Complaint Review: Allied Interstate - Missouri

- Allied Interstate Missouri U.S.A.

- Phone:

- Web:

- Category: Collection Agency's

Allied Interstate, Should I Answer The Phone? Started calling everyday recently trying to rip mee off. Missouri

*Consumer Suggestion: Alot of invalid info here! Be Careful!

*Consumer Comment: SOL???

*Consumer Comment: Remember what Company we are talking about here....

*Consumer Comment: Calm down, Dawn

*Consumer Suggestion: So if a collection agency calls your house

*Consumer Comment: Donald does have a point

*Consumer Comment: The mincless

*Author of original report: Sorry to cause a fight

*Consumer Comment: Quit name-calling-who knows if it's a collector

*Consumer Comment: Try a caller ID machine

*Consumer Suggestion: Take it from someone who has experience with JDB's

*Consumer Comment: Joe is a moron!

*Consumer Comment: Joe is a moron!

*Consumer Comment: Joe is a moron!

*Consumer Comment: Joe is a moron!

*Consumer Suggestion: Put yourself on don't call list

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

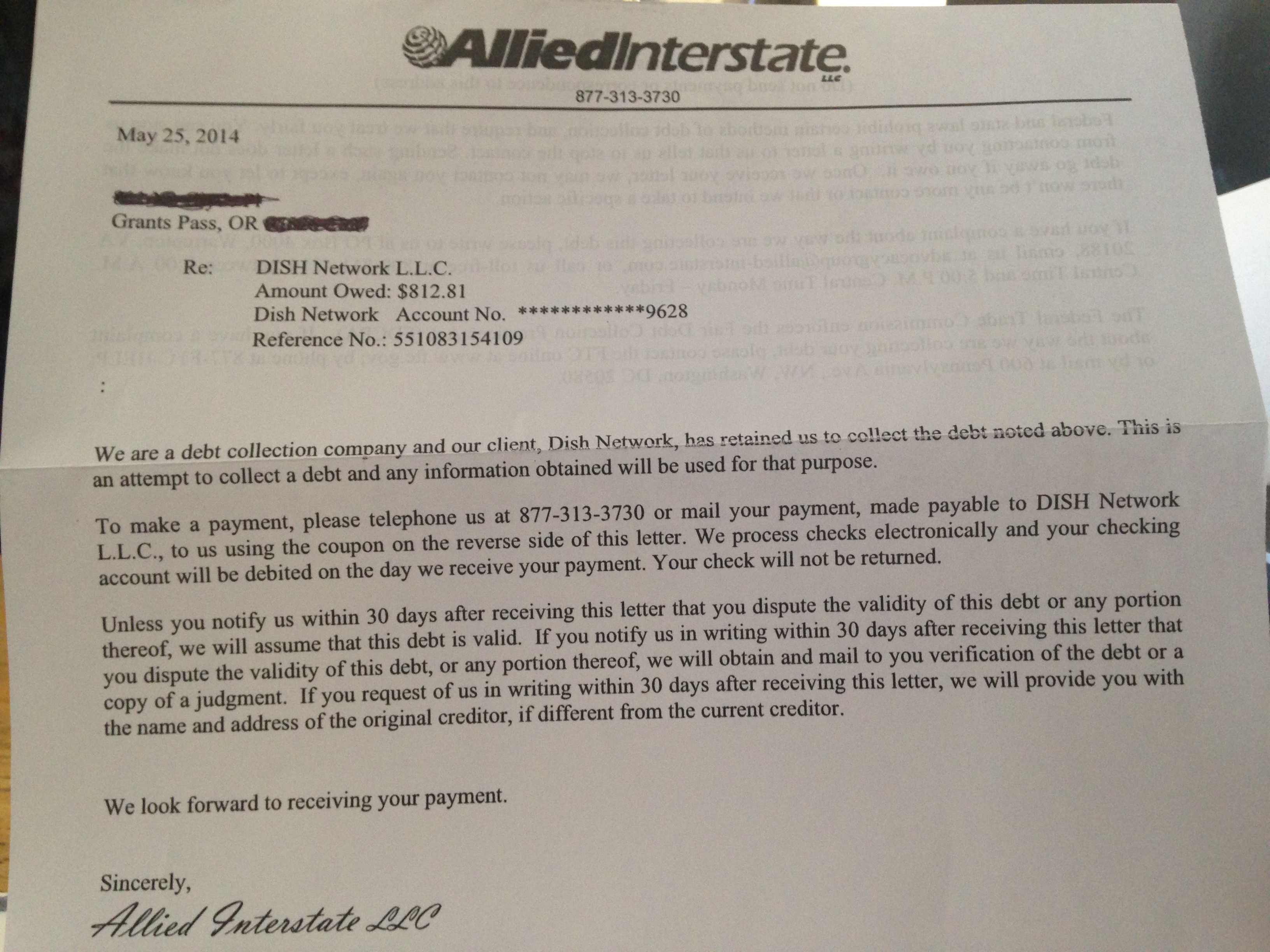

I started getting calls everyday from Allied Interstate a few days ago. I have caller ID and never answer unless I know who it is. Anyway, the number came up unknown and they leave messages that state who they are but do not say who they are calling for or what they are calling about. The man says due to Federal regulations he cannot leave more info. I haven't called him back yet and I came across this company while reading this site today and now I am really scared to answer the phone or call back.

I may have a couple of old small debts but I don't want to call and find out. It may be my husband they are looking for. They won't say. They could be calling for someone else according to the reports on this site. They never sent a letter like they said on the answering machine either. Does anyone know what would happen if I never answered the phone?

Cathey

Gladstone, Missouri

U.S.A.

This report was posted on Ripoff Report on 10/18/2005 11:02 PM and is a permanent record located here: https://www.ripoffreport.com/reports/allied-interstate/missouri/allied-interstate-should-i-answer-the-phone-started-calling-everyday-recently-trying-to-161255. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#16 Consumer Suggestion

Alot of invalid info here! Be Careful!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, February 09, 2006

1. The "Do Not Call List" applies ONLY to telemarketers. It does not apply in any way to any debt collector. That is what the FDCPA provided us with the provision to use the Cease Communications request.

2. There is not one standard SOL of 7 years. Each state has a different SOL for enforcement of debt colection. The FCRA 7 year rule is only for reporting negative information, and has absolutely nothing to do with debt collections, or SOL.

