Complaint Review: Windham Professionals - Salem New Hampshire

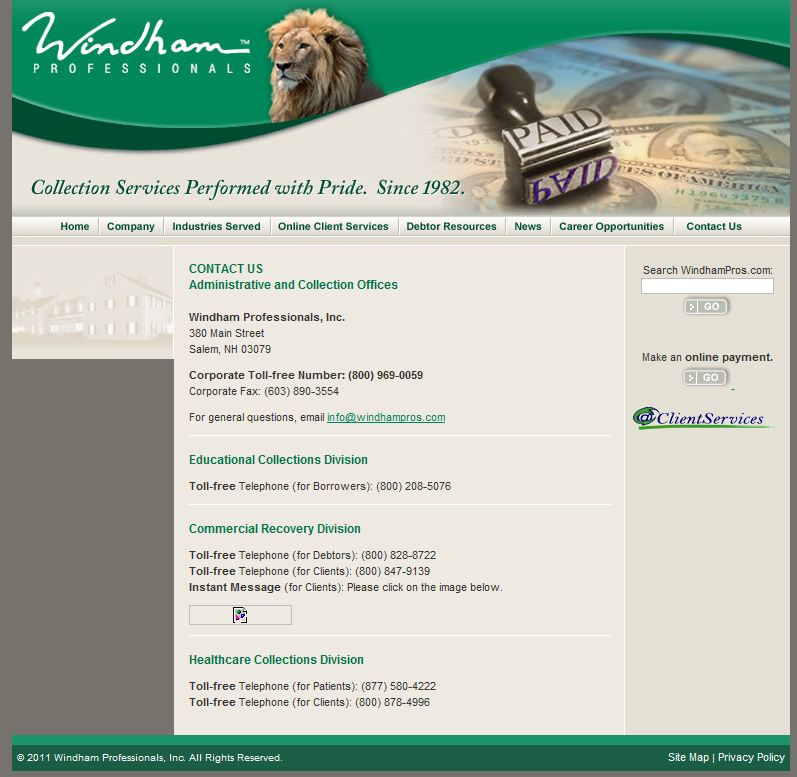

- Windham Professionals http://www.windhampros.com Salem, New Hampshire U.S.A.

- Phone: 800-969-0059

- Web:

- Category: Collection Agency's

Windham Professionals Refuses to Honor Rehabilitation Agreement Salem New Hampshire

*UPDATE Employee: I'm sorry

*Consumer Comment: My experience

*Consumer Suggestion: "26 years?"

*UPDATE Employee: Do your research

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

When I was younger, I moved around a lot as I searched for my first post-baccalaureate career. The post office wasn't as fast as I was, and sooner than later, I ended up with defaults on student loans....which were sold to guarantors, which were sold to collection agencies, aka Windham Professionals. I got married, had kids, and was unemployed. Then I got a great paying steady job, finally! There are no statute of limitations on student loans, no due process for wage garnishment (thankfully I'm not in that situation), and they cannot be discharged in bankruptcy.

I wanted to do the right thing, so I tracked down who owned my loan, and I called up Windham. They told me that if I made 9 consecutive payments, my loan would be magically rehabilitated, my loans would no longer be in default, and all negative items would be removed from my credit report. This was April 2008.

As of Feb, 2009, I have made 20 consecutive payments to Windham for $70 a piece. Twice per month for a total of $1400. I am continuing to make payments right now. I have not missed any. I recently called them to ask why my loan had not been rehab'ed yet. They responded that due to the "bad economy", and dried up credit market, no lenders were "available" to buy the loans back. I asked them "So I kept my end of the bargain, and you cannot keep yours?" Isn't this a breach of contract? Against the Higher Education Act? Fraud? Two weeks later they sent me a William D Ford Consolidation Application. I thought finally! It's about time! This must be the rehab lender they needed! Of course EVERY line on the form was incorrect and did not include my other student loan that I needed to consolidate. So I went to the William D Ford official gov't website and filled out a clean application and sent it back. I waited 1 month exactly.

While I'm waiting for this consolidation process to occur (4-6 months), I called up Windham again to make sure my payments would stop when the loan was bought, everything was in order, had they talked to William D Ford program officials, etc, etc.

Now they tell me that because I'm going to consolidate, all my rehab payments don't count because technically I haven't completed the program until a PRIVATE lender buys the loan. huh? They won't remove my negative items. They won't remove the defaulted status. They won't rehab the loan. They said I have 2 choices. Sign the consolidation paperwork and keep the bad credit, or HOPE AND PRAY that a PRIVATE lender buys the Rehabed loan (thus completing the program) and keep paying us in the meantime....and cancel all William D Ford Paperwork that pays them off. This seems fishy, illegal, and wrong. HELP!

David

Radford, Virginia

U.S.A.

This report was posted on Ripoff Report on 02/18/2009 03:01 PM and is a permanent record located here: https://www.ripoffreport.com/reports/windham-professionals/salem-new-hampshire-03079/windham-professionals-refuses-to-honor-rehabilitation-agreement-salem-new-hampshire-425721. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 UPDATE Employee

I'm sorry

AUTHOR: Green-Blood - (USA)

SUBMITTED: Wednesday, March 09, 2011

I am truly sorry you are having so much trouble. I do work for the company, and though I can't vouch for them all, we're really not all that bad.

