Complaint Review: Ameriquest Mortgage - Orange California

- Ameriquest Mortgage 1100 Town & Country Road Ste. 1200,Orange, Orange, California United States of America

- Phone:

- Web: http://www.ameriquestmortgage.com/

- Category: Financial Services

Ameriquest Mortgage Ameriquest Orange, California

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

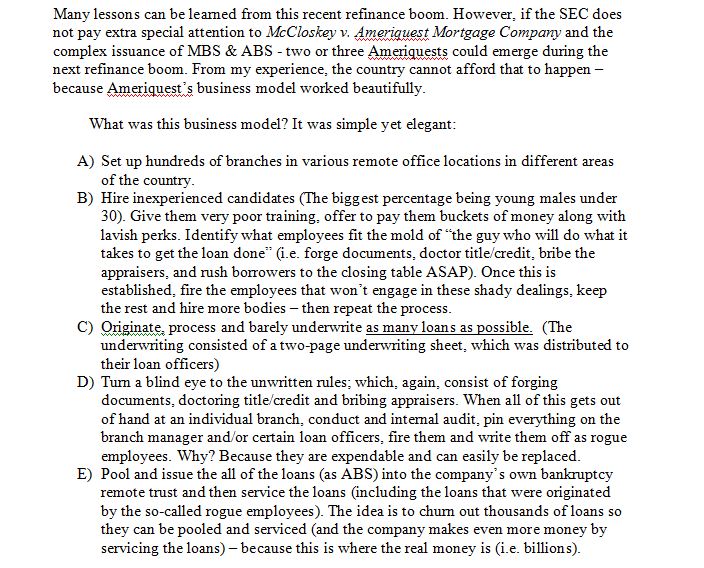

William McCloskey worked for Ameriquest from November 2004 till March 2005. William was fired after he reported illegal activity behind the walls of his Ameriquest branch, which virtually mirrored all of the widespread reports about the company (to local detectives, the PA Attorney General, the S.E.C. and the F.B.I).

William sued Ameriquest Mortgage Company under the whistleblower provision of the Sarbanes Oxley Act of 2002. The act pertained to publicly traded companies and issuers of securities under Section 15(d) and 12h-3 of the Securities and Exchange Act of 1934. Ameriquest was the largest issuer of asset-backed securities in the world during the refinance boom.William articulated how Ameriquest originated, processed and loosely underwrote toxic mortgages and then securitized them through their own subsidiary (Ameriquest Mortgage Securities) before the Department of Labor and the S.E.C. in McCloskey vrs Ameriquest Mortgage Company (2005-SOX-093).

Unfortunately, William ultimately lost the suit because of a technicality (he did not file his initial complaint with OSHA within 90-days). However, William thoroughly articulated how Ameriquest perpetrated the largest securities fraud scheme in the history of the United States. The securities fraud scheme was one of the biggest contributors to the collapse of the nation's markets and economy in September 2008. All of the bad paper issued by Ameriquest Mortgage Securities made its way around the world as collateralized debt obligations.

In McCloskey v. Ameriquest Mortgage Co.,ARB No. 08-123, ALJ No. 2005-SOX-93 (ARB Aug. 31, 2010), the Complainant argued that his SOX whistleblower complaint should be equitably construed as timely because the Respondent had a burden to inform him of the existence of the SOX, and failed to do so. The Complainant contended that the Respondent bore this burden based on the requirement to certify financial reports under Section 302 of the SOX. The ARB found that the Respondent did not have a burden to inform the Complainant of the whistleblower provision of the SOX and its filing deadlines, and that Section 302 was inapposite to the Complainant's case.

_____________________________________________________________________

1

Introduction

The Complainant, William John McCloskey, appeals the Decision and Order of Summary

Judgment Granting Respondents Motion to Dismiss of the Administrative Law Judge, dated

July 16, 2006, on the basis that the Respondent has actively mislead this honorable court by

knowingly making false statements, intentionally omitting information, causing portions of

statements to be misleading, and intentionally concealing material facts.

1. Jurisdiction

Complainant should be Entitled to Appeal Pursuant to the Doctrine of

Estopple by Misrepresentation/Ommision because of Additional Affirmative Misconduct

by the Respondent

Sarbanes-Oxley provides a new definition of prohibited misleading conduct that affects

participation in an official proceeding (Section 1512(b) of Title 18).

1) knowingly making a false statement

2) intentionally omitting information from a statement and hereby

causing a portion of such statement to be misleading, or

intentionally concealing a material fact, and thereby creating a

false impression by such statement;

3) with intent to mislead, knowingly submitting or inviting reliance

on a writing or recording that is false, forged, altered, or

otherwise lacking in authenticity;

4) with intent to mislead, knowingly submitting or inviting reliance

on a sample, specimen, map, photograph, boundary mark or other

object that is misleading in a material respect; or

5) knowingly using a trick, scheme, or device with intent to mislead

Section 1102 Tampering With a Record Or Otherwise Impeding An Official Proceeding

Section 1512 of title 18, United States Code, is amended--

(1) by re-designating subsections (c), (d), (e), (f), (g), (h), and (i)

as subsections (d), (e), (f), (g), (h), (i) and (j);

(2) by inserting after subsection (b) the following new subsection:

2

(c) Whoever corruptly--

(1) alters, destroys, mutilates, or conceals a record, document, or

other object, or attempts to do so, with the intent to impair the

object's integrity or availability for use in an official proceeding;

or

(2) otherwise obstructs, influences, or impedes any official

proceeding, or attempts to do so;

shall be fined under this title or imprisoned not more than 10

years, or both.