3.Know the difference between a debt collector and a junk debt buyer, and the difference between a collector employed by the original creditor and a third party debt collector. The laws apply differently to each.

Knowlege is power, so get it right!

#15 Consumer Comment

SOL???

AUTHOR: Joann - (U.S.A.)

SUBMITTED: Thursday, February 09, 2006

According to the credit reporting agencies as long as the credit companies refile the same debt before the 7 year sol you are stuck with it again still on your credit for another 7 years and I learned this from experience after a nasty divorce

#14 Consumer Comment

Remember what Company we are talking about here....

AUTHOR: Tina - (U.S.A.)

SUBMITTED: Friday, February 03, 2006

Laurie,

I have posted a report on this Company for their harrassing calls. I do not owe them anything. They have the wrong number but persist to call me every single day for the last 6 months.

Just telling them to stop calling because they have the wrong number doesn't work with this "bottom of the barrel" company. By law, they DO NOT have to stop calling you just because you say so. You have to submit in writing a Cease Communications letter via certified mail.

I also work collections and know this to be true. My Company will stop calling if our Customer asks us to, unless you account becomes grossly deliquent. Then we require the Cease Communications letter.

I have read everyone's comments about just paying your bills etc. I just want the ones commenting to remember what company we are talking about. These kinds of Collection Agencies are what make people afraid to answer their phones.

I understand how you feel Cathey. After reading all of the reports on Allied, I am TRULY grateful that I do not owe them anything. I am not sure if I would answer the phone either.

#13 Consumer Comment

Calm down, Dawn

AUTHOR: Debra - (U.S.A.)

SUBMITTED: Friday, October 21, 2005

Rather than eviscerating people who are doing a job, why not monitor your credit quarterly, or yearly. Then you can dispute incorrect entries on your cbr before they turn into bigger headaches. It's your credit, own it and take care of it.

Poor job of skiptracing? Have you done skiptracing? I do it everyday. I'm pretty good at it. I'm not perfect. I call people's ex-spouses, their parents. I call them more than once. So far as my research goes, that is a good address for them, and I am allowed to attempt to contact my debtor at his last, best address. What happens if I'm wrong? I ask for a better address or phone. Usually I don't get it, but I've been informed that the number/address is incorrect, so I am bound by law to cease all attempts at that number, and to note it so anyone coming along after me doesn't make the same mistake. What's my next move? Back to skiptracing. You'd be surprised how many times I find better information.

