Complaint Review: First Premier Bank - Sioux Falls South Dakota

- First Premier Bank firstpremierbank.com Sioux Falls, South Dakota U.S.A.

- Phone: 800-9875521

- Web:

- Category: Corrupt Companies

First Premier Bank Credit Card Sharks Ripoff Sioux Falls South Dakota

*Consumer Suggestion: Pay it.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

To Whom It May Concern,

In October of 2006 I received an offer from First Premier Credit Card stating I was preapproved for an unsecured MasterCard.

I filled out the application and received a credit card 5 days later with $179 worth of fees billed to my account.

I called to dispute the fees with First Premier and attempt to close my account but First Premier Stated I would have to pay the account in full in order for it to be closed.

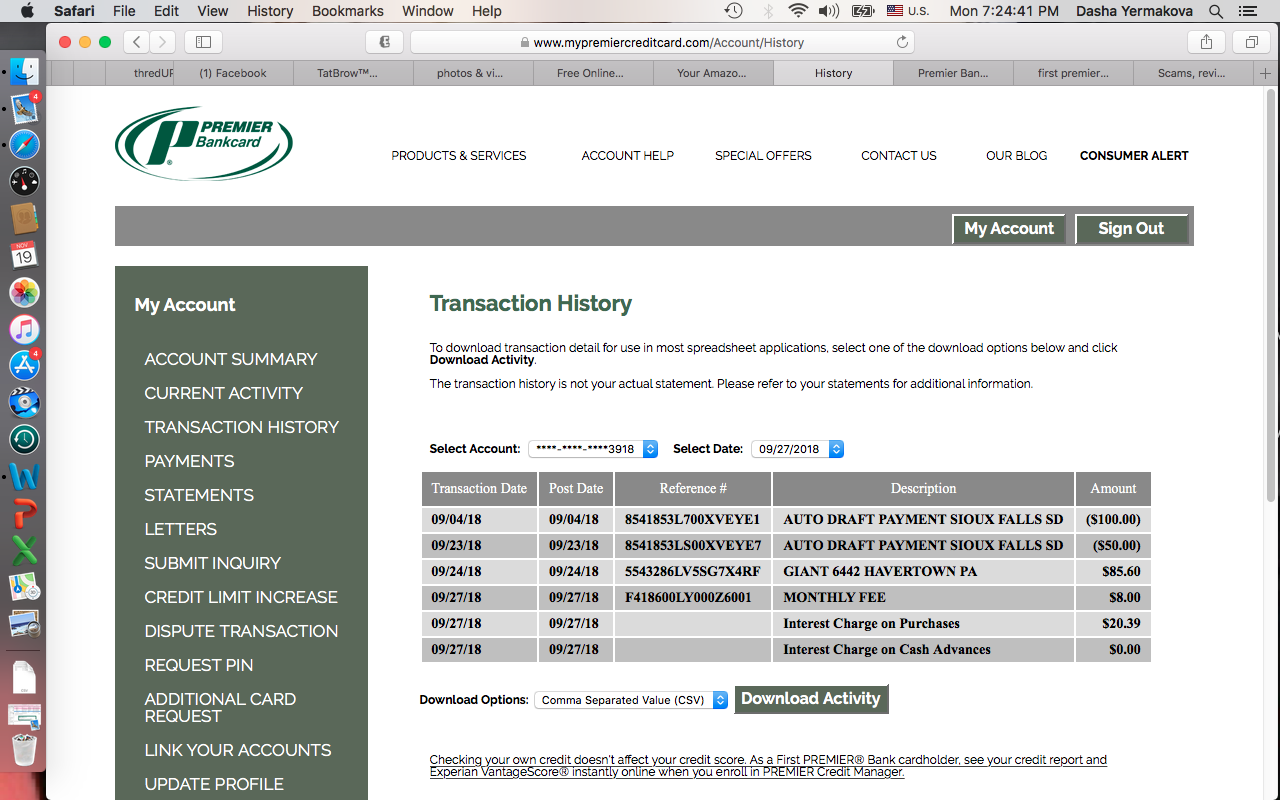

I paid half of the fees first billing statement, than the other half next billing statement. They lost my payment I sent it ny money order. I filled out a trace form to track down the payment and it was cashed but 3 days after the due date.

I refused to send them anymore money until they corrected my account, and credit the late fee.

I am still receiving bills from them and phone calls, offered to pay with a check by phone but they insisted on a $15.00 fee.

Help I am tired of these vultures and now they are attempting to send me to collections.

Thanks

Meggan

Meggan

Louisville, Kentucky

U.S.A.

This report was posted on Ripoff Report on 05/07/2007 04:52 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-premier-bank/sioux-falls-south-dakota-57117/first-premier-bank-credit-card-sharks-ripoff-sioux-falls-south-dakota-247317. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Suggestion

Pay it.

AUTHOR: Nikki - (U.S.A.)

SUBMITTED: Monday, May 07, 2007

Unfortunately for you, the schedule of fees on the insert that comes with the approval form to fill in shows the fees to activate the card. I agree they are vultures, but you need to read things before you apply. I know there's a lot of info on that page and you were probably happy to get an offer of credit, but this is something that many "bad credit" credit cards are doing now.

If I were you, I would pay it, in full, including the late fee, before it gets charged off or sent to collections. $200 is a small price to pay to not have this bad debt on your credit report for 7 years. Or, you can pay it and (if they still let you) keep the card and use it to build your credit. You said you applied in October, so hopefully it's not too late. If they still let you pay off the card and keep it, ask them if as a good faith measure, they will list your account as current with the credit bureaus.

If they don't let you keep the use of the card, and they have already placed a bad mark on your credit report, pay it in full, wait a few months, then dispute it with the credit reporting agencies. First Premier may just let it delete from your report if it is paid in full (I don't know for sure).

I don't have an account with First Premier, but I do have an account with a credit card just like it. I knew the fees, agreed to them (the only way I could get a card), paid them, and have had the card for 4 years without any late payments.

Years ago, my mom got this credit card and as soon as she saw the fees, she cancelled it and was refunded all the fees. It is listed as a good, closed account on her credit report. They probably got sick of people like her that didn't read the enclosed disclosure and stopped refunding the fees.

Back in the old days, we could refuse to pay, and fight with creditors, and stand up for ourselves when we believed we were duped, but those days are gone forever. Nowadays, we pay for our mistakes up the a**, and then move on.

To everyone who relies on the USPS for their bills. Between the USPS taking a long time to get mail to it's destination, and the creditors holding onto payments until after the due date, many payments are late. We literally have to send in our bills 12 days before the due date to have any hope on the payments getting processed ontime. I have a credit card with a reputable credit union that does not allow online payments. I sent my payment 10 days before the due date last month, and it was posted the day before the due date. That means 9 days to go through the mail and get posted. Lucky for me they didn't hold the payment 2 more days to charge the late fee (which they could have easily done).

Also, stay away from money orders. They are harder to track and we are finding we have to track almost every payment we send in the mail.

Advertisers above have met our

strict standards for business conduct.