Diane Tiberend, Adam Bass and the Respondent are well aware of Ameriquests

Involvement in the Securities Markets and are well aware that Respondents wholly owned

Subsidiary has a Class of Securities Registered under Section 12 and 15(d)

Judge Romano relied on Ms. Diane Tiberends sworn affidavit in order to grant

Respondents Motion to Dismiss.

Judge Romano cited Bulls v. Chevron/Texaco., et. Al., Case No. 2006-SOX-00117.

The non-moving party must present affirmative evidence in order

to defeat a properly supported motion for summary

decision. Anderson v. Liberty Lobby, Inc., 477 U.S.242, 247

(1986); Celotex Corp. v. Catrett, 477 U.S. 317, 324 (1986). It

ienough that the evidence consists of the partys own

affidavit, or sworn deposition testimony and a declaration in

opposition to the motion for summary decision. However,

such evidence must consist of more than the mere

pleadings themselves. Id. at 324. Affidavits must be made

on personal knowledge, set forth such facts as would be

admissible in evidence, and show affirmatively that the

affiant is competent to testify to the matters stated therein.

F.R.C.P. 56 (e).

The record will show that Diane Tiberend omitted pertinent information to deliberately

deceive this honorable court into believing that the Respondent does not have a class of securities

under Section 12 or 15(d) of the Securities and Exchange Act of 1934. As a matter of fact, Diane

3

Tiberand has been a signatory during the issuance of the Respondents wholly owned subsidiarys

asset-backed securities (see document marked as exhibit A).

Ameriquest Mortgage Securities filed reports under Section 12h-3 and Section 15 (d) of

the Securities and Exchange Act of 1934 in every transaction during the issuance of asset-backed

securities) before, during and after my tenure with Ameriquest.

(See copy of Edgar based issuance of securities as exhibit B)

As the non-moving party, it was the Respondents obligation to inform this honorable

court about the complex issuance of securities. No evidence whatsoever was submitted to

demonstrate that the Respondent was not an issuer or servicer of securities, or at least an entity of

a wholly owned subsidiary, which issued securities that were serviced by the Respondent

(Accordingly, a moving party may prevail by pointing to the absence of evidence proffered by

the nonmoving party).

Further, Adam Bass is the Executive Vice President of Ameriquest and a shareholder of

Buchalter Nemer. As a shareholder in the firm and as V.P. of Ameriquest, Mr. Bass is not a secondary

player far removed from any wrongdoing. Further, Mr. Bass has been a signatory during the issuance

of ABS to Ameriquests security holders. Therefore, his involvement is not limited and episodic.

Ms. Tiberends Sworn Declaration is a Textbook Deliberate False Dichotomy.

Ms. Diane Tiberend submitted the following statement in her affidavit:

4

7. Ameriquest is not a publicly traded company. Neither

Ameriquest nor its parent, ACC Capital Holdings Corporation,

has a class of securities registered under section 12 of the

Securities Exchange Act of 1934, or is required to file reports

under section 15(d) of the Securities Exchange Act of 1934.

Ms. Tiberends statement about ACC Capital Holdings and Ameriquest is actually true.

However, Ms. Tiberend is violating the law by concealing and omitting pertinent material

information.

If a reasonable fact finder evaluating the evidence could draw

more than one inference from the facts, and if that inference

introduces a genuine issue of material fact, then the court should

not grant the summary judgment motion. Augusta Iron and Steel

Works v. Employers Insurance of Wausau, 835 F.2d 855, 856 (11th

Cir.1988).

(A true and correct table showing how Ms. Tiberend is portraying the Respondents

structure and a true and correct table of how the Respondent issues ABS is labeled as exhibit C).

How Asset-Backed Securities are Issued

Ms. Tiberend succeeded in purposely trying to deceive this honorable court to believe that

securities do not exist at all. Again, it is undeniable that Ameriquest is involved in the securities

markets. Ameriquest Mortgage Securities is a wholly owned subsidiary of Ameriquest Mortgage

Company. As a matter of fact, ACC Capital Holdings, Ameriquest Mortgage Company,

5

Ameriquest Mortgage Securities and Ameriquest Securities Trust all have the same address and

corporate officers including John Grazer (CFO), Diane Tiberend and Adam Bass.

Ameriquest Mortgage Securities filed reports under Section 12h-3 and Section 15 (d) of

the Securities and Exchange Act of 1934 in every transaction during the issuance of asset-backed

securities (see copy of Edgar based issuance of securities as exhibit B).

As the non-moving party, it was the Respondents obligation to inform this honorable

court about the complex issuance of securities. No evidence whatsoever was submitted to

demonstrate that the Respondent was not an issuer or servicer of securities, or at least an entity of

a wholly owned subsidiary that issued securities that were serviced by the Respondent.

Further, Ms. Tiberend, Mr. Bass and the Respondent are well aware of their obligation

under Section 302 of Sarbanes-Oxley and they are well aware of how the act was tailored to

issuers of asset-back securities.

(A true and correct table from a prospectus with the SEC which shows how securities are

issued is labeled as exhibit D).

