Complaint Review: Credit Answers - Plano Texas

- Credit Answers 6200 Tennyson Pkwy. Plano, Texas Mexico

- Phone: 800-297-6417

- Web:

- Category: Credit Services

Credit Answers No Answers, just a Lip service collecting there fee, Sued! yes they will, Bankruptcey is all you can do after there help! Plano Texas

*Consumer Comment: Are you kidding me????

*UPDATE Employee: Credit Answers Not Rip Off

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

credit answers made it sound good, but the phone calls only got worst at home and at work, I almost lost my job, and the letters never ended. but there fee was collected, and at one point we were a day late on our deposit into the account we set up for credit answers, they went ahead and took money from our personal account and they didn't seam to have any problems with that. and when you served papers that you are being sued over your dets it isn't a glorified collection company, it is the courts and you about to lose everything! it is too bad that today in america that companys let this one only purpose is to pry upon the misfortune of others, be warned you will lose, credit answers will win, these type of companys are protected in texas and florida................M.

M

Clarksburg, California

U.S.A.

This report was posted on Ripoff Report on 02/13/2009 03:55 PM and is a permanent record located here: https://www.ripoffreport.com/reports/credit-answers/plano-texas-75024/credit-answers-no-answers-just-a-lip-service-collecting-there-fee-sued-yes-they-will-b-423888. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Are you kidding me????

AUTHOR: Scott - (U.S.A.)

SUBMITTED: Saturday, December 19, 2009

You are obviously another financial wiz kid. Why didn't you send a Cease and Desist letter so they couldn't call your Job? Let them call the home only.? And if your going to be late call a few days before. It's not the companies fault you were late on your deposit. I guess the interest rates going up on your credit cards are the credit card companies fault be cause you made your payment late? And they would never have had authorization to take from another account that is illegal and a flat out lie. And you don't get served immediatly, the county clerk informs you of the claim that's being filed and you have anywhere from 20-45 days to response. Why didn't you file for a continuance to post-pone any court proceedings? It could have bought you 4 months or more. That would have given you the time to save enough to settle. Too many holes in your story M.....Stop bashing good companies, and take some responsibility for creating all the debt to begin with. Debt settlement is the best way to go.

#1 UPDATE Employee

Credit Answers Not Rip Off

AUTHOR: Credit Answers Employee - (United States of America)

SUBMITTED: Tuesday, December 08, 2009

I have read over the complaints filed with my company. The problem I see with the complaints are:

1. We are a fully disclosure company. This means we are required to tell all of our clients that they will fall behind on payments. They will see their balances increase with higher interest rates and late payments. It will affect your credit. But this program is design to help a person who sees this getting ready to happen and needs the help. We tell you the creditors will call you, and they will call you very aggressively for the first 3 months. You have to know what harrassment is and stop it by turning them into the Federal Trade Commission. If you stick with the program and follow ALL of the steps we give you and understand that this program takes some time to be able to see the ending results, you will see a very good ending. The creditors report your accounts are closed and paid when done. This helps you to be able to rebuild your credit by clearing up the debt.