Did you know that a collector can be held personally responsible for their violations? How long do you think you'd last? My personal finances are on the line every time I pick up the phone, so it's in my best interests to obey the law.

Come and do this job for a while. With your attitude, you'd fit right in at an agency.

#12 Consumer Suggestion

So if a collection agency calls your house

AUTHOR: Dawn - (U.S.A.)

SUBMITTED: Friday, October 21, 2005

You are just going to give them your banking information right? GTF out of here. Collection agencies are ripping off, harrassing and stealing money out of bank accounts. What about the innocent victims? I had a phone bill for 996.00 in my name! I never even lived at the address but the collector insisted it was my bill, so d**n right cease and desist letter goes in the mail! A lot of these CA's see your social, do a poor job of skip tracing and you are getting the phone calls! I guess we should all just start paying bills that we have no memory of, after all collection agencies only hire the brightest and smartest people to work for them. Collectors get their best victims on the phone and they will misconstrue anything to get you to admit a bill is yours.If the amount is wrong, should we not ask for the correct amount? What if the year the bill defaulted is wrong, should we not ask? No one is saying dont pay your bills, what is being said is to use your consumer rights to keep CA's from backing you into a corner. If you dont like the fact that there are educated consumers than thats your problem.

#11 Consumer Comment

Donald does have a point

AUTHOR: Joe - (U.S.A.)

SUBMITTED: Friday, October 21, 2005

Donald,

You do have a point that paying what you owe in the first place would pretty much eliminate this whole mess. But once into a hole like a bunch of peolpe are going to be from the hurricanes and related circumstances, sometimes there just isn't the money to do so.

Some companies will take much less than the value that is owed to clear it off the books. Try settling them for 25 cents on the dollar...or less if possible. After all, many collectors buy their accounts for pennies on the dollar and anything they make above that is pure profit.

Many times, the collector OWNS the debt once purchased off the original creditor, so paying them off isn't going to make the original creditor any more money than they got from selling the defaulted account. Not true in all cases, but a whole lot of them. That is why many of the original creditors will be happy to hear from you with a settlement amount even less than the original figure you owed. Better than nothing, especially if it's old.

No, I'm not a lawyer, collector, or anything like that...but I do lend money to people and have to review their credit in doing so, and often times makes suggestions on how to accomplish what they set out to do.

Some of that help is, if I can't do anything for them at the time, how to remove errant, old or derogatory items from their credit so that can eventually get into a position to get a loan...possibly to even pay off those creditors and collectors or help them with settlements to at least be able to pay some of it off. The method I suggested before worked not only for me when I did have crummy credit years ago, but for many others to whom I've mentioned it.

If it's a judgment...it's best to do something to try to pay it or it will be there 10+ years on the credit and affect any ability to buy or sell a home, or even refinance. I've settled many judgements for people with an average of 30 cents on the dollar....more like 50-60% if it's only 2-3 years old, and 70-75% if less old than that. If it's just fresh...not likely for awhile.

Anyway...best wishes...hope some of this rambling on helps. PS: I don't telemarket...I only call on those who actually inquire...I personally hate cold calling and don't do it, period. Primarily I work with sub-prime clients.

#10 Consumer Comment

The mincless

AUTHOR: Donald - (U.S.A.)

SUBMITTED: Thursday, October 20, 2005

Whatever happend to paying what you owe...

Waiting for SOL?... avoiding calls because you might owe something?... investing in technology that blocks bill collectors from calling you?... STAY OFF THE PHONE?...

Federal law has it so all this is unecessary. Cease and desist.. certify the letter, get confirmation of delivery, record the calls (if they continue)... why do we act like children?

*how about we start paying our bills? let's start a trend in this country and stop letting deadbeats give us advice... it may be hard to do (and i am not talking about fixed income debtors, i mean the deadbeats) but make reasonable arrangements for bills, answer the phone.

and joe, before you go rambling on again about your telemortgage peddling, realize it has nothing to do with 3rd party debt collection... there are no "no call list" for collection agencies and very strict disclosure laws. it's probably a good sign that you don't know that.. usually debtors, attorneys and collectors know the laws so you are probably none of the three...