The SEC Rules for Issuers of Asset-Backed Securities are Crystal Clear

6

Excerpts from SEC Rules:

Companies that issue asset-backed securities have a reporting

obligation though either Section 13(a) or 15(d) of the Securities

Exchange Act of 1934, at least for a period of time

We have adopted this requirement largely as proposed. Because of

the broad scope of Section 302 of the Act, the new rules are

applicable to all types of issuers that file reports under Section

13(a) or 15(d) of the Exchange Act, including foreign private

issuers, banks and savings associations, issuers of asset-backed

securities, small business issuers and registered investment

companies.33

B. Discussion of Certification Requirement

1. Issuers Subject to Certification Requirement

Section 302 of the Act states that the certification requirement is to

apply to each company filing periodic reports under Section 13(a)

or 15(d) of the Exchange Act.39 Accordingly, new Exchange Act

Rules 13a-14 and 15d-14 apply to the principal executive officers

and principal financial officers, or persons performing similar

functions, of any issuer that files quarterly and annual reports with

the Commission under either Section 13(a) or 15(d) of the

Exchange Act, including foreign private issuers, banks and savings

associations, issuers of asset-backed securities and small business

issuers.40

c) Asset-Backed Securities Issuers

Issuers of asset-backed securities in public offerings have a

reporting obligation under either Section 13(a) or 15(d) of the

Exchange Act, at least for a period of time.44 Because of the nature

of asset-backed issuers, the staff of the Division of Corporation

Finance has granted requests allowing asset-backed issuers to file

modified reports under the Exchange Act.45

The modified reporting structure for asset-backed issuers allows

issuers or depositors to file modified annual reports on Form 10-K

and to file reports tied to payments on the underlying assets in the

trust. These reports include a copy of the servicing or distribution

report required by the issuer's governing documents and

7

information on the performance of the assets, payments on the

asset-backed securities and any other material developments that

affect the issuer. Because the reported information for assetbacked

issuers differs significantly from that for other issuers, the

certification requirement of Section 302 of the Act must be

specifically tailored for asset-backed issuers. The new rules

require asset-backed issuers to certify their reports. The staff of the

Division of Corporation Finance today is providing guidance for

asset-backed issuers regarding compliance with the certification

requirement.

Ironically, the CFO of Ameriquest Mortgage Securities, John P. Grazer, signed a 302

Certification on March 1, 2005 (this was the date of Complainants termination).

(See copy of Edgar based document marked as exhibit E)

Filers under Section 302 of Sarbox

From S.E.C. Division of Corporate Finance: Sarbanes-Oxley Act of 2002 Frequently

Asked Questions:

Section 2

Question 1: Section 2(a)(7) of the Sarbanes-Oxley Act of 2002

(the "Act") defines an "issuer" as an "issuer (as defined in Section

3 of the Securities Exchange Act of 1934 (15 U.S.C. 78(c)), the

securities of which are registered under Section 12 of that Act (15

U.S.C. 78l), or that is required to file reports under Section

15(d)." A company has offered and sold debt securities pursuant

to a registration statement filed under the Securities Act of 1933,

thus subjecting it to the reporting requirements of Section 15(d).

The company did not register the debt securities under Section 12

of the Exchange Act of 1934. Subsequently, the company's

reporting obligations have been statutorily suspended under

Section 15(d) because it had fewer than 300 security holders of

record at the beginning of its fiscal year. The company has not

filed a Form 15 and has continued to file reports pursuant to its

indenture. Is the company considered an "issuer" under the Act?

8

Answer: No. Because the issuer had fewer than 300 security

holders of record at the beginning of its fiscal year, the suspension

is granted by statute and is not contingent on filing a Form 15. The

definition of issuer applies only to issuers required to file reports.

However, see Question 9 regarding these kinds of filers under

Section 302 of the Act.

Question 9: Is an issuer that is filing or submitting reports

exclusively under Section 15(d) of the Exchange Act on a

"voluntary" basis (for example, pursuant to a covenant in an

indenture or similar document), due to a statutory suspension of

the Section 15(d) filing obligation, subject to Rules 15d-14 and

15d-15 and the disclosure required by Item 307 of Regulations S-B

and S-K?

Answer: Yes. All companies filing or submitting reports under

Section 13(a) or 15(d) must comply with those provisions whether

or not a Form 15 has been filed pursuant to Rule 15d-6.

In Flake v. New World Pasta, ALJ CASE NO. 2003-SOX-18/ ARB CASE NO. 03-126, the

ARB concluded:

An agencys views expressed by notice and comment rulemaking

are controlling when, as here, the statute expressly authorizes the

agency to issue implementing rules and regulations. United

States v. Mead, 533 U.S. 218 (2001). Thus, because the SEC

has clearly indicated that 15(d)s automatic suspension goes

into effect by operation of law USDOL/OALJ REPORTER PAGE 7

and a companys failure to file Form 15 has no effect on

the automatic suspension, we conclude that Rule 12h-3 does not

apply to New World.2

The differences between Flake v. New World Pasta and the instant case are glaring. Rule

12h-3 did not apply to New World Pasta, whereas 12h-3 does apply to Ameriquest/Ameriquest

Mortgage Securities. Further, New World Pasta was not required to file a 302 certification and

therefore not subject to section 806 of Sarbox.

9

Further, New World Pasta had a very small issuance of securities. Ameriquest Mortgage

Securities had multiple issuances of multiple classes of securities (i.e.R7, R8 R11, M3).

Moreover, the Respondent, along with its wholly owned subsidiary, was classified as the largest

issuer of asset-backed securities in the world.

New World Pasta Company is not required to file periodic and

other such reports under the Securities Exchange Act, since it has

less than 300 holders of its 9 1/4% Senior Subordinated Notes due

2009, and it has no other class of securities for which it is

required to file reports under the Securities Exchange Act.

Moreover, Ameriquest Mortgage Company served as the sponsor. The sponsor is

responsible for the periodic/annual reports on form 8-K, 10-K and any other Exchange Act

reports required to be filed by the Trust with the SEC, including the financial statements of the

Trust required to be included in such reports.

(See Edgar-based documents for New World Pasta and Ameriquest Mortgage Securities

marked as exhibit F)

Who is the Issuer of Securities?

On December 22, 2004, the SEC published final regulations, labeled Regulation AB.

