Complaint Review: Virginia Credit Union - Richmond Virginia

- Virginia Credit Union 7500 Boulder View Drive Richmond, VA 23225 Richmond, Virginia USA

- Phone: (804) 323-6000

- Web: www.vacu.org

- Category: Banks

Virginia Credit Union (VACU) If you have a credit card or loan product & have lost your job or had a medical emergency, you're screwed Richmond Virginia

*Author of original report: Actually I do have a valid complaint

*Consumer Comment: You do not have a valid complaint

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Being a member of VACU for over 15 years, I was proud to say that I was a member and often referred people to bank with VACU over the national banks. Why? Because VACU offered the best customer service and they seemed to be the antithesis of Big Bank USA. Notice I am used past tense to describe them.

It seems like the bigger VACU grows, the more bank like they become and the allure to bank with this credit union was the services they offered, at lower interest rates and willingness to work with you. I don't think that is the case anymore.

As I have stated earlier, I was a member for over 15 years and have been there through the many changes VACU has taken to supposedly improve as a financial institution. They have done nothing but taken a turn for the worse and thus have pushed me to bank, once again, with Big Bank USA, to my chagrin. My reasoning is I'd rather bank with Big Bank USA and should I experience a financial hardship they will work with you instead of suing you off the bat.

That's exactly what VACU has done. If you have a credit card or ANY type of loan with VACU and have experienced a job loss or medical emergency that has affected your finances, you are screwed. Not only do you not have options to work out your payments but they will sue you/take out a warrant in debt after 90 days late.

I lost my job, in which I notified all my creditors of my situation and was able to work out something with every single one of them, except, VACU. I informed them immediately of my job loss and because I was not late at the time, they told me they could not work out something to at least lower my payments to a workable amount. Well, because my financial situation was spiraling down fast and I wasn't getting much unemployment, I had to juggle my bills.

I have always paid my bills on time and had great credit (hence my being able to obtain a credit card AND two loan products with VACU) as well as other financial institutions. VACU offered no resolution, not even temporary, and my making even partial payments was not enough. After 30 days, the harassing calls began. I asked about payment arrangements to get a lower payment until I secured full time employment and they flat out said "No" and that I had to pay the full amount and they could not and would not be willing to make arrangements. I still made partial payments to at least show that I was making a good faith effort to pay on my loans and credit card as agreed.

After 60 days hit, my accounts were sent to collections and when one of the reps called me, they immediately gave the spiel about "This is an attempt to collect a debt...yada yada yada." When I informed collections of my situation, the only "offer" they had was for me to pay what was past due, which equaled the full amounts of payment, even though I had been making partial payments. They had no such plan to where they could at least temporarily lower the payments to a workable amount for both parties. It was basically all or nothing. My job loss did not matter to them. At least in 2013 it doesn't whereas 6-7 years ago, it would have and they would have worked with me. That's the noticeable change with VACU.