#9 Author of original report

Sorry to cause a fight

AUTHOR: Cathey - (U.S.A.)

SUBMITTED: Thursday, October 20, 2005

I didn't mean to cause a fight between anyone! I was just looking for people's opinions. It's obvious this company treat people horribly. I won't talk to people like that. I will hang up on them. Checking my credit report sounds like the best option. I will do that. We are also on the no call list already and I don't think that applies to collection agencies anyway but thank you for the suggestion. Like I said it would have to be an old debt or they may have the wrong house. Who knows. I've read about the zombie debt collectors on MSN as well as Allied Interstate! These people are unbelievable! Anyway, thanks everyone. I would like to say that I don't appreciate the comment made about my husband but since this person doesn't know my husband, who is wonderful by the way, I will not take it personally.

#8 Consumer Comment

Quit name-calling-who knows if it's a collector

AUTHOR: Joe - (U.S.A.)

SUBMITTED: Thursday, October 20, 2005

Lauri,

Gee...you've certainly got a bug up your a*s. You're so quick to call me a moron...but how am I to know it's a collector? I don't get collectors on me so I obviously don't know their pitch. Just trying to help the woman...no need for your nasty names.

Either way, Marc has a good point to pull your credit. At least in that regard, I do know one of their tricks...and that is to report old debt as if it were new.

Many times, like Marc says, it's an old debt. Many times, companies buy them wholesale for a penny or so each, and then report them on the bureau as if they were a new collection account...and drop your FICO score...and then they start harrassing you about them all over again. Lots of times, this is on accounts that are about to drop off the face of the earth as far as credit bureaus are concerned after the statutory 7 years.

There are penalties for doing this, up to and including triple damages and potential jail time for a collector doing this. Even with these penalties, not many people know it's illegal to report your old debt as new and start the whole 7-year cycle again. So do pull up your credit and see if that's something that is or isn't happening. Remind them that this is illegal and you will see them in small claims court to collect your damages.

Also...here's a way little known to screw everyone involved. Let's say that you owe party "A" about $100. They sell to collector "B" and now both are reporting you as delinquent on your credit bureau.

This works in some cases, but not all...but make arrangements to pay a settlement amount DIRECTLY to party "A" bypassing party "B". Make sure you get a satisfaction letter on your debt to party "A" - now remember, they are the original holder of the debt.

Now once you get your satisfaction documentation or letter, call up the credit bureaus reporting you and tell them to get both of those items off your report. Why should they do this? Here's why:

Party "A" after selling to party "B" technically no longer owns the debt and therefore having no legal interest in it any longer cannot report you as delinquent. Party "A" can, however, agree to settle that debt even though they don't own it in reality because they were the ones who originally suffered the loss..but this is the case believe it or not. Now, since party "B" is trying to collect on a debt that has been "satisfied", they no longer have any legal interest in it, nor the right to collect on a debt that has already been satisfied. They MUST remove it as well and stop reporting it to the credit bureaus.

Remind them also that reporting false information to the bureaus has serious consequences and that you will persue it in a court to seek damages if they continue.

This mostly works with hospitals, dentists, and other smaller creditors...it won't work with Discover...they're wise to it.

Not bad for a poopie-head moron...eh?

#7 Consumer Comment

Try a caller ID machine

AUTHOR: Marc - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

Years ago I bought a little gizmo from Radio Shack that solved my unwanted solicitor problem. You simply push a button and thereafter the calls from that number will be automatically rejected. Solicitors will call from different numbers, but you will eventually get them all. I'm sure nowadays there is an even better machine on the market. As I remember the phone companies themselves were the worst offenders, and not subject to the "Do Not Call" list. My only other advice would be to tell your husband to be a man, get some self-respect and pay his bills. His family is watching.

#6 Consumer Suggestion

Take it from someone who has experience with JDB's

AUTHOR: Dawn - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

Putting youself on a do not call list wont help you and listening to "Lauri the Collector" will almost certainly get you screwed. Take it from me when I tell you this.For all you know you could be a victim of identity theft. Your first order of action is to pull your credit report, look the entire thing over, if Allied is on your credit report great now you know where to send that validation and cease and desist phone contact letter to. Take a look at the debt they may be trying to collect on, check your states Stature of Limitations, if its past the SOL in your state they are SOL (s*** out of luck)as well, they cant sue you, if the bill is almost 7 years old its going to fall off anyway so I wouldnt bother rushing to pay it, all you are going to do is start the SOL clock again you dont want that, it could ruin your credit. STAY OFF THE PHONE, you may say something that they may construe as admission.

