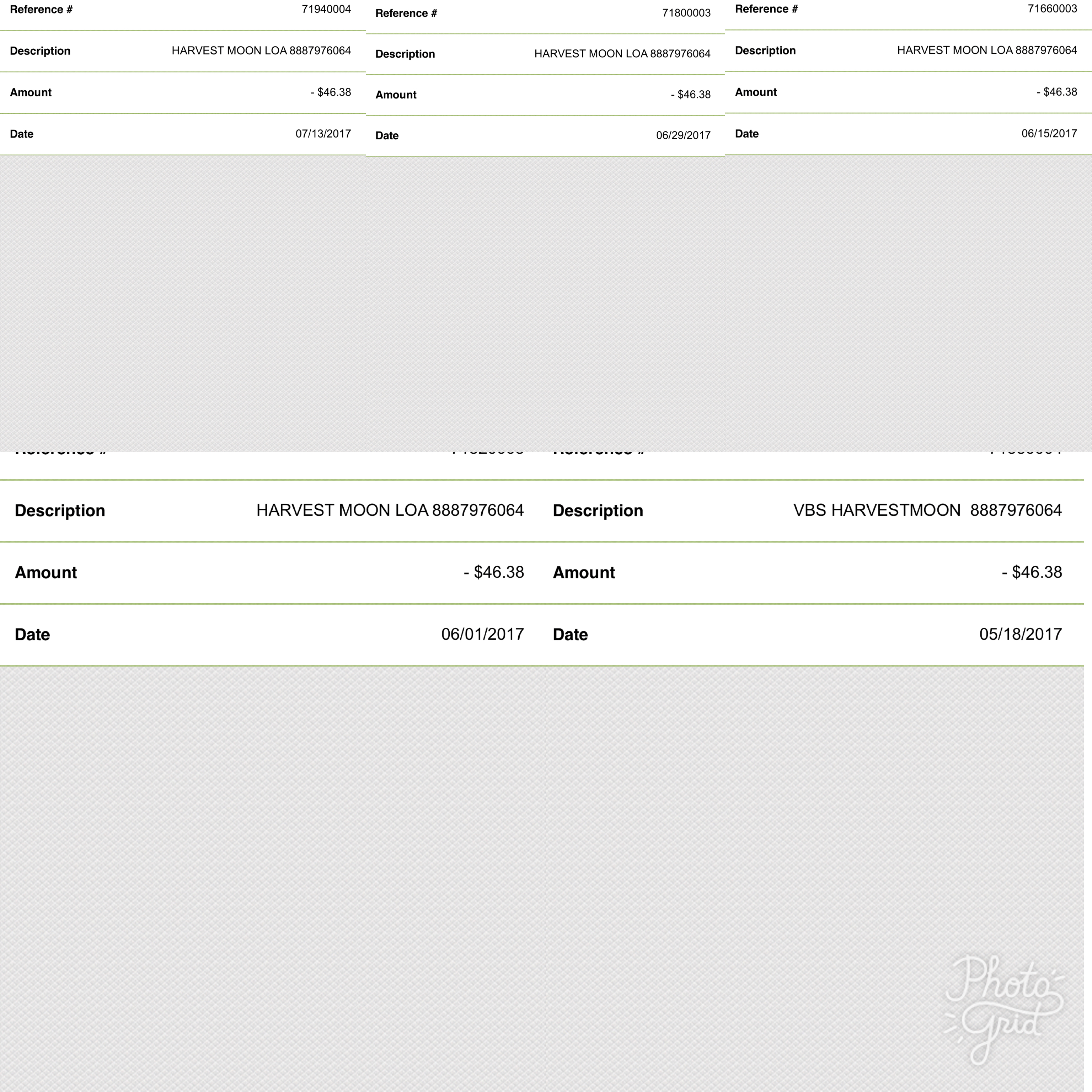

I am a resident in the State of Florida, Harvest Moon Loans provided me with two loans which is against the law. They are VERY misleading and a rip off. They were suppose to ONLY take a one time processing fee out of my bank account and then the rest was towards the loans. My first loan was $150 I've paid over $700 on this loan and the second loan was for $100 I've paid over $500 on this one. The state of Florida state "Only one (1) payday loan at a time and if the loan is not paid between 7-31 days it should be sent to collections. Harvest Moon Loans say that they are a tribal loan and dont follow state or federal laws. I'm a single parent with a daughter in college and this loan has caused many hard ships.

This report was posted on Ripoff Report on 11/25/2014 03:20 PM and is a permanent record located here: https://www.ripoffreport.com/reports/harvest-moon-loans/boulevard-california-91905/harvest-moon-loans-payday-loans-boulevard-california-1191398. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Author of original report

Response To Did You Read Your Contract

AUTHOR: Juanda - ()

SUBMITTED: Tuesday, November 25, 2014

YES, I did read my contract and also spoke with their representive who assured me that after the initial amount for processing was taken out of my bank account, the rest would go towards my principal of the loan. I think I stated that in my report. Now as a resident of Florida they broke a law that I knew nothing about, as this was my first time EVER taking out a loan and really had no knowledge of how they work. So excuse me for being ignorant to the fact of loans,however money was needed. I don't know if you've ever need money for a emergency or live paycheck to paycheck, but I do.

#1 Consumer Comment

Didn't you read your contract?

AUTHOR: FloridaNative - ()

SUBMITTED: Tuesday, November 25, 2014

I am not affliated with this company or any other payday loan type company. I went to the website to see if they are as deceptive as you claim. They are not. If you actually take the time to read the terms and conditions you would see that it is at a very high rate of interest plus the fees are calculated per $100 you borrow.

Here is a copy and paste right from their website for terms:

How much money can I borrow, and what are your fees?

Our loans range from $100 - $800. Fees vary from $20 - $60 per $100 borrowed plus 36% APR interest, depending on length of loan and status as a customer. Loan terms include Weekly, Bi-Weekly, Semi-Monthly and Monthly. Here is example of our rate. Click Here

As you can see, the rates are extremely high. I have no idea why you would choose this method of debt, but now that you are in it, you need to find a way to pay it off and not ever go there again. You can also report them to the AGs office to see if the Attorney General can point you in the right direction.

As to the rest of the information in your post, I found a reputable source that appears to support your claim of limitations for payday loans in Florida.

Here is a recap from NOLO(dot)com for payday loans in Florida:

Limitations on Payday Lending in Florida

Payday lending is limited in several ways in Florida. The law places limits on

- the amount of the loan

- the number of loans you can have outstanding

- the length of the loan term

- the fees and costs that can be charged, and

- the collection process if you don’t pay

Go to that website and look up the details. You may need to report the lender to the AGs office. I don't know if they have the power to do anything because they are a tribal lender. It is worth a try.

Advertisers above have met our

strict standards for business conduct.