Complaint Review: Jefferson Capital Systems LLC. - St. Cloud Minnesota

- Jefferson Capital Systems LLC. 16 McLeland Rd. St. Cloud, Minnesota USA

- Phone: 18662902838

- Web: www.paymentrewardsprogram.com

- Category: Online Trading

Jefferson Capital Systems LLC. On May 18,2015, I recieved a Collection agency envelope in my mailbox. At that time, I did not know it was a letter from a Collection Agency,what was strange to me was the return address was just a P.O. box number, 1120 and a city. Charlotte, N.C. 28201-1120. St. Cloud Minnesota

*Consumer Comment: Response to Tyg

*General Comment: Money...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

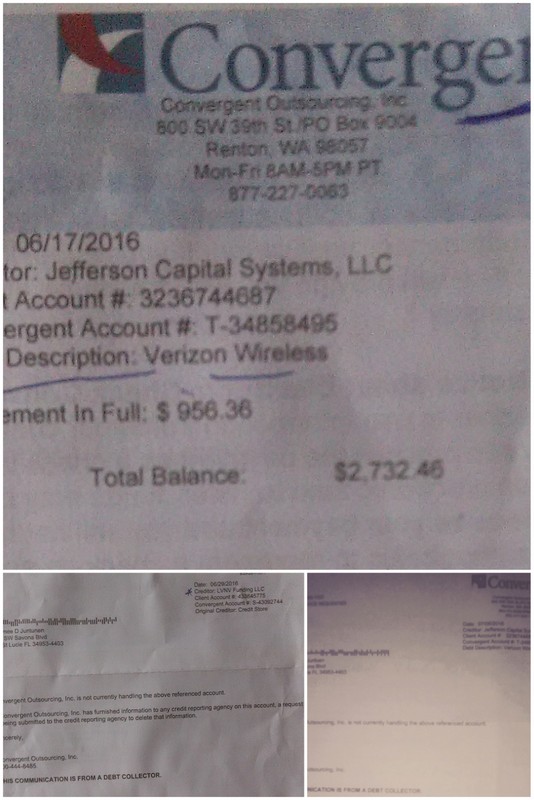

Jefferson Capital Systems LLC. On May 18,2015, I recieved a Collection agency envelope in my mailbox. At that time, I did not know it was a letter from a Collection Agency,what was strange to me was the return address was just a P.O. box number, 1120 and a city. Charlotte, N.C. 28201-1120. I was suspicious! I opened the envelope and read the following: regarding an old Charged off debt to Fingerhut/Axsys National.