#5 Consumer Comment

Joe is a moron!

AUTHOR: Lauri - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

Cathey,

It sounds from the information that you provided that Allied Interstate is a collection agency. By Federal Law they CAN'T leave a message with all kinds of information, just the name of the person they are trying to reach, the name of the person calling and a call back #.

If the party they are trying to reach isn't you, then that's it...let them know this is your #, you don't know the person they are trying to reach, and to please remove your #. By law, they can no longer call you.

If it's about a debt you owe, then the best way to handle it is to PAY IT! Ignoring a debt will NOT make it go away.

If you owe money, being on the Do Not Call list means absoutley nothing, as your not being marketed for a sale, you are being contacted regarding a debt you incurred and are refusing to pay.

#4 Consumer Comment

Joe is a moron!

AUTHOR: Lauri - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

Cathey,

It sounds from the information that you provided that Allied Interstate is a collection agency. By Federal Law they CAN'T leave a message with all kinds of information, just the name of the person they are trying to reach, the name of the person calling and a call back #.

If the party they are trying to reach isn't you, then that's it...let them know this is your #, you don't know the person they are trying to reach, and to please remove your #. By law, they can no longer call you.

If it's about a debt you owe, then the best way to handle it is to PAY IT! Ignoring a debt will NOT make it go away.

If you owe money, being on the Do Not Call list means absoutley nothing, as your not being marketed for a sale, you are being contacted regarding a debt you incurred and are refusing to pay.

#3 Consumer Comment

Joe is a moron!

AUTHOR: Lauri - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

Cathey,

It sounds from the information that you provided that Allied Interstate is a collection agency. By Federal Law they CAN'T leave a message with all kinds of information, just the name of the person they are trying to reach, the name of the person calling and a call back #.

If the party they are trying to reach isn't you, then that's it...let them know this is your #, you don't know the person they are trying to reach, and to please remove your #. By law, they can no longer call you.

If it's about a debt you owe, then the best way to handle it is to PAY IT! Ignoring a debt will NOT make it go away.

If you owe money, being on the Do Not Call list means absoutley nothing, as your not being marketed for a sale, you are being contacted regarding a debt you incurred and are refusing to pay.

#2 Consumer Comment

Joe is a moron!

AUTHOR: Lauri - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

Cathey,

It sounds from the information that you provided that Allied Interstate is a collection agency. By Federal Law they CAN'T leave a message with all kinds of information, just the name of the person they are trying to reach, the name of the person calling and a call back #.

If the party they are trying to reach isn't you, then that's it...let them know this is your #, you don't know the person they are trying to reach, and to please remove your #. By law, they can no longer call you.

If it's about a debt you owe, then the best way to handle it is to PAY IT! Ignoring a debt will NOT make it go away.

If you owe money, being on the Do Not Call list means absoutley nothing, as your not being marketed for a sale, you are being contacted regarding a debt you incurred and are refusing to pay.

#1 Consumer Suggestion

Put yourself on don't call list

AUTHOR: Joe - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

What??? So he gave you a line about federal regulatios not allowing to say more? BULLSH*T...he is a liar.

I work for someone and call legitimately for a loan...and leave whatever message I see fit. The only time I can't call is either before 8am or after 9pm BY LAW....or if you are registered with the national Do Not Call list you can easily find and sign up for online.

He won't tell you why he's calling simply because then you will know what sort of garbage he's peddling...and not answer the phone at all next time. Old trick...very old...tell the slime bucket to take a hike and put you on their don't call list.

Once registered, give it 30 days or so and your calls will slow down. Anyone calling after that, take the company name and any number or other info you can gather. They can be subjected to an $11000 fine per instance...and in many states $500 or more of that is payable to you. Washington State residents pay attention here...in cases of unsolicited spam, you can collect the whole fine...some people make a living at this by threatening lawsuits and asking the company for $500-$1000 to waive future rights to sue them...but then there is a law specific to WA state. I've seen this work personally.

Good luck.

Advertisers above have met our

strict standards for business conduct.