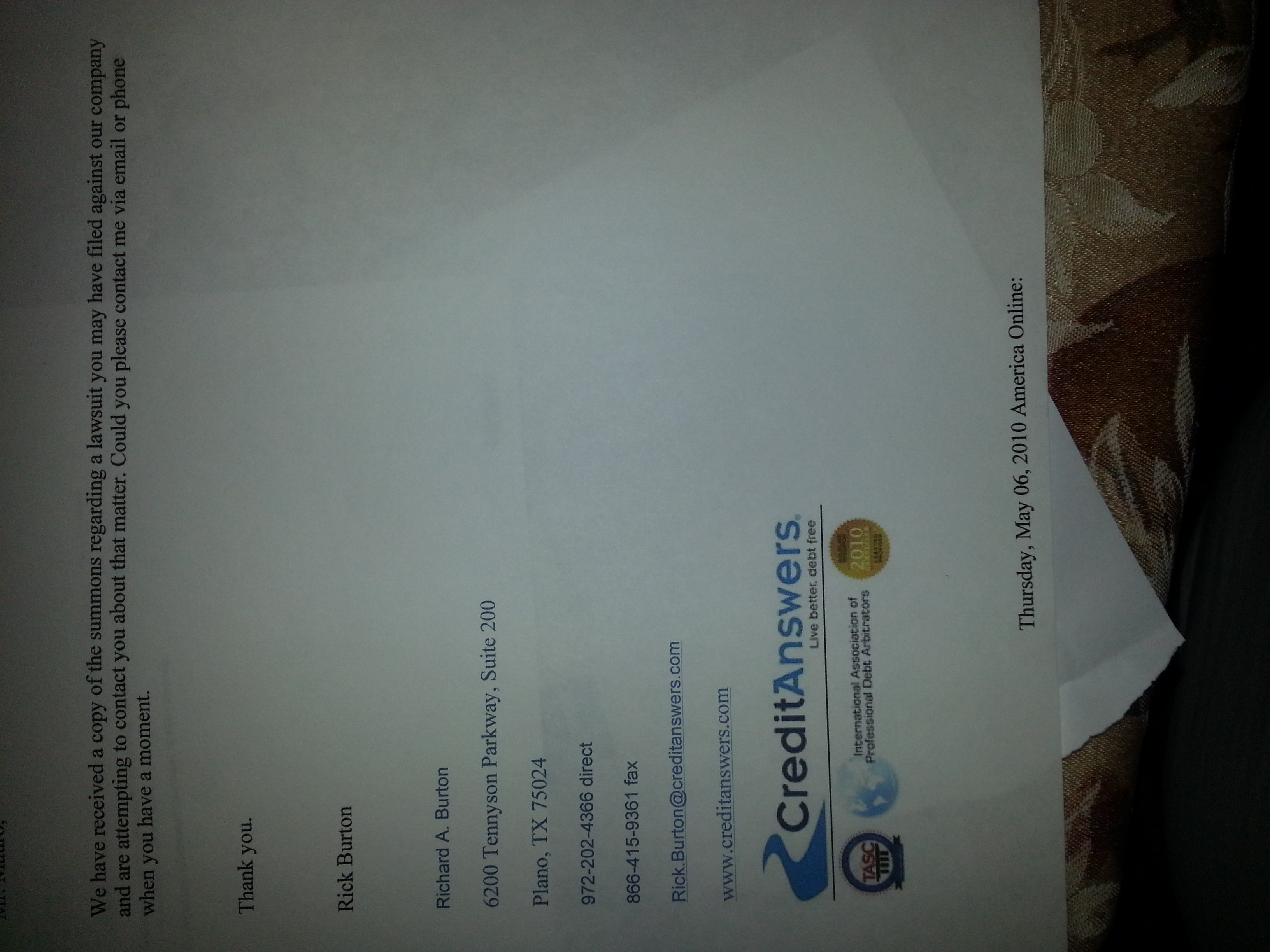

2. We tell you up front you could get sued. But you have to communicate with your settlement coach IF you get a court complaint. AND you HAVE to sign for the certified mail to get it. We need to know if this happens because we can help you IF you communicate with us and do not let the time expire that the court gives you to respond.

3. As far as the late payment: Our company sets our clients up on and automatic payment drafted from their checking account that they give us persmission to deduct from. The date is set up also by the client. The client knows when it is due and knows the payment will be taken on that date. How are we supposed to know the payment will not be there on the date that it was scheduled? We let our clients know also if they see a problem with the payment coming up to call us 5 days BEFORE it is due and we will help them with giving more time if needed.

All of the complaints I just read on the RipOff report are fully disclosed in the original enrollment that you MUST read before you sign up. If you read it and signed it then why are you now complaining???

Clients must communicate with the company if anything comes up for this to be successful for them.

Advertisers above have met our

strict standards for business conduct.