The depositor (Ameriquest Mortgage Securities). As Regulation

AB would clarify, the depositor for the asset-backed securities,

acting solely in its capacity as depositor to the issuing entity, is the

issuer for purposes of the asset-backed securities of that issuing

entity (Ameriquest Securities Trust).

All public asset-backed issuances that commenced after December 31, 2005 were

grandfathered in their entirety. However, under the previous reporting system, asset-backed

10

issuers were still required to file annual reports on Form 10-K and to file reports tied to

payments on the underlying assets in the trust. Again, because the reported information for assetbacked

issuers differs significantly from that for other issuers, the certification requirement of

Section 302 was specifically tailored for asset-backed issuers.

Prior to Regulation AB, Sarbox created a separate certification requirement applicable

only to Asset- Backed Issuers. Under rules established by Sarbox, each asset-backed issuer must

provide a signed certification addressing:

review by the certifying officer of the annual report and other reports containing

distribution information for the period covered by the annual report;

the absence in these reports, to the best of the certifying officer's knowledge, of any

untrue statement of material fact or omission of a material fact necessary to make the

statements made, in light of the circumstances under which such statements were made,

not misleading;

the inclusion in these reports, to the best of the certifying officer's knowledge, of the

financial information required to be provided to the trustee under the governing

documents of the issuer; and

11

compliance by the servicer (Ameriquest Mortgage Company) with the servicing

obligations and minimum servicing standards.

Ameriquest Remains the Master Servicer of the Loan Pool

Ameriquest was ranked as one of the largest servicers of MBS and ABS in the world.

Their final master servicer rating was RPS3+ prior to their assets being obtained by Citigroup.

In the Reply Brief of Respondent, the Respondents former counsel cited 18 USC Sec.

1514 (A):

"No company with a class of securities registered under section 12

of the Securities Exchange Act of 1934 (15 U.S.C. 781), or that is

required to file reports under section 15(d) of the Securities

Exchange Act of 1934 (15 U.S.C. 78o(d)), or any officer, employee,

contractor, subcontractor, or agent of such company, may

discharge, demote, suspend, threaten, harass, or in any other

manner discriminate against an employee in the terms and

conditions of employment because of any lawful act done by the

employee."

Ameriquest Mortgage meets and exceeds this definition, because not only was its wholly

owned subsidiary (Ameriquest Mortgage Securities) an issuer of asset-backed securities (along

with Ameriquest Securities Trust as the issuing entity), they were the master servicer of the ABS

loan pools worth billions of dollars.

The Prospectus (Rule 424 (b) (3) clearly states:

The master servicer will be required under the applicable

servicing agreement to use its best efforts to enforce the

repurchase or substitution obligations of the mortgage loan seller

for the benefit of the trustee and the holders of the securities,

12

following the practices it would employ in its good faith business

judgment were it the owner of the mortgage loan.

In Decision and Order of Summary Judgment Granting Respondents Motion to Dismiss,

Judge Romano wrote:

I acknowledge that Respondents activities have the potential to

affect the financial welfare of publicly traded companies with

which it does business. However, any product or service that a

company purchases creates the potential for profit or loss for the

company that purchases it.

This would have been a logical conclusion on Honorable Judge Romanos part if the

Respondent did not service the loan pools. Ameriquest Mortgage Companys obligation

continued, however, even after the CFO (John Grazer) of Ameriquest Mortgage Securities signed

off under the 302 Certification Requirement of Sarbox because of its servicing obligations

with a master servicer rating issued by Fitch, Moodys and Standard & Poors.

Officers of ACC Capital Holdings/Ameriquest Mortgage/Ameriquest Mortgage Securities

have Engaged in Willful Malfeasance During the Course of Normal Business and on

Appeal.

The following passage was taken from the free writing prospectus (form 424B5) for

Ameriquest Mortgage Securities Trust 2006 (which consisted of loans originated, processed and

underwritten during Complainants tenure). The passage uses the same exact terminology as the

Sarbox whistleblower provision (i.e. director, officer, employee, or agent of the master servicer

or to the depositor). It is indisputable that Complainant was an employee of the master servicer

of the loan pools.

13

Each servicing agreement will provide that the master

servicer may resign from its obligations and duties under the

related agreement only if its resignation, and the appointment of a

successor, will not result in a downgrading of any class of

securities or upon a determination that its duties under the related

agreement are no longer permissible under applicable law. No

resignation will become effective until the trustee or a successor

servicer has assumed the master servicers obligations and duties

under the related agreement.

Each servicing agreement will further provide that neither

the master servicer, the depositor nor any director, officer,

employee, or agent of the master servicer or the depositor will be

under any liability to the related trust fund or securitiyholders for

any action taken, or for refraining from the taking of any action, in

good faith under the related agreement, or for errors in judgment;

provided, however, that neither the master servicer, the depositor

nor any such person will be protected against any liability which

would otherwise be imposed by reason of willful misfeasance, bad

faith or gross negligence in the performance of duties thereunder.

Each servicing agreement will further provide that the master

servicer, the depositor and any director, officer, employee or agent

of the master servicer or the depositor will be entitled to

indemnification by the related trust fund and will be held harmless

against any loss, liability or expense incurred in connection with

any legal action relating to the related agreement, the securities or

a breach of any representation or warranty regarding the

mortgage loans, other than any loss, liability or expense that is

related to any specific mortgage loan or mortgage loans, unless

that loss, liability or expense is otherwise reimbursable under he

related agreement, and other than any loss, liability or expense

incurred by reason of willful misfeasance, bad faith or gross

negligence in the performance of duties thereunder or by reason of

reckless disregard of obligations and duties thereunder. In

addition, each servicing agreement will provide that neither the

master servicer nor the depositor will be under any obligation to

appear in, prosecute or defend any legal action which is not

incidental to its opinion may involve it in any expense or liability.

