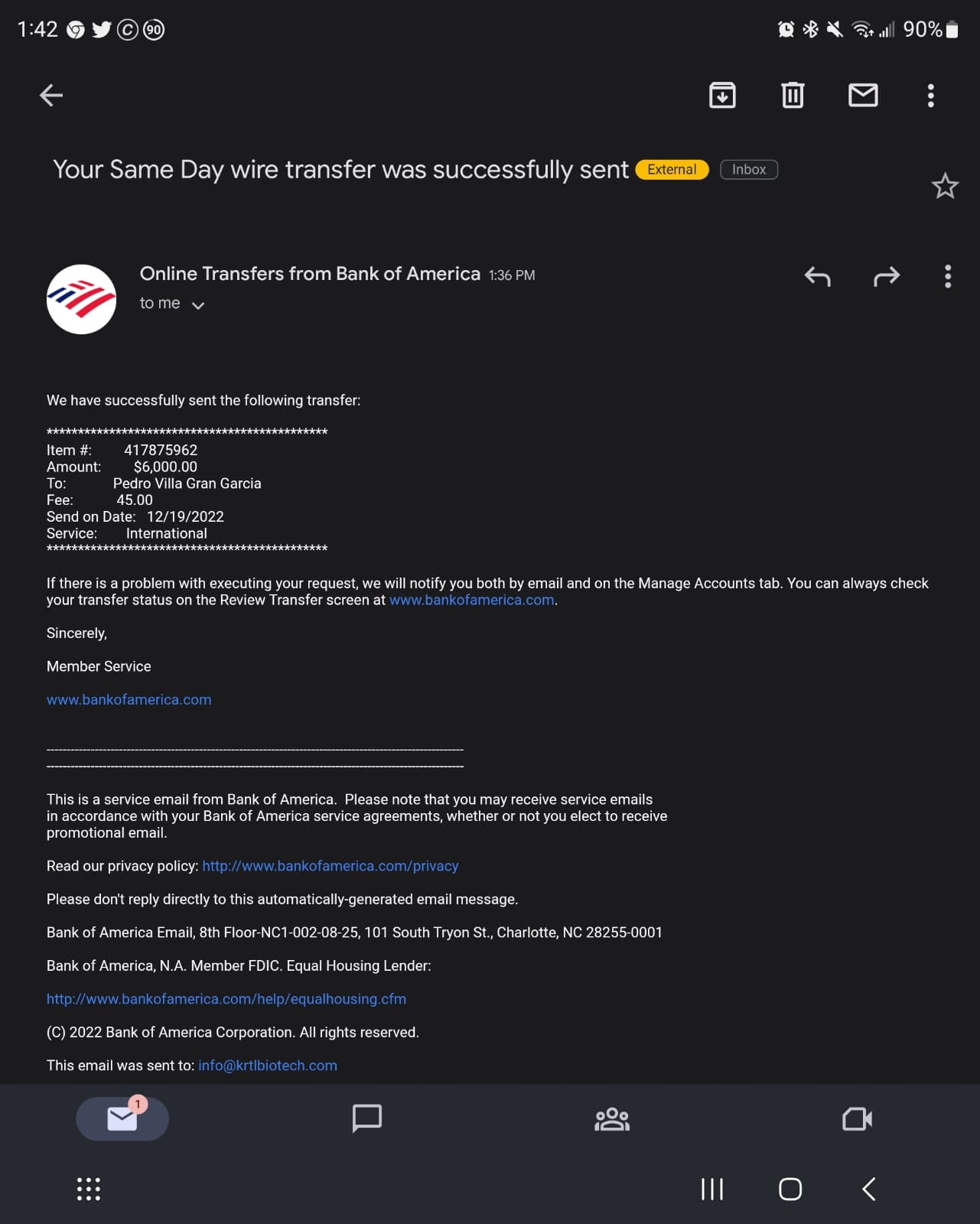

Complaint Review: Bank Of America - Augusta Georgia

- Bank Of America bankofamerica.com Augusta, Georgia U.S.A.

- Phone: 800-432-1000

- Web:

- Category: Banks

Bank Of America Ripping off people with overdraft fees Augusta Georgia

*Consumer Suggestion: A few suggestions......

*Consumer Comment: That's a Lot of Fees

Bank of America has charged my account overdraft fees of $35 about 30 times this year. That adds up to $1050 in overdraft fees! They charge for each transaction no matter how much. It could be .05 or 50.00. They do not discriminate when charging these fees.

Something needs to be done about these outrageous fees. It is almost like the interest charged on a payday loan, which is illegal here in Georgia.

I hope someone files a class-action lawsuit. I would sign on for it!

Jennifer from georgia

Hephzibah, Georgia

U.S.A.

This report was posted on Ripoff Report on 12/10/2007 09:36 AM and is a permanent record located here: https://www.ripoffreport.com/reports/bank-of-america/augusta-georgia-30909/bank-of-america-ripping-off-people-with-overdraft-fees-augusta-georgia-290252. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

A few suggestions......

AUTHOR: Jessica - (U.S.A.)

SUBMITTED: Monday, December 10, 2007

Maybe you should try:

1) Not spending money you don't have

2) Keeping an accurate record of deposits / payments

3) Pay cash!

I'm so tired of people claiming they were ripped off when they break the rules and have to pay the price!

The "fees" you pay for going overdrawn are just that.....FEES!

Banks charge these fees to keep customers from spending money they don't have. The charges aren't interest.....that's why the amount is the same no matter what the overdrawn amount is!

I've been with BoA for about 3 years and have never paid an overdraft fee.......and I'm one of those people who live paycheck to paycheck. I just don't spend any more money than I have.

#1 Consumer Comment

That's a Lot of Fees

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Monday, December 10, 2007

But you've provided nothing to suggest the fees aren't proper. In fact, the fees are probably done in accordance with your account agreement, so there is no rip-off from what I can see. Let's also face another fact: An NSF fee is not interest. It is a penalty for overdrawing your account and you are penalized for every transaction done when you don't have money in your account. Courts have ruled these fees are not interest; to classify these as interest would mean the fees would vary in amount - since they do not vary and are uniform in nature, there is no choice legally but to classify as a penalty per transaction. Here are steps to curb your fees:

1. It sounds like you have a debit card. Debit cards are the biggest money maker for the banks because they count on people like you to not track their account the right way. Use cash for all purchases below $25.00. For anything over $25, like groceries, gasoline, and the like - use the debit card. If you keep using the debit card for small purchases, just cut the d**n thing up and toss it.

2. Keep a written record of your transactions, or a check register.

3. Do not depend on an accurate balance online; online transactions should only be used to (1) check for fees, and (2) fraudulent transactions. Your accurate balance is on your register.

These steps should reduce the amount of fees you pay to the bank. So far, not following these steps has cost you a lot of money. This should drastically reduce the amount of fees.

Best of luck.

Advertisers above have met our

strict standards for business conduct.