The RHB program does give you benefits that the involuntary actions taken against you wouldn't. For one, the program is 9-12 months, sometimes it does take longer if a lender doesnt immediately pick up your loan.

We do not own your loan, we are contracted by Sally Mai.

If you are going to have your taxes taken (Certified for Tax Offset) and you set up in the program, you must make ABOUT 4 payments to come off of it. NO LESS THEN FOUR will take you off of the list. BUT the IRS does not move with the speed of lightening... We can give you a number to see when you do come off of the list and even just to see if you're on it. If your taxes are taken NOT ALL OF THEM GO TO THE LOAN. The IRS takes a percentage of what ever you were supposed to get back, no WP...

You can also be garnished for 15% of your wages with every paycheck. Some places take more depending on the laws in that state. Your SSI can also be garnished. And other companies can also take your professional license.

Being garnished does not count as a volintary action even if you "allow" windham to do it. Therefore your account will not come out of default and the marks will not be erased when it is gone.

Taxes do not cover the debt. If your taxes are taken and it is more then what your debt is. It doesnt count the interest rate. You still need to call and have it taken care of. Weither thats the IRS or our doing I dont know, sorry.

At the end of the program you have all of your borrower rights back, you can consolidate, put it in forbarence, it comes off of your credit, and your taxes will be safe once more.

You will also stop hearing from people like us. We do, however, make reminder calls.

In your situation you were having trouble putting the money together... People like me understand. I'm in college supporting my MOTHER, I'm still just a kid...

We can only hold the payment off for so long, it still has to be within your due date and the month.

If you pay on the 18th every month, that makes your Due date the 28th. The due date isnt when you pay, its set up so it gives you a little bit of leeway and it makes it look like youre paying EARLY, every month.

I am sorry that wasnt enough for you...

If you have any other questions or concerns please asked me.

Remember we're only doing our job. But there is no reason to be rude to a person, I try very hard to be pleasant, I really only want to help.

We don't all bite.

#3 Consumer Comment

My experience

AUTHOR: john - (United States of America)

SUBMITTED: Saturday, January 22, 2011

I received a call and was told of an impending garnishment.

I asked what I could do about it and they offered me the program.

The promises were that in 6 months, they would clean all reports of default from my report and that I could change my payment to a lower amount then too. I could also call and push a payment in case i found myself in trouble and unable to pay the monthly 200.

I live check to check and my job slims way down in the summer so I save a little to get by. They needed all that I saved. 500... So I scrambled and scraped through.

I sent back the contract with adjustments so that it would reflect what I was told but was told that I had to sign it again 'as is' which meant that all the promises were gone. The contract does nothing but protect them from following through with what they said to me.

It turned out that it was 9 months before they will remove the defaults and change my payment. When I called a couple months later to ask for a payment push, I was told that they could hold off for a couple weeks but the next payment would still be due on time. So I had to pull 400 out of no where in the span of 2 weeks.

I can accept the lies that got me to sign up but I also found out that they'd be taking more than 2000 dollars for themselves as payment for the program. If they don't adjust my payments and remove the defaults, I will not stop until I've made it happen and gained restitution for the time lost.

Once I pay someone more than 2000 when I could have just slowly payed the original debt at my own speed and been in the same position, I don't consider it a privilege at all. They'd just better follow through.

#2 Consumer Suggestion

"26 years?"

AUTHOR: Truth - (U.S.A.)

SUBMITTED: Saturday, March 28, 2009

After 26 years of outstanding service, why isnt you co accredited by the BBB? Could it be b/c you are full of it and Windham Prof. is a decietfull greedy little (and i do mean little) co. trying to penny pinch any way they can?

#1 UPDATE Employee

Do your research

AUTHOR: John - (U.S.A.)

SUBMITTED: Friday, March 13, 2009

Nothing that the company or it's employees told you is false or misleading. Let's get a few things straight:

1: Windham is NOT a debt purchasing company and does NOT OWN any debt that they collect on. Windham is a contracted agency that competitively bids for business and continues to hold many of it's contracts due to 26+ years of PROFESSIONAL debt collection.

2: Read your rehabilitation letter, I am sure that the terms specify implicitly that the program lasts for 9 months, however there may be instances where the process takes longer and if that happens then you need to continue to make payments until that happens (which you are doing.) Remember one thing...YOU defaulted, not Windham.

3: A program like a rehabilitation is a PRIVILEGE and not a right! Our clients demand the BALANCE IN FULL and only allow programs once we complete the qualification process which includes a full financial, new references, verified/certified funds and a signed rehabilitation agreement.

I am willing to believe that if I pulled your file that I would find that the story as you tell it is a bit different than how you describe it. Perhaps not, but the bottom line is that you are dealing with one of the most professional, compliant companies in the industry...you should not take out your financial frustrations out on the ones trying to help you....

Advertisers above have met our

strict standards for business conduct.