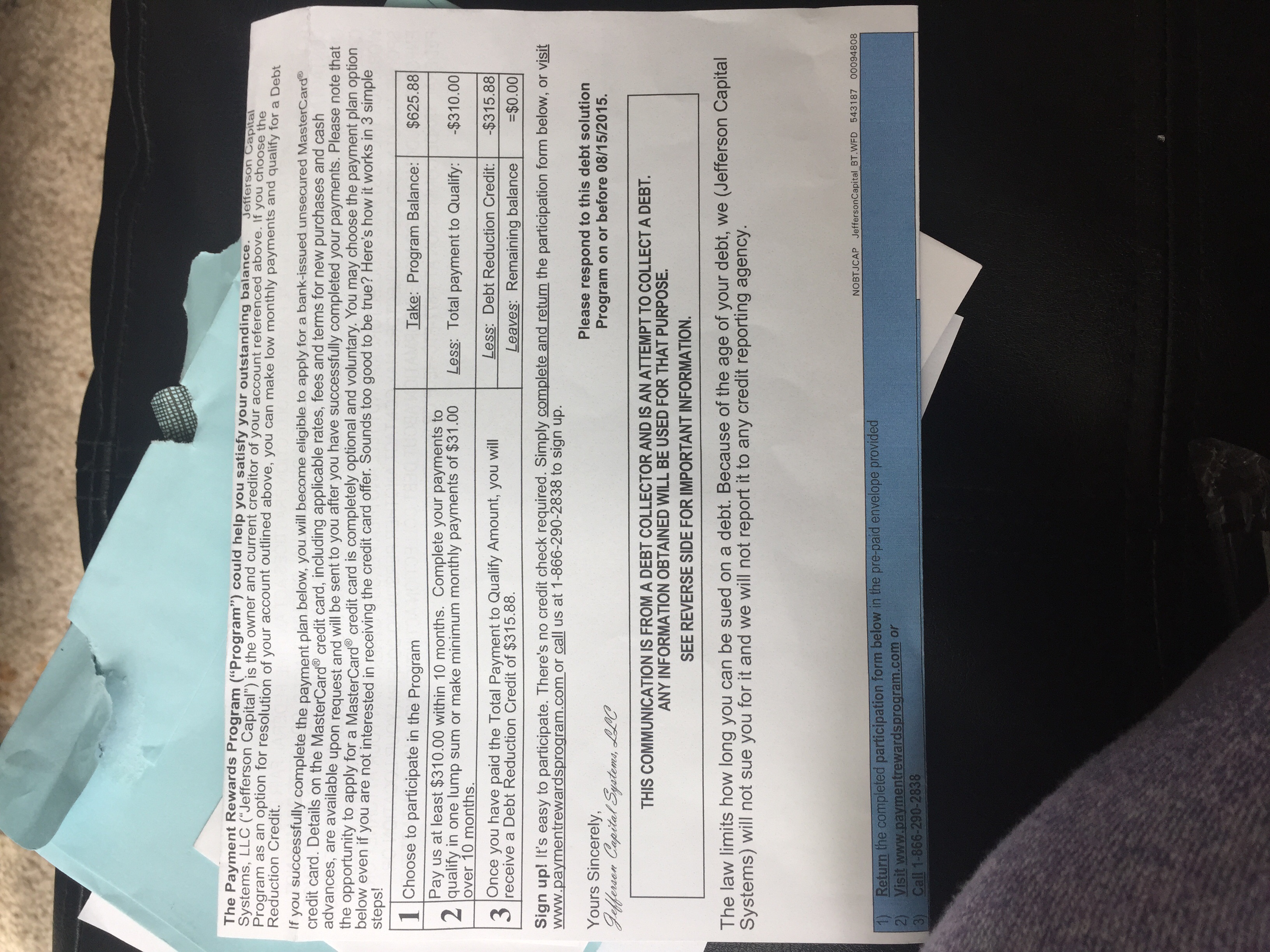

The charge off date was 02/28/2002, the amount was for $679.69. I do not owe that much due to the fact that I returned many items to Fingerhut at that time. I was living in Iowa at that time. Anyway,Jefferson Capital was offering me a way to pay off this charged off debt for low monthly payments of $34.00 a month for 12 months. In return, I would qualify for an unsecured Mastercard credit card using their new Payment Rewards Program. I almost fell for it,glad I did some research and read further down the letter to the CATCH!

They call this a Debt Solution. This is what I read; This information is not Legal advice. The law limits how long you can be sued on a debt. Because of the Age of your debt, We(Jefferson Capital Systems) CANNOT sue you for it and we will not report it to any Credit Reporting Agency. However, in many circumstances,you can renew the debt and start the time period for the filing of a Lawsuit against you, IF you take SPECIFIC ACTIONS such as making a certain payment on the debt or making a written promise to repay the debt You should determine the EFFECT OF ANY ACTIONS YOU TAKE WITH RESPECT TO THIS DEBT! I am disabled and live on a fixed low income. I did some further research on NOLO online.

The statute of limitations on old debts in Iowa is 10 years. In Idaho, it is 6 years. When I realized how close I came to falling for this SCAM, I was Horrorified! This is INSIDIOUS!! This Collection Company must be stopped, NOW!! What if I were a lower mentally functioning individual who did not know any better and sent off a payment opening myself up to a Lawsuit? CONSUMER, BEWARE!!) St. Cloud Minnesota

This report was posted on Ripoff Report on 05/18/2015 11:00 PM and is a permanent record located here: https://www.ripoffreport.com/reports/jefferson-capital-systems-llc/st-cloud-minnesota-56303/jefferson-capital-systems-llc-on-may-182015-i-recieved-a-collection-agency-envelope-in-1230082. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Response to Tyg

AUTHOR: LawyerUp - (USA)

SUBMITTED: Tuesday, March 22, 2016

All that you wrote is Lie!!! Check the federal and state LAWS!! According to you, a dept of 20.00 could be sold & rediculous interest tacked on each time the debt changes hands..to inflate upwards of 1,000.00 each time. Congress passed laws to stop these tactics. Do not pay these guys a dime, if you do; THEN the clock does begin again. These Crooks use scare tactics to extract money from unknowledged individuals.

BTW all dept reported is not Legal, look at what Captial Credit Cards did; held onto checks and not posting them until they could charge a 25.00 late fee- Wells Fargo did the same thing with checking accounts, not posting deposits on time.

#1 General Comment

Money...

AUTHOR: Tyg - (USA)

SUBMITTED: Friday, May 22, 2015

NO DEBT is ever ACTUALLY charged off. NO BUSINESS will EVER allow money to be lost WILLINGLY!!! It doesnt matter where YOU lived, ONLY where thier MAIN office is set up. Many corporations set up in states that have loose laws. So while YOU may have thought your debt was charged off, the REALITY is that is was SOLD to a collection agency. Each time that debt is sold the counter resets. All this really boils down to is someone trying to collect a debt from someone who DOES NOT pay their debts. WHY is it ALWAYS someone else fault when LIFE comes back around a smacks the hell out of YOU? YOU KNOW that you owed THEM money. YOU were trying to get out of paying WHAT YOU LEGALLY OWE!!! Typical consumer. SCREW EVERYONE over yet its a injustice when THEY want what YOU owe them.

Advertisers above have met our

strict standards for business conduct.