Complaint Review: Geico - Marlton New Jersey

- Geico Marlton, New Jersey U.S.A.

- Phone:

- Web:

- Category: Insurance Companies

Geico ripoff Unethical and Dishonest to Applicants Marlton New Jersey

*Consumer Suggestion: Geico uses deceptive practices to make more money & raise premiums

*Consumer Comment: unethical???

*Consumer Comment: Unfortunately

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

In my experience, I've applied for an entry-level position with Geico. After the phone interview, I was told to go to the local office and take a pre-employment computer test. This is an elementary level/basic skills test. It is multiple choice and very simple.

Another applicant was taken the same test on computer next to mine. When we finished, we were told to meet the interviewer at the desk. She dismissively said, "Sorry guys, you did not pass." This was very insulting for two college graduates to hear. She told me that she was not allowed to show me the test score. I fully understand why. Because I caught her in a lie.

I don't mind not getting hired to work for Geico, but I believe every applicant deserves a legitimate reason for not going on to the next level in the hiring process. This was an unethical practice and I hope no future applicant has to experience it.

Any feedback will be greatly appreciated!

Dom

Beverly Hills, California

U.S.A.

This report was posted on Ripoff Report on 01/03/2007 04:37 PM and is a permanent record located here: https://www.ripoffreport.com/reports/geico/marlton-new-jersey-08053/geico-ripoff-unethical-and-dishonest-to-applicants-marlton-new-jersey-228542. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Suggestion

Geico uses deceptive practices to make more money & raise premiums

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, February 06, 2007

GREED. A word I can only use in the light of all the obvious corruption and fraud going on in America today at every level of business and government it seems. The insurance companies, as a whole, seem to be plagued with so much from corp. CEO's on downward though especially...

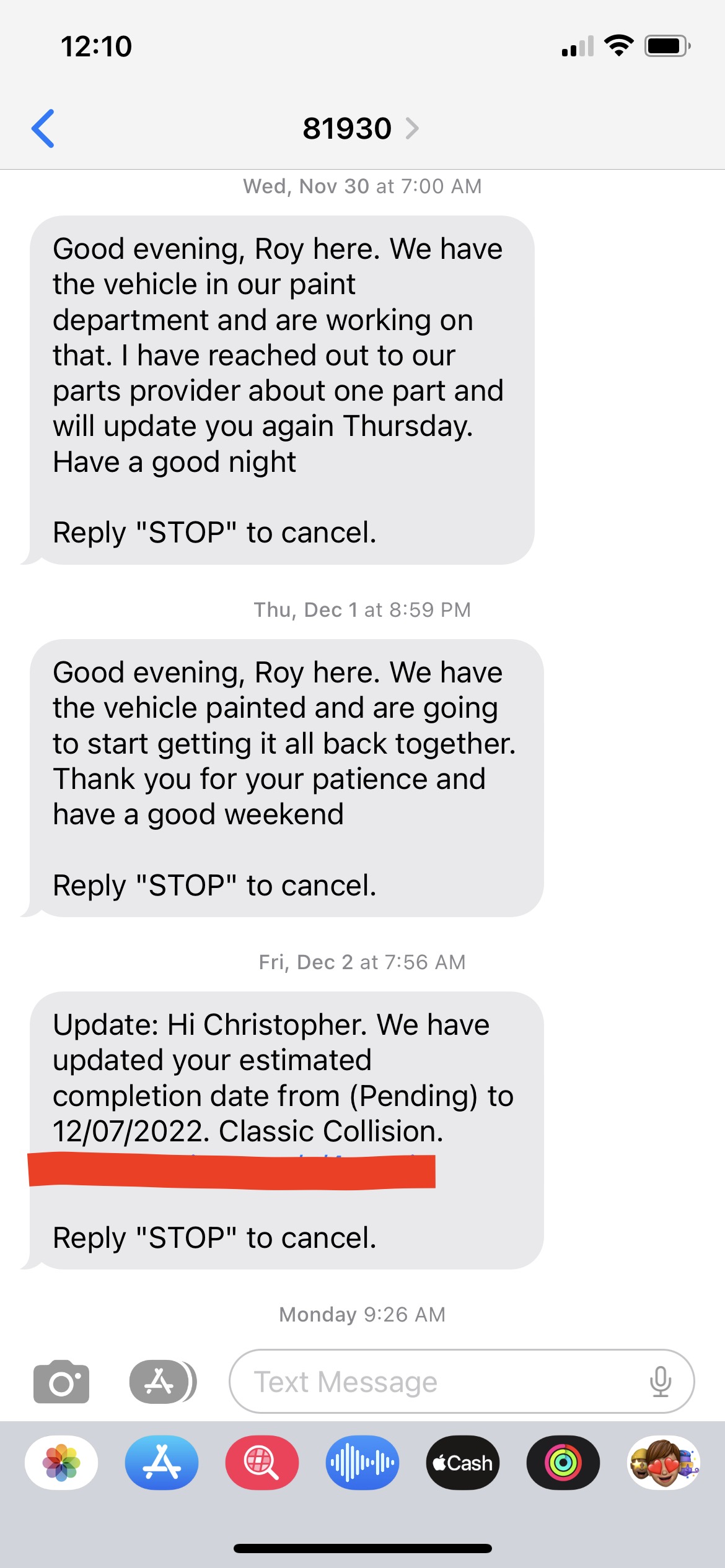

Our family's problem being with Geico several years now and having no claims against our policy whatsoever is this. My wife had a series of operations and medical troubles through Christmas and in January, I contacted Geico then to ensure an insurance payment was received which I thought my wife made before going to hospital. It was not and was a simple oversight on our part and I apologized for that, though I still was within the 30 day overlap period which you pay ahead on your premiums. So I made a payment on phone then and actually paid ahead.

