Complaint Review: Bank Of America - Charlotte, North Carolina Nationwide

- Bank Of America Nationwide U.S.A.

- Phone:

- Web:

- Category: Banks

Bank Of America / MBNA Latest Unethical Activity Filing phony tax reports Charlotte Nationwide

*Consumer Comment: Do I understand correctly?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

There's and old saying that says if it looks like poop, feels like poop and smells like poop, then you have a pretty good idea of what it is.

Try this one for size.

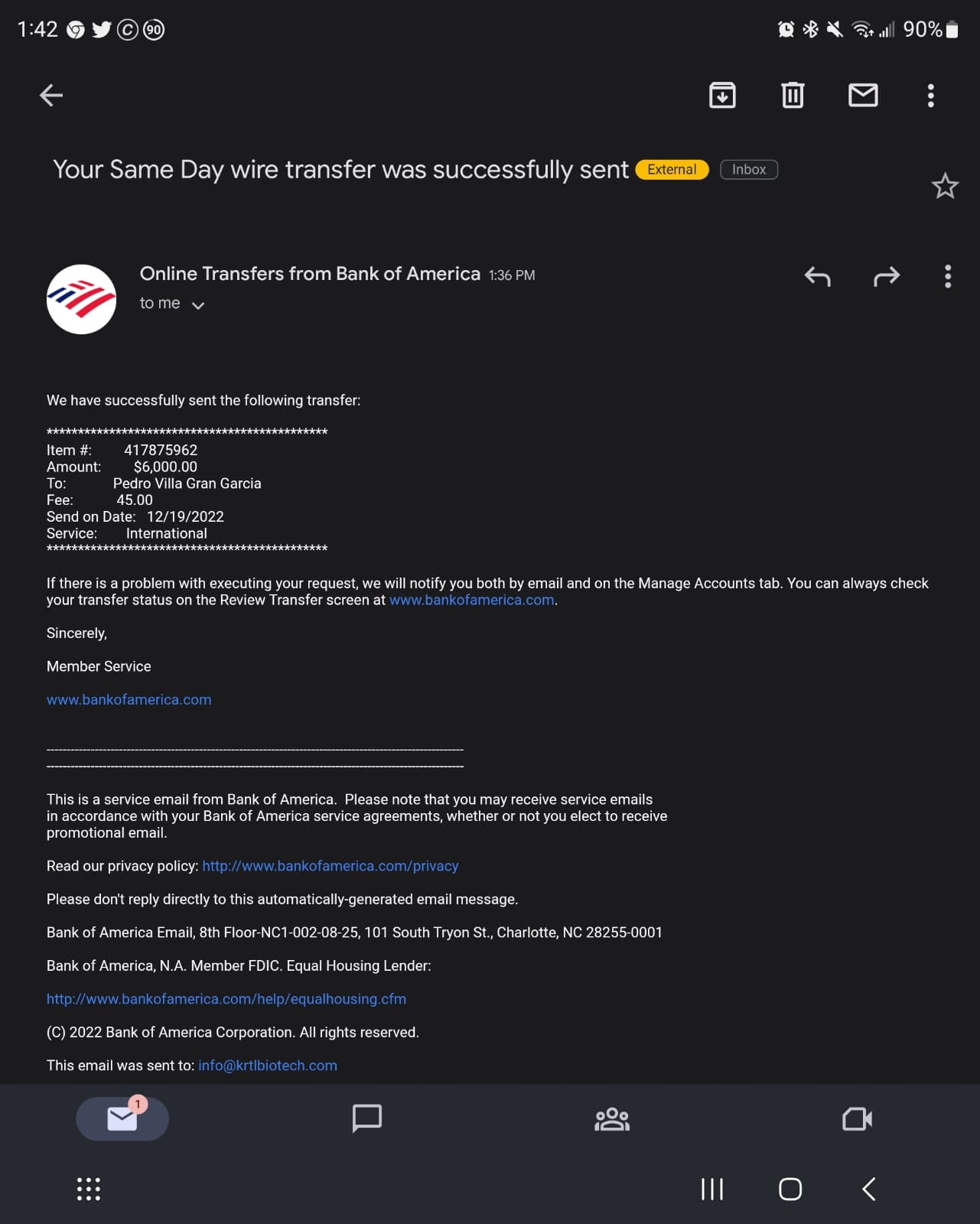

More than 10 years ago MBNA (which merged with Bank of America) had written off a carge card issued to a woman. The amount they wrote off was about $12,000.

Then they sold it to a bottom-feeder debt scavenger in Tulsa, OK. That company tried to collect and she told them to get lost.

But the slumdogs were running a scam of their own and went bankrupt by 1999.

In 2008 MBNA was acquired by Bank of America. And, it seems that they claimed they still owned the account that they "sold" a decade earlier. Not only that, but they were compiling fees and charges that would make Tony Soprano look like a wimp. So when they merged and transferred these phony assets to BofA, they valued the account as more than $37,000

I suspect that BofA was well aware of the scheme and complicent because they then took a tax credit by allegedly writing off and "forgiving" more than $37,000. They even sent a Form 1099C to the IRS, through one of their wholly own subsidiaries, FIA Inc.

So then the IRS started to harass the husband of the woman who had passed away in 2007. BofA had never mailed a copy of the fictitious form to the deceased woman. And the IRS isn't too swift in handling this kind of stuff.

One employee of BofA admitted it was a "mistake" but my guess is that there were thousands of people screwed over by this game.

I believe this was unethical as well as illegal. If I loan you $10 and you don't pay me, I have lost $10. But, I have not lost interest and fees as I didn't give them to you to start with. You can't lose what you never had. (Unless it is your reputation.) Hummmm, smells like poop.

If you have been victimized by this scheme, please contact PFSsyndicate@Gmail.com We'll keep your info confidential; but there is a good chance that we may be able to bring a class action suit against these overpaid liars and collect millions, not just an apology letter. There is also a blog about this caper at http://banfofamerica-mbnafraud.blogspot.com/

Investigator

Anytown, Alaska

U.S.A.

This report was posted on Ripoff Report on 02/09/2009 11:58 AM and is a permanent record located here: https://www.ripoffreport.com/reports/bank-of-america/nationwide/bank-of-america-mbna-latest-unethical-activity-filing-phony-tax-reports-charlotte-nation-421959. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Do I understand correctly?

AUTHOR: Ken - (U.S.A.)

SUBMITTED: Monday, February 09, 2009

Are you saying that when a bank charges off a bad debt that they aren't entitled to accumulated interest and fees? If you are saying that, I think you're mistaken.

I wouldn't be a bit surprised if an amount like $12,000 grew to $37,000 before it was finally charged off. It's sort of the number one reason not to get yourself into a position like this. Once a bank does charge off a bad debt, it is considered income to the debtor, since it was money they in effect 'gained' by never paying it back.

$37,000 seems high but not out of the ball park, and it's certainly not a scam.

Advertisers above have met our

strict standards for business conduct.