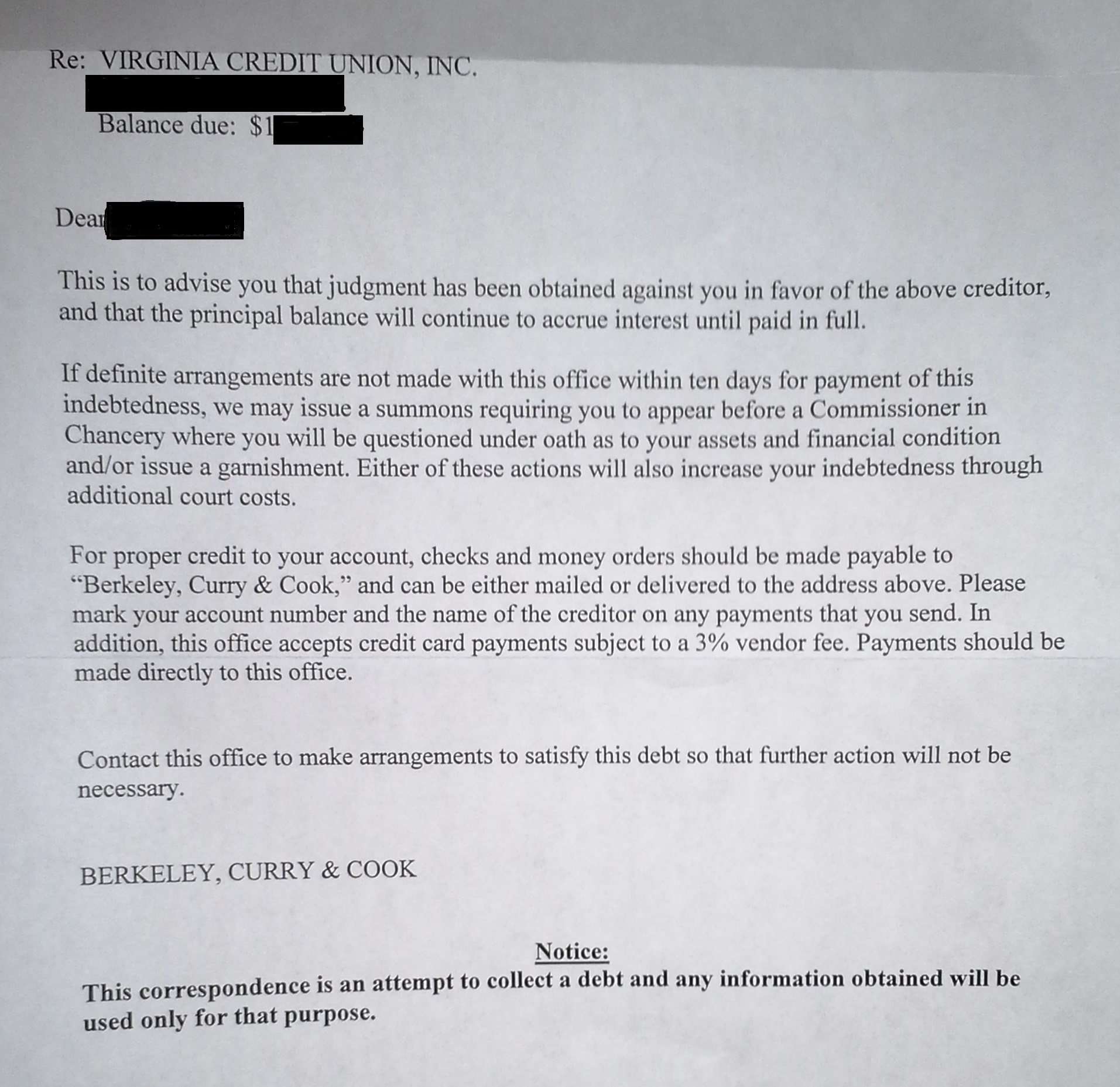

I wasn't able to commit to the full payment they were asking for and informed them, again, of my job loss and they were not hearing it. Ninety days passed and they sued me for Warrant in Debt for both the loan and the credit cards. When I called to ask what that was about, they said they do their own in house collection and thus sue to collect funds rather than outsource with a collection agency.

Well, isn't that grand?

Nevermind that you have to decide to keep a roof over your head, if you have to decide if food or gas money to go to yet another interview that does not result in a job offer is more important. Nevermind if you fall ill and cannot work to pay your bills.

VACU has changed. And not for the better. Their expansion throughout the state of Virginia has resulted in mimicing the policies of Big Bank USA, except at least Big Bank USA will at least work with you if you fall on hard times.

I do not want to convey a message of victimhood with this report, just be wary when obtaining any type of creidt card or loan product. You will have better financial solutions at Big Bank USA and this is coming from someone who was anti-bank for YEARS.

That said, explore your options. VACU has jumped the shark when it comes to offering good customer service and looking out for its members. You are now just another number and not a member, as they say on their website.

This report was posted on Ripoff Report on 11/23/2013 10:16 AM and is a permanent record located here: https://www.ripoffreport.com/reports/virginia-credit-union/richmond-virginia-23225/virginia-credit-union-vacu-if-you-have-a-credit-card-or-loan-product-have-lost-your-j-1101681. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Author of original report

Actually I do have a valid complaint

AUTHOR: GTFOH - ()

SUBMITTED: Monday, December 02, 2013

The loan terms do not indicate that defaulted loan payments willbe pursued via the court system, just a general "pursuit by collections". They will harass you until you send them a cease and desist letter to stop harassing you on the phone.

#1 Consumer Comment

You do not have a valid complaint

AUTHOR: coast - ()

SUBMITTED: Saturday, November 23, 2013

“I have always paid my bills on time…”

Your statement, ”the allure to bank with this credit union was the services they offered, at lower interest rates and willingness to work with you” implies that you don’t always pay your bills on time. Financial institutions must increase their rates to offset losses due to loan default. Maybe VACU is able to offer lower interest rates because they aggressively pursue delinquent account holders.

Do your financial agreements with VACU state that they will alter the terms if you are unable to meet your financial obligations? No, not likely. Your claim that other creditors opted to alter the terms of their agreements is NOT relevant.

You can whine and stomp your feet all day but it does not change the fact that you are in default and are expected to honor your financial obligations.

Advertisers above have met our

strict standards for business conduct.