Complaint Review: Legal Loan Review - Anaheim California

- Legal Loan Review 505 South Villa Real, Suite 100 Anaheim, California United States of America

- Phone: 714-919-7243

- Web: http://www.legalloanreview.com/

- Category: Legal Process Services

Legal Loan Review poor customer service, ignored calls and repeat emails, unprofessional, LIARS!!! Anaheim, California

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

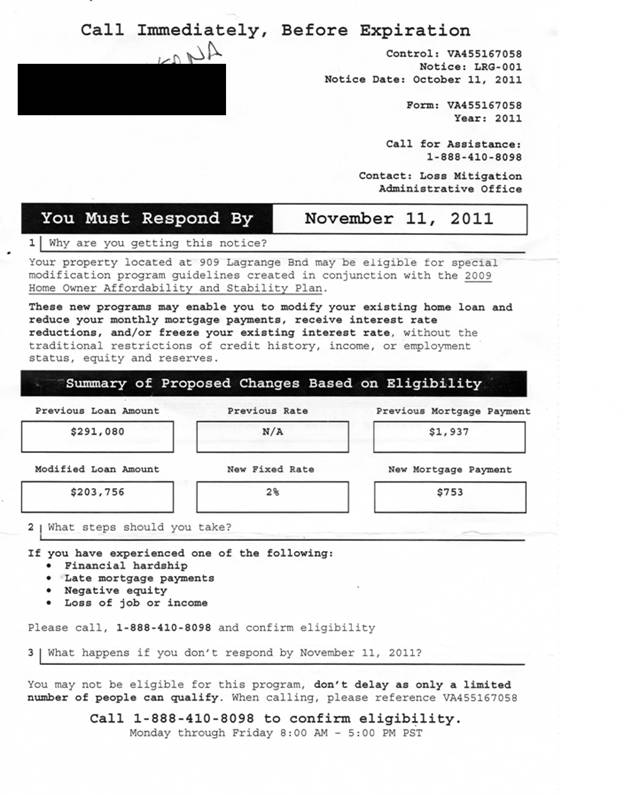

At the end of July we received a modification form in mail. We spoke with Len Gould (LLR). All pertinent info was relayed to him, and he promptly got back to us saying we were approved and guaranteed modification, that we needed to send in payment plus fax all paperwork that was emailed to us. We were told it could take 6-8 wks for process.

On 8/4/11 we sent $2995 and faxed all paperwork asked of us. On 9/20 we received an email from Len stating that we needed additional documentation that was missing from the file. We replied via email and asked him to verify what was needed. Emails sent and voice messages left on 9/24 and 10/5 with no reply.

On 10/14 received a voice message stating there was more missing info. On 10/20 Abby Orellan sent an email regarding that credit card information/financial information was needed d/t an interview with a negotiator from the bank.

On 10/25 Mary Perez sent an email stating that the file was under review, we were waiting for negotiator and to please send credit card/financial information (that we had already sent). On 10/26 we sent an email asking for the correct fax # (since we had already sent/faxed the info on after the message we received on the 20th).

On 11/29 we sent email to Mary regarding the status of our modification, we received no reply. On 12/19 we sent another email to Mary, that we had received a letter from our bank that they had just received our request, we were able to speak with someone at LLR who told us not to speak w/the bank ourselves or submit paperwork to them as LLR was representing us.

At the end of December we received a voice mail stating that our file was under review. On 1/26/12 we received a hardship form from our bank, since we were told not to speak with the bank we sent an email and made phone calls to LLR with no reply in what to do. On 2/2 we received another form from our bank. Again we sent another email and phone call to LLR with again no reply in what to do/how to handle such form.

On 2/23 a voice mail was left stating to call LLR. We returned the phone call and were told that the modification was denied due to hardship form not complete!!! On 2/24 spoke with an Alex Guerra who stated that there was never a guarantee that the modification would go through, it could take a couple of years to actually happen if it did so. He also stated that our lender was one of the hardest to get a loan modification from and he stated that "it's not that I can't give you a full refund, I won't give you a full refund. We have used all the funds and have done what we said we were going to do".

According to their website, they now no longer accept payment in full prior to services rendered as of October 2011.

Also I have now looked at the Pennsylvania codes for loan modifications and found:

Title 10BANKS

AND BANKINGDEPARTMENT OF BANKING[10 PA. CODE CH. 47]

Mortgage Loan ModificationsStatement of Policy

[40 Pa.B. 3868]

[Saturday, July 10, 2010]

The Department of Banking (Department) adds Chapter 47 (relating to mortgage loan modificationsstatement of policy) under 7 Pa.C.S. 6138(a)(4) (relating to authority of department), section 12 of the Consumer Discount Company Act (CDCA) (7 P.?S. 6212) and section 202.D of the Department of Banking Code (71 P.?S. 733-202.D).

47.5. Improper activities regarding mortgage loan modifications.

A licensee providing mortgage loan modifications should not:

(4) Charge advance fees to a borrower for a mortgage loan modification.

(8) Fail in a timely manner to: (i) Communicate with or on behalf of a borrower.

(9) Engage in false or misleading advertising. Examples of false or misleading advertising include: (ii) Advertising which includes a ''guarantee'' unless there is a bona fide guarantee which will benefit a borrower.

(10) Make a statement or engage in an action which is false, misleading, deceptive or inappropriate. Examples of false, misleading, deceptive or inappropriate statements or actions include: (ii) Encouraging or directing a borrower not to communicate with the holder or servicer of the borrower's mortgage loan. (iii) Leading a borrower to believe that a mortgage loan modification can be negotiated on behalf of the borrower when the licensee has reason to believe that a mortgage loan modification cannot be negotiated on behalf of the borrower.

This report was posted on Ripoff Report on 04/03/2012 05:08 AM and is a permanent record located here: https://www.ripoffreport.com/reports/legal-loan-review/anaheim-california-92807/legal-loan-review-poor-customer-service-ignored-calls-and-repeat-emails-unprofessional-863042. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.