The master servicer or the depositor may, however, in its

discretion undertake any action which it may deem necessary or

desirable with respect to the related agreement and the rights and

duties of the parties and the interests of the securityholders. In that

event, the legal expenses and costs of the action and any resulting

liability will be expenses, costs and liabilities of the

14

securityholders, and the master servicer or the depositor, as the

case may be, will be entitled to be reimbursed and to charge the

trust fund for the reimbursement. Distributions to securityholders

will be reduced to pay for the reimbursement as set forth in the

related prospectus supplement and servicing agreement.

Any person into which the master servicer may be merged

or consolidated or any person resulting from any merger or

consolidation to which the master servicer is a party, or any

person succeeding to the business of the master servicer, will be

the successor of the master servicer under each agreement, so long

as that person is qualified to sell mortgage loans to, and service

mortgage loans on behalf of, Fannie May or Freddie Mac.

Ameriquest Mortgage/Ameriquest Mortgage Securities/Ameriquest Securities Trust were

Intertwined and represented One Entity

Normally, banks that originate, process and underwrite their own loans sell their mortgage

pass throughs to a bankruptcy remote trust, which is not directly involved with the bank.

A pass-through is created by transferring a slug of mortgages to a trust, which in turn

issues certificates representing a pro rata slice of all the principal and interest it receives. A trust

comprising $100 million in mortgages paying an average interest rate of 6 percent would sell a

certificate entitling the investor to, say, 1 percent of the trust proceeds. The investor would

therefore collect 1 percent of $6 million each year, adjusted for their share of defaults or

principal repayment proceeds, until all of the mortgages were paid down.

Ameriquest Mortgage, Ameriquest Mortgage Securities and Ameriquest Securities Trust

were all housed under one roof with the same corporate officers. This made the issuance of ABS

for Ameriquest unique because all loans written by Ameriquest Mortgage Company were

15

deposited into the companys own bankruptcy remote trust by Ameriquest Mortgage Securities,

which was a wholly owned subsidiary of Ameriquest Mortgage Company.

An ALJ in Hughart v. Raymond James & Associates, Inc, 2004-SOX-9 (ALJ Dec. 17,

2004) suggested that a case under Section 806 may proceed solely against a subsidiary if the

parent company and its wholly owned subsidiary are so intertwined as to represent one entity.

Ultimately, the ALJ dismissed the complaint because the two corporate entities had a sufficient

degree of separation such that they were not one entity for consideration of the applicability of

SOX.

The same can not be said in the instant case. There was not any separation, whatsoever,

between Ameriquest Mortgage, Ameriquest Mortgage Securities and Ameriquest Securities

Trust.

Wachovia Bank, National Association v. Ameriquest Mortgage Company

Wachovia Bank recently sued Ameriquest for failure to repurchase 135 nonperforming

mortgages that Ameriquest sold to Wachovia on Dec. 29, 2005 (mortgages that were originated,

processed, underwritten and securitized during the Complainants tenure). See Wachovia Bank,

National Association v. Ameriquest Mortgage Company Case No. 3:2007cv00443.

16

The nonperforming loans included "incorrect credit scores, false employment status and

misstatements of the kind of home being financed" which mirror Complainants exact allegations

in the instant case.

Ameriquest not only refused to repurchase any of the 135 loans but had ceased

communicating with Wachovia regarding the mortgage loans. Ameriquest responded only after

Wachovia sued them for a billion dollars.

The Complainant in the instant case offered to testify for Wachovia because the

description of the nonperforming loans mirrored his accusations against Ameriquest in the

instant case. Their attorneys were gracious enough to call the Complainant to inform him that

Ameriquest settled the case.

The nonperforming loans were pooled as MBS. This clearly shows that the Respondent

had repurchase obligations for MBS as well as ABS.

The Respondents Counsel has been Recently Sanctioned

In a decision regarding an order to show cause in the case for Ameriquest Mortgage Co .v.

Jacalyn S Nosek, 2006 WL 3262629 (D . Mass . 2006)., bankruptcy judge Joel Rosenthal found

that, throughout earlier proceedings, lawyers at both firms, in representing Ameriquest, had

continually represented that Ameriquest was the holder of Noseks mortgage, when in fact it had

been assigned to another lender.

17

Judge Rosenthal held:

At a time when mortgages and notes are bought and sold at a

pace so swiftly that the assignor and assignee cannot keep up with

the paperwork, had the attorneys at the Ablitt firm checked the

firms file, they would have seen that Norwest was perhaps the real

party interest. . . . The firm cannot shield itself from institutional

knowledge.

Judge Rosenthal fined the firm $25,000 and attorney Robert Charlton another $25,000.

The Respondents counsel in the instant case, Buchalter Nemer, was fined the remainder, for

$100,000.

The Nosek v. Ameriquest case, which was based on a single loan, clearly demonstrates

that the Respondent has a history of submitting flawed affidavits.

The Respondent and its Attorneys could be subject to Section 307 of Sarbox

Section 307 of the Sarbanes-Oxley Act mandates that the Securities and Exchange

Commission shall issue rules setting forth minimum standards of professional conduct for

attorneys appearing and practicing before the Commission. (Everything on the record is

reported to the SEC).

The Act goes on to identify two specific rules that are to be included in the SEC

regulations:

(1) requiring an attorney to report evidence of a material violation

of securities law or breach of fiduciary duty or similar violation by

the company or any agent thereof, to the chief legal counsel or the

chief executive officer of the company (or the equivalent thereof);

and

18

(2) if the counsel or officer does not appropriately respond . . .

requiring the attorney to report the evidence to the audit committee

of the board of directors of the issuer or to another committee. . or

to the board of directors.