However, after I made the payment, Geico told me there would be a problem. They told me because the payment did not get their when due, regardless I was in the overlap period, they could no longer keep us on their preferred client rate we had been on a long time, and they pushed the renewal date of our current policy backwards 30 days in fact, so it looked as if we had no isurance for 30 days and a lapse in coverage which was not true!

And now, our policy would be reduced from full comprehensive to basic liability (premium still the same) and that we had to have our vehicle taken to some inspection agent in our area for them to review the car that was insured. Geico also said our policy effectively was canceled and a new policy would have to be issued. But they assured us pending this inspection, if all was fine as before, we would get the comp./collision reinstated on our vehicle because that vehicle still is financed and our lender needs to show as 1st lienholder on the policy; yet Geico didn't care about that.

So we took our car to a local Geico inspection agent right away and the guy walked around the car and did a visual only, gave us a copy of a form checked off as "no damage to vehicle" and that was that. He said he was to send results back to Geico and we would hear from them... So we waited like Geico said to receive response based on that and to get our comp. policy back.

It has been about 2 weeks now, and in this time, our lender has contacted us saying they show no insurance on our vehicle and wanted an answer what was going on. Then we get notice from DMV whom I called and explained what happened to us. Even the DMV said it made no sense and to get hold fo Geico right away, or we would be repsonsible for paying the state a fee or having our plates taken in 6 days if there was no insurance.

Well, in this period, we also got another policy from Geico, with same policy number as original comp/collision we always had, but now this showed all collision coverage taken off policy with the same premium as the previous full policy we always had.

We called Geico yesterday and they acted like they didn't care to hear about the inspection they required us to get, nor cared about our tenure with them, or the simple oversight how we missed the payment because of my wife's medical problems at the time; and though they took our payment, we were told they refused to contact DMV (as they told us they would after the inspection proved car was not damaged), and said, if we want to get the collision/comp back on and show our lender as 1st lienholder (as they always were before), that we would have to pay an additional premium cost now of $500.00 more to get back what we had previously.

Geico refused to care or understand the situation and used no common sense in our case, and told us that was it or nothing- so if we do not pay $500.00 more ASAP, our lienholder will cancel our auto loan and call that note and take our car and this is NOT right!

We did call several other companies right away to do comparison, but since insurance companies use an exclusive computer data system, Geico inputed data on our policy that the other insurers have seen, which they base their premiums by, and to go to AIG for instance would cost us $1,000.00 more for same exact policy!

And our friend who has worked 15 years with Erie Insurance Company and is an underwriter for them, also agrees this is dirty pool, but reiterates this sort of thing has been going on inside the insurance companies to make more money and it is unethical... And even Erie, looking at the insurance industry ratings system used, sees Geico's marks about our policy, so that makes us look as a high risk, and they cannot write us a policy without an exorbitant rate applied either...

I feel like this is some legalized scam, because we have always been good customers with Geico, and even had our sons and many others convinced to go to them with their business, but Geico told us none of that mattered. They told us, even though they realize we did not have a lapse in policy, that until their next underwriter review occurs on our policy renewal date (July 2007) they could not adjust or make changes on their computer system to reflect our policy!!

This is a crock and I feel like we have been defrauded by Geico or financially extorted in an elaborate way to now be forced to pay even higher premiums on the very same policy numberwe always held. And as another note to those who may question my complaint here, Geico NEVER sent us any cancellation notice or late payment notice either and told us they stopped doing that as a cost cutting event for Geico..

I calculated last night, in my lifetime of driving, I never had an accident or at-fault problem ever. I had 2 windshields replaced years ago on my comp. policy (minus my deductible of course) broken by rocks from a semi in front of us on the highways and that is all. But in all my driving years, I have paid in excess of $56,000.00 in car insurance premiums not including our current homeowners which we have through Geico or life insurance with another company, etc...

#2 Consumer Comment

unethical???

AUTHOR: Don - (U.S.A.)

SUBMITTED: Wednesday, January 03, 2007

How is this unethical? You did not score high enough on the test to warrant being hired. They do not have to show you your test. Not getting hired somewhere is part of life. Besides, if they did lie to you about the test, do you really want to work for them anyways??

#1 Consumer Comment

Unfortunately

AUTHOR: John - (U.S.A.)

SUBMITTED: Wednesday, January 03, 2007

it sounds like they were merely trying to fill their EEOC quota sad to say. I went through this same thing trying to get into the electricians union years ago. They were nice about it and flat out came out and told me that is what they were doing. I was a little bummed but that's the way it goes I guess.

I could be wrong but can only guess this due to the fact they wouldn't show the test scores.

Advertisers above have met our

strict standards for business conduct.