Respondent Packaged all of its Loans as MBS & ABS

The respondent purchased 25% of its loans as mortgage backed securities and sold them

to publicly traded companies. However, the respondent pooled the other 75% of its loans as

asset-backed securities.

The pools of MBS were loans that the Respondent bought and sold. The ABS pools,

however, constituted everything that was originated, processed and underwritten by Respondent.

The Barclays Capital Ad from the Wall Street Journal

On June 6, 2006, Complainants former attorney filed an answering brief to the

Respondents reply brief. In that brief, new evidence was submitted that was not readily

available when the record was closed. The additional evidence (An ad for Barclays Capital in

the WSJ) showed that the Respondent issued over 1 billion dollars worth of asset-backed

securities on the secondary market in 2005.

The Barclays Capital ad specifically showed that the Respondent issued

$2,006,426,000.00 worth of Floating Rate Notes (Mortgage ABS) and $75,000,000.00 worth of

Fixed-Rate Notes (Servicer Advance ABS) on the open market in 2005.

19

In Decision and Order of Summary Judgment Granting Respondents Motion to Dismiss,

Judge Romano wrote:

Accordingly, in order to withstand respondents motion, it is not

necessary for complainants to prove their allegations. Rather, they

must only allege the material elements of their prima facie case.

The Complainant went above and beyond alleging the material elements of his case by

submitting the Barclays ad on appeal. Again, the ad clearly showed that the Respondent issued

asset-backed securities. The rules of Sarbox are crystal clear as to what the obligations of an

issuer of asset-backed securities are (i.e. Section 302).

Instead of making and honest and forthright argument, the Respondents former attorney

submitted this rambling diatribe in the Respondents Objections and Reply to Complainants

Supplemental Response to Respondents Answering Brief:

The so-called proof of this is a copy of some sort of advertisement

for the sale of mortgage notes. This document contains ads from

American Express, Americredit, Avis, Capital One, Fremont and

GMAC, all of which have nothing to do with Ameriquest.

The Respondents former attorney tried to obfuscate things by stating that the various

companies in the ad had nothing to do with Ameriquest. It is impossible to miss the irony here -

because all of the companies in the ad have a reporting obligation under Section 302 of

Sarbanes-Oxley since they are all issuers of asset-backed securities.

In that same brief, the Respondents former attorney cited Brady v. Calyon Sec.:

20

In the Brady case, as here, plaintiff did not allege that any of the

defendants were publicly traded companies, and he did not dispute

their contentions that they were neither publicly traded companies

nor issuers of securities as defined by Sarbanes-Oxley. Instead,

plaintiff alleged that defendants have acted as agents and/or

underwriters of numerous public companies.

It was the Respondents obligation to submit briefs that contained cogent arguments about

the issuance of securities (along with the information which Complainant is providing for them

in this brief), whether it was their opinion that they were not held accountable to Sarbox. Instead,

the Respondent blatantly denied the issuance of securities.

(A courtesy copy is marked as exhibit G)

The Respondent has Engaged in Previous Intimidation and Misleading Conduct on Appeal

From Objections and Reply to Complainants Supplemental Response to Respondents

Answering Brief:

There is no personal or subject matter jurisdiction in this

case and nothing provided by Complainant in this rogue

Supplemental Brief in anyway alters that fact. Complainants

brief should be stricken. Also, the Complainant should be required

to pay Respondents costs on appeal, for deliberately burdening

the Board and Respondent by filing a scam document, and for

attempting to mislead the Board concerning applicable law.

The opposing counsel tried to mislead the board by accusing the Complainant of misleading the

board in two areas:

21

1. By denying that they are held accountable to Sarbox (knowing fully well that Ameriquest

Mortgage Securities issued asset-backed securities and that Ameriquest Mortgage serviced the

securities and was issued a master servicer rating by the ratings agencies.

2. By trying to scare a "little guy" like the Complainant away by threatening to charge him for

their costs

(11) Limited Sanctions Available to Employers for Frivolous Actions

If the Secretary of Labor finds that an employee complaint is frivolous

or has been brought in bad faith, the Secretary of Labor may award to

the prevailing employer a reasonable attorneys fee not exceeding

$1,000.29

The Respondent has not Produced any Evidence to Clearly and Convincingly

Demonstrate any Real Motive for Terminating the Complainant

Ms. Tiberend stated that the Complainant was terminated for poor production. She did not

clearly and convincingly demonstrate that the Complainants production was any different from

that of similarly situated employees.

In addition, the nonmoving may not rely solely on allegations or

conclusory statements. Greene v. Dalton, 164 F.3d 671, 675 (D.C.

Cir. 1999); Harding v. Gray, 9 F.3d 150,154 (D.C. Cir. 1993

2. Timeliness of Complaint

Estoppel by Silence

It is indisputable that the Respondents wholly owned subsidiary is subject to Section 302

of Sarbox.

22

An estoppel will not be raised against one because he was silent

where there was no duty on him to speak, 12 Fla.Jur., Estoppel

and Waiver, 42, page 419.

The Respondent was duty bound by Sarbox to be forthright with the Complaintant once

he raised Sarbox in issue. The Complainants March 2, 2005 letter to the PA Department of

Banking, which contained a March 1, 2005 email to the SEC held far more water than the sworn

affidavit submitted by Diane Tiberend on appeal.

Estopple is far more than being within the peripheral range of this litigation - because the

Respondents wholly owned subsidiary had a class of securities registered under section 12 and

15(d) of The Securities and Exchange Act of 1934 and was required to perform a 302

Certification.

Facts of Moldauer and McCloskey Distinguishable

Judge Romano based his decision on Moldauer v. Canandaigua Wine Co, 2003-SOX-26.,

The Complainant in that case alleged that he was entitled to equitable tolling to excuse an

untimely filing of a SOXwhistleblower complaint based on three grounds: (1) he was unable to

conduct his affairs after he was terminated because he had to leave the United States, (2) he

raised his this claim with incorrect agencies within the statutory period, (3) neither Complainant

nor the attorney he retained in conjunction with the severence agreement were aware of the Acts

whistleblower protection, (4) he argued that the limitations period should be tolled because he

was unaware of SOX during the limitations period.

23

The ARBs decision in Moldauer actually substantiates Complainants claim in the instant

case for equitable tolling and equitable estopple because (1) The Respondent was duty bound to

be forthright about SOX because its wholly owned subsidiary was an issuer of asset-backed

securites, therefore held accountable to section 302 and 806 of Sarbox, (2) its employed auditors

were required to be SOX compliant).

In instant case, the Complaintant provided that: (1) he engaged in a protected activity

because his allegations did in fact point to violations of SEC rules and regulations , which

regulate the issuance of and transactions involving publicly traded asset-back securities (2) The

Respondent knew of the protected activity and failed to act on it, (3) The Complainant suffered

unfavorable personnel action (4) The Respondent was duty-bound by its internal audit program.

(A copy of Standard & Poors Servicer Evaluation is marked as exhibit H)

Judge Romano might have come to a different conclusion about the Complainants

Argument were it not for the Respondents blatant misrepresentation in the Tiberend Declaration

Judge Romano wrote:

On March 2, 2005 Complainant sent a letter to the Pennsylvania

Department of Banking allegeing that he was fired from

Respondent for reporting instances of forgery of Borrowers

Authorization Forms among Managers. (ALJ1). However, none of

these allegations, it taken as true and in light most favorable to

him, relates to mail fraud, wire fraud, bank fraud, or securities

fraud. Likewise, his allegations do not point to violations of SEC

rules and regulations, which regulate the issuance of, and

transactions involving, the secutities of publicly traded companies.

24

The Complainant respectfully disagrees with Judge Romano. The Borrowers

Authorization Form is the form used to release all of the borrowers personal information to

release loans. Further, the Complainant had reported all of the incidents at his former branch and

other branches, which included the doctoring of title and credit reports and the over inflating of

appraised values of home. All of this was part of a systemic company-wide scheme to defraud

their investors by pooling bad paper (i.e. based on loans with over inflated appraisals, doctored

title and credit) on the open market while retaining the servicing rights. Again, all of this was

reported by the Complainant.

Based on the Complainants accusations in the instant case, the pools of mortgages should

never have been investment grade. The aftermath of the subprime meltdown has proven the

Complainant right. The 325 million dollar class action against the Respondent and Wachovia

Bank, National Association v. Ameriquest Mortgage Company clearly proves every accusation

that the Complainant ever made about Ameriquest to the SEC.

Respondent was subject to an Internal Audit Program recommended by Standard and

Poors

A 2002 servicer evaluation issued by Standard and Poors indicated:

At the recommendation of Standard & Poors, Ameriquest

introduced an internal audit program during 1999. The internal

audit function is outsourced to an external accounting firm that

performs audits of loan servicing throughout the calendar year. In

order to better manage risk and thoroughly access controls in all

25

servicing functions, management has successfully introduced this

audit program to all areas of loan servicing during the past 24

months.

(See S&P document marked as exhibit H)

The internal audit program was still in place during the Complainants tenure. The

Respondent should be forthcoming about the identity of the external accounting firm due to the

Enron/Arthur Anderson similarity.

In the March 2, 2005 letter, the Complainant wrote:

Mr. Koene stated to me that the company is doing an internal

audit, and anything derogatory will be pinned on Mr. Squillachie.

I informed Mr. Koene that and audit from a government agency

will probably be done because of the fact that I contacted them. He

asked me if I was proud of blowing the whistle on the company,

and I replied to him that his statement that everything will be

pinned on Mr. Squillachie made me extremely proud.

(A copy of Standard & Poors Servicer Evaluation is marked as exhibit H)

Levi v. Anheuser Busch Companies, Inc actually Substantiates the Complainants claim for

Equitable Tolling

Judge Romano cites Levi v. Anheuser Busch Companies, Inc ARB Nos. 06-102, 07-020,

08-006, ALJ Nos., 2006-SOX-27 and 108, 2007-SOX-55 (ARB Apr. 30, 2008)

Turning to the prior letters, the ARB found that complaints filed

with government agencies about the Respondent's behavior, even

assuming that they were SOX-related protected activity, do not

present a cognizable SOX complaint where they occurred prior to

the alleged retaliation taking place. In other words, to be

cognizable, the Complainant must have filed a timely complaint

after his discharge grounded in the allegation that his protected

activity was a contributing factor in the adverse action taken by

the Respondent.

26

The judge erred by concluding that: it may be inferred that Complaintants letter was

sent to the SEC prior to his to his termination date on March 1, 2005. The letter actually

contained an email to Ms. Carol Rosenblat of the SEC, which the Complainant drafted as soon as

he returned home from the retaliatory termination by the Respondent. The wording of the email

could not be any clearer: In todays termination meeting, Jason Mansell, had asked other

account executives to forge Borrower's Authorization Forms until my termination meeting

today.

Below is the excerpt from the March 2, 2005 letter, which contained the copy of the email

that the Complainant sent to Ms. Rosenblat of the SEC:

______________________________________________________

This is a copy of the email that I sent to Ms. Rosenblat:

Thank you for taking the time to send me the information that we

talked about this afternoon.

In today's termination meeting, I gave my manager an opportunity

to have a conference call with his manager after I informed him

that I had been reporting everything to outside agencies. He was

the branch manager for about 3 weeks, and he did not know that I

had informed the Area Manager that my co-worker, Jason

Mansell, had asked other account executives to forge Borrower's

Authorization Forms until my termination meeting today. I

explained the following passage from the link below to him in so

many words:

Suppose an employee suspects his or her company is playing fast

and loose with its financial reports. Being an upright citizen, he

or she reports those suspicions to the federal government. The

supervisor catches wind of this and fires the employee. Under the

new provisions, that supervisor and company officers could face

27

criminal fines or even jail time for such an action. It doesn't

matter whether the employee's suspicions were correct; the key is

reasonable belief that there are federal fraud violations.

I believe that he was under pressure to fire me from the area

manager, Corey Scandin. But, the fact remains that I articulated

exactly what had taken place.

This is a copy of the email that was sent out to the local branches

by Scandin praising Mansell about a week after I informed him

about the forgery:

______________________________________________________

The clock for the statute of limitations started ticking the moment that the Complainant

was terminated. The Complainant immediately reported the adverse action to the SEC as soon as

he returned home from his termination meeting.

Therefore, the judge erred by concluding:

Even if these letters were read to provide notice of fraud or

securites violations, it could not be read to state a claim for relief

for an act of retaliation that had not yet taken place.

Finally Judge Romano wrote:

I also note that Complainant admitted that the SEC notified him

in the March 1, 2005 letter that the Act had very short

deadlines. (ALJ6). I find that this establishes that he had notice of

the short nature of statute of limitations under the Act.

This is akin to the IRS sending letters out to every American stating: You have a short

deadline to file your taxes. If the IRS gave instructions like this, Americans would not know

about the April 15 deadline and they would not know how and where to file their taxes.

28

Hence, because the SEC did not renumerate what the exact deadline was or where to file,

the Complainant could not have known where to state a claim of relief.

The Complainant Respectfully requests Commission Amicus participation in the Instant

Case

After assessing the Commissions factors for Amicus participation, the Complainant concluded

that the SEC must be called upon in order to offer its views on important securities law issues

surrounding the complex issuance of asset-backed securities. The Complainant is convinced that

this case will set precedent for both the securities industry and the subprime mortgage industry.

(See copy of letter to SEC Office of the General Counsel along with Complainants article titled

Keeping the Industry Honest marked as exhibit I)

Conclusion

The Tiberend Declaration contains material false statements and is tainted by bad faith,

and is therefore unreliable. The ALJ could not issue a decision because the respondent failed to

disclose how securities were issued.

Wherefore, the Complainant, William John McCloskey, prays that this appeal be granted.

Dated September ____, 2008 Respectfully submitted,

By: __________________________

William John McCloskey

Formatted: Line spacing: double

29

List of Exhibits:

1. Edgar-based documents showing Diane Tiberend as a signatory. A copy attached

hereto as Exhibit A.

2. Edgar-based documents showing various issuances of securities under rule 12H-3.

A copy attached hereto as Exhibit B.

3. Tables showing the how Ameriquest issued ABS. A copy attached hereto as

Exhibit C.

4. Tables showing how ABS is generally issued from a prospectus with the SEC. A

copy attached hereto as Exhibit D.

5. A 302 Certification signed by John Grazer. A copy attached hereto as Exhibit

E.

6. Edgar-based document showing that New World Pasta was not subject to Rule

12h3 or a 302 Certification. A copy attached hereto as Exhibit F.

7. Barclays Capital ad Showing Ameriquests issuance of ABS. A copy attached

hereto as Exhibit G.

8. Standard and Poors servicer evaluation for Ameriquest. A copy attached hereto

as Exhibit H.

9. Complainants request for SEC Amicus participation along with Complaints

article. A copy attached hereto as Exhibit I.

30

True and correct copies sent to:

Administrative Review Board Hon. Ralph A. Romano

U.S. Department of Labor Administrative Law Judge

Suite S-5220 Office of Administrative Law Judges

200 Constitution Avenue, NW 2 Executive Campus, Suite 450

Washington, DC, 20210 Cherry Hill, NJ 08002

{Hard Copy Regular Mail} {Hard Copy Regular Mail}

Cynthia Fair Deputy Director

Buchalter Nemer Division of Enforcement

333 Market Street, 25th Floor U.S. Securities and Exchange Commission

San Francisco, CA 94105-2126 100 F Street, N.E.

{Hard Copy Regular Mail} Washington, DC 20549

{Hard Copy Regular Mail}

Directorate of Enforcement Programs Regional Administrator

U.S. Department of Labor, OSHA Region 3

Room N-3603, FPB U.S. Department of Labor, Osha

200 Constitution Ave., N.W. The Curtis Center, Suite 740 West

Washington, DC 20210 170 S. Independence Mall West

{Hard Copy Regular Mail} Philadelphia, PA 19106-3309

{Hard Copy Regular Mail}

Associate Solicitor Regional Solicitor

Division of Fair Labor Standards U.S. Department of Labor

U.S. Department of Labor The Curtis Center, Suite 630 East

Room N-2716, FPB 170 S. Independence Mall West

200 Constitution Ave., NW Philadelphia, PA 19106-3306

Washington, DC 20210 {Hard Copy Regular Mail}

{Hard Copy Regular Mail}

Office of the General Counsel

Securities and Exchange Commission

100 F Street, NE,

Washington D.C. 20549,

{Hard Copy Regular Mail}

31

This report was posted on Ripoff Report on 12/30/2012 02:16 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ameriquest-mortgage/orange-california-92868/ameriquest-mortgage-ameriquest-orange-california-989014. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.